Based on the French-German “7 + 7 report”, this policy note argues that reforms in the euro area have to continue to make the euro sustainable. It explains why risk sharing and market discipline are complements rather than substitutes, and presents a broad set of reforms needed to reconcile these two concepts. These include reforms to mitigate the sovereign-bank nexus, to strengthen the credibility of the fiscal framework, and to introduce new instruments for fiscal stabilization.

A great European, Hans-Dietrich Genscher, once said: “Our future is Europe. We do not have another one.” This is, in fact, an important and true statement, and it underlines the importance of thinking about reforms in Europe. This is why a group of seven French and seven German economists (the “7+7 group”) published a comprehensive report on euro area reform last year (Bénassy-Quéré et al., 2018).

This report has received a lot of attention, and one of the reasons is that the group of authors of the report was quite heterogeneous. But in spite of some diverging economic views, it proved not so hard to find a consensus. This gives some hope that Europe can find a consensus on these issues in spite of the existing red lines. Two such red lines are debt mutualization and permanent transfers among Member States. Within the “7+7 group”, those two red lines were respected. But further red lines exist that may have to be crossed to make the euro area stable.

It is important to acknowledge that the euro area remains fragile. But many politicians have lost this sense of urgency that something needs to be done. The feeling is that the crisis is more or less over and no reforms are needed in the short run. This may be a misperception. The global economy currently experiences a slowing expansion, and the same is true for the euro area after a relatively long boom. Risks are rising. There is the trade conflict, the imminent Brexit, and the risk that the euro area crisis may return. Of course, a lot of progress has been made. Europe has created new or improved institutions: the European Banking Union, which is crucial for the stability of the banking sector, and the European Stability Mechanism for crisis management; the Stability and Growth Pact was reformed, and there are new regulations in the financial sector, like Basel III.

Nevertheless, there are several problems that have not been solved. Many Member States still show very high public debt levels. Public debt increased sharply in the global financial crisis, and the relatively good times afterwards have not been used sufficiently for consolidation in some Member States. This is partly due to the fiscal framework, which has proven to be procyclical, partly ineffective and politically divisive. So debt levels are still high and fiscal space in the next crisis or recession is limited in many Member States, excluding, most importantly, Germany.

At the same time, monetary space is limited. The macroeconomic situation would have allowed for an earlier normalization of monetary policy, but this has not happened. At the present situation slowing growth makes the exit from loose monetary policy unlikely. Consequently, the euro area may not be able to rely on the ECB to the same extent as it has done in the last crisis. This is not so much because there are no instruments left but rather because these instruments become more and more politically controversial, which may impact the ECB’s independence.

The European banking sector remains relatively weak. Of course, capital ratios are higher than before the crisis. But especially in the light of the observed reduction in loan-loss provisions, they are still not high enough. Non-performing loans have decreased, but they may rise again fast in the next recession. There has also been increased risk-taking, not least due to the low interest rate environment. Exposures to domestic sovereigns remain very high, and the profitability of banks is structurally low.

In comparison to the USA, there is relatively little risk sharing in the euro area. There was a sharp drop in financial integration after the financial crisis. Financial integration proved not to be resilient in the crisis because it was mostly interbank loans, which disappeared in the middle of the crisis. Hence, the risk sharing did not work when it was needed most. The banking and the capital markets are still segmented in Europe, and so there is little financial risk sharing and what is more, there is virtually no fiscal risk sharing.

In 2018, the importance of these issues became clear when there was a sharp rise in Italian government bond spreads in the context of the Italian government formation and budget negotiations. On the one hand, this is a good sign because it seems there was some market discipline, and it partly worked because the Italian government became a bit more careful when they saw these harsh market reactions. On the other hand, there are studies showing that this increase was partly driven by redenomination risk. This also shows up in the transmission of these increases to other euro area countries. Moreover, the shock was transmitted to Italian and other European banks, which shows that the sovereign-bank nexus is still alive and strong.

