Central bank independence (CBI) and its link to inflation have become a part of conventional wisdom. However, the literature shows that there is a lack of a stable general pattern for the relation between CBI and inflation, even for relatively homogenous groups of countries. We use two indexes for CBI: one proposed by Grilli, Masciandaro and Tabellini (1991) and another one by Cukierman, Webb and Neyapti (1992) to analyse the CBI-inflation relationship in the groups of advanced and non-advanced economies. In addition, we use disaggregated indices to check what aspects of independence are of highest importance. Our results suggest that CBI has negative significant impact on inflation mostly by results for non-advanced economies and that this relationship did not change during the recent crisis.

Central bank independence (henceforth CBI) and its link to inflation have become a part of conventional wisdom in economics. It is most often explained by the time inconsistency of optimal policy and inflationary bias of the government when the latter is responsible for both the real economic activity and nominal stabilization as described by Kydland and Prescott (1977) and Barro and Gordon (1983). Government is tempted to create unexpected inflation to modify the ex post real value of nominal contracts (including wages); that in turn stimulate employment and output. Of course, rational agents are aware of this temptation so they adjust their inflation expectations to the equilibrium point where there is no unexpected inflation, but inflation is higher than the optimal level. Central bank independence as a tool for reducing this inflationary bias may mean – as in Rogoff’s (1985) interpretation – a central bank with a different preference for stable prices than society or – as in most practical applications – a central bank with a strict priority for the price stability and no direct responsibility for employment, output etc. Goodhart (2003) and Gnan and Masciandaro (2016) present the same story in a more narrative manner to make it understandable for the general public. This theoretical explanation and solutions for the inflation-bias problem have been extensively and critically discussed (cf. Piga (2000) and references therein), but this rationale for CBI is still present in the literature. It follows directly that we should observe a direct relationship between inflation and CBI.

Another strand of literature concerns major central banks engaging themselves into so-called unconventional monetary policy during the great financial crisis. As some of those activities seem to go beyond the specific mandate that justifies theoretically central bank independence itself, as a natural outcome questions arise about the limits of that independence: should it cover only the narrowly defined monetary policy or should it also include other central bank activities going beyond that, including macroprudential policy (cf. Blinder et al. (2017), de Haan and Eijffinger (2016, 2017), Issing (2016); Mersch (2017)). Most discussants give a clear answer that the concept of central bank independence applies only to the central bank as a monetary policy institution. However, those extensions of central bank functions that are mentioned earlier have been accompanied by changes in central bank laws and regulations (cf. Khan (2017)). Thus, it is a valid question to check whether different measures of central bank independence have showed some changes for the crisis and after-crisis period, and whether the link between central bank independence and inflation has changed its nature after the crisis. For example, for the turnover rate, Artha and de Haan (2015) find that financial crises increase the probability of a central bank governor turnover.

Validity of the link between central bank independence and inflation can be empirically tested only when central bank independence is quantified. The most popular approach to measuring CBI is to create an index based on expert assessment of various dimensions of CBI: legal, economic, financial etc. The index designed by Grilli, Masciandaro and Tabellini (1991) and another index constructed by Cukierman, Webb and Neyapti (1992) are most widely used in the literature. The former includes 15 components that are divided into two groups measuring respectively economic and political independence; the latter includes 16 components and they form four groups measuring the governor’s political independence, monetary policy process (its design and resolution of potential conflicts), objectives of the central bank, and limits for central bank’s lending to the government.

Recent surveys of empirical work directed into finding a meaningful relation between central bank independence – measured with those indexes – and inflation can be found i.a. in Balls et al. (2016), Bodea and Hicks (2015) and Iwasaki and Uegaki (2017). All those surveys and some earlier critical papers show that – setting aside measurement issues per se3 – it is difficult to obtain a negative and statistically significant effect on inflation of central bank independence across all groups of countries and time periods.

Alesina and Summers (1993) showed a near perfect negative correlation between inflation and central bank independence for advanced economies for the period between 1955 and 1988; similar results can be found in Carlstrom and Fuerst (2009) for pre-2000 years, in Balls et al. (2016) for the 1970s and 1980s etc. Klomp and de Haan (2010) in their meta-analysis covering 59 studies found a similar relation for OECD countries. In contrast, Bodea and Hicks (2015) report that central bank independence is insignificant as a factor explaining growth of M2 for OECD countries, but negative and significant for non-OECD countries; similar results were obtained by Alpanda and Honig (2010).

