This paper identifies the economic policy options to respond to a possible economic downturn and strengthen the euro area in the medium- and long-term. The European and world economies have weakened over the past year and GDP growth is unlikely to rebound swiftly. The subdued outlook for growth and inflation prompted the European Central Bank to implement another round of easing measures in September and to call for fiscal and structural policies to be stepped up to create a more supportive and efficient policy mix. In parallel, long-standing structural impediments to productivity growth have yet to be resolved, improving human and physical capital through increased investment in education and key infrastructure. In the absence of a euro area budget for stabilisation, a supportive fiscal stance for the euro area as a whole requires a more coordinated response. Very low or negative financing costs provide an opportunity to refresh and modernise the public capital stock, thereby boosting potential growth, bring forward projects with a high social, environmental and economic return, and help the transition to an environmentally and socially sustainable economy. The low interest environment is also increasing the efficiency of fiscal policies, while complementing the functioning of monetary policy, which is already highly overburdened.

After six consecutive years of expansion, the euro area economy has weakened over the past year. Europe has seen a sharp slowdown in external demand and a contraction in manufacturing, which is starting to spill over to other parts of the economy. While the solid performance of the labour market has helped to sustain private consumption and domestic demand, GDP growth is unlikely to rebound swiftly. In contrast to previous assessments, the euro area economy is now believed to have entered a protracted period of subdued growth and low inflation.

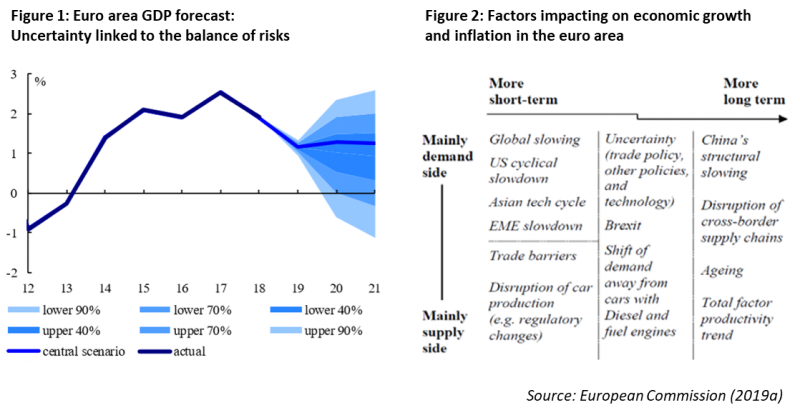

The euro area economy is also facing an elevated level of uncertainty (Figure 1). The downside risks surrounding the central scenario remain predominant and characterised by a high degree of interconnectedness, which could magnify their impact on the economy if they were to materialise. A further escalation of trade and geopolitical tensions and a sharper-than-expected slowdown in China could dampen global economic activity, with negative repercussions for the euro area. Furthermore, spill-overs from the weakness of the manufacturing sector could further moderate growth, while a disorderly Brexit could have a disruptive impact on economic activity in the euro area. While some trade tensions and structural factors dampening euro area growth are temporary, others are more permanent (Figure 2).

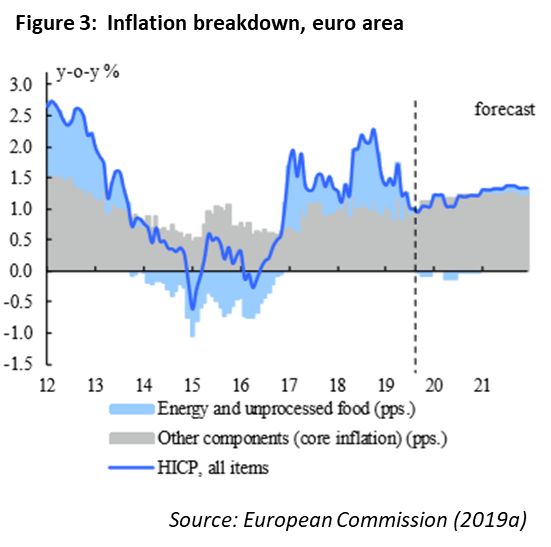

Headline inflation remains below target and core inflation seems to have stabilized at levels slightly above 1% (Figure 3). While the wage Phillips curve looks to be intact, the pass-through of wage increases to consumer prices has been limited so far as firms have been shrinking their profit margins. Meanwhile, at least market-based long-term inflation expectations show a worrisome development that former European Central Bank President Draghi recently characterized as a possible “re-anchoring at levels between zero and 1.5%” and thus clearly below the European Central Bank’s medium-term objective.

