At the 4th SUERF • CGEG|COLUMBIA|SIPA • EIB • SOCIETE GENERALE High-Level Conference on EU-US perspectives held in New York on 16 October 2019, Klaas Knot participated in a session on “The Quest for policy scope”. He highlighted how longer-term changes in the global economy pose important challenges for central banks’ ability to control inflation. Some of these challenges affect all central banks, while others are specific to the institutional context in which the ECB operates. These challenges have become more relevant over time, and should be important elements of future reflections on monetary policy strategy.

More than a decade after the Global Financial Crisis erupted, inflation in the euro area has still not reached the ECB’s aim of below, but close to, 2%. This despite unprecedented conventional and unconventional monetary easing and five years of economic expansion. Moreover, market-based indicators of long-term inflation expectations in the euro area have fallen, fueling concerns that the anchoring of inflation expectations may have weakened.

Against the backdrop of a weakening global economy and heightened geopolitical risks, these concerns prompted the ECB to take further measures to boost inflation at its September meeting.

A lot has been said and written about the desirability of this package of policy measures. Last week the ECB published the Account of the meeting, which includes an extensive overview of the arguments exchanged in its Governing Council. Today I do not want to dwell anymore on the merits of the policy package or its individual elements. Rather, I would like to look ahead and discuss how longer-term changes in the global economy continue to create important challenges for monetary policy. These challenges relate to the controllability of inflation by monetary policymakers. I will argue that these challenges have gained in relevance over time. I therefore believe they should be important elements of future reflections on monetary policy strategy. Some of these challenges affect all central banks, while others are specific to the institutional context in which the ECB operates.

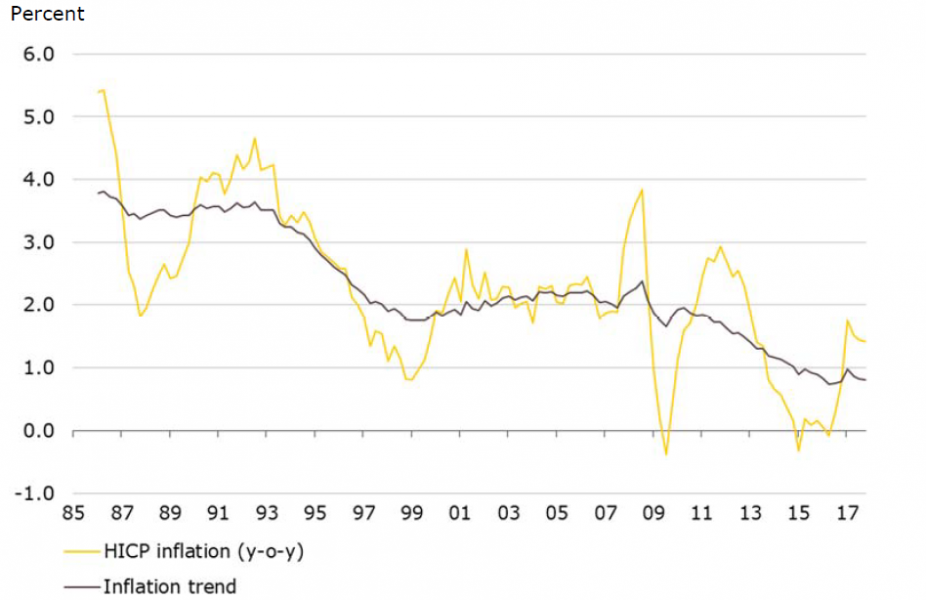

To set the scene, let me first present two stylized facts on long-run inflation dynamics. First, low and falling inflation is not a recent phenomenon. At DNB we have performed an analysis that decomposes inflation in a time-varying trend and a cyclical component (Figure 1). The results show that inflation has been subject to a renewed downward trend since the crisis. This differs from the episode that is known in the literature as the Great Moderation when there was no significant up- or downward trend in inflation.

Figure 1. Euro area HICP inflation and its trend

Notes: The trend is estimated by an Unobserved Components Model of HICP inflation and the un-employment rate for the euro area, see Bonam et al. (2019).

