Since the Great Financial Crisis, a growing number of central banks have adopted abundant reserves systems (“floors”) to set the interest rate. However, there are good grounds to return to scarce reserve systems (“corridors”). First, the costs of floor systems take considerable time to appear, are likely to grow and tend to be less visible. They can be attributed to independent features of the environment which, in fact, are to a significant extent a consequence of the systems themselves. Second, for much the same reasons, there is a risk of grossly overestimating the implementation difficulties of corridor systems, in particular the instability of the demand for reserves. Third, there is no need to wait for the central bank balance sheet to shrink before moving in that direction: for a given size, the central bank can adjust the composition of its liabilities. Ultimately, the design of the implementation system should follow from a strategic view of the central bank’s balance sheet. A useful guiding principle is that its size should be as small as possible, and its composition as riskless as possible, in a way that is compatible with the central bank fulfilling its mandate effectively.

The Great Financial Crisis (GFC) has been a watershed for the way in which central banks set the short-term interest rate on a day-to-day basis. The crisis has literally upended these operating procedures. Is the change desirable or should it be reversed?

The question may appear inconsequential, at least at first sight. After all, why should it make a big difference? All that matters, it could be argued, is at what level the rate is set, not how it is set. Indeed, while things have changed somewhat in recent years, a keen interest in operating procedures remains generally limited to central bankers and the market participants most directly concerned, particularly those active in money markets.

This limited interest, while understandable, is regrettable. For operating procedures shed light on the great power that central banks wield, as well as on the source of that power and on its limits (Borio (1997)). Moreover, they also have broader implications for the functioning of money and even capital markets, for how monetary policy spreads its influence through the financial system, for central bank emergency interventions at times of financial stress and for the optimal size and structure of the central bank’s balance sheet.

Against this backdrop, this paper assesses the post-GFC sea-change in operating procedures. It does so from the perspective of someone who has studied them in the past and sees current developments with a mix of surprise and some discomfort. My hope is that the analysis will make it clear that the discomfort is not just a matter of unjustified nostalgia.

More specifically, the paper examines the relative merits of abundant reserves systems (ARS) and scarce reserves systems (SRS) in implementing interest rate policy. This is what has typically been referred to, somewhat inaccurately, as the relative merits of floor versus corridor systems. That said, the analysis will also address more briefly the bigger and closely related debate over the size and composition of the central bank’s balance sheet.

The key takeaway is that it is worth giving serious thought to returning to SRS – “getting up from the floor”, as it were.

The first section summarises the post-GFC sea-change. The second explains it might be desirable to reverse course. The third considers the broader question of the central bank’s balance sheet. The conclusion summarises the key messages.

The common features of pre-GFC operating procedures were very clear. The overriding objective was to make the policy stance effective while at the same time leaving a minimal imprint on the financial system. This gave rise to three, tightly related, characteristics.1

First, there was a single operating target at the very short end of the curve, almost invariably an overnight rate.2 This rate, in effect, captured the overall monetary policy stance – in technical terms, it was a sufficient statistic for that stance.

Second, the “decoupling principle” ruled. Signalling did the heavy lifting in steering the overnight target. Through signals, the central bank would tell banks where it wanted the overnight rate to be.3 In the meantime, light-touch liquidity management operations worked only in the background. They would keep the market for bank reserves in balance and ensured that the demand for settlement balances “did not get in the way”.4 Importantly, the operations were designed not to disturb market prices.5 The rest of market rates then aligned seamlessly with the overnight rate and expectations thereof. Of course, the central bank could pull off this magic signalling “trick” – often little appreciated by non-specialists – because of its monopoly over the supply of banks’ settlement balances and its ability to set features of the demand for them, such as the terms on reserve requirements (eg averaging and remuneration).

Third, SRS were the rule and ARS very much the exception. An SRS system is here defined as one that ensures that the overnight rate is above the interest rate on bank reserves (possibly zero); and an ARS as one where that interest rate (or zero) is the binding “floor” for the overnight rate – typically implemented through a deposit facility.6 More precisely, in an SRS, the factor determining the overnight rate is the demand for reserves for settlement purposes (“settlement balances”), possibly constrained by reserve requirements with averaging provisions. By contrast, in an ARS reserves exceed that amount. The handful of central banks that had an ARS – in fact, only two (New Zealand and Norway), at least among advanced economies – did satiate the demand for settlement balances, but only marginally.

To be sure, beneath these similarities, differences abounded – think of them as “a hundred ways to skin a cat” (Borio (2001)). But, looking back, the similarities prevailed. And those differences made hardly any difference.

Operating procedures were simple and tidy.

Fast-forward to today and the sea-change is obvious, at least in several AEs. In many respects, the current features are the mirror image of the pre-GFC ones.

First, central banks can no longer capture the policy stance with a single (overnight) operating target. Because of their large-scale asset purchases and special lending schemes, they have extended their direct influence well beyond the overnight segment.

Second, gone is the decoupling principle. Liquidity management operations are an integral part of the policy stance. And when central banks tried to rescue the principle as they started, or considered starting, to unwind their balance sheets, it proved very hard. Recall how shrinking the balance sheet was supposed to be “as boring as seeing paint dry”. Well, it has not been.

