These are the main implications:

|

|

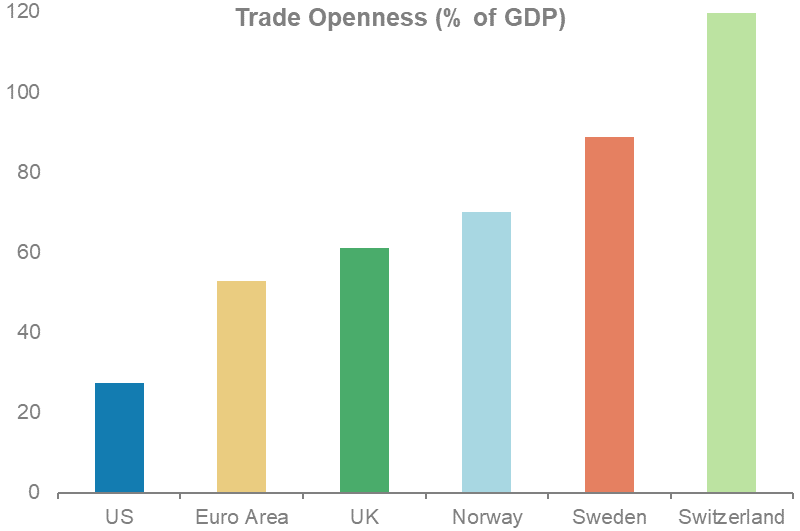

| Source: OECD, Morgan Stanley Research estimates; Note: Exports plus imports. |

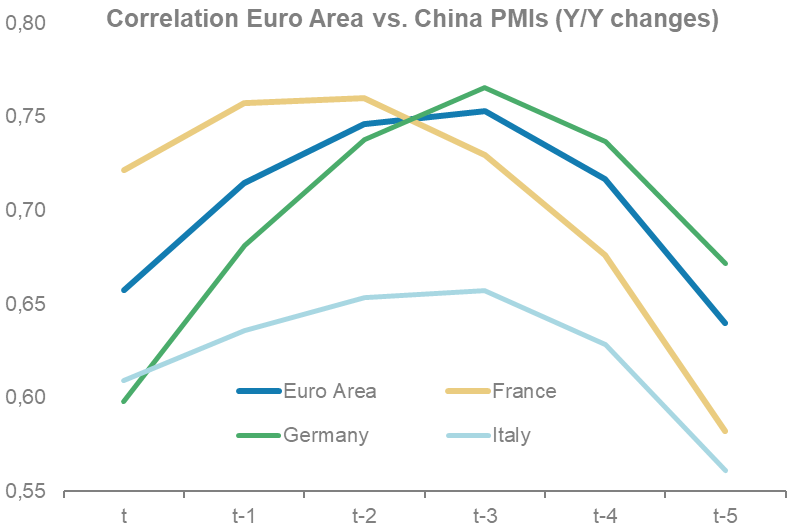

Source: Morgan Stanley Research calculations |

|

|

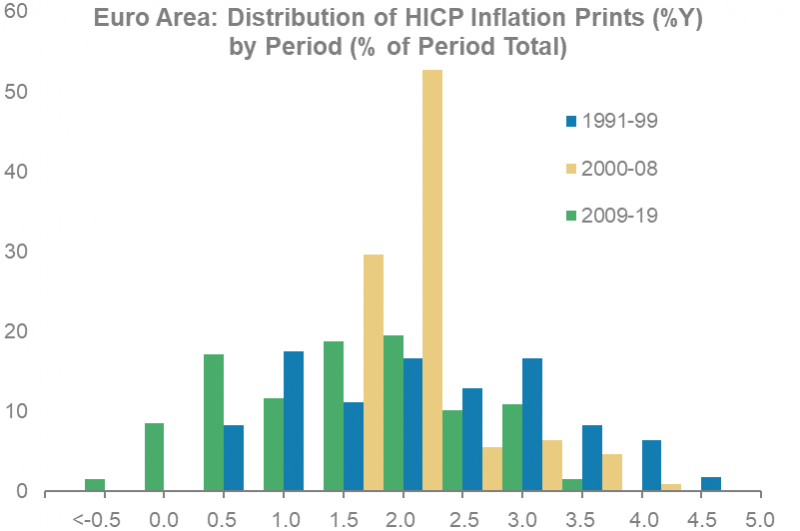

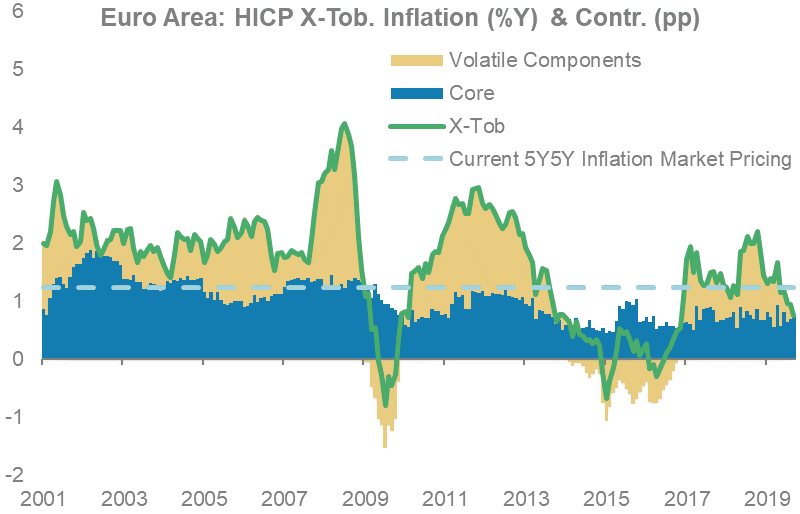

