Unprecedented policies will be needed to respond to the next economic downturn. Monetary policy is almost exhausted as global interest rates plunge towards zero or below. Fiscal policy on its own will struggle to provide major stimulus in a timely fashion given high debt levels and the typical lags with implementation. Without a clear framework in place, policymakers will inevitably find themselves blurring the boundaries between fiscal and monetary policies. This threatens the hard-won credibility of policy institutions and could open the door to uncontrolled fiscal spending. This paper outlines the contours of a framework to mitigate this risk so as to enable an unprecedented coordination through a monetary-financed fiscal facility. Activated, funded and closed by the central bank to achieve an explicit inflation objective, the facility would be deployed by the fiscal authority.

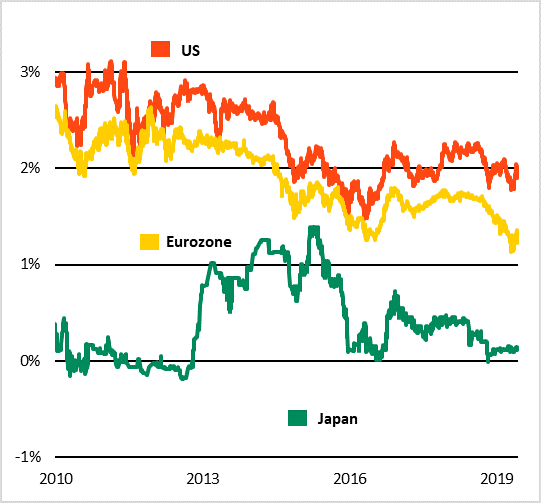

Monetary policy is in an unusual spot at this point in a record-long expansion. After a decade of unprecedented monetary stimulus around the world, actual inflation and inflation expectations still remain stubbornly low in most major economies. Inflation is falling persistently short of central bank targets even in economies operating beyond full employment – notably the US. It is even more unusual to see a drop in inflation expectations in the late-cycle stage when concerns would typically focus on overheating.

There are two potential reasons for why inflation is so low. First, the links between activity and inflation – the Phillips curve relationship – appears to have weakened in the post-crisis period. Inflation might have become less sensitive to the reduction of slack in the domestic economy, perhaps as a result of greater integration of global production and technology. Second, there is a self-fulfilling aspect to inflation: what people expect inflation to be in the future is a key driver of inflation today. If employees expect lower inflation going forward, wages won’t increase as much. Perhaps as a result of central banks not being able to bring inflation back to their targets so far or pervasive doubts about their ability to stave off future shocks, there has been a persistent drift lower of inflation expectations.

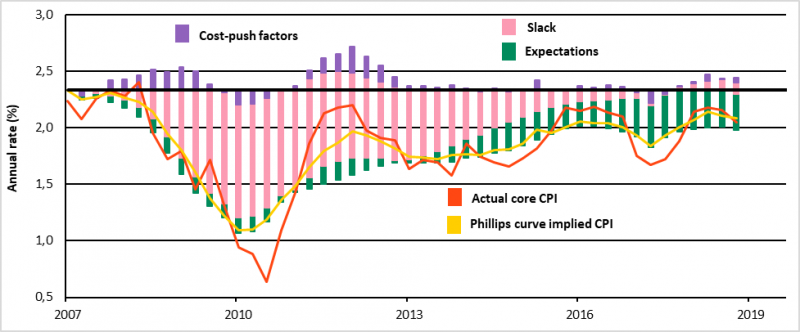

The chart below illustrates how weaker inflation expectations, starting in 2014, have offset the impact of reduced slack in shaping the actual US core CPI. The persistent drop in inflation expectations could call into question monetary policy frameworks established on targeting inflation. Other major economies start to look like Japan where years of weak growth and deflation were not countered sufficiently by monetary or fiscal policy – let alone both. We see reasons why the Phillips curve will likely reassert itself in the future – the chart shows the core CPI implied by the Phillips curve is not materially different from actual outcomes. But for the remainder of this cycle it is unlikely to do so quickly enough to allow a typical normalisation of monetary policy – hundreds of basis points in higher short-term rates – before the next downturn.

Expectations drag inflation lower

US core Consumer Price Index drivers, 2007-2019

Sources: BlackRock Investment Institute, with data from Refinitiv Datastream, August 2019. Notes: This chart shows the actual change in the annual rate of US core Consumer Price Index (CPI) and estimates of the contributions of various economic drivers. We break the drivers of inflation as implied by the Phillips curve into three factors: slack, cost-push factors (mainly via productivity growth and various global input costs) and inflation expectations. The factors are broken down by percentage point of contribution to the overall implied Phillips curve inflation from the starting point in 2007. The implied Phillips curve estimates are partly based off the August 2013 paper The Phillips Curve is Alive and Well. We use a measure of inflation expectations similar to the 2010 paper Modeling Inflation after the Crisis.