Third, many central banks have adopted ARS. In several cases reserves are much larger than any conceivable liquidity needs. As a result, they are no longer just a payments or settlement medium but also a store of value, competing with other assets in terms of remuneration.

We know the reason for the shift: the huge and unsterilised increase in central bank balance sheets, which was designed to ease further the policy stance at the zero, or effective, lower bound or to address financial stress. Large scale asset purchases – often termed, too loosely, quantitative easing (QE) – have accounted for the lion’s share of the increase.7 As a result, central bank balance sheets have reached levels previously seen only in wartime.8

The sea-change has gone hand in hand with another remarkable development – widespread market segmentation. Gone is the seamless alignment of market rates with the (uncollateralised) overnight rate: some arbitrage relationships in overnight and term money market segments have seemingly broken down.9

Examples abound. Market rates may languish below the deposit facility rate – “floors may leak”. Collateralised rates may hover well below uncollateralised ones, by an amount that exceeds any possible difference in credit risk – a symptom of collateral scarcity. And some spreads that used to be stable may now be more volatile.

Where do we (or should we) go from here? In talking to central banks, the impression is that they are becoming used to ARS. ARS have become a kind of “New Normal”, linked to larger central bank balance sheets.

There are essentially four arguments for retaining ARSs.

Argument one: the floor system does its job. The central bank does manage to control the overnight rate with the desired degree of precision, in both good and bad times.10 To be sure, the degree of control may not be perfect. But the rate hovers roughly where the central bank would like to see it and its volatility is generally low and acceptable. Simply put, if it ain’t broken, why fix it.

Argument two: in the New Normal, it would be hard to implement an SRS. This is because the demand for reserves has become less predictable. Sometimes, there may be tensions and spikes in the overnight and other closely related market rates, such as the repo rate. The money market ructions in September 201911 are the most notorious example: they showed that, despite very large reserves, there was no excess after all. As a result, central banks have been cautiously testing the waters as they unwind their balance sheets.

Various reasons have been put forward to explain this unpredictability in the demand for reserves. Central banks have broadened the set of counterparties, including central clearing counterparties (CCPs).12 There is greater segmentation in the (secured and unsecured) interbank market and probably beyond. Importantly, new prudential liquidity requirements are now in place: settlement balances, possibly constrained by reserve requirements, are no longer the only factor determining the need for deposits with the central bank. It is as if these deposits now have to obey two masters: the monetary authority and the prudential authority.

Argument three: abundant reserves have the additional benefit of supporting financial stability. Regardless of prudential requirements, they provide banks with ample liquidity buffers. Moreover, if one believes that there is a scarcity of safe assets, then bank reserves are an additional source of supply.13

Argument four: regardless of the relative merits of the system, the question of which system to adopt is rather premature. No reason to think about changing, at least now. In some jurisdictions, it will take a long time to reduce central bank balance sheets.

No doubt, these arguments have merit. But they are not that compelling. Take each in turn.

Argument one: the system has indeed “worked” in sense that it has yielded control over the overnight rate. That said, it has not come without costs.

Directly or indirectly, these costs reflect a key factor: reserves have also become a store of value. In the process, the central bank has switched off the signalling mechanism of control: now it is liquidity management operations that do all the heavy lifting. Moreover, the central bank has taken over much of the intermediation in the overnight interbank market. As a result, many of the unwelcome features of the financial landscape that we may be tempted to treat as exogenous may well be, to a significant extent, endogenous, ie the consequence of the ARS system itself.

Three types of cost are worth highlighting.

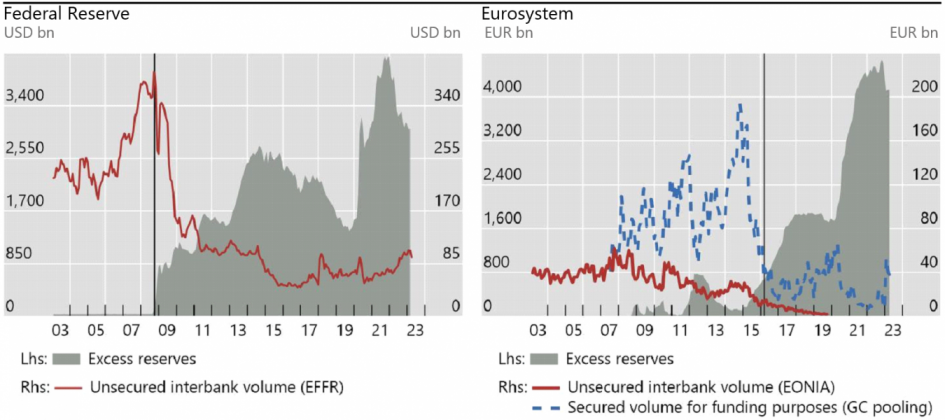

One is that the ARS kills the overnight interbank market (Graph 1). And the damage can easily extend beyond the overnight tenor: if banks expect to have sufficient liquidity also in the future, it is not obvious why they should trade with each other for funding purposes beyond the overnight segment either.14,15 The damage is long-lasting.16 If you don’t use a muscle, it atrophies. Desks are dismantled. Institutional memory withers. In the meantime, not just the total amount of reserves, but their distribution begins to matter.