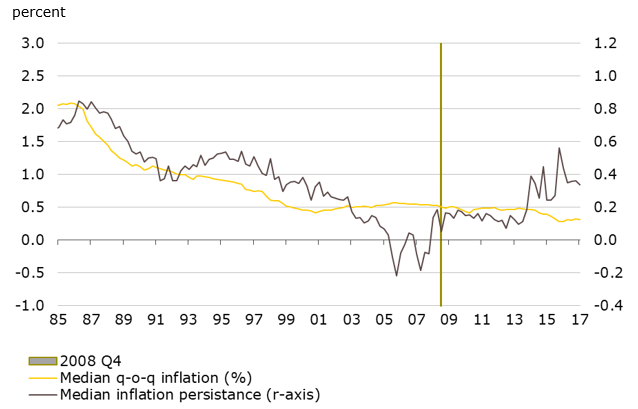

Second, not only has inflation been subject to a downward trend, but also its inertia – or persistence – has increased since the crisis (Figure 2). After having declined gradually between the mid-1980s and the early 2000s, inflation persistence is now back at its long-term average.

Figure 2. Euro area HICP inflation and its persistence

Notes: Inflation persistence is estimated from a time-varying autoregressive model over a 30-quarter mo-ving window for seasonally adjusted, quarter-on-quarter euro area headline inflation. The graph shows HICP inflation (in percent) together with the inflation persistence parameter. The vertical bar shows the start of the GFC. For details, see Bonam et al. (2019).

The million dollar question is then what these developments signal for central banks’ ability to control inflation. Let me explain my take on this issue. Notwithstanding the ongoing debate on its validity, I still regard the Phillips curve as a relevant analytical framework to structure our thinking.

According to the standard view, the Phillips curve explains the inflation process in terms of three main elements. The first element is expectations of future inflation. Expectations can be forward-looking, in which case inflation is self-equilibrating; or backward-looking, in which case inflation is more persistent.

The second element is economic slack, which captures the impact of aggregate demand. While slack has traditionally been measured by an output gap or unemployment gap, recent research suggests that more granular indicators of labor market conditions are needed to better capture Phillips curve relationships in the data.1

The third element is shocks. These shocks can in principle have a positive, negative or ambiguous effect on inflation. If shocks are more permanent, inflation will be more inertial. If we look back at the euro area over the past decade, most of these shocks appear to have been quite persistent and have dampened inflation for some time. The main example here is the lower level of energy prices that we have experienced in recent years.2 Brexit can be seen as another shock that has an impact on the euro area economy, although it is not clear yet whether it will push inflation up or down.

Inertia in inflation can also reflect slow moving changes in the economy, which have been at work on a global scale for some time. As documented in a recent report by the World Bank, these changes include the ongoing globalization trend, the declining bargaining power of labor, demographic changes, technological progress and the rise of e-commerce, and financial factors.3 Empirically, this inertia can be captured by a downward trend in (core) inflation.4

Now, how would this apply to the characteristics of inflation dynamics that I have just described? First, in a benign environment like the period of the Great Moderation between the mid-1990s and the early 2000s, inflation expectations were mainly forward-looking. Slack had a strong and stable link with inflation. And shocks were temporary and not very large. Also, there was no discernible trend in inflation. In this environment, monetary authorities had no difficulties in keeping inflation expectations well-anchored.

In the current environment, however, inflation is low and more persistent. In a Phillips curve framework, this might reflect more backward-looking inflation expectations, more persistent negative shocks, and/or a flatter slope of the Phillips curve. But there is another interpretation as well – the Phillips curve elasticities may have remained broadly stable, while at the same time a downward trend is pushing down inflation persistently. The latter finding is confirmed by DNB research on the trendcycle decomposition that I showed you before.5

Let me stress here that I am not talking here about a secular trend that inherently lasts forever. Indeed, the model used by DNB allows for a time-varying trend. Some of the underlying factors might fade out or reverse. For example, if the ongoing surge in protectionism becomes entrenched, the trend towards increasing globalization that we have observed since the mid-1980s might actually be reversed. Hence, inflation might at some point start trending upwards again. For the moment, however, the declining trend inflation component is something we will have to deal with.

So what does this environment imply for central banks? Despite accommodative monetary policy, inflation may remain persistently below the central bank’s objective for a considerable amount of time. This could undermine monetary authorities’ credibility and the effectiveness of their policies.

To support credibility, central banks may therefore want to push the cyclical inflation component even harder, more aggressively easing policy in conventional and unconventional ways. As Janet Yellen observed in the US context, “given that inflation has been so very low for so long […] it may be necessary to have a hot labor market for inflation to move back to 2 percent on a stable basis.”

But in doing that, a central bank like the ECB would face another major challenge. Eventually, these policies will run into economic, institutional and legal restrictions.

