This note focuses on the euro area and examines two important issues that have gained policy-makers’ attention in the wake of the Covid-19 pandemic and the subsequent economic recovery: the elevated inflation and the functioning of the monetary policy transmission mechanism. Energy commodity prices, particularly gas and electricity, rose exponentially, bringing euro-area inflation to unprecedented levels. The ECB’s monetary policy decisions have contributed to keeping inflation expectations anchored, containing the risk of a wage-price spiral and preserving the proper functioning of the monetary policy transmission mechanism.

The Covid-19 pandemic and the subsequent strong economic recovery have brought to the attention of policy-makers two important issues: the functioning of the monetary policy transmission mechanism and elevated inflation. While the former showed up more than once since the Global Financial Crisis, the latter had completely disappeared from the radar since the beginning of the Great Moderation in the mid-eighties. Although these two issues are relevant for many advanced economies, this note focuses on the euro area.

When the pandemic hit, financial markets came under severe stress and many segments showed clear signs of disruption and malfunctioning. Markets rapidly recovered as central banks injected large amounts of liquidity and started purchasing private and public securities. Societies were reopened and economies recovered rapidly, despite the uncertainty connected with the emergence of new highly transmissible Covid-19 variants.

Since the middle of 2021, energy commodity prices have risen exponentially in global markets reaching historically high values. While the rise in oil prices was sizeable but not exceptional compared with past episodes, the increases in gas and electricity prices were unprecedented. The European Central Bank (ECB) started normalizing its monetary policy in late 2021 to counter the rise in inflation; sovereign bond markets in some jurisdictions of the euro area came under pressure in the spring of 2022.

Two lessons can be drawn from the 2021-2022 inflation surge for the ECB’s monetary policy. First, monetary policy can re-anchor long-term inflation expectations after a prolonged period below target and can prevent their upward de-anchoring. Second, quantitative tools can help preserving the smooth functioning of the monetary policy transmission mechanism. Both lessons have implications for both the ECB’s policy rate setting and long-term yields in the euro area.