In response to heightened trade tensions and macro uncertainty, central banks have pivoted towards lower rates and more stimulus, eroding the limited policy remaining even before the next downturn strikes. In the eurozone, this means the ECB is poised to go even more negative. Such a pre-emptive pivot to loosen policy – when the expansion is slowing but growth remains positive – reflects central banks’ concerns about the risks to growth, persistent inflation undershoots and their reduced room for policy manoeuvre. This has even led to talk of using currency intervention as a tool, prompting concerns about competitive devaluations. Yet foreign exchange intervention does not change this overall picture – at best it’s a zero-sum game that does nothing to boost the global economy. Bottom line: 10 years into an expansion that was designed to restore the normal working of monetary policy, we are already eroding the limited policy space left.

Monetary policy – both conventional and unconventional – works through lower interest rates. Lowering rates across the yield curve helps stimulate demand by lowering the cost of financing consumption or investment. It also gives investors incentives to rebalance into riskier assets, in principle reducing the cost of capital for companies. If policy rates are near their effective lower bound and the scope for longer term rates to fall is limited, monetary policy cannot provide much more stimulus through this channel – a liquidity trap situation. We detailed the factors that have been driving the decline in interest rates in our November 2017 paper The safety premium driving low rates.

The secular decline in neutral interest rates (r-star) – the estimate of rates that neither stimulates nor hinders economic growth – has reduced the distance from the effective lower bound (ELB) and thereby how much the central bank can cut in a downturn. Lower potential growth is one factor, but our r-star estimate, based on a Fed model, has fallen by more than growth since the mid-2000s – especially after the crisis. We believe this wedge reflects the role played by an increase in global risk aversion, initially stoked after the late-1990s Asia financial crisis and later magnified by the GFC. These severe shocks motivated persistently higher precautionary savings by both the public and private sectors, dragging down the neutral rate. Our estimates suggest that greater risk aversion and lower potential growth each account equally for the roughly 150 basis point decline in the US r-star since the GFC.

Rising risk aversion also makes perceived safe assets more alluring and compresses their yields relative to other assets. This is why investors are pushing interest rates ever lower and flattening out yield curves. Nominal yields on long-term government bonds are at new record lows – the entire German bund yield curve is now negative – or back near historic ones in the US. The term premium – the compensation that investors typically demand for bearing the greater risk of long-term bonds – is negative again. Interest rates in Europe and Japan may already be near their ultimate floor as long as there is still physical cash.

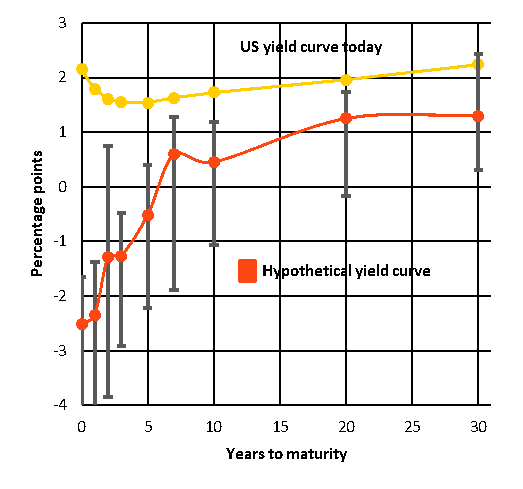

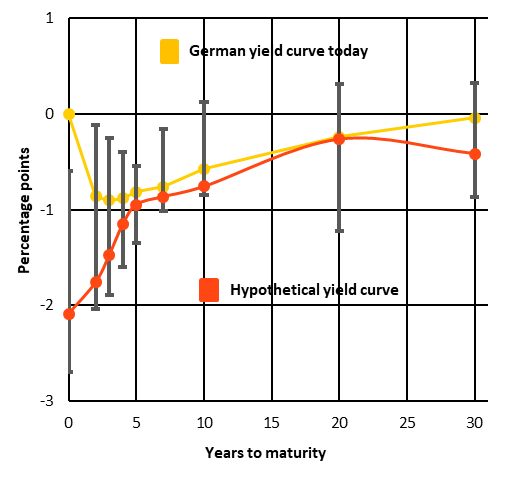

The chart on the left below shows the current US Treasury and German bund yield curves compared with a hypothetical one based on the median curve moves during the recessions of recent decades, adjusted for structural changes to neutral rates. We do this to get a sense of how the curve might need to shift lower from current levels if it were to react in a similar fashion as during past recessions. To get a similar move now, short-term rates would need to drop to around -2% in both countries. We believe such a move is highly unlikely if not impossible – the ELB where central banks stop cutting rates, and investors stop chasing negative yields, is almost certainly higher than this.

