In April of this year, the European Commission published its proposals to update the current rules on multilateral fiscal surveillance and the excessive deficit procedure. Central to the proposals is the introduction of national medium-term fiscal structural plans that are supposed to replace the existing annual convergence and stability programs. The main component is a path, over a period of at least four years, for net primary government expenditures. The expenditure path should be set such that government debt is on a plausible downward trajectory or maintained at a prudent level no later than the end of the period. The proposed emphasis on compliance with country-specific net expenditure trajectories aimed at government debt sustainability is to be welcomed. In contrast, maintaining the one-size fits all 3% threshold for the budget balance undermines several of the acclaimed advantages of the proposed new governance system, including that it would be simpler and less pro-cyclical. Finally, little in the Commission’s plans suggests that enforcement under the proposed framework will not be as weak as under the current framework.

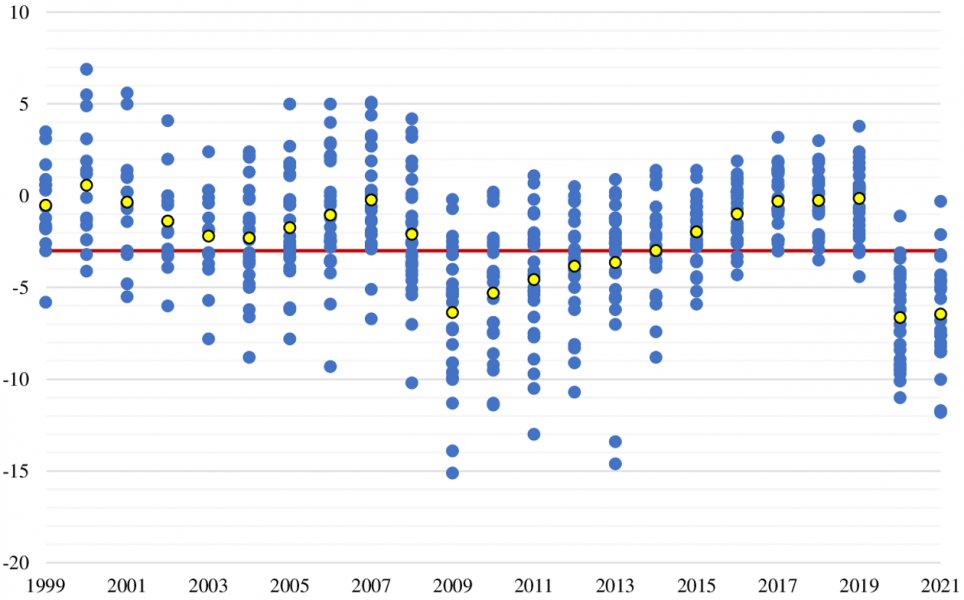

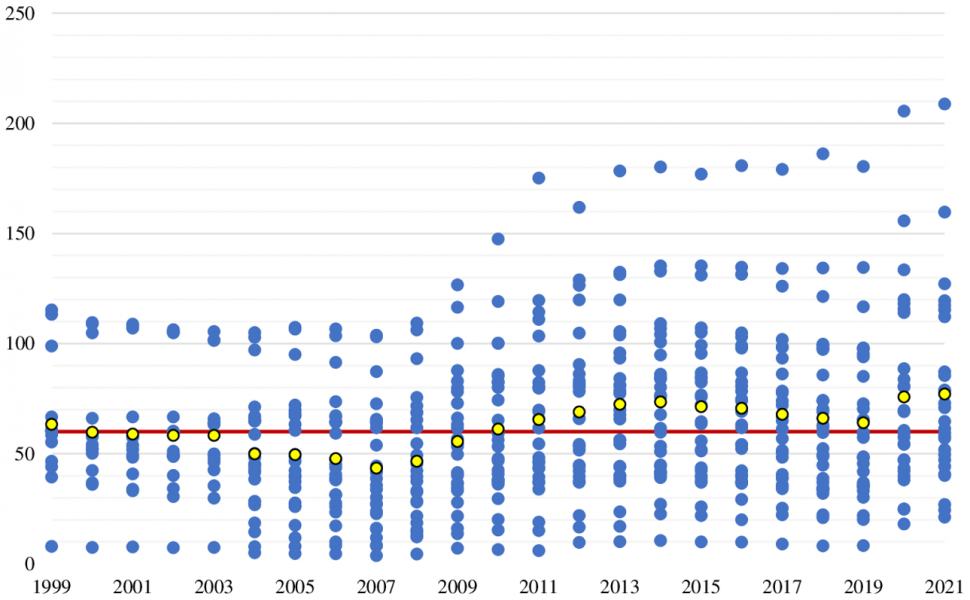

The current rules governing national fiscal policy in the European Union (EU) fall short. This is evidenced by deficits frequently exceeding the 3% of GDP threshold (Figure 1) and the persistently high debt levels in some member states (Figure 2) and the fact that member states’ fiscal policies tend to be procyclical (de Haan and Gootjes, 2023). Moreover, the rules are highly complex partly because of the reform measures taken in response to the European debt crisis (Amtenbrink and de Haan, 2023). They are largely based on indicators that are difficult to measure and subject to significant revisions (European Fiscal Board, 2019). Examples include the output gap (the difference between actual and potential GDP) and the structural budget balance (the budget balance adjusted for cyclical influences). This complexity contributes to weak compliance. Moreover, several studies show that member states considered the 3% deficit benchmark as a guideline for national fiscal policy rather than a ceiling not to be exceeded (Caselli and Wingender, 2018; Kamps and Leiner-Killinger, 2019). This explains why the deficits of many member states hovered around 3% of GDP even in good economic times and why the reference value was regularly exceeded in cyclical downturns. In these situations, neither the European Commission nor the Economic and Financial Affairs Council (ECOFIN) were subsequently willing to impose the sanctions on non-compliant member states made available by EU law.

Figure 1: Dispersion of general government budget balances (in % of GDP) in the EU, 1999-2021

Source: AMECO database. Note: The blue dots show the government budget balances of EU Member States; the yellow dots show the EU average. The red line shows the 3% deficit limit. The outlier for Ireland in 2010 (-32%) has been dropped.

Figure 2: Dispersion of government debt ratios (in % of GDP) in the EU, 1999-2021

Source: AMECO database. Note: The blue dots show the public debt ratios of EU Member States; the yellow dots show the EU average. The red line shows the 60% debt limit.

