In 2016, the Oesterreichische Nationalbank celebrated its 200th anniversary. As part of a coordinated research project, the OeNB also issued a special double issue of its quarterly bulletin Monetary Policy & the Economy Q3-Q4/2016 covering a broad range of themes in two hundred years of central banking in Austria.2

The financial crisis of 2008 has upset several firmly-held beliefs about the role of central banks and the design of their policies. Central banks have changed their instruments and assumed new responsibilities. A new consensus, comparable to one prevalent during the Great Moderation, however, is yet to emerge. At this juncture, taking a look at the long-run evolution of central banking helps put changes (and continuities) into perspective and provides a fruitful way to reflect on the possible future of central banking.

In the special issue of Monetary Policy & the Economy entitled “Two hundred years of central banking in Austria: selected topics” 15 authors analyse nine themes in the last 200 years of Austrian monetary history. Except one all articles address one particular aspect of central banking in a very-long run perspective: the determinants of inflation performance, the relationship to the government, the choice of an external anchor, responsibility for financial stability and lending of last resort, and last but not least, the central bank as provider of both cash and non-cash means of payment. We found the following themes to be of wider relevance to the readers of the SUERF Policy Note, also for future central bank and monetary policy design:

• While monetary stability was always recognized as desirable by policy makers and central bankers, it was repeatedly violated, notably in periods of war. Disinflation was knowingly delayed for fear of social and political unrest. The ultimately unavoidable currency reforms had to be all the more drastic, fundamentally damaging people’s trust in money and the state order in more general. The trade-off between short and long-term concerns, and the question as to how to deal with exceptional circumstances will always remain a challenge for central banking.

• Deflation was not uncommon in Austria’s monetary history. While in the 19th century, it tended to be supply-side driven and thus not a matter of major concern, the demand-side, policy induced deflation during the Great Depression was devastating for the Austrian economy and political system. This seems to fit with the more recent distinction between benign and malign deflations.

• Central bank independence has always been a delicate political issue. It was hard to achieve and to preserve, and did not survive in times of severe government financing needs, notably wars. The political stalemate between Austria and Hungary in the Austro-Hungarian monarchy de facto increased the central bank’s independence, and the last decades before WW I were a period of long-lasting monetary stability. This may bode well for the ECB within the euro area’s multi-country architecture.

• A formal definition of consumer price stability as the monetary policy goal is a very recent development. Up until the Bretton Woods System, monetary policy relied on external anchors – metal standards or, later, exchange rates. Except for war times, these anchors worked remarkably well to preserve the value of money in a very long-term perspective, despite temporary disturbances. Modern monetary regimes without external anchors have a comparatively short track record and have yet to prove such similar ability to ensure long-term monetary stability, also during difficult times.

• Austria’s gradual transition from the demise of the Bretton Woods System towards the eventual Deutsche Mark peg also offers an interesting case study of how policy ambiguity can be helpful in cautiously establishing consensus for a stability-oriented policy among society and in keeping one-way market bets at bay. The road towards EMU and the experience in the euro area so far in some respects also seems to fit this notion.

• While the term “macro-prudential regulation and supervision” is quite recent, the use of quantitative limits in order to contain (and, in fact, also various subsidies and tax discounts in order to stimulate) credit growth was very common in Austria between the 1950s and 1970s (as it was in other countries). More generally, from the foundation of the central bank in 1816 onward, financial stability was seen as an integral part of monetary stability in a broader sense, and tools were designed accord-ingly. A more integrated view of macroprudenti-al policies would seem useful also now.

• As part of its responsibility for financial stability, the central bank recognized its function as a lender of last resort early on. Its effectiveness was, however, at times limited by lack of trust in central bank money, which was in turn due to excessive lending to government and/or depleted foreign reserves. Also from this perspective, monetary and financial stability need to be seen jointly in an integrated way.

• Cash was a major achievement of modern monetary orders. Its wide-spread use originated in its convenience of use. While its fiat nature invited repeated abuse by the issuer(s), it continues to be the dominant means of payment in Austria to this date, not least due to its good stability track record over recent decades. Path dependence and innovations which make cash convenient and cost-effective may explain this.