Conventional and unconventional monetary policy space is therefore limited and rapidly being used up even before central banks respond to the next downturn, let alone a full-blown recession. So now what?

Central banks are running out of ammunition

Actual and hypothetical US-German yield curves, based on historical recession impact, 2019

|

|

Sources: BlackRock Investment Institute, with data from Refinitiv Datastream, August 2019. Notes: The chart shows the current US Treasury and German bund yield curves and hypothetical yield curves. The hypothetical curves show what the yield curve would look like based on the curve’s median move during the past five recessions. The bars show the range of moves during those recessions. To account for the changing interest rate environment of the past few decades, the curve moves are adjusted based on the structural decline in neutral rates discussed on this page. Forward looking estimates may not come to pass.

Fiscal policy can do more heavy lifting when monetary policy alone is no longer enough. Even without any coordination, governments have room to borrow and invest more – especially in a low interest rate environment – to effectively stir activity. We have argued that there has not been enough government spending globally on infrastructure, education, renewable energy or other technologies to lift total factor productivity growth back to its pre-crisis trends and boost potential growth.

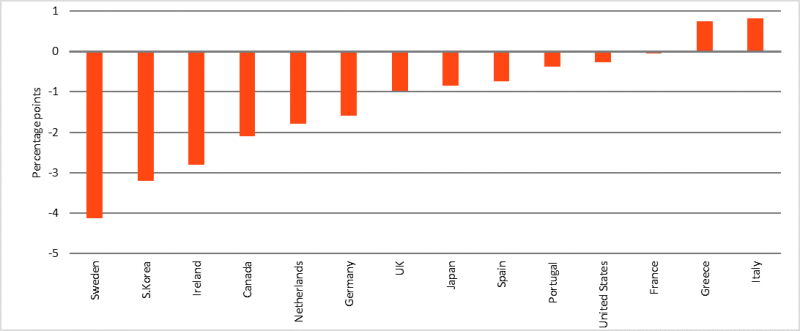

The low interest rate environment increases fiscal space not only by making it cheaper to borrow, but also makes it possible for some governments to grow out of the increased debt. The ratio of interest expense to revenue for DM governments is lower on average now than it was before the crisis, even though debt levels are considerably higher. So as long as risk free rates stay below the return on capital and trend growth, it is possible to increase deficits and still see debt-to-GDP ratios fall (Blanchard 2019, Furman and Summers 2019). The chart below shows how this is true for many DM countries.

As discussed earlier, there are good reasons to expect an environment favourable to fiscal policy to persist: the deep-rooted forces underlying the global saving glut will not change quickly on their own or will need material changes to be affected. That appears to be the market’s belief, with investors willing to push very long-term yields to vanishingly low levels: the Swiss 30-year bond yield is near -0.4% and Austria’s 50-year bond maturing in 2062 is one of the best performing financial assets this year.

Room to borrow and spend

DM real rates minus GDP growth, 2018

Sources: BlackRock Investment Institute, with data from the Organisation of Economic Cooperation and Development, August 2019. Notes: The chart shows real interest rates minus GDP growth based on the OECD’s May 2019 economic outlook. The interest rate is the effective rate paid on debt and thus adjusted by the maturity of the overall debt.