The consequences are material. For one, this raises the likelihood of tensions when reserves need to circulate freely, as we saw in the US markets in September 2019. As a result, it will require the central bank to increase its injections of liquidity to calm markets at times of stress, ultimately magnifying moral hazard.17 In addition, there is a risk of a ratchet effect: the longer the ARS stays in place, the greater the demand for reserves can become.18 Variants of such concerns have led the Central Bank of Norway and the Swiss National Bank to take half a step back and adopt tiered floor systems and absorb reserves.19

Graph 1: Excess liquidity and the decline in interbank money market activity

Notes: The vertical line in the left-hand panel indicates the start of reserve remuneration by the Federal Reserve, which marked the switch to a floor system. The market for the effective federal funds rate includes participants that are not eligible to receive interest on reserves. The vertical line in the right-hand panel corresponds to when EONIA converged to the deposit facility rate, when excess reserves rose as a result of the Eurosystem’s Public Sector Purchase Programme (PSPP). Sources: Board of Governors of the Federal Reserve System; Bloomberg; BIS.

A second, closely related, cost is the distortions that the ARS system can introduce in markets. It can contribute to collateral scarcity: after all, only banks can use reserves. Collateral scarcity has been an issue in the euro area.20 Moreover, it can contribute to price anomalies, such as leaking floors. As the overnight rate hits the floor, the impact of segmentation due to institution-specific features increases. Given no or little trading among banks, new players become the marginal ones, de facto setting the interest rate. Think, for instance, of those institutions in the United States that have access to central bank deposits but are not eligible for interest on them.

But the issue is more general. Once reserves become a store of value, they can trigger pervasive, possibly unpredictable waves across relative yields in the financial system. The reason is that the amount exogenously set by the central bank must be willingly held at the exogenously set interest rate.21 As the excess increases, to the extent that banks find reserves costly – eg because they crowd out more profitable investments, such as by consuming capital – attempts to get rid of them will put downward pressure on other yields.

Depending on country-specific features, the downward pressure could reach uncomfortable levels, possibly to the point of calling for further adjustments to the framework. This is especially the case at times when banks are reluctant to grow their balance sheet – its “price” is high. Non-banks would look for alternative investment opportunities, most likely pushing down the rates on the closest substitutes, such as reverse repo rates.22 In addition to the critical role of more structural factors,23 this may help explain the sharp downward spikes on repo rates in the euro area at quarter ends and the utilisation of the new reverse repo facility in the United States – a kind of safety valve.24

One can look at it another way. In an SRS, where the demand for reserves is purely for settlement purposes, and signalling does the heavy lifting, the impact of the implementation framework is limited to the corresponding overnight rate. The decoupling principle reigns. In an ARS, the impact cannot be contained in the same way. Paraphrasing Jeremy Stein, excess liquidity gets in all the cracks (Stein (2013)).

A third type of cost is of a more political economy nature. It is the perception that the central bank “subsidises” banks.25 The central bank can then become an easy target for criticism, as is already the case, especially if banks are reluctant to offer more attractive rates to depositors. After all, why should they if they have plenty of liquidity, so that they are less pressed for funds, and if their capital, and hence lending capacity, is absorbed by an unwanted item on their balance sheet? This subsidy question is part of a broader concern with central bank financial results.

Argument two: it is hard to imagine that, because of instability in the demand for reserves, an SRS would be more difficult to operate than in the past – or, perhaps one should say, not as easy. The overwhelming majority of central banks around the world are still operating such a system and without difficulties. This is so even when they have large balance sheets, mainly reflecting holdings of foreign exchange reserves, as in many EMEs. And, of course, they are operating the systems following the implementation of the new Basel III prudential requirements. Some of the concerns may simply reflect the loss of institutional memory within central banks. One can hear echoes of the so-called “fear of floating” regarding exchange rates (Calvo and Reinhart (2002)).

Why should operating an SRS not be so complicated? Because, arguably, the instability in the demand for bank reserves is to an important extent endogenous to the ARS itself. The previous analysis already identified two specific reasons: obstacles to the smooth redistribution of reserves and the risk of a ratchet effect. But there is a more general one: the store of value function makes the demand for reserves sensitive to relative returns, not least those of other short-term instruments such as government debt and repos.