There are also examples of similar inconsistencies even for studies limiting their coverage to much smaller groups of countries. Iwasaki and Uegaki (2017) and Petrevski et al. (2012) are interested only in the transition economies. The former paper’s conclusion is that there exists a close relationship between central bank independence and inflation, but in the latter central bank independence is statistically insignificant. A review of empirical studies shows that it is still difficult to obtain a negative and statistically significant effect on inflation of central bank independence across all groups of countries and time periods. This lack of a stable general pattern for the relation between central bank independence and inflation, even for relatively homogenous groups of countries, gives motivation for further studies on this topic.

For more in depth analysis of the impact of CBI on inflation larger sets of data were needed covering more countries and longer time span. The appearance of such larger sets of panel data allowed for studies of the effects of changes in CBI and its components over longer periods of time and their possible impact on the CBI-inflation link (e.g. Arnone and Romelli (2013), Dincer and Eichengreen (2014)). Empirical researchers used a dynamic panel approach with model specification allowing explicitly for possible differences between countries with stronger and weaker institutions supporting rule of law to a different extent and for the important role of other economic and political variables (cf. e. g. Polillo and Guillen (2005), Bodea and Higashijima (2017), Papadamou et al. (2017)). In our empirical study we use two indices for central bank independence: the Cukierman, Webb and Neyapti (CWN) index, from the database provided by Garriga (2016), and the Grilli, Masciadaro and Tabellini (GMT) index, calculated for a longer sample by Masciandaro and Romelli (2015)4. The common sample of these two independence measures covers the period from 1992 to 2012 for 52 countries. After excluding one country for missing data other than CBI index, our panel includes 51 countries, of which we classify 24 as advanced economies, and 27 as non-advanced (emerging and developing) economies.5