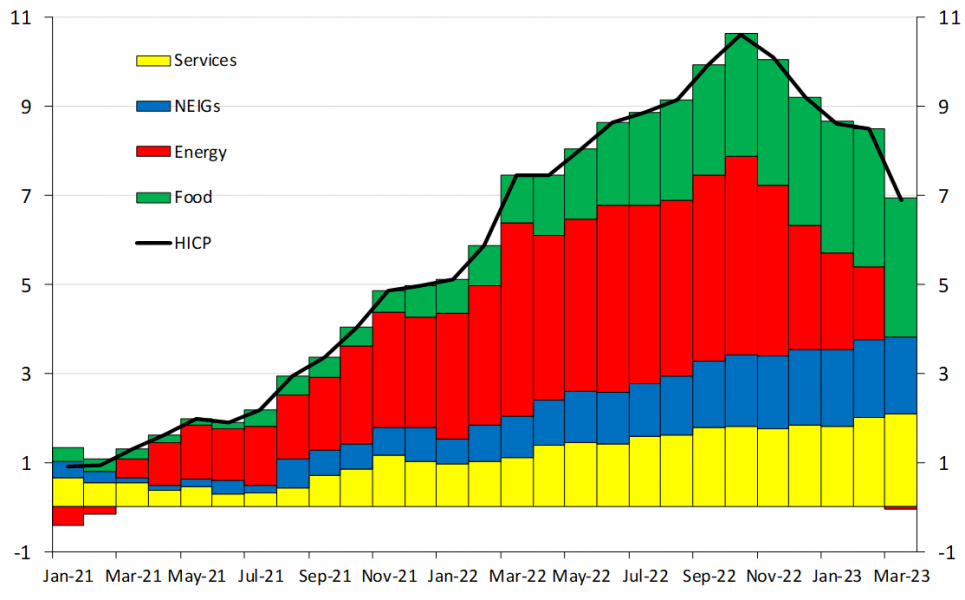

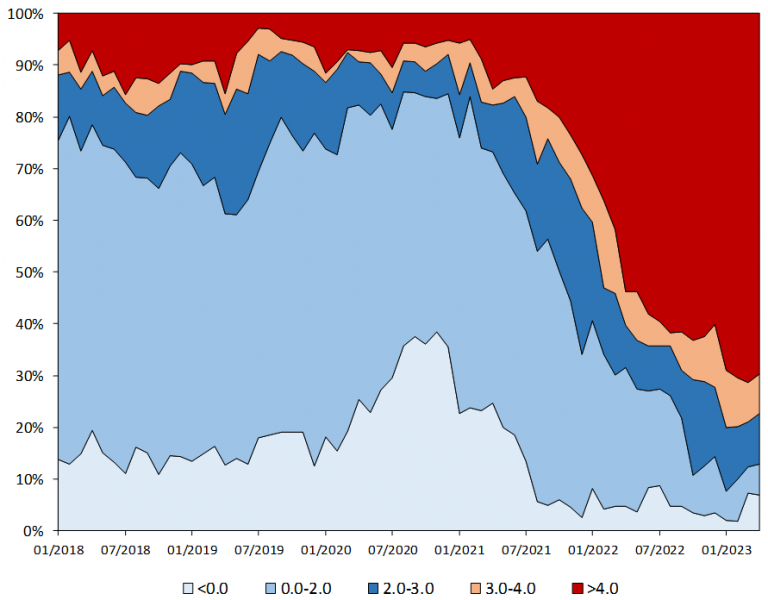

Since mid-2021, energy commodity prices have risen sharply. Their unprecedented increase and persistence brought euro area headline inflation to double-digit figures in autumn 2022 (to a historical record of 10.6 per cent in October), driven to a large extent by the dynamics of the energy component (Figure 1). Core inflation also reached unprecedented levels (close to 5 per cent at the end of 2022), reflecting almost evenly the contributions of non-energy industrial goods and services. Around 70 per cent of the prices of goods and services included in the Harmonized Index of Consumer Prices (HICP) increased by more than 4.0 per cent in the first four months of 2023 (Figure 2); the percentage is 64 in the case of core goods and services.

Energy shocks have played a more prominent role in driving inflation compared with shocks to aggregate demand (Neri et al. 2023). The energy component accounted for 2.1 percentage points out of the 5.7 per cent of core inflation in March 2023. Demand- (accumulated savings and post-Covid reopening) and supply-side factors (bottlenecks and non-energy commodities) accounted for the remaining part of core inflation.

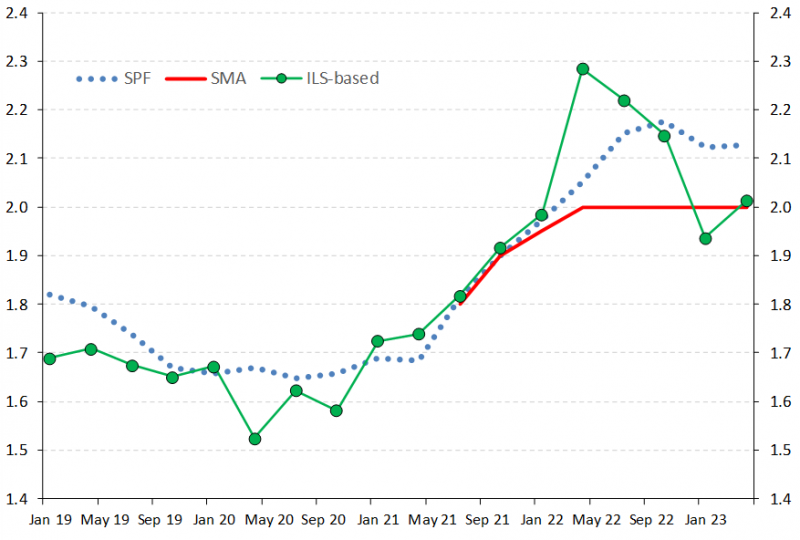

Despite the unprecedented increase in inflation, both market- and survey-based long-term inflation expectations have remained well anchored to the target (Figure 3). After several years well below 2.0 per cent, in the October 2022 round of the ECB Survey of Professional Forecasters (SPF) long-term inflation expectations reached levels consistent with the new 2 per cent symmetric inflation target announced in July 2021. Both developments are consistent with a re-anchoring of expectations.

Figure 1: Headline inflation and contributions of its components (per cent and percentage points)

Source: European Central Bank.