• Austria’s monetary history also illustrates that monetary policy cannot be fully understood by the common macroeconomic perspective alone. Monetary policy effectiveness rests crucially on incentives, information availability and the structure of markets in which the central bank operates, and thus on microeconomic factors. Such more microeconomic perspectives seem also crucial for current pending policy issues such as: the interplay between monetary, fiscal and structural policies; the challenge of optimal financial sector regulation which finds a balance between creating appropriate incentives to avoid moral hazard while not discouraging lending; and the challenge to avoid time inconsistent policy actions in the event of major bank failures.

A story of extremes: hyper-inflations and currency reforms, benign and malign deflation, and long periods of remarkable monetary stability

Austrian monetary history during 200 years must be understood against the background of a dramatic political history. When the Nationalbank was founded in 1816 it received the monopoly of banknote issuance for the entire Austrian Empire that at the time formed the second largest European country in terms of territory after Russia. When the Empire disintegrated in the wake of WW1, the Nationalbank found itself responsible for the currency of a small country in the middle of Europe. After Nazi-Germany occupied Austria in 1938, the Nationalbank ceased to exist before being reestablished, when Austria was liberated in 1945. Today, the Nationalbank is member of the European System of Central Banks (ESCB). The name of the Austrian currency and its monetary regime changed several times during the two centuries.

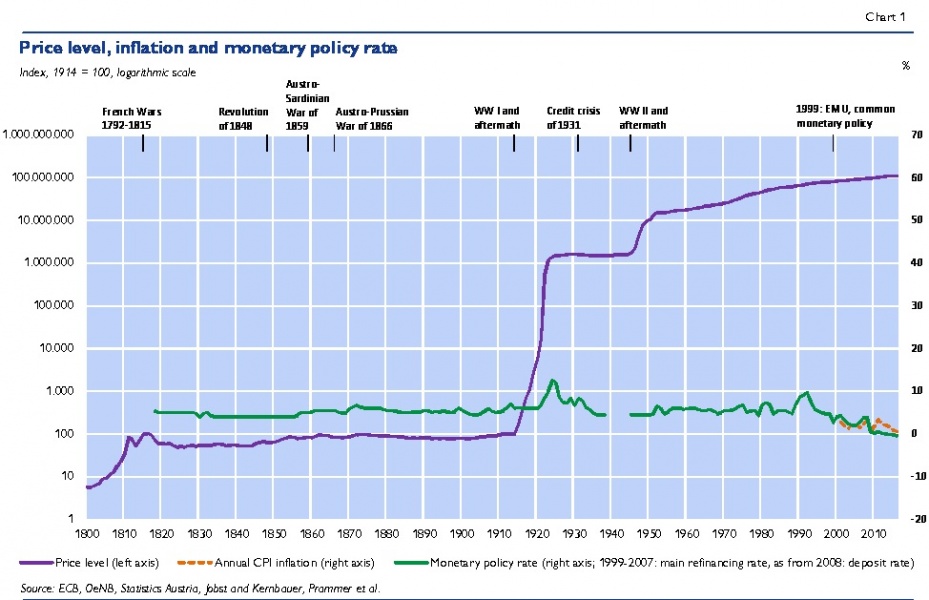

No wonder that the 200-year history of inflation in Austria is a story of extremes. Year-on-year inflation ranged from -16% (1819) to almost +2900 % (1922). Yet, as Beer, Gnan and Valderrama (2016) point out, within this long period, there were also very extended periods of remarkable monetary stability, notably in the “long 19th century” up until WW I and since Austria’s accession to the EU in 1995 up until now. The repeated periods of slight deflation in the 19th century, notably in the first half of the 19th century and in the post-Gru nderzeit last quarter of the 19th century were “benign” in the sense that they were not accompanied by economic contractions, while the deflation of the early 1930s went hand in hand with a sharp economic contraction during the Great Depression. The (post) WW I and II periods witnessed hyper or very high inflation, resulting from a combination of a destruction of physical and human capital, large-scale monetary war financing, pent-up inflation (WW II) and conscious late action by the central bank to address escalating inflation for fear of social and political unrest (post WW I). In both instances, re-establishing monetary stability required drastic monetary reforms, i.e. far-reaching cancellations of financial assets, to eliminate monetary overhangs, which damaged peoples’ trust in money and the state order more broadly. The period of highest peace-time inflation occurred in the 1970s and 1980s, when efforts were made to cushion the negative output effects of supply-side oil price shocks through expansionary demand policies.