In addressing the question of appropriate economic policy mix, one challenge seems obvious: namely one of diverging views on the nature and potential remedy for the present economic slowdown.

In Europe in particular, we seem to come from different views. One school of thought sees the current economic situation as a rather regular cyclical slowdown after a (long) period of recovery. Others question the basic functioning of the economy at the current juncture and suggest that we have entered into a time of structurally low economic growth. Naturally, these different interpretations give rise to completely different policy prescriptions (Figure 4).

The ‘cyclical slowdown’ view stresses, among others, that – owing to the recent economic expansion – unemployment rate has already fallen to below its pre-crisis level in the euro area, which has fuelled robust wage growth. Moreover, GDP should continue to grow in all euro area Member States. According to this view, low interest rates reflect the supportive monetary policy stance as well as the necessary private sector deleveraging after a pre-crisis period of unsustainable credit expansion. From this perspective too, a more active use of fiscal policy in the euro area faces objective constraints, including the EU fiscal rules, while the already accommodative monetary policy provides ample support and still has some room for manoeuvre, if needed.

The ‘secular stagnation’ or protracted slow growth hypothesis warns that the euro area may have entered a period of low growth and low inflation. Indeed, while GDP now exceeds pre-crisis levels in most Member States, the average annual growth rate in the post-crisis period has been much lower than in the decade before. Furthermore, falling unemployment rate from 2013 onwards has barely fed through into wage growth, which has risen only recently and has had limited pass-through to inflation. On this ground, some observers have questioned the functioning of Phillips curve mechanics at the current juncture.2 In addition, there is evidence that the equilibrium interest rate has declined in the euro area and that investors expect low real rates to prevail for a long time to come. All this could have implications for the effectiveness of monetary policy raising economic growth on its own. Finally, according to the secular stagnation hypothesis, restraining deficits and debt, originally meant to protect the economy from a threat of ‘too high’ interest rates and inflation now risks undermining euro area economic developments.

While empirical analysis has not been able to provide strong evidence in favour of one of these views, there appears to be a clear risk that without active, immediate and resolute policy action the euro area ends up in a bad equilibrium from which it may be difficult to climb for a protracted period of time. In order to see the respective policy options, we need now to focus on specific instruments. The following section will discuss each of them.

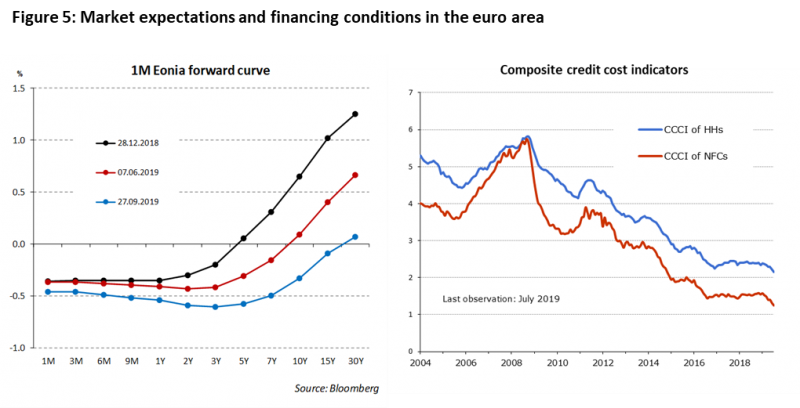

European Central Bank monetary policy since the crisis has been highly accommodative (see Figure 5) and the European Central Bank – using both conventional and unconventional monetary policy measures – has successfully fought off deflationary risks and supported growth. Despite some concerns about policy space, the European Central Bank has demonstrated that it is able to continue to provide monetary accommodation in light of the current slowdown, most recently by engineering a further cut of the deposit facility rate by 10 bps to -0.50% coupled with tiering of banks’ excess reserve remuneration, an enhanced forward guidance and renewed and open-ended net asset purchases.