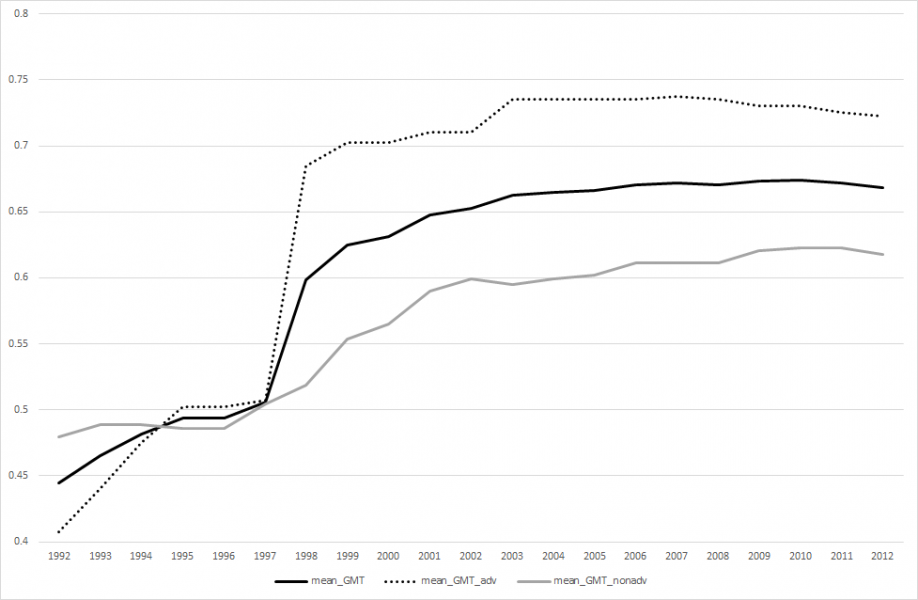

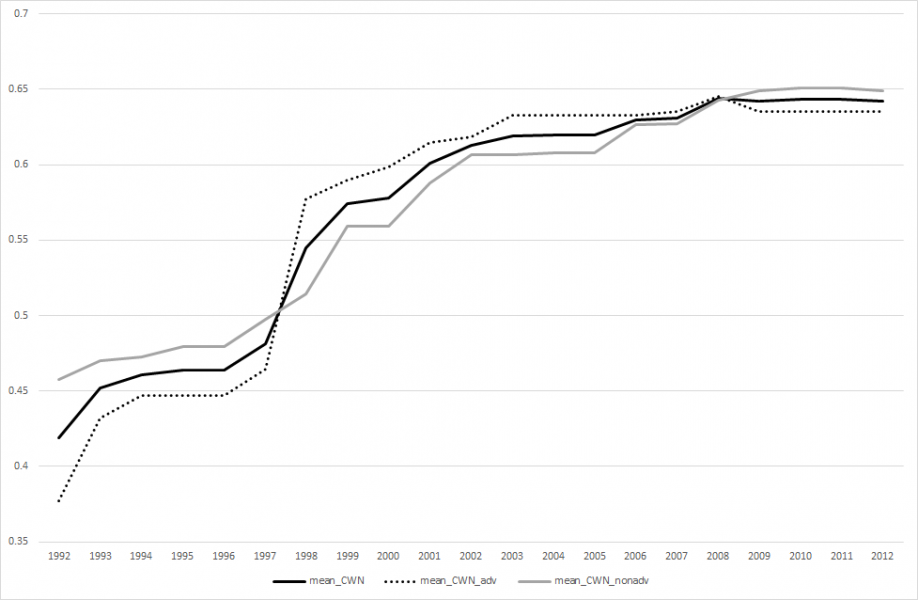

Figures 1. and 2. show the mean values of GMT and CWN indices for the whole sample of countries as well as for the group of advanced and non-advanced economies over the entire period. The data suggest that the legal CBI started declining slightly after the beginning of the global financial crisis. However, the timing of the decline was different in both groups of countries. In the advanced countries CBI was increasing continuously until 2007 (according to GMT) or 2008 (according to CWN) and decreased afterwards. In the non-advanced economies the decline occurred later (after 2011), although it is difficult to state definitely if the trend continued. Nevertheless, it seems that the crisis stopped the trend towards greater CBI around the world.

Figure 1. GMT index

Source: own preparation

Figure 2. CWN index

Source: own preparation

Both indices consist of several sub-indices. The CWN index consists of four parts describing: the term of office, appointing and dismissing conditions of the chief executive officer, limitations on lending to the government, objectives of the central bank – what is the status of price stability objective in the central bank’s mandate, and policy formulation conditions – the extent to which central bank has the authority to formulate monetary policy and the power to resist the government. The GMT index consists of political and economic indices. Political independence refers to the capacity of monetary policymakers to choose the final goals and is described by three components: the procedure for appointing the central bank’s board members, the relationship between the central bank’s governing body and the government and the formal responsibilities of the central bank. Economic independence refers to the ability of the central bank to choose the instruments of monetary policy and consists of two aspects: limitations on lending to the government and the types of instruments under the control of the central bank (Grilli et al., 1991). Although many studies indicate high correlation between these two CBI measures, in our study this correlation equals 0.67, which suggests some differences between them. Moreover, they capture to a different extent changes in the legal framework of central banks introduced after the outburst of the global financial crisis. Hence, for the period 2008-2012 the correlation between the indices decreases and equals 0.59. Even more significant differences may be observed for the respective sub-indices. Balls et al. (2016) claim that differences between these two CBI measures have been increasing over time and they discuss some examples of these discrepancies for several countries. These differences suggest the use of both measures in empirical studies to verify the robustness of the results to the choice of the CBI quantification method.

An empirical study should also take into account potential differences in the impact of CBI on inflation developments between advanced and less advanced economies. This problem has been recognized in the literature and larger panel data, such as described above, allow for such analysis. In our empirical study we additionally took into account that different aspects of CBI may have different effect on inflation depending on the development level of economies. We were able to conduct such analysis as we had at our disposal disaggregated data on the CBI indices (sub-indices constituting the CWN and GMT measures). Our results show that CBI has negative significant impact on inflation only in the group of non-advanced economies. In the advanced economies CBI seems to play no significant role in disinflation process. Our findings suggest moreover that the relationship between inflation and CBI did not change during the crisis. As far as respective aspects of CBI are concerned, it seems that virtually none of the sub-indices is significant for inflation in advanced countries, while most of them has significant impact on inflation in the non-advanced ones. In this respect our conclusions differ from those obtained by Balls et al. (2016), who found that operational (economic) independence had significant negative impact on inflation in advanced economies in the 1970s and 1980s (but no effect later), while in the emerging and developing economies neither political nor operational independence were significant for inflation developments. It is interesting to note that the most important aspects of independence for lowering inflation and minimizing the inflation gap in the emerging and developing countries are economic/policy independence and restrictions on lending to the government. This is consistent with the basic economic intuition behind the central bank independence relation to inflation, i.e. the negative outcomes of debt monetization and the importance of autonomy of the central bank in setting the policy instrument.