| Source: Eurostat, Morgan Stanley Research | Source: Eurostat, Morgan Stanley Research; Note: Volatile components = Energy + food. |

|

|

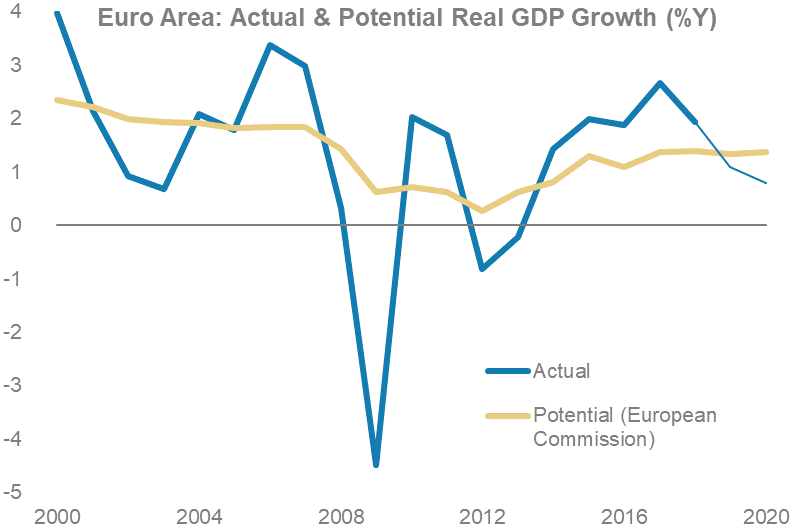

| Source: Eurostat, European Commission, Morgan Stanley Research; Note: Thin line = Morgan Stanley Research forecast. |