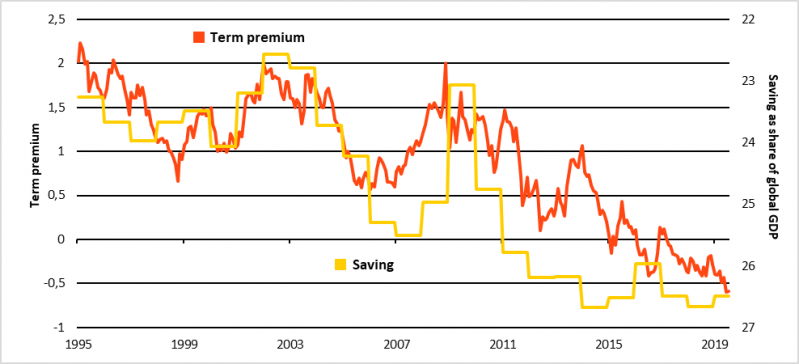

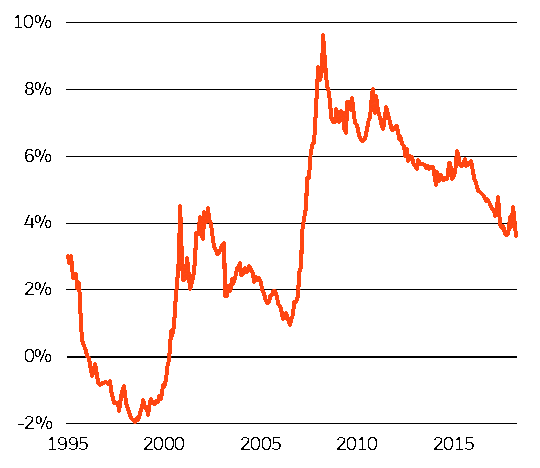

Yet there is no guarantee this favourable wedge between interest rates and trend growth would persist in the face of a major fiscal expansion. The strength and persistence of global precautionary saving pushed real interest rates below growth, driven by the decline in both neutral rates and the term premium – the latter now near -50 basis points in G3 bond markets, according to our estimates. See the chart below. But a significant increase in borrowing by governments globally could absorb part or all of this saving glut, pushing real interest rates towards or even above growth. The rise in public debt levels over the last four decades and the expansion of the welfare state (notably spending on retirement and health care) has been a meaningful force pushing neutral rates higher. Rachel and Summers (2019) estimate that higher public debt levels alone have added 150 to 200 basis points to neutral rates, while the expansion of social welfare spending added another 250 basis points – preventing an even steeper fall in neutral rates.

Furthermore, with debt/GDP ratios reaching new record highs, it would not take much of a shock to growth or interest rates for the debt ratio to balloon and spark concerns about debt sustainability. Hence high existing debt levels mean fiscal policy is vulnerable to even transitory interest rate spikes. Such a surge in rates could damage the fiscal policy space. This could arise from a so-called sudden stop: a temporary drying up of liquidity due to concerns about debt sustainability or losing reserve currency status.

Typically, countries that issue debt in their own currency can sustain higher debt levels and have more flexibility than countries that cannot. Yet countries borrowing in their own currency cannot completely avoid a surge in rates. If debt is on an unsustainable trajectory, the central bank can intervene by either increasing the monetary base by printing money or restarting QE. In the first case, runaway inflation would likely result at some point. In the second, it is important to realise that QE does not improve the government’s solvency: as the central bank issues reserves to buy bonds, the consolidated balance sheet of the government sector – including the central bank – is unchanged. Even if a central bank reduces sudden stop risks, QE shortens the maturity of the consolidated government debt by swapping bonds for reserves (Blanchard and Tashiro 2019).

Record debt levels might also stoke expectations that taxes will be raised, or benefits reduced, in the future. Such expectations could reduce current private sector spending and reduce the effectiveness of any public spending increase, a phenomenon known as Ricardian equivalence. There are other important challenges to large-scale fiscal stimulus. Fiscal policy has historically not been nimble enough, with tax and spending packages being debated when the economy most needed a demand boost. This is particularly true when spending measures are complex and take time to implement, such as with infrastructure and education – especially when multiple layers of government are involved. Fiscal spending alone doesn’t guarantee an efficient or productive allocation of resources. Regulation can slow fiscal spending even after financing has been given the green light. There are also political challenges. High debt levels feed debates on the need for fiscal consolidation, especially in ageing societies where the distribution of government benefits among different age brackets is becoming a heated issue. And austerity is not just a debate in some countries – deficit limits are hardwired into law in a number of countries.

Fiscal expansion could absorb saving glut

BlackRock estimate of the G3 term premium global saving to GDP inverted, 1995-2019

Sources: BlackRock Investment Institute, Federal Reserve Bank of New York and IMF, with data from Refinitiv Datastream, August 2019. Notes: This chart shows our estimate of the G3 term premium on 10-year sovereign yields and gross global savings. The G3 term premium is a GDP-weighted average of the US, German, and Japanese term premium, with each individual country estimated using a term structure model – based on the relationship between short- and long-term interest rates – similar to that of a New York Fed model. Global savings reflect gross savings, or output excluding final consumption relative to overall GDP.

A soft form of coordination would rely on monetary and fiscal policy both providing stimulus when needed. Looking at the policy response during and after the crisis, and as we discussed earlier, there was room for a better policy mix with less reliance on monetary policy and more emphasis on fiscal policy. This is, in principle, a fruitful avenue to explore. Yet there are reasons why that better policy mix was not achieved – chiefly that it is practically and politically easier to resort to monetary policy. These forces are likely to keep prevailing in the future – and those simply hoping for a better form of soft coordination will probably be disappointed.

Major economies are on a path of neutral budgets or mild deficit consolidation over the next five years, based on IMF forecasts as of April 2019. This comes as their debt servicing costs have declined relative to growth – and given the recent plunge in interest rates those debt servicing costs have likely fallen further. See the expected change in the interest bill in the chart on the left below. This implies that fiscal policy is currently not pulling its weight.

This means that in a downturn the only solution is for a more formal – and historically unusual – coordination of monetary and fiscal policy to provide effective stimulus. Already many of the monetary policy tools adopted since the crisis – QE including private sector assets – have fiscal implications. Special facilities such as the eurozone’s Outright Monetary Transactions (OMT) during the sovereign crisis also show how the central bank can throw its balance sheet behind fiscal solutions.