Figure 2: Share of HICP components according to pace of change (per cent)

Source: European Central Bank.

Figure 3: Long-term inflation expectations (per cent)

Source: European Central Bank and Cecchetti, Pericoli and Grasso (2022). Note: ILS-based expectations are adjusted for the inflation risk premium.

The 2021-22 inflation surge has highlighted the key role of anchored inflation expectations. The normalization of the ECB’s monetary policy has shown the importance of preserving the smooth functioning of the markets that are relevant for the transmission of monetary policy through the financial system.

The 1973 and 1979 oil price shocks triggered a high and persistent inflation in advanced economies. A weak monetary policy response in the form of a late tightening or early loosening was a major cause of the failure in keeping inflation and its expectations under control after the 1973 episode. A strong tightening after the 1979 shock was required to bring inflation down and re-anchor inflation expectations. Advanced economies experienced severe recessions after the two shocks that were reinforced by the response of monetary policy (Corsello, Gomellini and Pellegrino, 2023).

After the two shocks, central banks understood the important role played by expectations and adopted new monetary policy strategies with a clear mandate to pursue price stability. A credible commitment to a low inflation became a key element of monetary policy strategies. An important lesson was learned. If not promptly and rapidly addressed, high and persistent inflation may lead to an upward de-anchoring of inflation expectations and second-round effects. In these circumstances, the monetary policy response required to lower inflation may imply large macroeconomic costs.

The importance of the anchoring of long-term inflation expectations was also clear during and after the 2013-14 disinflation (Corsello, Neri and Tagliabracci, 2021). An earlier adoption of asset purchases by the ECB would have prevented the sharp decline in long-term inflation expectations (Neri and Siviero, 2018) and contributed to keeping inflation close to 2 per cent (Neri, 2023).

In December 2021, the ECB started normalizing its monetary policy to contain the inflationary pressures by announcing the end of the net asset purchases within the Pandemic Emergency Purchase Programme (PEPP) and the reduction of those within the Asset Purchase Programme (APP).

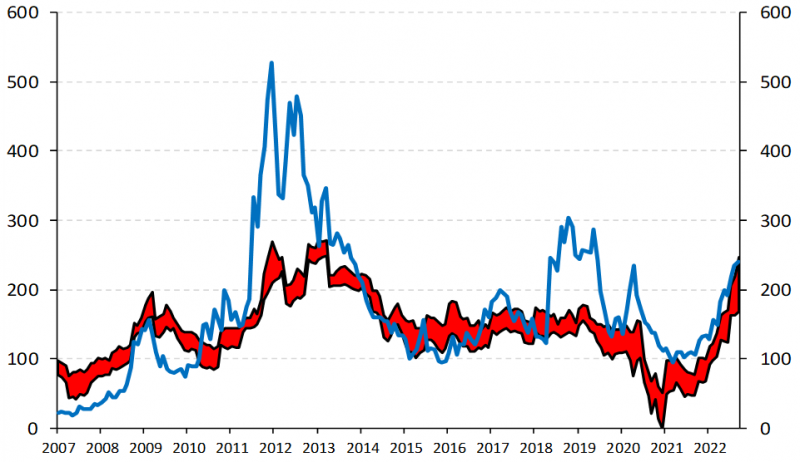

Due to uncertainty over developments in the war in Ukraine and the subsequent decline in the risk propensity of investors, sovereign bond yields increased markedly. Between April and mid- June 2022, the yields on the 10-year BTP rose by about 2 percentage points, to over 4 per cent, the highest value since the end of 2013. The spread with respect to the corresponding German Bund widened by 90 basis points, reaching over 240 on 14 June. The spread increased also for other euro area economies.

Sovereign yields increased markedly after the decisions of the ECB Governing Council on 9 June, which caused markets and analysts to expect a more rapid pace of policy rate hikes. The abrupt increase in yields and in the spread observed in Italy did not seem justified by the underlying macroeconomic fundamentals (Figure 4).1

Figure 4: Italian spread: observed and fair values (basis points)

Source: Ceci and Pericoli (2022). Note: the red shaded area denotes the 0.10-0.90 percentile range across different specifications of the model.