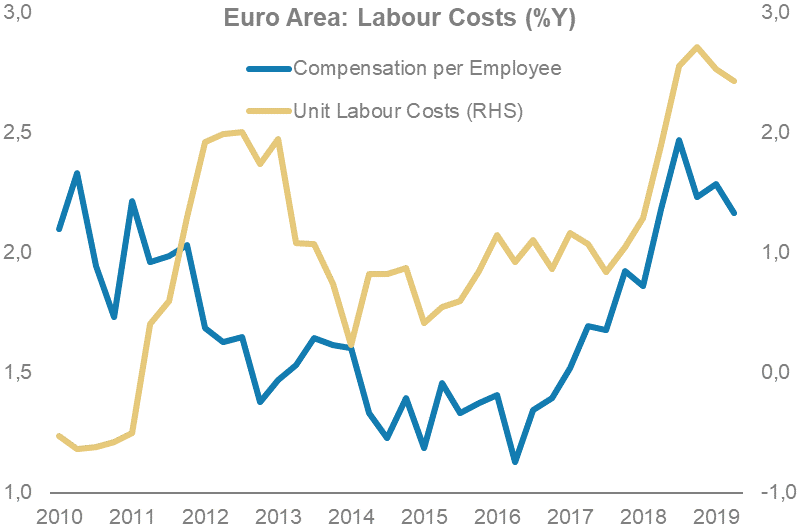

Source: Eurostat, Morgan Stanley Research |

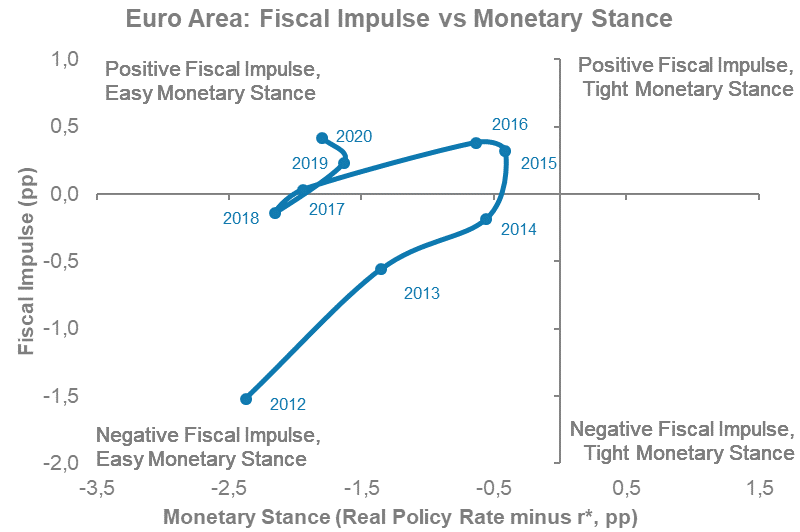

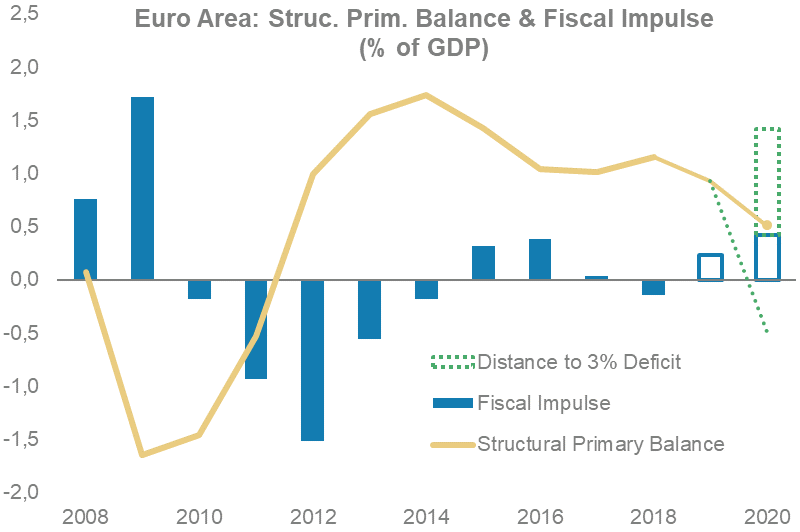

The fiscal-monetary policy mix will likely shift over time

|

|

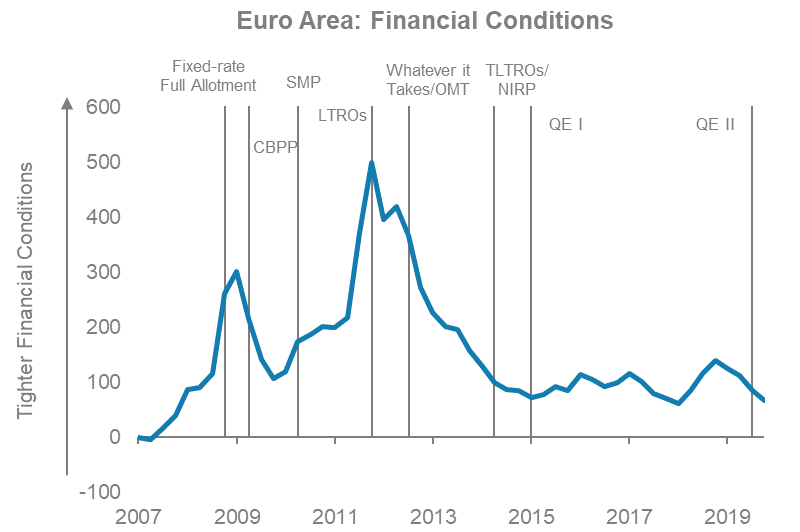

| Source: ECB, Morgan Stanley Research estimates | Source: National governments, Morgan Stanley Research estimates |