Certain economic restrictions, like the difficulties associated with lowering interest rates far into negative territory, have become more relevant as a consequence of a falling natural rate.6 The scope for central banks to fight recessions by lowering short-term policy rates has likely gotten structurally smaller. While non-standard monetary policy measures can be used to ease policy further when policy rates have reached their effective lower bound, these too will eventually run into economic restrictions, when increasing side-effects start to outweigh the diminishing marginal returns of further easing. These restrictions are not unique to the ECB, and they challenge the notion that also persistently low inflation “is always and everywhere a monetary phenomenon”.7

Other, institutional and legal restrictions are more specific to the EMU. The ECB operates in an as of yet not fully complete monetary union and faces a large number of heterogeneous fiscal counterparts. It is also bound by a Treaty that explicitly prohibits it from engaging in monetary financing, the interpretation of which has been subject of debate and even litigation.

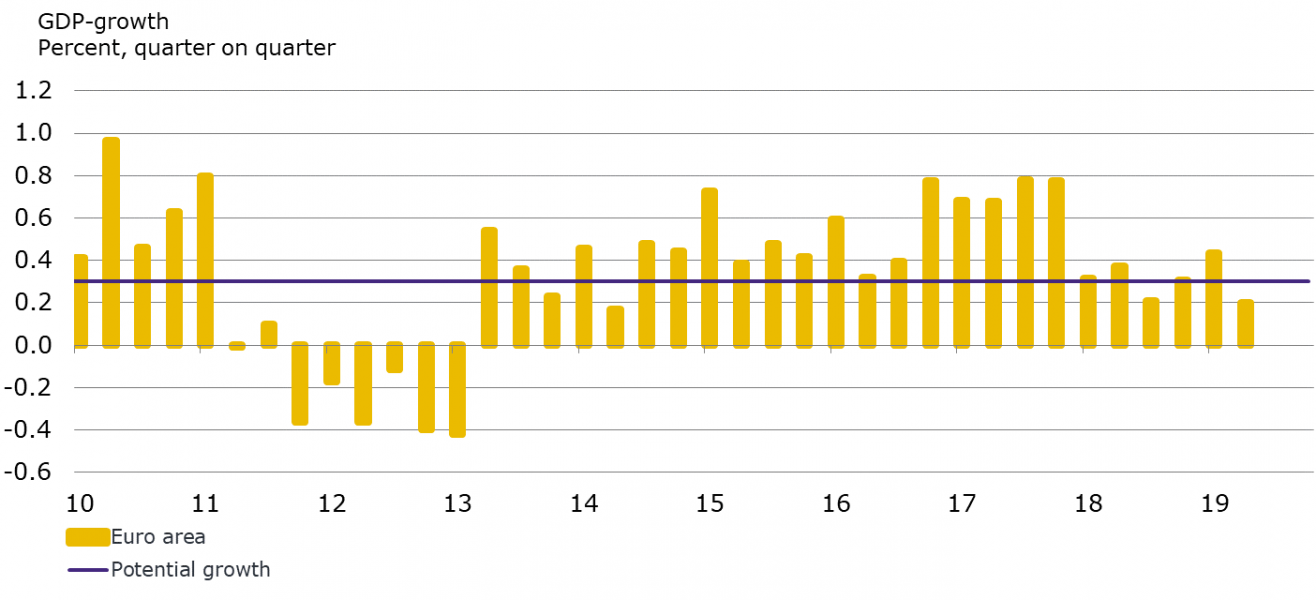

The ECB, however, has stood up to the challenge. Supported by the significant strengthening of EMU and reduced legal ambiguity around the ECB’s freedom to act, the ECB has substantially widened ist toolkit. Both in terms of instruments to ease the stance of monetary policy beyond the ELB, and instruments to restore impairments in the transmission mechanism of monetary policy. This has contributed to a strong recovery of the euro area economy (Figure 3). From 2013 until 2018, growth has steadily exceeded potential, closing the output gap in the process. While it is challenging to put a number on the ECB’s contribution, ECB staff analysis suggests that the monetary easing since 2014 has cumulatively contributed almost 2% to GDP.8

Figure 3. Euro area growth

Source: Eurostat.