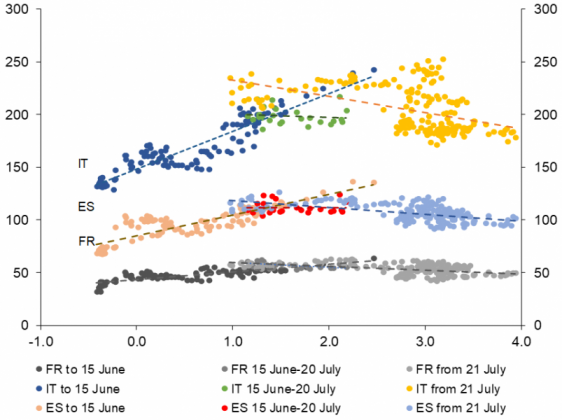

The tensions partially eased after 15 June, when the Governing Council held an extraordinary meeting and decided to introduce flexibility in reinvesting maturing securities within PEPP and to step up the design of a new instrument to counter the fragmentation of euro-area sovereign bond markets.2 At the beginning of July, ten-year BTP yields stood at around 3.3 per cent and the spread with German ten-year bonds was about 195 basis points, a figure that was less far from values consistent with the macroeconomic fundamentals. The yields on the government bonds of Greece, Spain and Portugal and the spreads with German bonds also declined significantly and became less sensitive to expectations about the ECB’s policy rate (Figure 5).

Figure 5: The ECB’s measures against fragmentation risk (x-axis per cent; y-axis basis points)

Source: Banca d’Italia Economic Bulletin, October 2022 and I. Schnabel, ‘Inflation in the euro area: causes and outlook’, speech at the Luxembourg-Frankfurt Financial Professionals Network, Luxembourg, 22 September 2022. Note: The y-axis shows the yield spreads between 10-year government bonds and the corresponding German Bund; the x-axis shows the expected value of the €STR rate implied by the overnight indexed swap forward contract at end-2023.

On 21 July 2022, the Governing Council approved the Transmission Protection Instrument (TPI), which could be activated in the event of unwarranted tensions in financial markets that pose a threat to the smooth transmission of monetary policy across the euro area. Safeguarding the monetary policy transmission mechanism is a precondition for the Governing Council to be able to preserve price stability.

The normalization of the ECB’s monetary policy, which started in December 2021, brought the stance in restrictive territory in spring 2023. While the full effects on inflation are still to be seen, there is no doubt that the policy decisions have contributed to preserving the anchoring of long-term inflation expectations and containing the risk of a wage-price spiral.

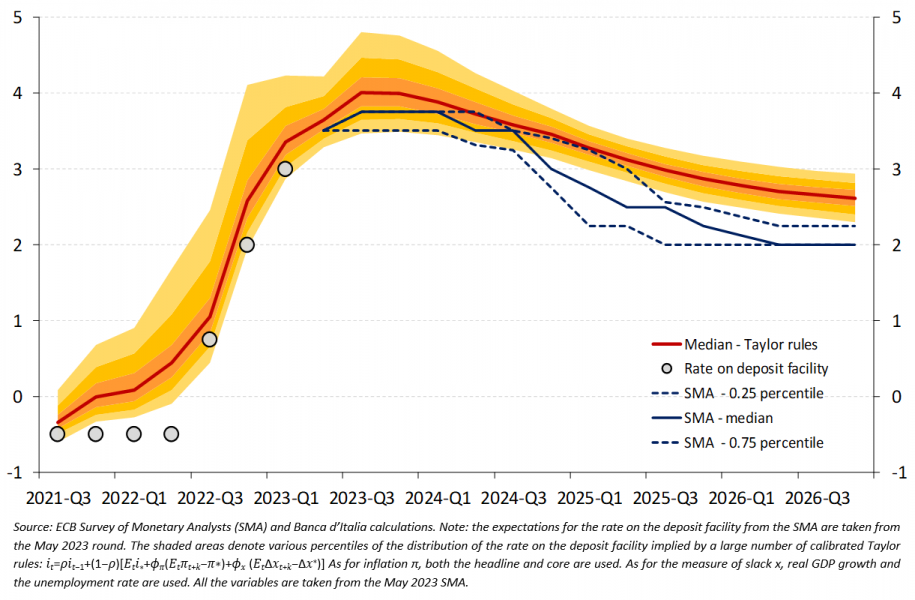

The pace and scale of the increase in the ECB’s policy rates has been unprecedented and the effects on lending rates and credit supply and demand have been significant. As policy rates are getting closer to their peaks, as highlighted by both market- and survey-based expectations and Taylor rules (Figure 6), future decisions should take into account both upside and downside risks to the inflation outlook. The large uncertainty surrounding macroeconomic developments makes the calibration of the monetary policy stance a complex exercise and calls for “small steps” (Panetta, 2023).