Any additional measures to stimulate economic growth will have to go beyond the interest rate channel and “go direct” – when a central bank crediting private or public sector accounts directly with money. One way or another, this will mean subsidising spending – and such a measure would be fiscal rather than monetary by design. This can be done directly through fiscal policy or by expanding the monetary policy toolkit with an instrument that will be fiscal in nature, such as credit easing by way of buying equities. This implies that an effective stimulus would require coordination between monetary and fiscal policy – be it implicitly or explicitly.

The most extreme case of monetary and fiscal coordination is pure monetary financing of government debt. That is, the central bank permanently increases its balance sheet to purchase government debt and facilitate the additional spending or directly inject money into the economy through a so-called helicopter drop. Helicopter money is named after Milton Friedman’s analogy that former Fed Chair Ben Bernanke referenced in a well-known 2002 speech on what extreme measures Japan could take to defeat deflation.1 Helicopter money puts central bank-created money directly in the hands of spenders – whether households, businesses or the government – rather than relying on indirect injections or incentives, such as lower interest rates. Tax cuts or public spending could be explicitly financed by an increase in the stock of money (Turner 2015, Gesell 1916/2007).2

We would highlight two key points on helicopter money. First, the fiscal expansion it represents – for example a tax rebate – needs to coincide with a boost in the stock of money. This ensures that any increase in interest rates is limited and there is no crowding out of private investment. Second, this boost to the stock of money has to be permanent. Otherwise, the money might not be spent if the increase is expected to be reversed in the future. If these conditions are met and helicopter money is delivered in sufficient size, it will drive up inflation – in the long run, the growth of money supply drives inflation.

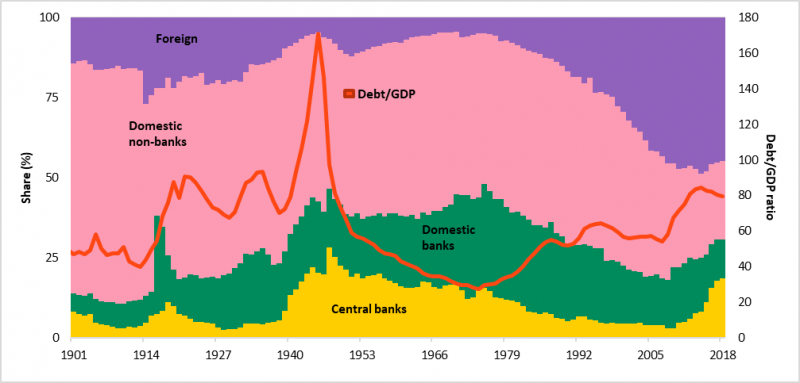

Monetary financing of fiscal expansion is not new – indeed it is as old as the first case of hyperinflation. Monetary financing happened frequently until the early 1980s in many DM countries: Italy, France, Sweden and in the UK until the early 1990s. It came to an end when central banks got serious about controlling inflation after the mistakes of the 1970s. As the chart below shows, central bank government bond holdings as a share of the overall debt are still below historical peaks even with all the QE of the past decade. Central banks were made independent with a mandate to limit inflation and in some cases were banned from directly funding government budget deficits. The extreme cases of monetary financing getting out of hand are well known and have a name: hyperinflation. Examples include the Weimar Republic in the 1920s as well as Argentina and Zimbabwe more recently.

That highlights the main drawback of helicopter money: how to get the inflation genie back in the bottle once it has been released. As noted above, history is littered with examples of how central bank money printing leads to runaway inflation or hyperinflation. Yet there is little experience in using helicopter money to generate just-enough inflation to achieve price stability. History as well as theory suggests large-scale injections of money are simply not a tool that can be fine-tuned for a modest increase in inflation.

Bigger bank holdings of debt

Different holders of DM government debt, 1901-2018

Sources: BlackRock Investment Institute and IMF, August 2019. Notes: The chart shows the historical breakdown of different holders of DM government bonds and overall DM debt-to-GDP.

The political backdrop is key at this juncture. Many central banks became truly independent in the wake of the painful lessons learned from the high inflation and low growth environment of the 1970s. This contributed to a lasting environment of low and stable inflation as well as stronger growth while giving monetary policy the flexibility to respond swiftly in times of crisis. But the post-crisis environment put central banks at the centre of political debates, and their independence is under threat. As we have argued, the response to the next downturn will inevitably blur the lines currently dividing monetary and fiscal policy. Without clarifying and adjusting the policy framework, the threat to central bank independence and of uncontrolled fiscal expansion will only get worse in the next downturn, in our view.