Considering the subdued outlook and with risks clearly tilted to the downside, the increasing constraints faced by monetary policy have to be reckoned with. Also, the side effects of an ultra loose monetary policy will come to the fore. These include asset price misalignments, for example on housing markets, and increased risk taking in search for yield in particular by those euro area banks that are displaying low profitability, but also includes concerns about the financial health of those investors that are limited in their risk-taking abilities, such as pension funds. A further risk that has gained some prominence lately pertains to political tensions, in particular in response to the potential euro depreciation associated to monetary easing.

While some of these adverse effects can be addressed by macro-prudential measures or other mitigating measures such as the recently introduced tiering of banks’ excess reserves with the Eurosystem, it still is clearly preferable to prevent those side effects. This begs the question what role other policies can play and naturally puts the spotlight on fiscal policies to take on a more prominent role in supporting the euro area economy, as has also been repeatedly highlighted by the European Central Bank. From an efficiency standpoint, the argument can also be made that the interest-saving curve is likely to be steeper in the current environment of high uncertainty, which further suggests that fiscal policies are more effective than monetary policy at the current juncture. The role of fiscal policy becomes more important in sustaining demand in the short term, boosting potential growth via higher public investment and helping raise the equilibrium real interest rates.

Fiscal stance in the euro area

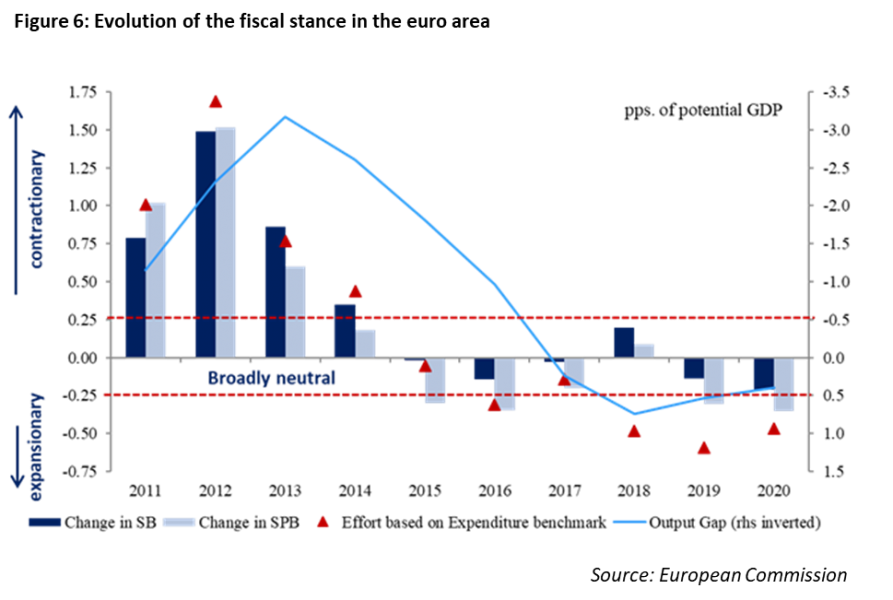

To assess the aggregate euro area fiscal stance, three measures are considered: the change in the structural balance, the change in the structural primary balance and the discretionary fiscal effort (Figure 6).

A period of restrictive and pro-cyclical fiscal policies post-crisis was due to a number of factors, not least the risk that a number of Member States could (and, indeed, did) lose financial market access. Since 2015 the euro area has experienced an overall neutral fiscal stance. This change in the direction of fiscal policy has supported the economic recovery when monetary policy was already overburdened. In 2019 – and already in 2018 based on the expenditure benchmark – fiscal policies supported economic activity leading to a slightly expansionary fiscal stance in the euro area.

For 2020, when looking at the change in structural primary budget balance, the euro area fiscal stance is expected to be slightly expansionary. This is confirmed by the fiscal effort based on the expenditure benchmark methodology, which points to a more expansionary fiscal stance. This seems appropriate as the downside risks have intensified and have started to materialise.

Going forward, we need to bear in mind the risks associated with two possible policy errors. In particular: the risk of pursuing an excessively expansionary fiscal policy in the event of a pickup in growth, versus the risk of excessive fiscal prudence in the event that the current slowdown deepens.

The current situation with large compounded downward risks could call for more pre-emptive policy action, rather than reactive. That approach would basically amount to a risk-based approach to fiscal policy, combining the central scenario with the downside one. In the present circumstances, the costs of too little stimulus in the case of a downside scenario may outweigh the costs of too much stimulus should a more favourable scenario materialize.