Our findings show that it is not only CBI that may have different impact on inflation depending on the type of the economy. In our study we used a set of controls to include other potential determinants of inflation process. The institutional arrangements such as level of democracy or the exchange rate regime seem to play much more significant role in the group of non-advanced countries than in the advanced ones. The results provide, therefore, strong evidence for the differences in the determinants of inflation between different types of economies.

Our conclusions can be viewed as an argument in the renewed debate about the importance of the institution of central bank independence. After significant trend towards higher independence and encouraging results of studies evaluating the impact of CBI on inflation performance in advanced economies, the environment of low and stable inflation rates in the later period (or even “too low for too long” inflation rates in some economies) raised questions about necessity of this institution. Even more controversies emerged after engagement of many major central banks in quasi-fiscal activities. The results of our study confirm the importance of legal CBI for emerging and developing economies. It seems that CBI has negative significant impact on inflation and inflation gap in the group of non-advanced economies while no significant effect in the advanced ones. Although much attention is given in the recent literature to the changes in the role of central bank independence after the beginning of the recent crisis, we did not find evidence for changes in the impact of CBI on inflation after the crisis.

Our findings provide clear policy implications. It seems that in advanced economies with high overall quality of institutions CBI adds little to the control of inflation. The opposite is true in the case of less advanced countries. In the face of weaker other institutions establishing of an independent central bank strongly supports disinflation process in these countries.

Alesina, A., L.H. Summers (1993). Central Bank Independence and Macroeconomic Performance: Some Comparative Evidence. Journal of Money, Credit and Banking, 20, 177-188.

Alpanda, S., A. Honig (2010). Political monetary cycles and a de facto ranking of central bank independence. Journal of International Money and Finance, 29, 1003-1023.

Arnone, M., D. Romelli (2013). Dynamic central bank independence indices and inflation rate: A new empirical exploration. Journal of Financial Stability, 9, 385-398.

Artha, I., J. de Haan (2015). Financial Crises and the Dismissal of Central Bank Governors: New Evidence. International Journal of Finance & Economics. 20, 80-95.

Balls, E., J. Howat, A. Stansbury (2016), Central Bank Independence Revisited: After the financial crisis, what should a model central bank look like? M-RCBG Associate Working Paper Series No. 67, Harvard Kennedy School.

Barro, R., D. Gordon (1983). A Positive Theory of Monetary Policy in a Natural Rate Model, Journal of Political Economy. 91, 589-610.

Blinder, A., M. Ehrmann, J. de Haan, D.-J. Jensen (2017). Necessity as a mother of invention: Monetary policy after the crisis. Working Paper Series No. 2047, ECB.

Bodea, C., M. Higashijima (2015), Central Bank Independence and Fiscal Policy: Can the Central Bank restrain Deficit Spending?. British Journal of Political Science, 47, 47-70.

Bodea, C., R. Hicks (2015). Price Stability and Central Bank Independence: Discipline, Credibility, and Democratic Institutions. International Organizations, 69, 35-61.

Cargill, T.F. (2016). The Myth of Central Bank Independence. Mercatus Working Paper.

Cukierman, A., S.B. Webb, B. Neyapti (1992). Measuring the Independence of Central Bank and Its Effect on Policy Outcomes. World Bank Economic Review, 6, 353-398.

de Haan, J., S.C.W. Eijffinger (2016). The politics of central bank independence. EBC Discussion Paper 2016-004, Tilburg University.

de Haan, J., S.C.W. Eijffinger (2017). Central bank independence under threat? Policy Insight No. 87, CEPR.

Dincer, N.N., B. Eichengreen (2014). Central Bank Transparency and Independence: Updates and New Measures. International Journal of Central Banking, 10, 189-253.

Forder, J. (1999). Central Bank Independence: Reassessing the Measurements. Journal of Economic Issues, XXXIII, 23-40.