In April of this year, the European Commission published its proposals to update the current rules on multilateral fiscal surveillance and the excessive deficit procedure. Central to the proposals is the introduction of national medium-term fiscal structural plans that are supposed to replace the existing annual convergence and stability programs. It is envisaged that these plans will include member states’ fiscal, reform, and investment plans. The main component is a path, over a period of at least four years, for net primary government expenditures. Not included in the calculation of this expenditure are discretionary measures on the revenue side, as well as interest expenditures and cyclical unemployment expenditures. The expenditure path should be set such that government debt is on a plausible downward trajectory or maintained at a prudent level no later than the end of the period. In addition, plans should ensure that the government deficit is brought or maintained below the reference value over the medium term.

It is further envisaged that the national medium-term fiscal structural plans must identify public investments that are prioritized and reforms to be implemented. At the same time, the plans would have to be consistent with ECOFIN recommendations to correct any macroeconomic imbalances and benefit the Union’s common priorities such as in the areas of energy and climate, as well as digitalization.

Member States would be given the option to extend the regular adjustment period of at least four years foreseen in national fiscal structural plans by up to three years if meaningful reform and investment commitments are made that again have to meet a variety of criteria, such as relating to the capacity of these commitments to enhance growth, support fiscal sustainability, and address common EU policy priorities.

In its proposal, the Commission gives itself a key role in the preparation of the national medium-term fiscal structural plans, whereby Member States with deficits and/or debt ratios above the reference values are treated somewhat differently. For these member states the Commission would be in charge of establishing a “technical trajectory” for net expenditure covering an adjustment period of at least 4 years, aimed at ensuring that the government debt ratio is brought or kept on a plausible downward trajectory, or at prudent levels. In addition, the adjustment path is supposed to ensure that the government deficit is brought and kept below the 3% of GDP reference value. According to the proposal, the fiscal adjustment effort over the life of the fiscal structural plan would have to at least commensurate with the total effort over the entire adjustment period, while the growth rate of national net expenditures over the plan horizon would have to remain lower on average than economic growth. For member states with deficit and debt ratios below the thresholds, the Commission would be in charge of providing “technical information” on the structural primary balance needed to ensure that, without additional policy measures, the deficit remains below the 3% reference value over a 10-year period following the expiration of the national plan.