|

|

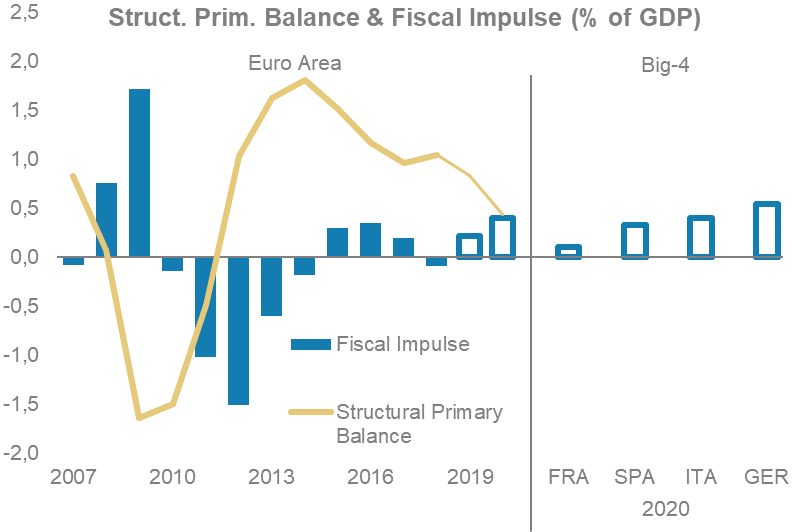

Source: European Commission, Morgan Stanley Research; Note: Empty bars, thin line = Morgan Stanley forecast; Structural primary balance = cyclically adjusted primary balance ex one-offs; Fiscal impulse = change in structural primary balance; +/- = fiscal boost/drag.