Meanwhile, the popularity of EU membership has risen, partly related to the imminent Brexit. However, there is a large heterogeneity across countries, political polarization and anti-European movements prevail in quite a few countries. It seems likely that crisis management has contributed to that. Interestingly, neither the debtor nor the creditor countries were very happy. While the creditor countries had the feeling, they were paying for other people’s mistakes, the debtor countries had the feeling that austerity programs had been unfairly imposed on them.

Taken together, the status quo of the euro area remains unstable. The recovery has relied strongly on the ECB, which may not be possible to the same extent in the future due to limited monetary space. At the same time, there is limited fiscal space. Therefore, it will be much more difficult to deal with the next recession or crisis.

At the same time, there is a deadlock that delays, or slows down, the reform process, which poses a threat to the stability of the euro area. As argued in the “7+7 report”, this is partly due to different philosophies. The words “German” and “French” used below in order describe the opposing views should not be taken literally. Now, what is the “German” view? The “German” view emphasizes the unity of liability and control, the role of market discipline, incentive compatibility, fiscal discipline, enforceable rules, and the absence of a transfer union. The “French” view emphasizes the need to insure against asymmetric shocks, to avoid procyclicality, and to create safe assets. These different philosophies translate into different policy implications. The “German” view would prescribe a regime for the orderly restructuring of sovereign debt, credible fiscal rules with sanctions, and a removal of the regulatory privileges for sovereign exposures of banks, whereas the “French” view would argue for a fiscal capacity, European deposit insurance and safe assets.

The central point of the report is that it is a mistake to argue that these two views are contradictory. On the contrary, the report argues that risk sharing and market discipline are complements because they rely on each other. Note that the “7+7 paper” is not a political paper. It is not about forming packages that are acceptable for political reasons. It rather is an economic paper, which argues that a consistent approach to euro area reform has to have both elements risk sharing and market discipline.

The argument in a nutshell is as follows. If there is no discipline, risk sharing will tend to lead to moral hazard, and this is not sustainable in the longer run. Hence, it is clear that some type of discipline is necessary. However, disciplining devices that are merely based on administrative or political procedures are hard to enforce for political reasons. This is where market discipline comes into play. However, market discipline alone will not be enough because market discipline without risk sharing will be destabilizing and therefore it cannot be credible. To give an example, the government cannot say that it no longer bails out banks if there are no stabilizing features that prevent a meltdown of the entire financial system. Therefore, risk sharing and market discipline belong together, and one cannot work without the other.

There are three important elements of euro area reform. The first is that the financial architecture needs to be strengthened with two main features: breaking the sovereign-bank nexus and creating a European banking and capital market. The second is that the credibility of the fiscal framework has to be increased. This speaks in favor of an expenditure rule that is less procyclical and better enforceable. Moreover, rules are needed for a credible restructuring of sovereign debt as a last resort. And finally, more stabilization is needed through a European unemployment reinsurance scheme with an incentive-compatible design and without permanent transfers.

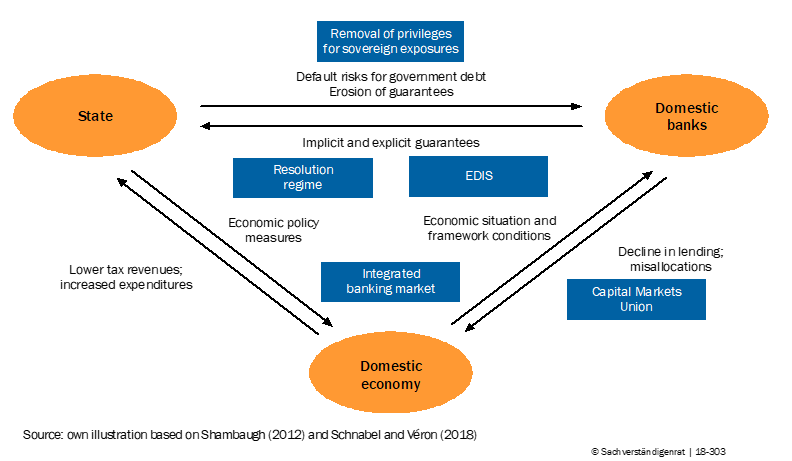

As to the financial architecture, there is one core question: How can the sovereign-bank nexus be broken or at least be mitigated? There are various connections between the state and the banks (see chart 1). First, there are direct connections. One of them is through implicit or explicit government guarantees, which is bank rescues on the one hand, and, what people tend to forget, deposit insurance on the other. Deposit insurance can only be credible if it has an implicit government backstop. But this creates a connection from the weaknesses of banks to the sovereign. In the other direction, it goes through the holdings of sovereign debt by banks and this again creates a direct connection between the problems of sovereigns and banks.