Monetary-fiscal policy mix

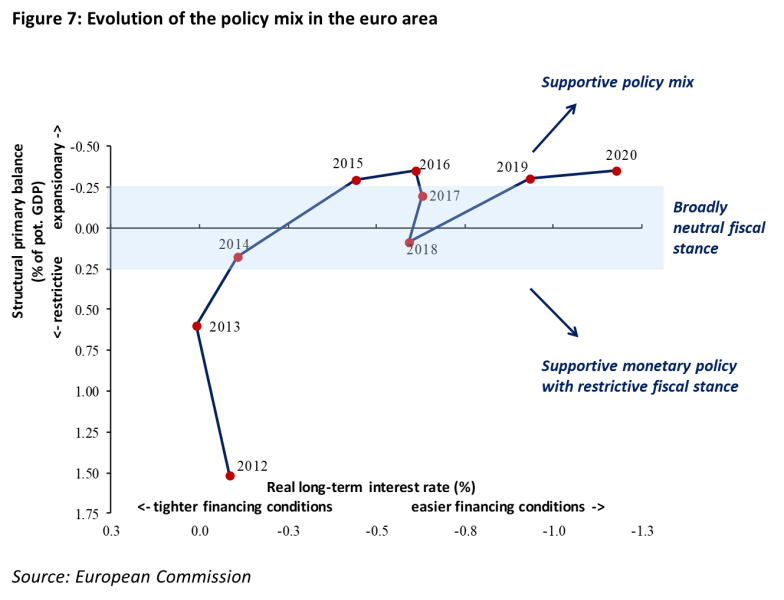

The fiscal stance should also take due consideration of the monetary policy stance, which is expected to remain supportive (Figure 7). In September 2019, the European Central Bank announced a new package of accommodative policy measures, including a further cut in the Deposit Facility Rate to -0.50% and an open-ended restart of net asset purchases. In combination with the European Central Bank Governing Council’s forward guidance, monetary policy is expected to stay very accommodative in 2020 and beyond.

At the same time and as discussed above, having carried the burden of the reflationary effort over the past years, monetary policy is facing increasing negative side effects. In announcing the latest round of unconventional monetary expansionary measures, the former European Central Bank President Draghi has explicitly called for fiscal policy to become the main instrument in supporting demand going forward. According to the European Central Bank, this would greatly enhance the speed and effectiveness of monetary policy. The former European Central Bank President Draghi called in particular on governments with fiscal space ‘to act in an effective and timely manner’, in view of the weakening economic outlook and the continued prominence of downside risks.

The case for a fiscal policy response that is robust to a possible economic downturn is becoming increasingly pertinent. This would support monetary policy in an overall policy mix that mitigates the risks facing the euro area economy, at a time when risk of monetary policy being constrained increases.

Differentiation of fiscal stance

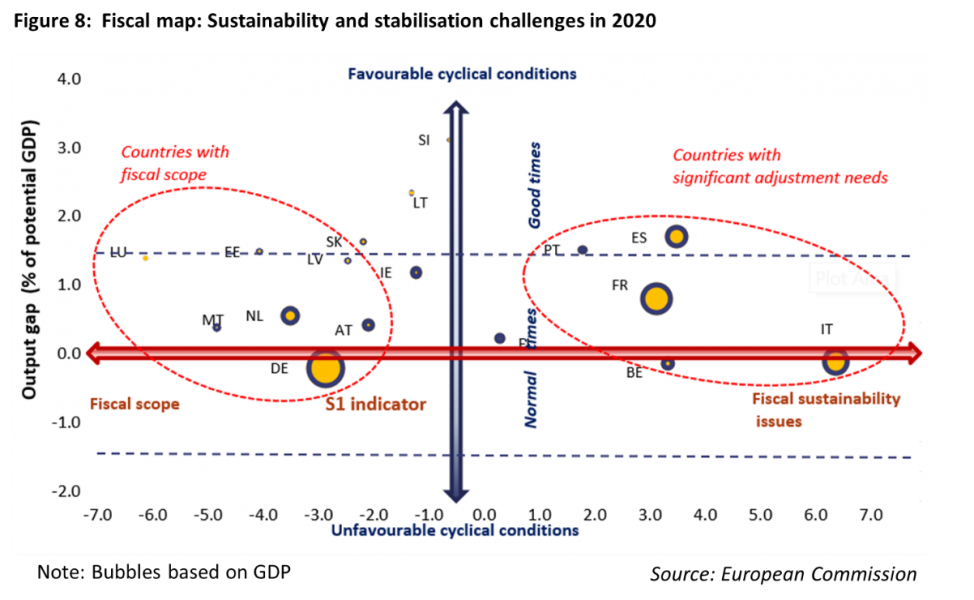

That being said, the differentiation of fiscal stance across countries is clearly suboptimal. We need to recognise the very heterogeneous fiscal position of euro area Member States’ level in terms of their available fiscal space and debt sustainability risks (Figure 8).