Figure 6: Analysts’ expectations on the Eurosystem deposit facility rate and Taylor rule implied rate

(per cent)

The risk of an excessive tightening of financing conditions is material. The on-going tightening of credit standards on loans to non-financial corporations and households, which is due to banks’ increased risk perception and reduced risk tolerance, may exert an upward pressure on lending rates. Increased competition among banks for overnight deposits may lead to an increase in their remuneration, raising banks’ cost of funding and lending rates. The reimbursement of the TLTRO-III funds may lead to congestions in financial markets, as banks in the euro area also expected to issue a large amounts of bonds, raising their costs. Renewed bank tensions in the banking sector, such as those recently observed in the U.S., may also lead to an increase in bank bond yields and to a decline in bank stock prices, further raising their funding costs.

The monetary policy cycle is close to its peak, as financing conditions have tightened substantially compared to the beginning of the cycle and banks are less willing to take on excessive risks from lending. As long-term inflation expectations are anchored and the risk of a wage-price spiral is limited, it may be advisable to take stock of both the effects of monetary policy achieved so far and of those still in the pipeline and wait for the impact of past energy price shocks on core inflation to fade away. The ECB’s policy decisions since December 2021 have preserved the anchoring of long-term inflation expectations, which is key for the convergence of inflation to 2 per cent, and have contributed to counter fragmentation of financial conditions and preserve the smooth transmission of the monetary policy stance within the euro area. The prospects for interest rates in the longer-term are uncertain, and probably more than before the Covid-19 pandemic. Some of the structural factors at play before the pandemic, however, may continue exerting downward pressure on interest rates.

Bernardini, M. and A.M. Conti (2023). “Announcement and implementation effects of central bank asset purchases”, Banca d’Italia Working paper, forthcoming.

Cecchetti, S., A. Grasso and M. Pericoli “An analysis of objective inflation expectations and inflation risk premia”, Banca d’Italia Working paper 1380.

Ceci, D. and M. Pericoli (2022). “Sovereign spreads and economic fundamentals: an econometric analysis”, Banca d’Italia Occasional paper 713.

Corsello, F., M. Gomellini and D. Pellegrino (2023). “A note on inflation and energy price shocks: lessons from the 1970s”, Banca d’Italia Occasional paper, forthcoming.

Corsello, F., S. Neri and A. Tagliabracci (2021) “Anchored or de-anchored? That is the question”, European Journal of Political Economy, 69 102031.

Neri, S. (2023). “Long-term inflation expectations and monetary policy in the euro area before the pandemic”, European Economic Review, 154 104426.

Neri, S., F. Busetti, C. Conflitti, F. Corsello, D. Delle Monache and A. Tagliabracci (2023). “Energy price shocks and inflation in the euro area”, Banca d’Italia Occasional paper, forthcoming.

Neri, S. and S. Siviero (2018). “The non-standard monetary policy measures of the ECB: motivations, effectiveness and risks”, Credit and Capital Markets 51, 513-560.

Panetta, F. (2022). “Small steps in a dark room: guiding policy on the path out of the pandemic”, speech at an online seminar organised by the Robert Schuman Centre for Advanced Studies and Florence School of Banking and Finance at the European University Institute, 28 February 2022.

Schnabel, I. (2022). “Inflation in the euro area: causes and outlook”, speech at the Luxembourg-Frankfurt Financial Professionals Network, Luxembourg, 22 September 2022.

See Ceci and Pericoli (2022). Estimating yield and spread figures that are consistent with the fundamentals is a complex exercise, which can be carried out using various approaches. The results can be model-dependent. The estimates must be taken with caution, as the recent data are characterized by large fluctuations after the outbreak of the pandemic and after the Russian invasion of Ukraine.

Bernardini and Conti (2023) show that flexibility in asset purchases can reduce sovereign bond spreads.