Chart 1: Illustration of the sovereign-bank nexus

In addition, there are indirect connections running through the domestic economy. If there is a sovereign debt crisis or if there is a domestic banking crisis, this will have an impact on the domestic economy. In turn, this will feed back into problems at the sovereign or at the banks. How strong these feedbacks are, depends on whether there is an integrated European capital market, which implies that firms in need of funding can shift from bank funding to capital market funding. It also depends on how well the banking sector is integrated. A highly integrated banking sector allows firms to switch to other European banks if the domestic banks are in trouble. At the same time, if the European banking sector is integrated, a domestic problem will not affect the domestic banking sector to the same degree.

This points towards the most important banking sector reforms:

In addition, a well-developed European capital market is desirable. Most importantly, resilient capital flows should be fostered, especially equity flows. This is one of the main goals of the Capital Markets Union, and it could be supported by removing the debt bias in taxation. Furthermore, it would be important to expand the competencies of the European Securities and Markets Authority (ESMA).

One issue the “7+7 group” did not agree on is whether there is a need for a European safe asset. There are quite a few arguments why one may need such an asset. One of them is related to the regulatory treatment of sovereign exposures. In order to ensure that there is more diversification in banks’ sovereign bond holdings, this would currently mean that some banks would have to move into riskier assets. For example, German savings banks may have to shift into Italian government bonds. Not everybody may think that this is the best idea. So the question is whether a European safe asset may provide a solution.

Regarding the fiscal framework, there is now emerging consensus on the need to switch to a fiscal expenditure rule as the current rules are too hard to enforce and procyclical. They have too little bite in good times, while being too harsh in bad times. So the general idea in the proposals is that expenditures should not grow faster than long-term nominal GDP (i. e., potential growth plus expected inflation), and that they should grow more slowly if the country misses some long-term debt targets, which could be the 60% from the Maastricht Treaty. One very important question remains: How can such rules be enforced? The proposal in the report was that one could force countries to finance excessive expenditures through junior debts, what some people have called accountability bonds, in order to introduce an element of market discipline that can be enforced more easily.

The second important issue is the question of orderly sovereign debt restructuring, which is needed to make the no-bailout rule credible. Importantly, there should not be an automatic debt restructuring of the stock of debts because this could lead to self-fulfilling effects. However, there should not be ESM loans granted to insolvent countries without debt restructuring. Holdout problems should be mitigated through comprehensive collective action clauses, and some of this has already been agreed in the last summit. Importantly, this interacts with the question of sovereign exposures, because if bank holdings of domestic sovereign exposures are reduced, this lowers the costs of debt restructuring. The third issue is fiscal stabilization.

But why is there a need for fiscal stabilization in the first place? One reason is that national fiscal space can be insufficient in spite of responsible behavior. Some argue that, in such cases, it would be much better to have an insurance through the financial sector, namely through financial integration. However, looking at the progress made in financial integration, it is unlikely that the desirable level of risk sharing can be achieved in the medium run, and therefore a fiscal mechanism may still be necessary. It has also been argued that stabilization already exists through the ESM programs. However, it is not wise to use them as a substitute for macroeconomic stabilization. In fact, a major advantage of a fiscal capacity is that it can act as an automatic stabilizer.

Such an instrument should be designed in a way that takes into account moral hazard problems and helps to prevent long-term permanent transfers. This includes design features like the reinsurance principle, ex-ante conditionality, experience ratings and so on. But even if not all incentive problems can be dealt with perfectly, this does not necessarily mean that such instruments should not be introduced at all, because these downsides still have to be weighed against the potential benefits from stabilization. And, in fact, more stabilization may actually help to make market discipline more credible.