Inflation volatility was high in the first half of the 19th century, reflecting frequent supply side price shocks, and between the late 1960s and early 1980s, reflecting the oil price shocks and the associated stop and go economic policies. Using frequency domain analysis, the authors confirm a link between money and inflation for long but not for business-cycle frequencies, depending on the monetary regime. The authors cannot establish a stable empirical short-term Phillips curve relationship between output and inflation.

Hyperinflations did not just happen…

Austria’s monetary history testifies that periods of hyper or very high inflation were not the result of lack of knowledge on the part of policy makers. On the contrary, monetary stability was regarded from the very beginning as a major monetary policy objective, and policy makers were also aware that excessive money creation threatens monetary stability. What caused hyper-inflations was a higher weighting of shorter term objectives, such as financing war expenditures or fear of the immediate consequences of disinflation and monetary reform. The more effective post-WW II containment of inflation seems at least partly to have reflected learning by policy makers from the traumatic post-WW I hyper-inflation experience. By contrast, as experienced in many other countries and as explained in economic theory, the expansionary and inflationary response to the 70s/80s oil price shocks seems at least partly to have reflected the then-prevailing economic thinking, which did not yet distinguish between supply and demand-side inflation and fully appreciate the role and formation of inflation expectations.

…and central bank independence did not protect against monetary financing during wars

The OeNB’s history testifies, as Beer, Gnan and Valderrama (2016) as well as Jobst and Kernbauer (2016) show, that the rationale for central bank independence in the quest for monetary stability was recognized at least as early as the beginning of the 19th century and featured prominently in the design of the Austrian national bank in 1816. But the history of the Bank’s statutes also bears testimony of the persistent resistance of rulers and politicians to relinquish the power to print money at will; that independence is never complete and requires the combination of statutory rules and their actual application by central bankers and the sovereign; that even once gained, central bank independence tends to be eroded over time; that extreme events – such as in Austria’s history: wars – can put an abrupt end to central bank independence in favor of monetary financing; and that a constellation whereby one central bank serves two or more states – as was the case in the post-1867 Austro-Hungarian empire – can de facto increase the central bank’s autonomy and thus further the pursuit of monetary stability.

From a privately-owned to a fully nationalized central bank…

The institutional relationship between government and the central bank is shaped by a number of features. Many features show remarkable continuity, such as the appointment of the governor and the directors, which has always been a prerogative of government, irrespective of ownership.

One important aspect of this relationship are the financial relations, which comprise ownership, allocation of central bank profits, and rules on monetary financing of the government. Prammer, Reiss and Köhler-Töglhofer (2016) offer a detailed account on all three aspects.

Austria’s central bank originally was founded as a fully private bank and indeed remained so until after WW I. Thereafter, the government’s share gradually increased from a minority share in the interwar period to a 50% share between 1955 and 2006. The government’s share was increased to 70% in 2006 and it is only very recently (2010) that the Bank was fully nationalized.

The distribution of central bank profits was quite early on, from 1878, dissociated from the ownership structure, in the sense that the state received a high – and over time increasing – share of seigniorage. Today, 100% of the OeNB’s profits (which are determined in line with Eurosystem monetary income allocation rules) go to the Austrian government.

…with monetary financing happening over extended periods, notably during and after wars

At first sight this might seem to contrast with 19th century practices, when until 1878 the Austrian government did not directly participate in central bank profits at all. However, there were alternative means for transferring seignorage gains to the government. A first possibility was by means of loans granted by the bank at concessionary rates. For instance, between 1816 and 1847, the interest on these loans was 2 to 3 percentage points below market yields. In addition, the Austrian government repeatedly issued parallel government paper money, which later on repeatedly had to be converted by the central bank. Lending at concessionary rates became obsolete once the government’s share in central bank profits was made explicit from 1878 (see Prammer, Reiss and Köhler-Töglhofer (2016)).