The case for a fiscal expansion geared towards investment in countries that have put their debt under safety thresholds is hardly controversial, including because of the erosion of the public capital stock that would follow from the continuation of current trends. At the same time, Member States with available fiscal space should be ready to do more if a severe economic downturn materialized. The case of high-debt Member States is admittedly more difficult. Member States facing sizeable sustainability challenges should rebuild fiscal buffers and give priority to active debt reduction. These Member States have little or no scope to undertake supportive fiscal policy, in spite of the low interest rate environment. In those countries a fiscal expansion could potentially lead to adverse reactions by financial markets and may be counterproductive. Higher sovereign risk premia may more than offset the effects of a stimulus with detrimental overall effects. At the same time, a risk-based approach robust to the materialization of a recession scenario would implicitly demand that automatic stabilizers be allowed to operate. Recent statements emanating from the European Central Bank lend support to both positions.

Additional productive spending would be appropriate in Member States with available fiscal space to enhance their growth prospects in the medium run, in a context of low interest rates. This would also help to reduce the substantial downside risk to the economic outlook highlighted by the Commission and other organizations” forecasts.

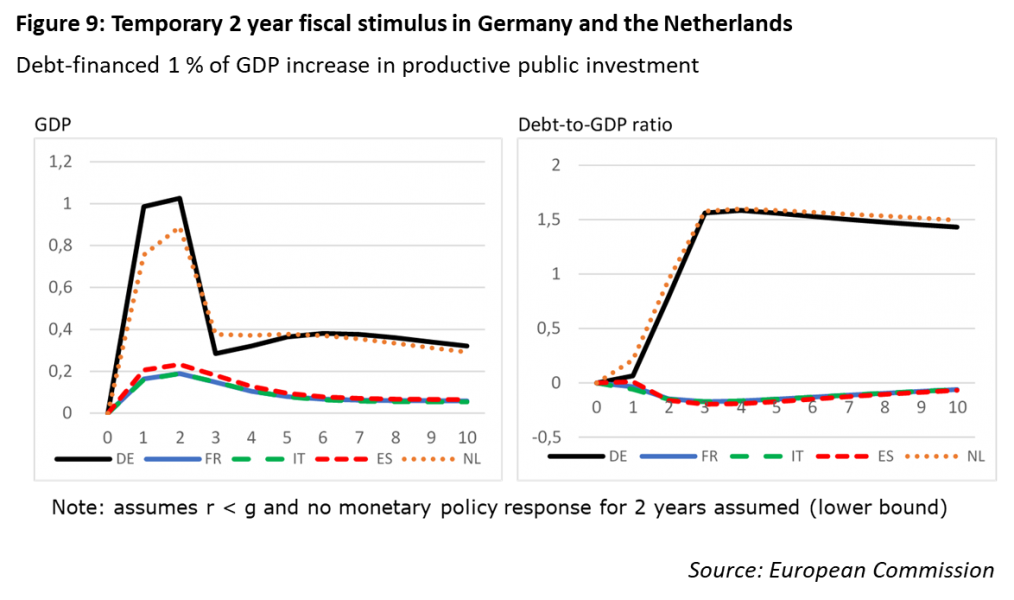

Figure 9 shows model simulations of temporary increases in productive spending of 1% of GDP in Germany and the Netherlands alone, two member states with ample fiscal space focusing on the implications for the growth and the debt-to-GDP ratios. The impact multiplier is around 1 for Germany and the Netherlands. In the medium run, even after the stimulus has been removed, output remains above baseline as productivity has increased. Spill-overs to other euro area Member States are modest, around 0.1-0.2.