There is growing political discontent across major economies – and central banks are one of the targets. Widening inequality has fostered a backlash against elites. There are many drivers of inequality, including at its root technology, winner-take-all dynamics and globalisation. The GFC and the resulting forced bailout of financial institutions deemed too big to fail has added fuel to this backlash. Not acting during the GFC would have almost certainly led to a Great Depression-like outcome – much higher unemployment and even worse inequality. Yet that counterfactual provides no solace to those feeling left behind. And the monetary policy tools themselves might have increased inequality – and are certainly perceived to have done so – by pushing up the prices of assets owned by only a fraction of the population. Governments, not central banks, have the largest impact on issues of inequality and redistribution. And a greater use of fiscal policy tools is needed to offset the impact of central bank policies on inequality, including the impact of monetary policy.

That is why we believe the boundaries between fiscal and monetary policy will continue to be blurred – and why a clear framework to mitigate this risk is needed. Without a clear framework, the political pressure will build on many fronts.

Some of these pressures might lead to better outcomes and better de facto coordination between monetary and fiscal policy. For example, policy innovations in the next downturn will likely need to take inequality more directly into account to be politically palatable. Not all asset purchase programmes are born equal when it comes to their impact on inequality. Policy responses that put money more directly in the hands of citizens might be more attractive. The rise of central bank-issued electronic money (not cryptocurrencies) might achieve these objectives in ways that were not previously possible.

But this is also a slippery slope. A drift away from central bank independence – where the overall monetary policy stance is dominated by short-term political considerations – could quickly open the door to uncontrolled fiscal spending. The risk is real. This slippery slope leads to arguments that monetary policy can finance fiscal deficits – and that there is only a tenuous link between inflation and money-financed deficits, as some proponents “Modern Monetary Theory” (MMT) claim.

The key is that coordination does not require giving up central bank independence. Instead, policy frameworks need to evolve to acknowledge that it is not the response itself that needs to be independent. The policy response in times of crisis will have to involve elements of both fiscal and monetary policy. But the contribution of monetary and fiscal authorities to the response can still be cleanly separated. The approach described below provides a concrete example of how this can be done.

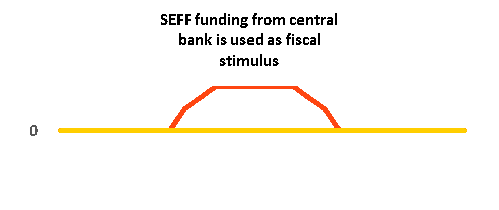

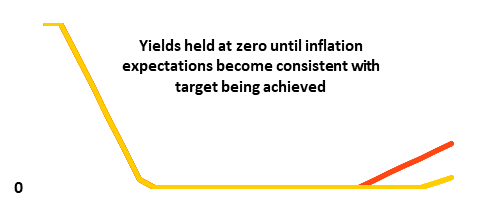

It is unlikely a more stimulative policy mix will happen on its own, while unconstrained monetary financing presents important risks. We believe a more practical approach would be to stipulate a contingency where monetary and fiscal policy would become jointly responsible for achieving the inflation target. To be sure, agreeing on the proper governance for such cooperation would be politically difficult and take time. That said, here are the contours of a framework:

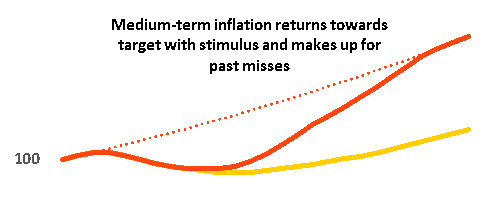

This proposed framework could include Bernanke’s temporary price-level target where the central bank commits to not only reach its inflation target but make up for past shortfalls (see Bernanke 2017 and our June 2019 work on inflation make-up strategies). Importantly, it complements it by specifying the mechanism – the SEFF – to push inflation higher. This is inspired by Bernanke’s 2016 proposal for a money-financed fiscal programme.

This approach improves on other fiscal approaches to providing stimulus when rates are at the ELB, we believe. Similar to Furman and Summers (2019) and Blanchard (2019), it argues for the use of fiscal policy – yet it does not rely on rates staying below growth for the entire time needed to stimulate the economy.

Our proposal stands in sharp contrast to the prescription from MMT proponents. They advocate the use of monetary financing in most circumstances and downplay any impact on inflation. Our proposal is for an unusual coordination of fiscal and monetary policy that is limited to an unusual situation – a liquidity trap – with a pre-defined exit point and an explicit inflation objective. Quasi-fiscal credit easing, such as central bank purchases of private assets, could be operated by the SEFF rather than the central bank alone to separate monetary and fiscal decisions.

A credible stimulus strategy would help investors understand what will happen once the monetary policy space is exhausted and provides a clear gauge to evaluate the systematic fiscal policy response. Spelling out a contingency plan in advance would increase its effectiveness and might also reduce the amount of stimulus ultimately needed. As former US Treasury Secretary Henry Paulson famously said during the financial crisis: “If you”ve got a bazooka, and people know you”ve got it, you may not have to take it out.”