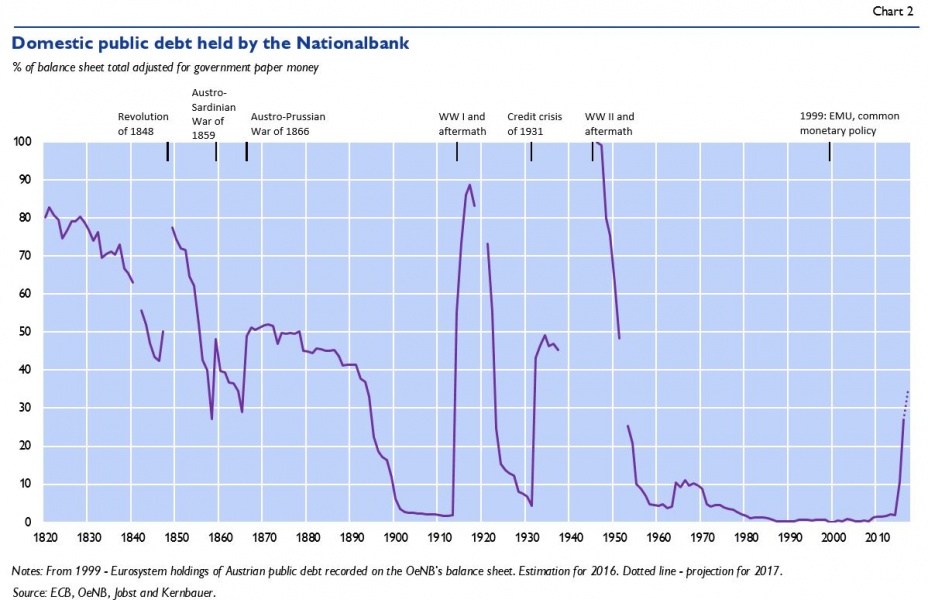

Throughout the 19th until the mid-20th century, monetary financing by the Austrian central bank was most visible during wars, most notably during and after WW I and II. Furthermore, post-WW I and WW II hyperinflations substantially eased the government’s debt burden. The Bank also participated directly in the recapitalization of the Creditanstalt in 1931. After the adoption of the Nationalbank Act of 1955, the Bank’s holdings of government debt (excluding bonds held in the Bank’s investment portfolio) quickly declined and remained at very low levels.

Government debt in central bank balance sheet in isolation no useful indicator for threat to price stability

While currently the Eurosystem’s Public Sector Purchase Programme (PSPP) is strongly increasing the share of government debt in the ECB’s and NCBs’ balance sheets, the motivation for these purchases clearly distinguishes them from past periods of monetary financing: The purchases are exclusively done in the secondary market and explicitly aim at bringing inflation back up to the ECB’s definition of price stability as a year-on-year increase in the Harmonised Index of Consumer Prices for the Euro area of below but close to 2%.

Chart 2 shows the development of the Bank’s holdings of government debt as a share of the central bank balance sheet total. It is obvious from comparison with Chart 1 that periods of extreme monetary financing during and after WW I and II were associated with hyperinflation. By contrast, developments in the 19th century and the interwar period do not yield such a close correlation, implying that government debt in central bank balance sheet in isolation is no meaningful indicator of a threat to price stability.

Recognition of importance of monetary stability is reflected in early develop-ment of price indices

The early recognition that the evolution of the costs of living is important for economic agents is also reflected in the fact that attempts to measure inflation date back already to the early 18th century to William Fleetwood and Gian Rinaldo Carli. As Fluch (2016) points out, however, a close monitoring of price indices became common only after WW I, which may reflect the hyper-inflation experience.

External monetary anchors ensure long-term monetary stability

While the quest for monetary stability was present throughout Austria’s entire monetary history, its precise meaning and the strategy to achieve it evolved over time. In particular, during most of its pre-euro history, external anchors such as silver in much of the 19th century, gold or gold-exchange standards in the late 19th and the early decades of the 20th century, and exchange rate pegs in the second half of the 20th century (against the US Dollar during the Bretton-Woods period, mostly Deutsche Mark thereafter until euro area participation) played a central role for anchoring monetary policy actions and inflation expectations (see Handler, 2016). While Austrian currencies often traded below their metal parity as a result of war-related overexpansion of money and metal convertibility was often suspended for extended periods, the principle of the metal standard was never challenged, which may explain that overall the value of money was kept remarkably stable during this period (see Chart 1 and Beer, Gnan and Valderrama, 2016). Also in the post-Bretton Woods era, the disciplinary peg to the Deutsche Mark, in tandem with the competition-enhancing effects from Austria’s EU accession as well as the need to satisfy the entry criteria to the euro in the run up to 1999, were key to achieving and maintaining price stability in Austria.