As an illustration, consider the case of Basel III’s Liquidity Coverage Ratio (LCR). In the ratio, government paper and reserves are perfect substitutes for regulatory purposes: banks can fulfil the requirement with either, without constraints. As a result, the demand for reserves becomes very sensitive to the spread. This would not be the case in an SRS, in which the central bank would steer market overnight rates to be well above the deposit facility rate. The opportunity cost of holding reserves would be too high and the demand for settlement balances would again be the only relevant factor in driving their demand at the margin.26 Given the more attractive pricing, banks would fulfil the requirement as far as possible with government securities. In effect, we would be back in the pre-GFC world.27

Put differently, the sources of uncertainty in implementing an ARS and an SRS differ. In an SRS, it is uncertainty about the demand for settlement balances. Because that demand is not interest-elastic, effort is expended to forecast autonomous factors and make them more predictable, and to put in place mechanisms that can limit the volatility of the overnight rate (eg reserve requirements with averaging provisions). In an ARS, the uncertainty relates largely to the demand for reserves as a store of value and hence its impact on the overall constellation of relative yields. But, in addition, the uncertainty about settlement needs is not eliminated and lurks in the background. It can appear with a vengeance as the central bank seeks to withdraw the excess or tensions in the financial system arise. In turn, this can magnify those tensions.28

Argument three: it is far from obvious that a glut of bank reserves is good for financial stability. After all, short-term government paper and reserves are reasonably good, although by no means perfect, substitutes, for liquidity purposes.29 Accordingly, even those who believe that a shortage of safe assets has been a key reason for financial instability would argue that it would be better for the central bank to issue its own paper or do reverse repos: the instruments could be made available to all.30 In addition, as noted above, the atrophy of monitoring and trading muscles may actually require the central bank to intervene more, rather than less, intensely at times of stress.31 And more generally, historically, it has not been a lack of liquidity, but capital erosion, that has lurked at the core of banking crises.32

Argument four: it is not necessary to wait for the central bank balance sheet to shrink before moving towards an SRS. There is no one-to-one mapping between the size of the central bank’s balance sheet and the composition of its liabilities. Just look at those EME central banks with huge FX reserves. In fact, size and composition can be largely decoupled. There are many tools to shrink the reserves for a given balance sheet size, such as through central bank paper or time deposits, reverse repos or FX swaps. Each has its pros and cons, depending on the institutional context. But some of them have an additional merit: they increase the supply of collateral – the “new money” in today’s collateral-based financial system.

Of course, while the absorption of reserves may be gradual to start with, at some point the shift to an SRS will have to take place overnight, in a kind of big bang. The two systems do not lie along a continuum: the demand for reserves is not a smoothly downwards-sloping one, given the nature of settlement balances. You either target the overnight rate by signalling (SRS) or you satiate the banks with liquidity (ARS). There is no middle ground.

How could a smooth transition back to an SRS system be engineered? The central bank would need to put in place safeguards to avoid spikes and undesirable volatility in the overnight rate. It could announce in advance the day and time of the shift. It could then set relatively tight bands around the target overnight rate through standing facilities (eg, a repo and reverse repo one) and absorb the excess reserves. Over time, the bands could then be widened, as familiarity grows with the features of the demand for settlement balances and with the system.33

Let’s now widen the focus and consider a bigger issue – the central bank balance sheet.

One concern is that the wish to keep an ARS ends up dictating the size of the central bank’s balance sheet. The argument could go as follows. The ARS system requires the monetary authority to satiate the demand for bank reserves. At the standing deposit facility rate, that demand could be large and unpredictable. As a result, the balance sheet must have a minimum size that is considerably larger than in the past.

This, however, would be the tail wagging the dog. The operating system should be the outcome of a strategic view regarding the balance sheet’s size and composition. And that view should include risk management as a key consideration.

Size and composition should be derived from broad principles. A useful starting point is that the balance sheet should be as small as possible, and its composition as riskless as possible, but no more. “No more” here means that the central bank should be able to perform its mandate effectively. In other words, the central bank should aim for a “lean” balance sheet.34

Country-specific differences aside, three functions are part of a central bank’s core mandate – functions that will constrain the balance sheet size and dictate its composition: underpinning the payments system; implementing monetary policy, including aspects linked to the exchange rate (making the stance operational); and crisis management, including acting as lender or market-maker of last resort. Except perhaps for foreign exchange reserve considerations, none requires a large balance sheet in normal conditions.

There are three benefits of having a lean balance sheet.

One is to limit the central bank’s footprint in the financial system and economy at large. This would reduce its involvement in resource allocation and also the risk of inhibiting market functioning.35 A small footprint would support a smoothly functioning economy while at the same time reducing the risk of political economy pressures, especially those that can easily arise if the central bank gets too involved in resource allocation.

A second, closely related, benefit is to limit the side effects of the link with the government’s balance sheet.

Some of these side effects are of an economic nature. The key one is the impact on the fiscal position through central bank remittances. Large-scale asset purchases financed with bank reserves greatly heighten the sensitivity of the fiscal position to higher interest rates. From the perspective of the consolidated state sector balance sheet – government plus central bank – they amount to a large debt management operation. Long-term government debt is retired and replaced with debt indexed to the overnight rate, ie bank reserves. Back-of-the-envelope calculations suggest that, for the central banks that have used such purchases more actively, some 30–50% of long-term debt is, de facto, overnight.36 This will show up as lower central bank remittances to the government and hence lower government revenues. And central bank losses will not just mean a weaker fiscal position, but they could also raise reputational and institutional challenges for central banks.