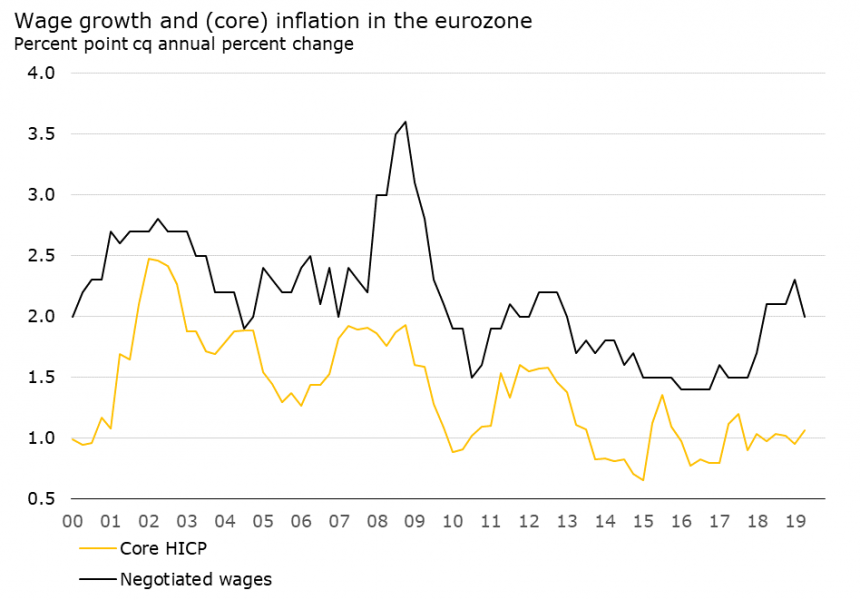

A tangible gain has been the improvement of the labor market. Unemployment has dropped significantly and wage growth has picked up. Yet, the final step to consumer price inflation has thus far proven elusive (Figure 4).

Figure 4. Euro area wage growth and core inflation

Source: Eurostat and ECB.

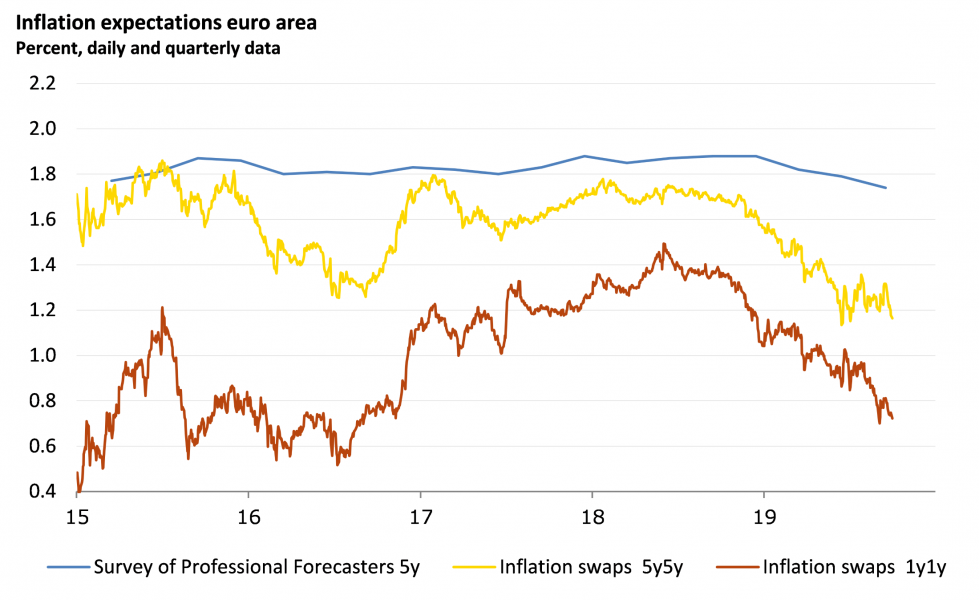

With recent headwinds to growth dampening the inflation outlook, the ECB took further measures to support inflation. Nonetheless, given the characteristics of the inflation process that I have outlined, even now that economic slack appears largely absorbed, economists and financial markets alike see low inflation remaining persistent and converging to our inflation aim only sluggishly (Figure 5).

Figure 5. Euro area inflation expectations

Source: ECB and Refinitiv.

All in all, the current situation facing the ECB is not one that was envisaged when the current monetary strategy was drawn up, back in 1998 and updated in 2003. The environment in which the ECB operates has evolved and so has the EMU’s institutional architecture. Against this backdrop, I support calls for a broad review of the ECB’s strategy, which should have as one of its main aims the widening of our policy scope.