The aim of exchange rate policy strategies changed over time: While in the 19th century, the metal standard and associated fixed exchange rate policy was basically seen as a technical relation to be maintained to ensure monetary stability in a broad sense, in the 20th century fixed exchange rate policies came to be regarded as a policy instrument to balance external accounts, to control inflation and to foster productivity by putting pressure on the domestic economy to maintain or improve international price competitiveness (Handler, 2016). The peg to the Deutsche Mark was motivated in Austria’s close economic ties with Germany, much in the spirit of an optimal currency area line of argument.

As a reflection to the consistent focus on external anchors, interest rates in Austria were rarely regarded as an instrument to be used for macroeconomic demand management. For one thing, in the 19th century, the central bank repeatedly saw its role in facilitating the government’s borrowing by keeping lending rates low. During the post-Bretton Woods hard currency policy, interest rates were determined by the needs arising from the unilateral peg to the Deutsche Mark. In this sense, Austria’s entry into the euro area did not mark much of a difference in terms of monetary policy autonomy. Policy interest rates remained remarkably stable throughout the entire 19th century up until WW I and were raised only in the aftermath of WW I as part of the currency stabilization efforts as well as in the aftermath of the post-oil shock, “Great inflation” and German reunification. Since Austria’s participation in the euro and the onset of the financial crisis, policy rates have reached unprecedented historical lows for Austrian standards (see Chart 1 and Beer, Gnan and Valderrama, 2016).

Regulation as an instrument of monetary policy – the early history of macropru

Macropru has been one of the hot topics in monetary policy since the 2008 financial crisis. However, as Do me, Schmitz, Steiner and Ubl (2016) show, macroprudential policy has a much longer history in Austria, reaching back to at least the 1950s. Back then as today, policymakers wanted to mitigate or prevent excessive credit growth, leverage and maturity mismatches. Even though objectives evolved – while today macropru mainly addresses financial stability concerns, policies in the 1950s to 1970s were preoccupied with the maintenance of external equilibrium and price stability – history can thus provide interesting insights for today. The authors point in particular to the necessity of a sound legal framework (which was for a long time missing in Austria) and the need for measures to be intrusive if they are to effectively curtail the build-up of systemic risks.

It is, by the way, interesting to note that alongside efforts to curtail credit growth, post-WW II Austrian economic policy always used instruments to stimulate credit growth in certain sectors, e.g. housing or the export sector, notably various forms of subsidies and tax discounts. The same is true of many other countries during the same period, as it is in post-crisis Europe today. Seeking a more integrated and coordinated view of restrictive and expansionary macroprudential tools in a wider sense seems to be worthwhile.

Time and again the lack of confidence in central bank money limited last resort lending

The at times strong involvement of the Bank in government financing not only hampered its pursuit of monetary stability. The resulting doubts on the future value of the currency also affected the bank’s capacity to react to financial crises. This is one of the key results of a survey of several episodes of banking and financial distress in Austria. Jobst and Rieder (2016) start from Bagehot’s concept that central banks, as the ultimate source of liquidity, should lend freely when the market is gripped by a generalized panic. By lending freely the central bank can stop the run and avert fire sales and their potentially severe macroeconomic consequences.

In fact, however, more often than not did the Austrian central bank ration lending and thereby quite likely made the emerging crises worse. This was not due to a lack of knowledge – Jobst and Rieder (2016) cite the example of 1912, where the Bank’s free lending provides a clean example of a policy according to Bagehot’s rules. It was also not due to a lack of willingness. The minutes of the Bank’s board meetings show that the directors clearly understood that their Bank was not a normal commercial bank but had a responsibility for keeping the financial system stable. And they did so very early on: in the first crisis the bank faced in 1820, the directors already invoked the duties of their “national institution” and argued that a withdrawal of credit (which some directors advocated in order to limit risks) would accelerate the ongoing decline in asset prices and trigger a systemic crisis. Rather, in several instances liberal lending by the Bank was made impossible by insufficient trust in central bank money, both banknotes and central bank liabilities on current account. The public was simply not willing to hold the (additional) liquid assets the Bank could offer, preferring precious metal or foreign assets instead. As a result, an increase in lending by the Bank was impossible or – alternatively – led to a depreciation of the domestic currency. Depreciation occurred in 1848 and 1931. In 1873 and 1923–25 the fear of a depreciation of the domestic currency was probably a key cause behind the cautious lending of the Bank.