Other side effects are of a political economy one.37 While central banks’ performance should be judged exclusively on how effectively they fulfil their mandates and not on their financial results, there is a strong temptation to focus on those results (Carstens (2023)). Especially when they make losses, central banks can come under heavy criticism, with risks to their reputation, independence and, ultimately, legitimacy. A small and risk-proofed balance sheet mitigates those concerns and increases the central bank’s room for policy manoeuvre. Such a balance sheet is what avoids blurring the line between monetary and fiscal policy – a form of institutional hygiene.

In this context, there may be a risk of underestimating the side effect of a step as apparently innocuous as paying interest on bank (excess) reserves, which opens the door to an ARS. Doing so raises the political incentive to take advantage of the newly found “captive” investor base, thereby potentially relaxing the government’s financing constraint. Banks represent a form of “captive” demand because they must accept the amount of reserves the central bank injects into the system through its open market operations. With any other instrument that drains reserves, the pricing has to be sufficiently attractive for market participants to be willing to lend to the central bank in the first place, which raises the funding cost and difficulties involved (eg failed auctions etc).38 All this puts a premium on institutional safeguards that protect central bank independence.

A third, often underestimated, benefit of a lean balance sheet is that it maximises the central bank’s ability to expand it when the need does arise. Given the costs of large and risky balance sheets, the initial size is a hindrance, not an advantage. The balance sheet must be elastic, not large.

This paper has argued that there are good reasons to return to an SRS.

There is a risk of underestimating the costs of ARS or floor systems. The costs take a considerable time to appear, are likely to grow and tend to be less visible. They can be attributed to exogenous features of the environment when, in fact, those features are to a significant extent endogenous – a consequence of the system itself.

There is equally a risk of grossly overestimating the implementation difficulties of an SRS. That perception, too, depends to a considerable extent on some problematic features of the environment that would disappear once an SRS is put in place – the instability in the demand for reserves being the key one. Not surprisingly, the overwhelming majority of central banks around the world are operating such systems, even those with large balance sheets.

There is no need to wait for the central bank balance sheet to shrink before moving in that direction. For a given size, the central bank can adjust the composition of its liabilities.

Ultimately, the design of monetary policy operating procedures should follow from a strategic view of the right size and composition of the central bank’s balance sheet. The principle proposed here is that the size should be as small as possible, and its composition as riskless as possible, but no more. “No more” here means “consistent with the central bank fulfilling its mandate effectively”. This would limit the economic and political economy costs of large and risky balance sheets and, by so doing, also maximise the balance sheet’s capacity to expand at times of need. That is, it would maximise the balance sheet’s elasticity, which is key.

To be sure, the analysis has deliberately highlighted a specific perspective and glossed over qualifications and country-specific factors. These will of course influence the final cost/benefit analysis. But while there may be “a hundred ways to skin a cat”, some of those ways may be better than others.

Åberg, P, M Corsi, V Grossmann-Wirth, T Hudepohl, Y Mudde, T Rosolin and F Schobert (2021): “Demand for central bank reserves and monetary policy implementation frameworks: the case of the Eurosystem”, ECB Occasional Paper Series, no 282, September.

Acharya, V, R Chauhan, R Rajan and S Steffen (2022): “Liquidity dependence: why shrinking central bank balance sheets is an uphill task”, proceedings of the Jackson Hole Economic Symposium of the Federal Reserve Bank of Kansas City on “Reassessing Constraints on the Economy and Policy”, August.

Afonso, G, M Cipriani, A Copeland, A Kovner, G La Spada, G and A Martin (2021): “The market events of mid-September 2019, Federal Reserve Bank of New York, Staff Reports, no 918.

Afonso, G, D Duffie, L Rigon and H S Shin (2022): “How abundant are reserves? Evidence from the wholesale payment system”, BIS Working Papers, no 1053, December.

Afonso, G, D Giannone, G La Spada and J Williams (2022): “Scarce, abundant, or ample? A time-varying model of the reserve demand curve”, Federal Reserve Bank of New York, Staff Reports, no 1019.

Arrata, W, B Nguyen, I Rahmouni-Rousseau and M Vari (2020): “The scarcity effect of QE on repo rates: evidence from the euro area”, Journal of Financial Economics, vol 137, no 3, pp 837–56.

Avalos, F, T Ehlers and E Egemen (2019): “September stress in dollar repo markets: passing or structural?”, BIS Quarterly Review, December.

Bech, M and T Keister (2012): “On the liquidity coverage ratio and monetary policy implementation”, BIS Quarterly Review, December, pp 49–61.

Bech, M, A Martin and J McAndrews (2019): “Settlement liquidity and monetary policy implementation – Lessons from the financial crisis”, Federal Reserve Bank of New York, Economic Policy Review, pp 1–25.

Bech, M and C Monnet (2013): “The impact of unconventional monetary policy on the overnight interbank market”, in A Heath, M Lilley and M Manning (eds), Liquidity and funding markets, proceedings of the 2013 Reserve Bank of Australia Conference.