Subsequently, governments of member states come up with their plans, which would then be assessed by the Commission. This assessment is planned to include a detailed examination of the effects of the national plans on the evolution of the government debt- and deficit-to-GDP ratios both during and after the adjustment period. In doing so, it is envisaged that the fiscal adjustment effort over the life of the fiscal structural plan should be at least proportional to the total effort over the entire adjustment period. In addition, the Commission would have to assess the extent to which the plans’ other requirements have been met.

Finally, based on this assessment by the Commission, the national plans would have to be endorsed by the Council. Where the Council finds that the plan does not meet the requirements, it recommends, on the recommendation of the Commission, that the Member State concerned submit a revised plan. Failing to submit an adequate (revised) plan would result in the Council, on a recommendation from the Commission, recommending to the member state concerned that the “technical trajectory” established by the Commission becomes the net adjustment path.

As to the monitoring of compliance with the proposed European rules, the Commission intends to focus on the implementation of agreed national fiscal structural plans. The Commission proposals make a clear distinction between breaches of the deficit and debt reference values. Infringements of the 3% reference value for the deficit would directly result in an excessive deficit procedure (EDP). However, as with the current procedure, a deficit above 3% could be considered exceptional if the Council has determined that there is a severe economic downturn in the euro area or the EU as a whole or that there are exceptional circumstances beyond the control of the member state that have a significant impact on its public finances. By contrast, a breach of the 60% debt ceiling would no longer in itself warrant the opening of an EDP. The determining factor for the latter would become the deviation of a member state from the net spending path agreed in the national medium-term fiscal structural plans. Technically speaking, as long as a member state adheres to the expenditure path, its debt ratio would be considered in conformity with EU law, namely to be “sufficiently diminishing and approaching the reference value at a satisfactory pace” (Article 126(2)(b) TFEU). This is a clear departure from the current system, in which a debt-to-GDP ratio above 60% regardless of the overall economic situation of a member state can in principle only be considered exceptional if the debt has declined by an average of one-twentieth per year over the previous three years (1/20 rule).

Once an EDP is launched, the requirements on a member state for effective action to be taken will differ for overshooting of the deficit and public debt benchmarks. In the former case, the member state would be required to implement a corrective net expenditure path consistent with a minimum annual adjustment of at least 0.5% of GDP as a benchmark. These required adjustments thus differ from the current required adjustment of a minimum annual improvement of at least 0.5% of GDP in the structural budget balance (net of one-off and temporary measures).

For overshooting of the debt ratio, the Commission’s proposal does not provide a target, but rather requires that the net spending path should redirect the debt ratio in a plausible downward direction or maintain it at a prudent level. It should also ensure that “the average annual fiscal adjustment effort in the first three years is at least as high as the average annual fiscal effort of the total adjustment period.” Again, the proposal thus departs from the current requirement that debt levels be reduced by an average of one-twentieth per year.

Regarding the sanctioning of non-compliance with the requirements under the EDP, it is envisaged that any fine to be imposed is limited to 0.05% of GDP for a period of six months and will be paid every six months until the Council judges that the member state concerned has effectively complied with the recommendation. At the same time, a ceiling is introduced as the cumulative amount fined may not exceed 0.5% of GDP.

The proposed revised fiscal surveillance framework puts the sustainability of public debt at the centre through a net expenditure rule. The focus on the net expenditure path rather than the (structural) budget balance is a significant improvement. This is because the budget deficit is not fully determined by the government. Instead, governments can directly influence most of their own spending, which speaks in favour of the use of a spending rule (Feld et al., 2018). Moreover, government expenditures are less dependent on the state of the business cycle than budget deficits, thus reducing forecast errors. It is rather disappointing that this approach is not consistently followed through in the Commission proposal, as the budget balance (and in some cases even the cyclically adjusted budget balance) still plays a role. What is more, the Commission proposes to adjust net spending for cyclical unemployment spending. This is asking for forecasting errors and manipulations. Moreover, it runs counter to the Commission’s objective of making the rules less dependent on variables that are difficult to determine. Also, the stipulation that the net expenditure path should reverse the debt-to-GDP ratio in a plausible downward direction is not very clear. Annex 5 of the Commission’s proposal contains all sorts of rather vague provisions on this, leaving room for the same kind of political tinkering as under the current framework (Gilbert and de Jong, 2017).