Cash is (still) king

While these financial crises episodes show that central bank money (including banknotes) was at times regarded with skepticism, a long-run perspective yields quite a different picture: Austrians have always had and continue to have a high preference for paper money. Paper money had a good start in Austria. First issued in 1762 by a predecessor institution of the Nationalbank, paper money was for several decades used voluntarily, sometimes even circulating at a small premium to legal silver coin. Even though paper money lost more than 90% of its value during the Napoleonic Wars and found itself utterly discredited in public opinion, after 1816 the newly founded Nationalbank succeeded quite rapidly in getting a sizeable volume of banknotes into circulation. In 1847, 75% of total cash in circulation in the Austrian Empire consisted of banknotes, only 25% of coins. In England at the same time the ratio was rather 50:50, whereas in Prussia, Bavaria and other German states 85% of total cash consisted of coins. Austrians seem to have liked banknotes as they were convertible into silver on demand and thus must have been held voluntarily. Between 1848 and the 1890s, convertibility of banknotes into precious metal was suspended and the predominance of notes over coins in circulation cannot be attributed to the preferences of the money-holding public alone. In spite of occasional inflation and suspended convertibility, however, Austrians seemed to have kept their sympathy towards paper money. When in 1901 the central bank started to put gold coins into circulation and Austrians got another chance to acquire specie, the coins were hardly used and quickly returned to the Bank’s vaults. Path depen-dence or oblivion – paper money reigned supreme.