Bell, S, M Chui, T Gomes, P Moser-Boehm and A Tejada (2023): “Why are central banks reporting losses? Does it matter?”, BIS Bulletin, no 68, February.

Bindseil, U (2004): Monetary policy implementation, Oxford University Press.

——— (2016): ”Evaluating monetary policy operational frameworks”, proceedings of the Jackson Hole Economic Symposium of the Federal Reserve Bank of Kansas City on “Designing resilient monetary policy frameworks for the future”, August.

Borio, C (1997): “The implementation of monetary policy in industrial countries: a survey”, BIS Economic Papers, no 47, July.

——— (2001): “A hundred ways to skin a cat: comparing monetary policy operating procedures in the United States, Japan and the euro area”, BIS Papers, no 9, December, pp 1–22.

——— (2011): “Rediscovering the macroeconomic roots of financial stability policy: journey, challenges and a way forward”, Annual Review of Financial Economics, vol 3, December, pp 87–117. Also available as BIS Working Papers, no 355, October.

Borio, C and P Disyatat (2010): “Unconventional monetary policies: an appraisal”, The Manchester School, vol 78, s1. Also available as BIS Working Papers, no 292, November 2009.

——— (2021): “Monetary and fiscal policies: In search of a corridor of stability”, VoxEU, 10 November.

Borio, C and B Nelson (2008): “Monetary operations and the financial turmoil”; BIS Quarterly Review, March, pp 31-46.

Borio, C, R McCauley, P McGuire and V Sushko (2016): “Covered interest parity lost: understanding the cross-currency basis”, BIS Quarterly Review, September, pp 45-64.

Calvo, G and C Reinhart (2002): “Fear of floating”, The Quarterly Journal of Economics, vol 117, no 2, pp 379–408.

Cap, A, M Drehmann and A Schrimpf (2020): “Changes in monetary policy operating procedures over the last decade: insights from a new database”, BIS Quarterly Review, December, pp 27–39.

Carstens, A (2023): “Central banks are not here to make profits”, op-ed, Financial Times, 7 February.

Central Bank of Norway (2021): “Norges Bank’s liquidity policy: principles and design”, Norges Bank Papers, no 21.

Cœuré, B (2013): “Where to exit to? Monetary policy implementation after the crisis”, speech at the 15th Geneva Conference on the World Economy: “Exit strategies: time to think about them”, Geneva, 3 May.

Committee of the Global Financial System (CGFS) (2015): “Regulatory change and monetary policy”, CGFS Papers, no 54, May.

Copeland, A, J Duffie and Y Yang (2022): “Reserves were not so ample after all”, Stanford University Graduate School of Business Research Papers, no 4185217.

De Grauwe, P and Y Ji (2023): “Monetary policies with fewer subsidies for banks: A two-tier system of minimum reserve requirements”, VoxEU, 23 March.

Duffie, D and A Krishnamurthy (2016): “Pass-through efficiency in the Fed’s new monetary policy setting”, proceedings of the Jackson Hole Economic Symposium of the Federal Reserve Bank of Kansas City on “Designing resilient monetary policy frameworks for the future”, September.

Du, W (2022): “Bank balance sheet constraints at the center of liquidity problems”, remarks at the Jackson Hole Economic Symposium of the Federal Reserve Bank of Kansas City on “Designing resilient monetary policy frameworks for the future”, August.

Eichengreen, B and M Flandreau (2010): “The Federal Reserve, the Bank of England and the rise of the dollar as an international currency, 1914–39”, BIS Working Papers, no 328.

Filardo, A (2020): “Monetary policy operating frameworks: are reforms heading in the right direction?”, Cato Journal, vol 40, no 2, Spring/Summer, pp 385–407.

Friedman, B and K Kuttner (2010): “How do central banks set interest rates?”, in B Friedman and M Woodford (eds), Handbook of Monetary Economics, vol 3, Elsevier, pp 1345–438.

Furfine, C (2001) “Banks as monitors of other banks: evidence from the overnight federal funds market”, Journal of Business, vol 74, no 1, pp 33–5.

Goodfriend, M (2002): ““Interest on reserves and monetary policy”, Federal Reserve Bank of New York, Economic Policy Review, May, pp 1–8.

Greenwood, R, S Hanson and J Stein (2016): “The Federal Reserve’s balance sheet and financial stability”, proceedings of the Jackson Hole Economic Symposium of the Federal Reserve Bank of Kansas City on “Designing resilient monetary policy frameworks for the future”, August.

Hauser, A (2019): “Waiting for the exit: QT and the Bank of England’s long-term balance sheet”, speech at the European Bank for Reconstruction and Development, London, 17 July.

Ho, C (2008): “Implementing monetary policy in the 2000s: operating procedures in Asia and beyond”, BIS Working Papers, no 253.

Lopez-Salido, D and A Vissing-Jorgensen (2023): “Reserve demand, interest rate control, and quantitative tightening”, working paper available on SSRN.

Maechler, A and T Moser (2022): “Return to positive interest rates: why reserve tiering?”, Money Market Event, 17 November.