The challenges I have outlined in this talk warrant a discussion on the merits of increased flexibility in the face of external shocks. One way to achieve this would be the introduction of a symmetric band around the inflation aim, which would buy the central bank time and flexibility in responding to forces it cannot control. The monetary strategy could also be made more flexible by lengthening the horizon over which it would be desirable to bring inflation back towards its aim. Increased flexibility could help the ECB to better communicate its commitment to price stability while acknowledging its currently limited control over short-run inflation. It would also provide additional room for maneuver to prevent the built up of macroeconomic and financial imbalances, which – at the moment they collapse – might cause an even more severe ELB situation.9

Of course, longer deviations of inflation from its aim pose communication challenges, and might cause a drift in inflation expectations. Also from this perspective, a symmetric band around our inflation aim would have merit. It would acknowledge that sometimes inflation will over-, while at other times it will undershoot. More explicit forms of ‘make-up’ strategies have been put forward too, for example by former FOMC Chair Ben Bernanke.10 These strategies explicitly aim at an inflation overshoot following a period of inflation below target. To the extent that such strategies bring us back to a very precise aim for average inflation, I fear, however, that they might end up limiting our flexibility rather than enhancing it.11

Last but not least, the ECB does not operate in a vacuum. Whichever way central bankers will decide in designing a new monetary strategy, perhaps the most important precondition to preserve policy scope is that other policies also contribute to macroeconomic and financial stability. In the euro area, important steps in this regard have already been taken. The ECB’s scope to ease its monetary stance has benefited greatly from the improvements to EMU’s institutional architecture. Yet, it is a fact of life that the ECB still faces 19 different fiscal counterparts. This makes the purchase of government bonds more fraught than in other jurisdictions. Time-inconsistent application of the Stability and Growth Pact and the absence of a central fiscal capacity have also contributed to fiscal policies not having been as countercyclical as in other advanced economies12. I would see merit in a simpler Stability and Growth Pact, with perhaps more emphasis on debt levels relative to budget deficits. To what extent this should be complemented with steps towards more fiscal risk sharing, is very much a political question. From my perspective, I can only note that more effective fiscal stabilization would have the potential to make the ECB’s job significantly easier.

See e.g. Aaronson, S., Cajner, T., Fallick, B., Galbis‐Reig, F., Smith, C. and W. Wascher (2014). Labor Force Participation: Recent Developments and Future Prospects, Brookings Papers on Economic Activity, Fall, 197‐255; and Bonam, D., de Haan, J. and D. van Limbergen (2018). Time‐varying wage Phillips curves in the euro area with a new measure for labor market slack, DNB WP 587, March.

For a thorough analysis of this phenomenon in the euro area, see Ciccarelli, M. and C. Osbat (2017) Low inflation in the euro area: Causes and consequences. ECB Occasional Paper No 181, January.

Ha, J., Ivanova, A., Ohnsorge, F., Unsal and D. Filiz (2019). Inflation: Concepts, Evolution, and Correlates. World Bank Policy Research Working Paper No. 8738.

A thorough empirical analysis of how the changes in the global economy can be characterized by a trend in inflation is provided in Cecchetti, S., Hooper, P., Kasman, B., Schoenholtz, K. and M. Watson (2007). Understanding the Evolving Inflation Process . Paper presented at the US Monetary Policy Forum, 9 March. For a discussion of the decline in trend inflation and increase in inflation persistence in the euro area over the past decade, see Ciccarelli, M. and C. Osbat (2017) Low inflation in the euro area: Causes and consequences. ECB Occasional Paper No 181, January.

See Hindrayanto, I., Samarina, A. and I. Stanga (2019). Is the Phillips curve still alive? Evidence from the euro area. Economics Letters 174, 149‐152. For a discussion of these results in a broader context, see Bonam, D., Galati, G., Hindrayanto, I., Hoeberichts, M., Samarina, A. and I. Stanga (2019). Inflation in the euro area since the Global Financial Crisis. DNB Occasional Study No.3.

For an overview of the debate on the changing natural rate of interest and its determinants, see Bonam, D., van Els, P., van den End, J.W., de Haan, L. and I. Hindrayanto (2018). The natural rate of interest from a monetary and financial perspective. DNB Occasional Study No.3, June.

Milton Friedman’s much quoted proposition can be found in Friedman, M. (1963). Inflation Causes and Consequences. Asia Publishing House, New York.

Hartmann, P. and F. Smets (2018). The first twenty years of the European Central Bank: monetary policy. ECB Working Paper No. 2219, December.

Borio, C. (2018). Looking through the glass. OMFIF City Lecture, London, 22 September.

See e.g. Bernanke, B. (2017). Monetary policy in a new era. Brookings Institute, October.

For a more extensive discussion on the pros and cons of make‐up strategies, see e.g. L. Mester (2018). Monetary Policy Frameworks. Panel Remarks at the session on “Coordinating Conventional and Unconventional Monetary Policies for Macroeconomic Stability”, Allied Social Science Associations Annual Meeting, Philadelphia, PA, 5 January.

See e.g. European Fiscal Board (2019). Assessment of EU fiscal rules, August.