This is one way to implement a credible coordination framework. In the next downturn, the loss of central bank independence and uncontrolled fiscal spending are risks. Any framework will need to put boundaries around such policy coordination to mitigate these risks.

In action

Stylised impact of SEFF on yields and prices

|

|

|

Sources: BlackRock Investment Institute, August 2019. Notes: These stylised charts show the hypothetical impact of a temporary increase in fiscal stimulus financed by the central bank, as reflected in the SEFF funding (red line). The other red lines show the impact on the inflation trend relative to the inflation target (dotted line) and on the long-term sovereign bond yield. The yellow lines show the hypothetical outcome if there is no stimulus in this scenario. For illustrative purposes only. There is no guarantee that any forecasts made will come to pass.

Going direct by country

| US | Legal framework | Despite the Fed”s wide latitude to purchase Treasury bonds, the debt ceiling and coordination with the Treasury and Congress, which restricted the Fed”s emergency lending authorities after the crisis, present challenges. Cooperation has precedent, however, during and after World War Two. That ended with the Treasury Accord of 1951, when the Treasury Department and the Fed decoupled debt management and monetary policy and agreed to “minimize monetization.” |

| Options to implement |

Congress could create a special Treasury account at the Fed and authorise FOMC to fill the account up to a pre-set limit (see Bernanke 2016). | |

| Eurozone | Legal framework | EU Treaty bans direct deficit funding (Article 123). Government bond purchases are subject to restrictions. European Stability Mechanism access to ECB is too close to monetary financing. Stability and Growth Pact debt limits are not affected by ECB holdings. |

| Options to implement |

Perpetual, zero-coupon targeted longer-term refinancing operation (TLTRO) for bank loans to each adult citizen (2/3 Governing Council majority – see Lonergan 2016). Public borrowing via European Investment Bank and other policy banks already possible in the eurozone. | |

| Japan | Legal framework | Deposit tiering in place, so interest on excess reserves less of a constraint than in other regions. The Bank of Japan (BOJ) is banned from providing funding in primary market. It is also banned from FX intervention decisions or holding foreign assets for its on own account (only Ministry of Finance can do so). |

| Options to implement |

Japan can introduce moderate additional fiscal spending without unscheduled Japanese government bond (JGB) issuance in the near term. In the future, the BOJ could increase QE to match greater JGB issuance or the BOJ could credit a government account at the central bank. | |

| UK | Legal framework | There is no codified national legislation against monetary financing of government deficit. The U.K. is a signatory of EU treaties that enshrine this prohibition but this may change if Brexit happens. The Bank of England Act enshrines the central bank’s independence from the Treasury with respect to monetary policy but this does not prohibit greater coordination on the part of the BOE. |

| Options to implement |

The BOE has a standing short-term lending facility to the government (“Ways and means advances to HM Government”) for the purpose of covering short-term shortfalls in cash. This has not been used since the crisis. The BOE could extend lending to the government directly through this account at a longer term and in more substantial sums. |

Sources: BlackRock Investment Institute, August 2019. Notes: We provide our views on the legal framework that might impact the ability of a central bank to go direct and assess options to implement such a policy coordination. This material represents an assessment of the market environment at a specific time and is subject to change. This is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon as research of investment advice.

The effectiveness and market implications of such a policy framework would depend on whether it is implemented well in advance of the next downturn. If it were, it would increase the chances of the framework being well understood by the markets, underpinning its credibility and efficacy.

In this scenario, this framework would tame current lingering fears that the ELB will constrain policymakers in a recession and prevent them returning inflation and the output gap back to target. The risk of a persistent liquidity trap should decline, justifying less of a negative inflation risk premium in sovereign yields, as reflected in market pricing of inflation expectations below. We would expect long-term bond yields to eventually rise, led by inflation expectations. This would argue for a preference for inflation-linked bonds over nominal instruments.

This relative preference for inflation-linked bonds would be even more pronounced when a downturn materializes. Real yields would decline rapidly as the central bank cuts policy rates towards the ELB. But markets would expect aggressive co-ordinated monetary and fiscal stimulus to push inflation back to target sooner than would be the case if the facility were not ready to be activated. Longer-run inflation expectations may not fall so far: indeed, shorter-run inflation expectations could overshoot as the central bank aims for above-average inflation during its price-level targeting phase. This would push up the relative returns of inflation-linked bonds over nominal counterparts.

The efficacy of such a framework would be undermined significantly if it were only introduced when a downturn is already underway. In this scenario, without a credible way to escape the liquidity trap caused by the ELB, inflation expectations would fall significantly as the recession strikes. At the same time, the compression in inflation expectations would prevent real policy rates from falling sufficiently to lift demand. Under this scenario, only when the coordination framework is finally introduced would inflation expectations begin to creep back up. This scenario would argue for a preference of nominal bonds over inflation-linked instruments.