Markets Committee (2019): Large central bank balance sheets and market functioning, report prepared by a study group chaired by Lorie Logan (Federal Reserve Bank of New York) and Ulrich Bindseil (European Central Bank) October.

Nelson, B (2022): “The Fed is stuck on the floor: here’s how it can get up”, Bank Policy Institute, 11 January.

Potter, S (2016): Discussion of U Bindseil “Evaluating monetary policy operational frameworks”, proceedings of the Jackson Hole Economic Symposium of the Federal Reserve Bank of Kansas City on “Designing resilient monetary policy frameworks for the future”, August.

——— (2017): “Money markets at a crossroads: policy implementation at a time of structural change”, remarks at the Master of Applied Economics Distinguished Speaker Series, University of California, Los Angeles, Federal Reserve Bank of New York.

Plosser, C (2018): “The risks of a Fed balance sheet unconstrained by monetary policy”, in M Bordo, J Cochrane and A Seru (eds), The Structural Foundations of Monetary Policy, Stanford: Hoover Institution Press, pp 1–10.

Rime, D, A Schrimpf and O Syrstad (2022): “Covered interest parity arbitrage”, The Review of Financial Studies, vol 35, no 11, November.

Selgin, G (2019): “The Fed’s new operating framework: how we got here and why we shouldn’t stay”, Cato Journal vol 39, no 2, pp 317–26.

Schaffner, P, A Ranaldo and K Tsatsaronis (2019): “Euro repo market functioning: collateral is king”, BIS Quarterly Review, December.

Schnabel, I (2023): “Back to normal? Balance sheet size and interest rate control”, speech at an event organised by Columbia University and SGH Macro Advisor, New York, 27 March.

Schrimpf, A and V Sushko (2019): “Beyond Libor: a primer on the new reference rates”, BIS Quarterly Review, March, pp 29–52.

Stein, J (2013): “Overheating in credit markets: origins, measurement, and policy responses”, speech at the research symposium Restoring household financial stability after the Great Recession: why household balance sheets matter, Federal Reserve Bank of St Louis.

Tobin, J and W Brainard (1969): “Pitfalls in financial model building”, American Economic Review, vol 58, May, pp 99–122.

Tucker, P (2022): “Quantitative easing, monetary policy implementation and the public finances”, IFS Report, no R223.

Woodford, M (2000): “Monetary policy in a world without money”, International Finance, vol 3, pp 229–60.

For a detailed and systematic comparison of operating procedures at the time, see Borio (1997) and (2001). The procedures did not change significantly until the GFC, when adjustments started to be made (Borio and Nelson (2008)). Ho (2008) compares operating procedures in selected countries in Asia. For a short overview of current systems, see Cap et al (2020) and the Markets Committee Compendium on the BIS website: www.bis.org/mc/compendium.htm.

The Swiss National Bank was an exception, as it targeted three-month Libor, given the structural features of the money market.

The critical importance of signalling in practical implementation is lost in standard formal models of operating procedures, where control of the overnight rate is portrayed as a vertical supply curve hitting a smooth and well behaved downwards-sloping demand curve. Compare, for instance, Borio (1997) and Borio and Disyatat (2010), Bindseil (2004) and Woodford (2000) with Bech and Monnet (2013). In the latter class of models, which have become increasingly standard, signalling has not much of a role to play and liquidity management operations do the bulk of the work. Borio (1997) also includes a detailed discussion of the role of averaging provisions and their link with signalling. See also Friedman and Kuttner (2010).

This essentially meant offsetting the impact of autonomous factors on the supply of reserves and possibly smoothing out the demand for settlement balances themselves, through eg reserve requirements with averaging provisions.

This definition of the “decoupling principle” is not used to refer to the possibility of adjusting the amount of reserves and the policy rate/operating target independently, which is a property of a floor system.

This does not mean, though, that the overnight rate will necessarily be at the floor. In particular, it may be below – floors may “leak” (see below). Many central banks had no deposit facility in the past, with the Federal Reserve pre-GFC being a case in point.

In some cases, though, the main counterpart was increases in foreign exchange reserves – large-scale purchases in foreign currency-denominated assets – which are another form of balance sheet policy (Borio and Disyatat (2010)). This is more common in emerging market economies (EMEs); among advanced economies, the Swiss National Bank is an example.

For those countries that had adopted ARS pre-GFC, the motivations were different. In the case of Norway, it was the impact of huge and unpredictable autonomous factors, in the form of government balances with the central bank. In that of New Zealand, the reasons were more “philosophical”, ie following Friedman’s principle that if producing money is costless, then its opportunity cost should be zero. See also Goodfriend (2002) for an advocate of this implementation approach.

See e.g. Duffie and Krishnamurthy (2016) on how dispersion across money market rates due to segmentation hampers the pass-through efficiency of policy rate changes. See Borio et al (2016) and Rime et al (2022) on how the frictions in money markets spill over to FX swap markets and contribute to violations in covered interest parity (CIP).

In general, the desired degree of precision and acceptable deviations can vary, depending on the specifics of the system and broader aspects of the financial system. For a discussion, see Borio (1997) and (2001).