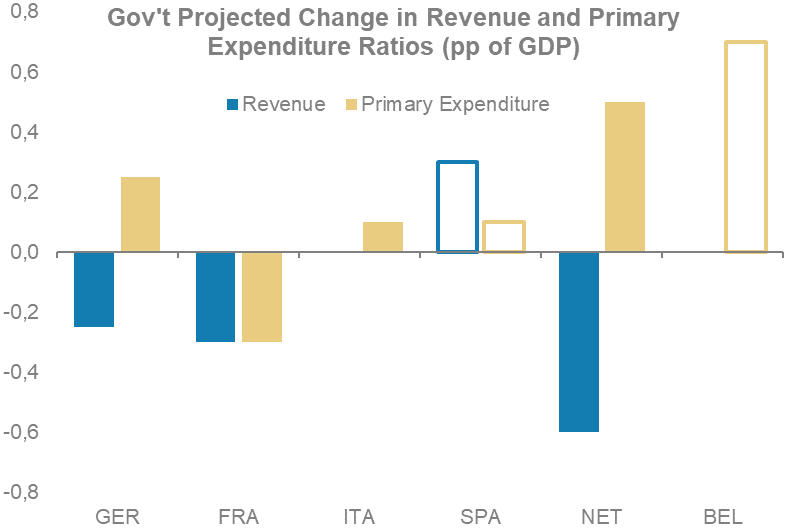

Some extra spending and tax cuts, but public investment remains low

|

|

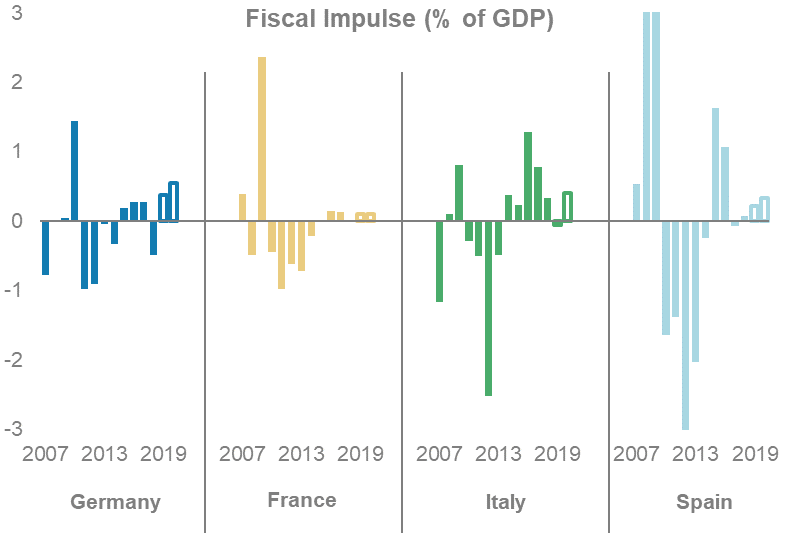

| Source: European Commission, Morgan Stanley Research forecasts | Source: Eurostat, Destatis, Insee, INE, Morgan Stanley Research |

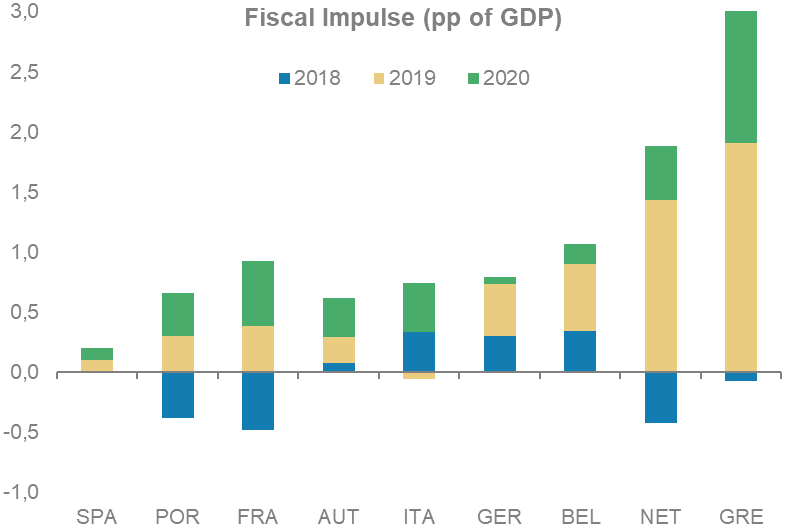

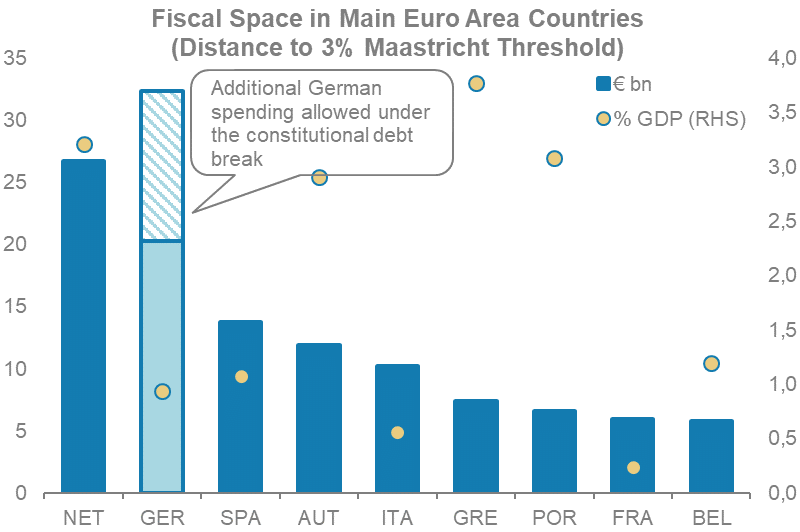

Potential for additional fiscal stimulus

|

|

Source: National governments, European Commission, Morgan Stanley Research estimates; Note: For Germany, we use the debt-brake rule, not a deficit of 3% of GDP; Greece’s targets are agreed with the official creditors, and currently they demand a 3.5% of GDP primary surplus.