A temporary stimulus would not leave a sizeable impact on the debt profile. It would lead to only a temporary and very small increase in the debt-to-GDP ratio of around 1½ pps. in Germany and the Netherlands, while there is a small improvement in the debt ratios in the other euro area countries due to higher growth effects from positive spill-overs. In the countries undertaken the stimulus, there is no need to raise taxes to reduce debt, as the increase in debt is temporary and gradually fades away.

Growth-friendly structural policies could play a role to raise the equilibrium real interest rate. At the same time, some of the structural challenges in the euro area are rather considerable, as is the time needed to design, implement and see the effects of those policies. In effect, the desired results would arguably materialize only in the medium-term at best.

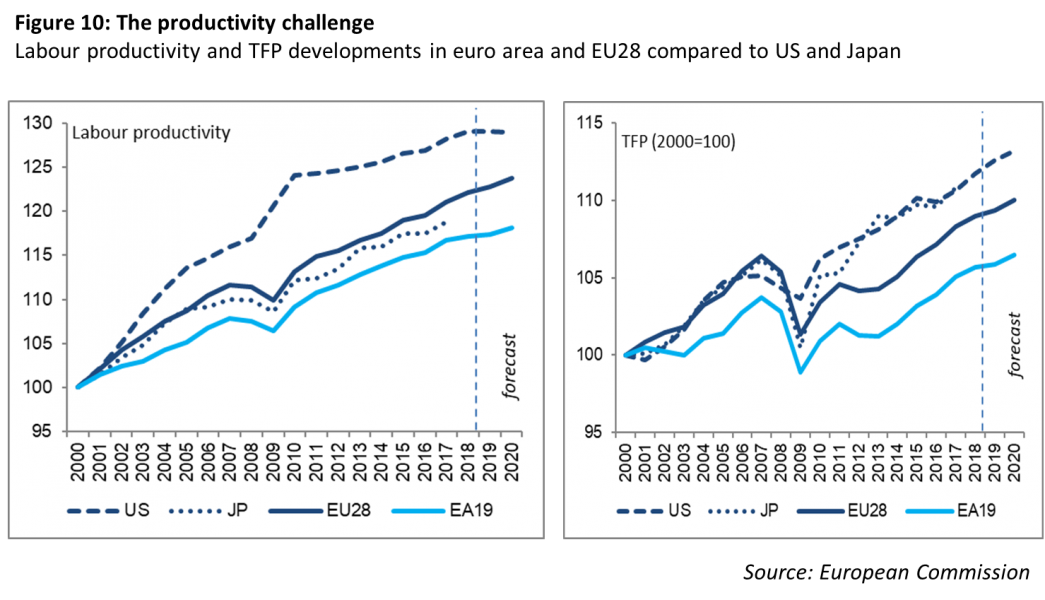

Certain problems that we face in Europe are linked to some long-standing, structural challenges of the European economy, in particular the persistent productivity gap with other global players like the United States and China.

Trend productivity growth has declined in the past decades in a number of countries, including in Europe (Figure 10, left hand side). The gap accumulated vis-a -vis the U.S. in the first decade of the 2000s may be, however, narrowing down in recent years both for the EU and the euro area, although at a slower pace for the latter.

In terms of total factor productivity developments, the US and Japan still outperform the EU and the euro area (Figure 10, right hand side). Since labour productivity growth is the sum of capital accumulation (i.e. growth in capital per worker) and TFP growth, this implies that the productivity catch-up of the EU and euro area vis a vis the US has basically been driven by investment.

In addition, the European economy faces rapid changes due to inter-related environmental, technological and demographic developments. These pose new challenges, in particular:

In the coming years, our economic policy should be geared towards boosting productivity, investment and sustainable growth, promoting fairness and equal opportunities and reinforcing macro-economic stability (Figure 11). These four objectives interact in various ways and pursuing them in combination requires a holistic and balanced approach where we work better together with Member States and across policy areas.

The green transition will create new jobs and a sustainable economy contributes to well-being, for example in the form of healthier working and living environments. To maximise synergies between the various policy goals outlined, significant public and private investments will be needed, for example in education, retraining and innovation. By leveraging private investment for a public policy purpose, the InvestEU Fund will serve this objective.

Our economic structures will have to be reformed to boost their overall resilience. A careful balancing of policy priorities will also be required, taking into account country-specific circumstances, to reconcile the need for long-term sustainability with the need to foster inclusive growth and macro-economic stability.