Instead of relying on a general standard that applies indiscriminately to all member states regardless of their debt sustainability and specific fiscal situation, the Commission’s proposal puts the emphasis on compliance with country-specific net expenditure trajectories. This is to be welcomed as it gives member states with sustainable debt levels more freedom to determine their fiscal policies, thereby creating an additional incentive for member states under heightened policy surveillance to work towards sustainable public finances by adhering to their debt reduction adjustment paths. In contrast, the one-size fits all 3% threshold for the budget balance would be maintained under the EDP. In the Commission’s view this rule is a well-established element of today’s EU budgetary surveillance that has effectively influenced fiscal policy and is well understood by policymakers and the general public. However, this positive view of the role of the 3% rule is contradicted by the fact that, as explained above, its main effect in the past has been to focus nominal adjustment strategies too strongly on this threshold rather than on medium-term objectives. Moreover, by keeping the 3% threshold in place the revised framework would remain procyclical, undermining one of the benefits of the proposed focus on the net expenditure rule. Leaving aside for a moment the legal implications, it would have been more consistent from an economic point of view to abolish the 3% deficit reference value altogether and make the opening of the EDP conditional only on exceeding the expenditure trajectory as agreed in national medium-term fiscal structural plans. Indeed, these should focus not only on the fiscal adjustments needed to address an unsustainable public debt-to-GDP ratio, but also on low government deficits. The required corrective measures required of a member state with an excessive deficit (a minimum annual adjustment of at least 0.5% of GDP as a benchmark) may lead to procyclical policies.

From a legal perspective, the European Commission’s proposals are an adjustment of the existing economic governance framework rather than a fundamental realignment, as becomes already clear from the fact that the 3% and 60% reference values remain relevant. This is not surprising, considering that a fundamental realignment would require a legally complex amendment of the European treaties, the political feasibility of which would be anything but certain; a problem that the EU already faced when reforming the framework after the European sovereign debt crisis in 2011-2013. Examining the Commission’s proposals, one is struck by the legal gymnastics that have sometimes been applied to ensure that the proposed changes do not conflict with current provisions in primary Union law on economic governance (Amtenbrink and de Haan, 2023). This also means that one cannot expect too much from the Commission proposals in terms of the simplification of the rules.

Finally, little in the Commission’s plans suggests that enforcement under the proposed framework will not be as weak as under the current framework. Here the, for the reasons mentioned above, understandable choice to avoid amending the European treaties comes at a price, since the Council remains, in principle, responsible for decision-making. Within the Council, ministers generally have no incentive to be critical of others. As Thygesen et al. (2022) state, “a vote against a licentious colleague is like providing a public good: all other ministers benefit, while the cost is borne by the minister who votes against.” It is to be feared that the Commission’s proposals will not change this.

Amtenbrink, F. and J. de Haan (2023) The European Commission’s approach to a reform of the EU fiscal framework: A legal and economic appraisal. European Law Review, forthcoming.

Caselli, F. and P. Wingender (2018) Bunching at 3 percent: The Maastricht fiscal criterion and government deficits. IMF Working Paper 18/182.

de Haan, J. and B. Gootjes (2023) National fiscal policy in EMU: Insufficient sustainability and stabilization? In Adamski, D., F. Amtenbrink and J. de Haan (eds), The Cambridge Handbook on European Monetary, Economic and Financial Integration, Cambridge University Press.

European Fiscal Board (2019) Assessment of EU fiscal rules with a focus on the six and two-pack legislation. Available at: https://commission.europa.eu/publications/assessment-eu-fiscal-rules-focus-six-and-two-pack-legislation_en.

Feld, L.P. et al. (2018) Refocusing the European fiscal framework. VOXEU. Available at: https://cepr.org/voxeu/columns/refocusing-european-fiscal-framework.

Gilbert, N.D. and J.F.M. de Jong (2017) Do the European fiscal rules induce a bias in fiscal forecasts? Evidence from the Stability and Growth Pact. Public Choice 170(1), 1-32.

Kamps, C. and N. Leiner-Killinger (2019) Taking stock of the functioning of the EU fiscal rules and options for reform. ECB Occasional Study 231.

Thygesen, N. et al. (2022) Making the EU and national budgetary frameworks work together. VOXEU. Available at: https://cepr.org/voxeu/columns/making-eu-and-national-budgetary-frameworks-work-together.