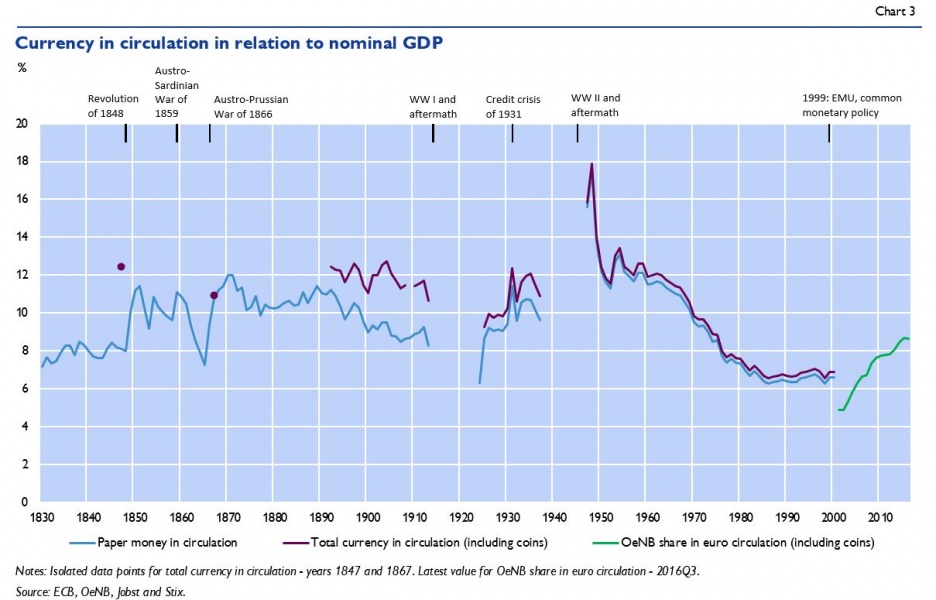

By the end of the 19th century paper money no longer competed only with coin, but also with the current accounts offered by a rapidly expanding banking system. As Jobst and Stix (2016) show in their contribution, paper money fared here quite well as well. Chart 3 shows cash in circulation in percent of nominal GDP except for the periods 1914-23 and 1938-48. Even though nominal GDP figures have to be taken with a grain of salt at least until the late 19th century, the picture that emerges is one of remarkable stability from the early 19th century until the mid-20th century, when cash in circulation fluctuated around roughly 10-12% of nominal GDP. By the 1980s this ratio had declined to about 7% but in the last decades has risen again to close to 9%. How can this observation be reconciled with the enormous technological advances in non-cash payment technologies? The authors suggest that the most likely explanation is that the observed stability resulted from countervailing forces balancing each other out. While non-cash payment technologies reduced the need for cash, the gradual monetization of the economy increased demand. In addition, to a significant degree cash serves not to execute transactions but to store value. In this respect, cash has lost significantly relative to deposits over the long run, but seems to have kept up in relation to nominal GDP. Given current debates about the future of cash, the authors conclude that further research is needed to better understand the use of cash.

In the Austrian case, the flipside of cash’s dominance was the late introduction of cashless technologies in an international comparison. Even though the central bank offered current accounts from the very beginning, they played a negligible role until the 1890s. In his account of the history of cashless payments in Austria, Kernbauer (2016) attributes Austria’s position as a latecomer to the economic backwardness of the Habsburg monarchy, a low degree of monetization and the already referred to abundance of paper money. Austria made up some leeway when in 1882 the foundation of the Postal Saving Bank with one stroke made the large network of postal offices available for interregional transfers. Around the same time central bank accounts became a widely used means for large-value payments. The economic climate between the two World Wars was not conducive to the introduction or spreading of new financial technologies. As elsewhere, the economic boom after World War 2 was accompanied by the rapid spreading of cash-less payments and a wider use of banking services in general. Still today Austrians remain attached to the use of cash, making Austria an interesting case study in current debates on the future of payment technologies. Path dependency very likely plays a role, as the wide use of cash has led to the adoption of efficient technologies in cash handling (reducing transaction costs for businesses and banks) and the wide and cheap availability of ATMs (reducing transaction costs for consumers).

Markets and information – the microeconomics of central Banking

For most part the studies referred to so far have taken a macro perspective. However, the effectiveness of many central bank policies also depends on incentives, the availability of information and the structure of the markets they are addressing, thus on what are essentially microeconomic factors. In their history of last-resort lending, Jobst and Rieder (2016) point to the crucial role of good information on individual borrowers and collateral quality not only to limit the central bank’s risk exposure but also to reduce moral hazard. They show that the Austrian central bank – very much like other central banks at the time – operated sophisticated mechanisms to scrutinize collateral and collect information on its counterparties in regular lending operations. The success (and difficulties) of the Austrian central bank in reacting to emerging banking distress thus not only depended on the scope to increase liquidity in the aggregate, as argued above, but also on the informational preconditions for effectively distributing additional liquidity without having to bail-out institutions or creating moral hazard ex post.

Another topic that is normally addressed from a macro point of view is the choice and design of the exchange rate regime. When in 1971 the end of the Bretton Woods system raised the question of the future exchange rate for the Austrian schilling, Austria ended up pegging the schilling to the Deutsche Mark, a peg that was successfully maintained until the introduction of the euro in 1999. While the macroeconomic aspects of navigating within the trilemma of fixed exchange rates, freedom of capital movements, and independence for monetary policy are subject of an extensive literature (see e.g. Handler (2016)), the actual changeover from US-Dollar pegging under Bretton Woods to the Deutsche Mark peg is less well known, even though it contains a number of interesting elements which, as Schmitz (2016) argues, were crucial for the successful implementation of hard-currency policy. The central bank had to overcome two hurdles: establishing consensus between the proponents of a weak and a hard schilling and then maintaining the peg in an environment of (increasingly) liberalized financial markets. The bank opted for a combination of a commitment to long-run stability with some ambivalence in the short-term and a degree of imprecision in the exact definition of the peg, at least in the beginning. Together, this allowed the different stake holders to gradually agree on the Deutsche Mark peg. The ambivalence concerning the exact exchange rate target at the same time kept one-way bets at bay, together with sound macroeconomic policies one element that can explain the longevity of the peg and the successful transition to the euro. Interesting to note, between 1896 and 1914 the Austrian central bank had operated its gold-peg with a similar ambivalence and equally successful (Jobst 2009).