An effective implementation of this coordinated framework has market implications beyond fixed income. As noted earlier, a structural increase in investor risk aversion – reinforced by the global crisis – has led to a persistently elevated equity risk premium (ERP). If this policy framework were effective at reducing the probability of a liquidity trap, nominal bond yields would tend to climb but underlying economic volatility may also decline – both of which would argue for a narrower ERP.

Reviving inflation expectations

Market inflation pricing, 2010-2019

Sources: BlackRock Investment Institute, with data from Bloomberg, August 2019. Notes: The chart shows the market pricing of inflation based on five-year forward inflation in five years’ time, as measured in inflation swaps.

Persistent risk aversion

US equity risk premium, 1995-2019

Sources: BlackRock Investment Institute, with data from Refinitiv Datastream, August 2019. Notes: We calculate the equity risk premium based on our expectations for nominal interest rates and the S&P 500 earnings yield. We use our expectations for interest rates so the estimate is not influenced by the term premium in long-term bond yields.

Bernanke, Ben. April 2016. What tools does the Fed have left? Part 3: Helicopter money. Brookings Institution blog: https://www.brookings.edu/blog/ben-bernanke/2016/04/11/what-tools-does-the-fed-have-left-part-3-helicopter-money/

Bernanke, Ben. October 2017. Temporary price-level targeting: An alternative framework for monetary policy. Brookings Institution blog. https://www.brookings.edu/blog/ben-bernanke/2017/10/12/temporary-price-level-targeting-an-alternative-framework-for-monetary-policy/

Bernanke, Ben. November 2002. Making sure “it” doesn’t happen here. Speech before the National Economists Club in Washington, DC. https://www.bis.org/review/r021126d.pdf

Blanchard, Olivier. January 2019. Public Debt and Low Interest Rates. The American Economic Review.

https://www.aeaweb.org/aea/2019conference/program/pdf/14020_paper_etZgfbDr.pdf

Blanchard, Oliver and Takeshi Tashiro. May 2019. Fiscal Policy Options for Japan. Peterson Institute of International Economics. https://www.piie.com/publications/policy-briefs/fiscal-policy-options-japan

Dell’Ariccia, Giovanni, Luc Laeven, Gustavo Suarez. June 2013. Bank Leverage and Monetary Policy’s Risk-Taking Channel: Evidence from the United States. International Monetary Fund Working Paper. https://www.imf.org/external/pubs/ft/wp/2013/wp13143.pdf

Furman, Jason and Lawrence Summers. March/April 2019. Who’s Afraid of Budget Deficits? How Washington Should End its Debt Obsession. Foreign Affairs. https://www.foreignaffairs.com/articles/2019-01-27/whos-afraid-budget-deficits

Gesell, Silvio. 1916/2007. The Natural Economic Order. TGS Publishers.

Lonergan, Eric. February 2016. Legal helicopter drops in the Eurozone. Philosophy of Money blog. https://www.philosophyofmoney.net/legal-helicopter-drops-in-the-eurozone/

Rachel, Lukasz and Lawrence Summers. March 2019. On Falling Neutral Real Rates, Fiscal Policy, and the Risk of Secular Stagnation. Brookings Papers on Economic Activity. https://www.brookings.edu/wp-content/uploads/2019/03/On-Falling-Neutral-Real-Rates-Fiscal-Policy-and-the-Risk-of-Secular-Stagnation.pdf

Turner, Adair. 2015. Between Debt and the Devil: Money, Credit, and Fixing Global Finance. Princeton University Press.

BlackRock disclosure

This material is reprinted with permission of BlackRock. This material is intended for professional and institutional clients only. The opinions expressed in this reprint are not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

The opinions expressed are as of September 2019 and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. You can access the original article here.

Capital at risk: The value of investments and the income from them can fall as well as rise and are not guaranteed. The investor may not get back the amount originally invested.

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

©2019 BlackRock, Inc. All Rights Reserved. BlackRock® is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners

As Bernanke said then: “In practice, the effectiveness of anti-deflation policy could be significantly enhanced by cooperation between the monetary and fiscal authorities…. A money-financed tax cut is essentially equivalent to Milton Friedman’s famous ‘helicopter drop’ of money.”

Former UK Financial Services Authority Chairman Adair Turner was one of the first in the post-crisis period to propose helicopter money because monetary stimulus had failed to generate adequate demand. One remaining risk with helicopter money is that people might be so concerned about the central bank printing money in such a way that they save rather than spend it, preventing the desired demand boost to the economy. In his 1916 book, Economist Silvio Gesell came up with the concept of “stamped money” as a way of getting around this problem – that new money would be “stamped”, or taxed, each month to encourage spending over saving.