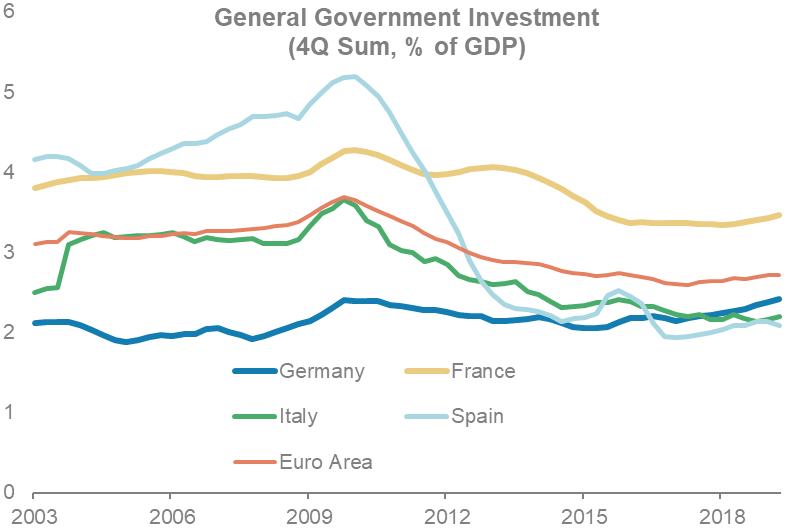

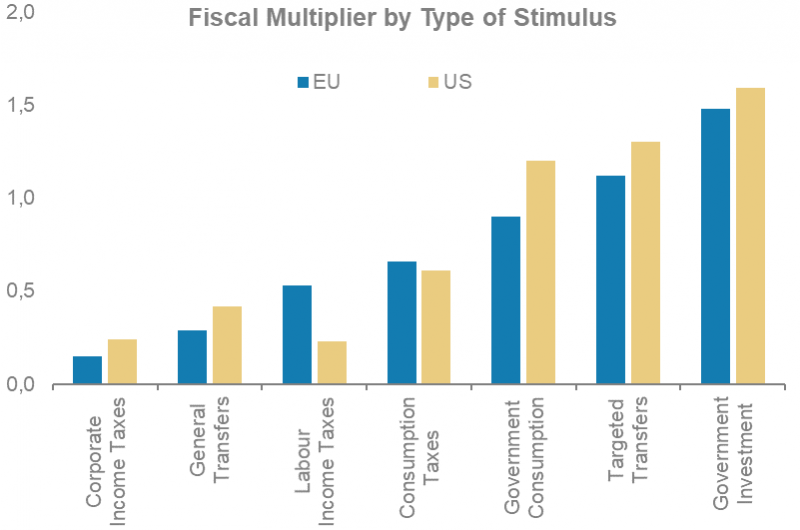

Little public investment means that the fiscal multiplier is likely to be small

|

|

| Source: National governments, Morgan Stanley Research; Note: Chart shows 2019 vs. 2020 changes; Given the current political situation in Spain and Belgium, the fiscal trajectory remains unclear, so estimates for these two countries as based on the assumption of no policy change. |