Concluding remarks

Given the at times turbulent history of the country it was associated with, the 200-year history of the Austrian central bank is particularly rich in experiences to draw from, and only some of them could be covered in the special issue of Monetary Policy & the Economy. Notably absent is microprudential regulation and the OeNB’s handling of the dissolution of the Habsburg monetary union after 1918.

Yet some broad themes emerge. First, monetary stability has been the primary objective of the Nationalbank from its foundation in 1816 onwards. Not surprisingly, achieving monetary stability was facilitated by adopting external anchors (silver, gold, pegs to key currencies) and central bank independence, here however, more important than formal independence seems to have been the prevalence of a broad consensus within society on the primacy of monetary stability.

The second theme is financial stability. Even though microprudential supervision – which had traditionally been handled by the Ministry of Finance – has only recently been added to the responsibilities of the Austrian central bank, the bank had shown keen interest in systemic financial stability from the very beginning. In this respect, the Bank’s new role in macroprudential supervision is only a new facet of a concern that had been with the bank for a long time. What the Bank’s history also shows, however, is that financial and monetary stability objectives can at times come into conflict.

Last but not least, a recurring theme is the importance to appreciate the microeconomic aspects of macroeconomic policies. Monetary policy effectiveness rests crucially on incentives, information availability and the structure of markets in which the central bank operates. This is true for both episodes of failure and success in the history of the Austrian central bank.

Antonowicz, W., Dutz E., Köpf, C., and B. Mussak (2016). Memories of a Central Bank. Oesterreichische Nationalbank since 1816. Brandstätter.

Beer, C., Gnan, E., and M. T. Valderrama (2016), A (not so brief ) history of inflation. OeNB, Monetary Policy and the Economy, Q3-Q4/16.

Döme, S., Schmitz, S. W., Steiner, K., and E. Ubl (2016), The changing role of macroprudential policy in Austria after World War II. OeNB, Monetary Policy and the Economy, Q3-Q4/16.

Fluch, M. (2016), The measurement of inflation in Austria: a historical overview. OeNB, Monetary Policy and the Economy, Q3-Q4/16.

Handler, H. (2016), Two centuries of currency policy in Austria. OeNB, Monetary Policy and the Economy, Q3-Q4/16.

Jobst, C., and H. Kernbauer (2016). The Quest for Stable Money. Central banking in Austria 1816-2016. Campus Verlag.

Jobst, C., and K. Rieder (2016), Principles, circumstances and constraints: the Nationalbank as lender of last resort from 1816 to 1931. OeNB, Monetary Policy and the Economy, Q3-Q4/16.

Jobst, C., and H. Stix (2016), Florin, crown, schilling and euro: an overview of 200 years of cash in Austria. OeNB, Monetary Policy and the Economy, Q3-Q4/16.

Jobst, C. (2009), Market leader: the Austro-Hungarian Bank and the making of foreign exchange intervention, 1896–1913. European Review of Economic History (2009) 13 (3): 287-318.

Kernbauer, H. (2016), Cashless payments in Austria: the role of the central bank. OeNB, Monetary Policy and the Economy, Q3-Q4/16.

Prammer, D., Reiss, L., and W. Köhler-Töglhofer (2016), The financial relations between the Nationalbank and the government. OeNB, Monetary Policy and the Economy, Q3-Q4/16.

Schmitz, S. W. (2016), The OeNB’s reaction to the end of the Bretton Woods system: tracing the roots of the Indicator. OeNB, Monetary Policy and the Economy, Q3-Q4/16.

Secretary General, SUERF, and Head of Economic Analysis Division, OeNB, ernest.gnan@oenb.at; Lead Economist, Economic Analysis Division, OeNB, and Research Affiliate, CEPR, clemens.jobst@oenb.at. This note reflects the personal views of the authors and should not be taken as official views of the Oesterreichische Nationalbank or the European System of Central Banks. The authors appreciate research assistance by Gerald Hubmann as well as helpful comments by Morten Balling, Frank Lierman and David Llewellyn.

Other publications include most notably two volumes on the institutional history of the Nationalbank (Antonowicz et al., 2016) and a history of central bank policy in Austria (Jobst and Kernbauer, 2016). For a complete overview of activities on the occasion of the OeNB’s 200th anniversary see https://oenb.at/en/About-Us/200th-anniversary-of-the-OeNB.html.