Garriga, A. (2016). Central Bank Independence in the World: A New Data Set. International Interactions, 42, 849-868.

Gnan, E., D. Masciandaro (2016) (eds.). Central Banking and monetary Policy: What Will Be the Post-Crisis New Normal?. SUERF Conference Proceedings 2016/4.

Goodhart, C. A. E. (2003). The constitutional position of the central bank, in: Money, Inflation and the Constitutional Position of the Central Bank. Institute of Economic Affairs, London.

Grilli, V., D. Masciandaro, G. Tabellini (1991). Political and Monetary Institutions and Public Financial Policies in the Industrial Countries. Economic Policy, 6, 341-392.

Issing, O. (2016). Central Banks – from Overburdening to Decline? White Paper No. 42, SAFE, Goethe University, Frankfurt.

Iwasaki, I., A. Uegaki (2017). Central Bank Independence and Inflation in Transition Economies: A Comparative Meta-Analysis with Developed and Developing Economies. Eastern European Economics, 55, 197-235.

Khan, A. (2017). Central Bank Legal Framework in the Aftermath of the Global Financial Crisis. Working Paper No. 17/101, IMF.

Klomp, J.G., J. de Haan (2010). Inflation and Central Bank Independence: A Meta Regression Analysis. Journal of Economic Surveys, 24, 593-621.

Kydland, F., E. Prescott (1977). Rules Rather than Discretion: The Inconsistency of Optimal Plans. Journal of Political Economy, 85, 473-492.

Masciandaro, D., D. Romelli (2015). Ups and downs of central bank independence from the Great Inflation to the Great Recession: theory, institutions and empirics. Financial History Review, 22, 259-289.

Mersch, Y. (2017). Central bank independence revisited. Keynote address at the Symposium on Building the Financial System of the 21st Century, Frankfurt, 30 March 2017.

Papadamou, S., E. Spyromitros, P. Tsintzos (2017). Public investment, inflation persistence and central bank independence. Journal of Economic Studies, 44, 987-1002.

Petrevski, G., J. Bogoev, B.S. Sergi (2012). The link between central bank independence and inflation in Central and Eastern Europe: are the results sensitive to endogeneity issue omitted dynamics and subjectivity bias?. Journal of Post Keynesian Economics, 34, 611-652.

Piga, G. (2000). Dependent and Accountable: Evidence from the Modern Theory of Central Banking. Journal of Economic Surveys, 14, 563-595.

Polillo, S., M.F. Guillen (2005). Globalization Pressure and the State: The Worldwide Spread of Central Bank Independence. American Journal of Sociology, 110, 1764-1802.

Rogoff, K. (1985). The Optimal Degree of Commitment to an Intermediate Target. Quarterly Journal of Economics, 100, 1169-1190.

This note is based on the article Kokoszczyński R., Mackiewicz-Łyziak J. (2019). Central Bank Independence – An Old Story Told Anew. International Journal of Finance & Economics. DOI: 10.1002/ijfe.1730. We gratefully acknowledge the license we got from John Wiley and Sons to use content of this article in this SUERF Policy Note.

Ryszard Kokoszczyński is member of the board of Narodowy Bank Polski and professor at the University of Warsaw. Joanna Mackiewicz-Łyziak is associate professor at the Faculty of Economic Sciences of the University of Warsaw. The views expressed here are those of the authors and do not necessarily reflect those of Narodowy Bank Polski.

Forder (1999) and Cargill (2016) present some critical remarks regarding the possibility of measuring CBI.

We are very grateful to Donato Masciandaro and Davide Romelli for making their data on CBI indexes available to us.

Our sample of advanced economies includes: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Japan, Luxembourg, Netherlands, New Zealand, Norway, Portugal, Singapore, South Korea, Spain, Sweden, Switzerland, United Kingdom and United States. Non-advanced countries include: Albania, Argentina, Brazil, Bulgaria, Chile, Croatia, Czech Republic, Hungary, India, Indonesia, Iran, Kuwait, Latvia, Malaysia, Mexico, Morocco, Romania, Russia, Saudi Arabia, Slovakia, Slovenia, Thailand, Trinidad and Tobago, Turkey, Ukraine, United Arab Emirates and Venezuela.