|

Source: Coenen et al. (2012), Morgan Stanley Research |

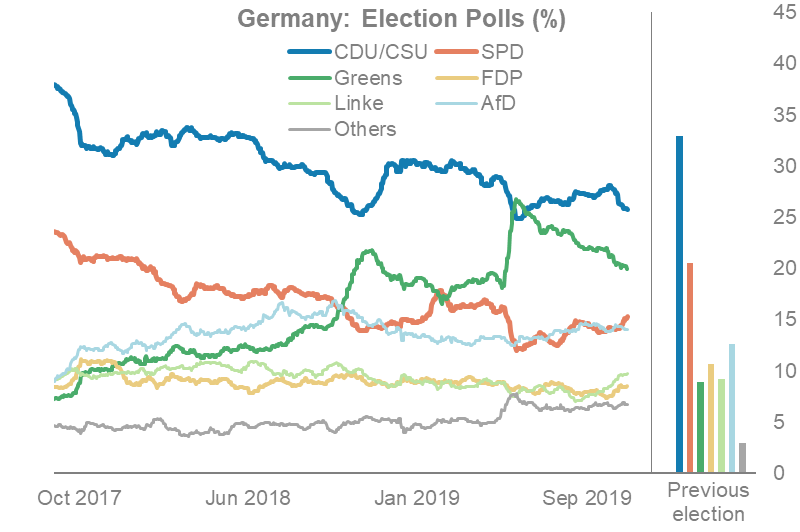

The political dimension of budgetary policy

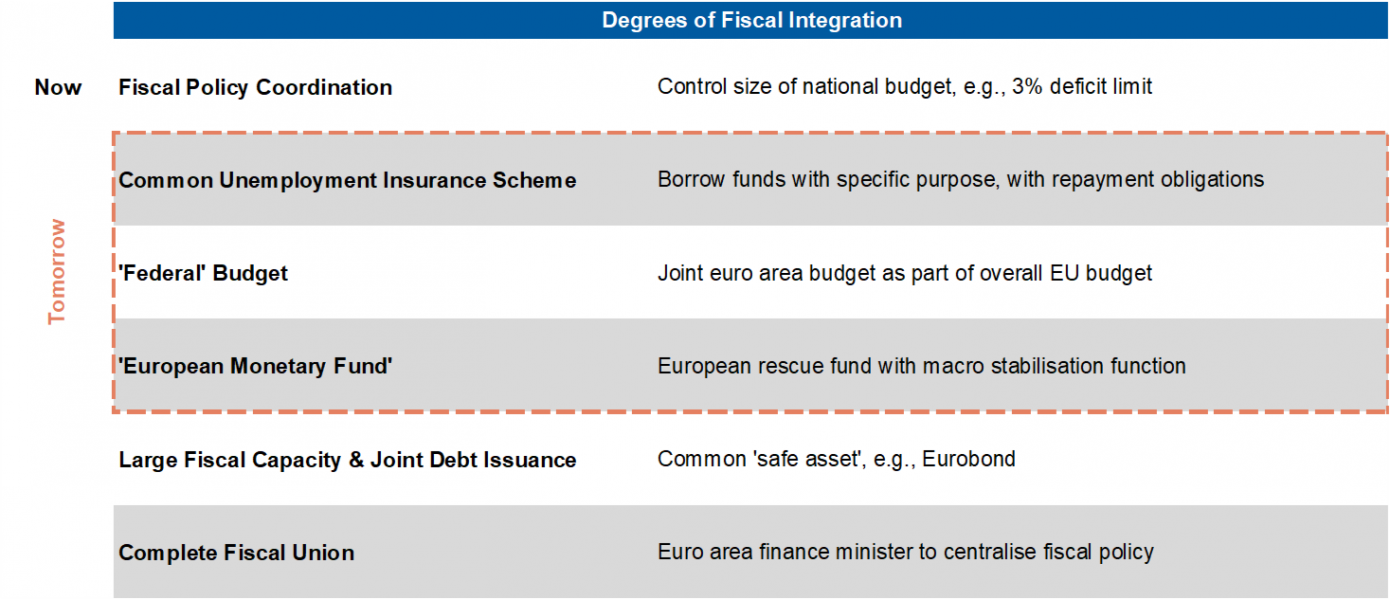

A budget for the euro area?

This article is based on research published for Morgan Stanley Research on 22 October 2019. It is not an offer to buy or sell any security/instruments or to participate in a trading strategy. For important current disclosures that pertain to Morgan Stanley, please refer to Morgan Stanley’s disclosure website: https://www.morganstanley.com/eqr/disclosures/webapp/generalresearch . Copyright 2019 Morgan Stanley.