At the same time, a number of clear trade-offs will need to be addressed. Both climate change itself and the flanking policies required to overcome the challenges it creates have important distributional consequences. A strong social consensus is therefore required to support the overhaul of the economy towards a more sustainable model. When designing policies and formulating recommendations, we need to ensure that support for the people most affected by this societal changes is put in place.

Trade-offs also exist between fairness and productivity, as the labour market integration of more lower-skilled workers reduces average productivity in the short-term but contributes to a more balanced and prosperous society over time.

In fighting a recession, it is fair to wonder how much policy space there is left for central banks, including given the unprecedentedly low level of interest rates. Moreover, monetary policy has been carrying the burden of the reflationary effort over the past years. Leaving the question of the effectiveness of further monetary easing aside, adverse side effects of monetary policy are gaining prominence. Growth-friendly structural policies could play a role to raise the equilibrium real interest rate. However, the desired results would arguably materialize only in the medium-term at best. On the other hand, fiscal spending is likely to be more effective than in normal economic times, due to higher multipliers. This has implications for the appropriate policy mix in the case of a negative shock.

The case for a fiscal policy response that is robust to a possible economic downturn is becoming increasingly pertinent. This would support monetary policy in an overall policy mix that mitigates the risks facing the euro area economy, at a time when risk of monetary policy being constrained increases. Short of the creation of an economic government backed by a fully-fledged fiscal stabilization capacity, the current situation offers an opportunity for attempting a truly horizontal approach to a differentiated fiscal stance. A more active role for fiscal policy in the policy mix would require more differentiation between Member States with fiscal space and Member States with high debt, taking into account the divergent sustainability challenges.

Besides a proper differentiation of the fiscal stance, it is also important to improve the quality and composition of public finances, in particular supporting the growth potential in the period of ageing populations, and improving the growth-friendliness of public finances. Moreover, it is argued that after long periods of cutbacks in public investment, the deterioration in the public infrastructure capital stock needs to be reversed, while there are also needs for skill upgrading to prepare for rapid technological change. On top of that come the challenges that climate change presents, which could require the introduction of far-reaching mitigation policies to decarbonize the economy (Green New Deal), and potentially expensive adaptation policies. This speaks in favour of combining short-term policies to support aggregate demand with a set of credible policy measures aimed at responding to the longer-term structural challenges, for example aiming at sustaining investment (Figure 12).

European Central Bank, 2019. Understanding low wage growth in the euro area and European countries. Occasional Paper Series No 232.

European Commission, 2015. When ‘Secular Stagnation’ meets Piketty’s capitalism in the 21st century. Growth and inequality trends in Europe reconsidered. Economic Papers 551.

European Commission, 2019a. European Economic Forecast Autumn 2019. Institutional Paper 115.

European Commission, 2019b. Communication on the 2020 Draft Budgetary Plans: Overall Assessment, COM(2019) 900 final.

European Commission, 2019c. Communication on “Annual Sustainable Growth Strategy 2020”, COM(2019) 650 final.

Hasenzagl, T., Pellegrino, F., Reichlin, L., Ricco, G., 2019. A Model of the Fed’s View on Inflation. CEPR Discussion Paper 12564.

Rachel, Ł., Summers, L., 2019. On Falling Neutral Real Rates, Fiscal Policy and the Risks of Secular Stagnation. Brookings Papers on Economic Activity, Spring 2019.

Roeger, W., 2014. ECFIN”s medium term projections: the risk of ‘secular stagnation’. Quarterly Report on the Euro Area, Directorate General Economic and Financial Affairs, European Commission, vol. 13(4), pages 23-29, December.

Ubide, A ., 2019. Fiscal Policy at the Zero Lower Bound. Intereconomics: Review of European Economic Policy, Springer; German National Library of Economics; Centre for European Policy Studies (CEPS), vol. 54(5), pages 279-285, September.

Director General for Economic and Financial Affairs, the European Commission until November 2019. This Policy Note is based on an address at a SUERF conference, organised in cooperation with Columbia University | SIPA, the European Investment Bank and Société Générale on “Racing for Economic Leadership: EU and US Perspectives” on 16 October 2019, and updated afterwards. The author would like to thank Jakub Mazur and Ulrich Clemens for useful discussion and input. The author writes in his personal capacity.

See for example Hasenzagl et al. (2019)