What types of stabilization instruments could be considered? One possibility is a European unemployment insurance against large shocks. The trigger would be a large shock, for example, to the unemployment rate, giving rise to a one-time transfer – not a loan but a transfer. It would not be repayable. It would be financed through national contributions, which would have an experience rating, meaning that if a country taps the funds, it will have to pay higher contributions in the future. Importantly, there should be no borrowing by the fiscal capacity. Finally, there should be ex-ante conditionality, meaning that a country would be allowed to access this fund only when it complies with the rules.

A second instrument, which is discussed and partly exists already, is a precautionary credit line at the ESM, which allows for access to short-term liquidity at relatively low rates, without having to apply for a regular ESM program. There is relatively strict ex-ante conditionality, but no or little ex-post conditionality. Some people fear that, under such circumstances, it will never be used. But such a liquidity line may help to stabilize expectations in a way that a country with sound fundamentals basically cannot lose market access. Then this instrument could serve its purpose even if it is never used.

How is it possible to deal with the political resistance in reaction to this type of proposals? One has to start by convincing both politicians and the population that the euro area is unstable in its current form and that something has to be done. A stable euro area contributes to stronger economic growth and helps to strengthen the role of Europe in the world. Simply waiting and not doing anything, or waiting for the next crisis are very bad options. Clearly, it will always be hard to implement such reforms, because there will always be opposition from one side or the other. So it will be necessary to form packages, but not only for political reasons but also for economic reasons. This probably means that all sides will have to cross some of their red lines.

Maybe it would help if some of the issues were discussed in the public more objectively. When looking at the discussion about the European Deposit Insurance Scheme (EDIS) in Germany, there are many wrong stories being told about EDIS. This is a serious problem, and politicians should stand up and admit that, while there are some issues, there are also good reasons for implementing EDIS. A much less emotional debate is needed on these issues, and certainly such red lines should not be an excuse not to act. Firm commitments are needed on both sides. In the debate about risk reduction and risk sharing, many Member States in the euro area had the impression that risk reduction was a moving target, which was always adjusted at the time when some countries came close to achieving the goal. Hence, there is a need for commitments on all sides, determining what are the preconditions and what are the consequences.

Finally, one has to take into account the political developments when designing economic programs. For example, there are economic arguments why austerity programs were needed in the crisis. But these programs probably also contributed to political polarization, which now makes reform much more difficult. Therefore, these issues have to be taken into account more broadly.

After the political events in Italy some people have argued that no further steps should be taken towards more European integration because Italy is not playing according to the rules. But this is a bad idea. Italy should not be used as an excuse to delay the reforms but the opposite is true. It rather shows how urgent the reforms really are. It would be unwise, both from the French and the German perspective, to reject any further market discipline or risk sharing, instead one should put more energy into thinking about how to design incentive-compatible mechanisms for risk sharing. Some say that if the next crisis comes, none of these reforms will have been implemented. Therefore, they come too late anyway. This is partly true, of course, because reforms will take time. But one should be aware that reforms would have important implications for expectations. They may help to stabilize the expectations regarding the future of the euro area and the willingness to reform in order to make the euro sustainable. And this is the ultimate goal.

Bénassy-Quéré, A., M. Brunnermeier, H. Enderlein, E. Farhi, M. Fratzscher, C. Fuest, P.-O. Gourinchas, P. Martin, J. Pisani-Ferry, H. Rey, I. Schnabel, N. Véron, B. Weder di Mauro and J. Zettelmeyer (2018), “Reconciling risk sharing with market discipline: A constructive approach to euro area reform”, CEPR Policy Insight No. 91.

Schnabel, I. and N. Véron. 2018. Breaking the stalemate on European deposit insurance.

https://voxeu.org/article/breaking-stalemate-european-deposit-insurance

Shambaugh, J. C. 2012. The euro”s three crises. Brookings Papers on Economic Activity 43 (1).