For a more detailed analysis of this episode, see e.g. Avalos et al (2019), Afonso et al (2021) and Copeland et al (2022).

See, for example, the case of the United Kingdom (Hauser (2019)).

For an elaboration of this view, see Greenwood et al (2016).

Potter (2016), for instance, argues that the function of the overnight segment is simply to redistribute reserves linked to arbitrary payment patterns. As such, it does not perform a useful economic function and, on top, it absorbs capital by increasing the size of banks’ balance sheets as they borrow and lend to each other.

Killing the overnight market has also raised challenges for the shift to new benchmark rates following the Libor scandal, as these rates require active trading (Schrimpf and Sushko (2019)). One more specific implication is the pressure to have a benchmark rate determined in a market in which non-banks also participate. This, in turn, may indirectly be one reason for extending access to the central bank balance sheet to them. See also below.

On this, see also the report by the Markets Committee (2019).

In this context, Selgin (2019), for instance, stresses the importance of interbank monitoring as a disciplining factor; Furfine (2001) provides evidence based on the (uncollateralised) overnight segment. See also Cœuré (2013).

See, for instance, Nelson (2022) and, for a reference to this possibility, Åberg et al (2021). In a similar vein, Acharya et al (2022) argue that large excess reserves induce banks to create commitments on them: the supply of liquidity generates its own demand.

In these systems, reserves are remunerated only up to a pre-determined amount and the central bank keeps the supply of reserves close to that point. This induces a certain amount of interbank trading, whenever some banks are beyond the threshold and others below it. On Norway, see Central Bank of Norway (2021); on Switzerland, see Maechler and Moser (2022).

For a discussion of these issues, see eg Arrata et al (2020), Schaffner et al (2019).

Indeed, these are precisely the types of effect discussed in Tobin and Brainard (1969), where an open market operation exchanges a government debt for a zero-yielding monetary base.

On this, see also Markets Committee (2019).

A pervasive structural factor has been changes in prudential regulation and supervision, internationally and domestically. For a detailed analysis of the US experience, see eg Potter (2017), who also explains the rationale for the introduction of the facility in those terms. For a cross-country perspective, see CGFS (2015).

A reverse repo facility, if unlimited, would also have broader implications for financial stability, as it makes it easier for runs on banks to take place at times of stress. The risk can be mitigated by including some caps. See eg the discussion in Greenwood et al (2016), although there it is couched in terms of the choice between commercial paper and RRPs.

De Grauwe and Yi (2023), for instance, stress this point. Tucker (2022) provides a systematic analysis of the link between monetary policy operating procedures and public finances

To be clear: banks will not be fully indifferent between the two, since settlement balances are superior to short-term paper for liquidity purposes, not least owing to settlement lags and possibly valuation effects, at least if one considers longer-dated securities (Schnabel (2023). The point is that they would not have an incentive to minimise those holdings. See also Filardo (2020). The substantive point is that the additional demand, which will depend on potential cash outflows, will not be interest-elastic. See Bech and Keister (2012) for a model that incorporates these additional considerations in a standard analytical framework.

The term “settlement balances” here includes also any precautionary balances held for prudential regulatory purposes. Some supervisors may still prefer that banks retain a minimum of reserves, as seems to be the case, for instance, in the United States. If so, and if the amounts held for reserve requirements (with averaging provisions) did not qualify, there could still be a supervisory-induced demand for reserves. That said, this demand would be interest-inelastic, and central banks should be able to estimate it rather easily, including by simply asking.

These points are relevant when considering the argument that an SRS is operationally more burdensome, with reference to the need to forecast autonomous factors and carry out fine-tuning operations (eg Potter (2017), Schnabel (2023)). This argument is less compelling to the extent that the broader, general equilibrium complications and side effects of an ARS materialise and are considered.

See Lopez-Salido and Vissing Jorgensen (2023) for a specific perspective on the demand for reserves that accounts for a convenience yield of reserves due to banks’ liquidity preferences. See also Afonso, Giannone, La Spada and Williams (2022) for an econometric estimation of the demand for bank reserves that allows for time variation in the relationship.

For an in-depth discussion of these issues and a proposal, see Greenwood et al (2016). In fact, if additional reserves are produced by buying a short-term security, given that reserves are only available to banks, from this specific perspective, the operation would not be helpful.

That said, one effect of ARS is to avoid the need for the central bank to lend – expand its balance sheet intra-day – to oil the financial system, especially given the tendency to throttle and delay payments. This reduces operational risk. See Bech et al (2019) and Afonso, Duffie, Rigon and Shin (2022).

For a review of some of these issues, see eg Borio (2011).

Another possible intermediate step that might provide further comfort would be to shift temporarily to a tiered system. That said, given the facilities that set the boundaries to the corridor, this is not necessary. Importantly, high-frequency volatility in the overnight rate need not be an issue as long as the central bank’s signal concerning the desired interest rate is effective, as banks and other market participants would tend to see through it. Central banks have displayed very different degrees of tolerance for this volatility; see Borio (1997) for a more detailed discussion of these issues.

For a similar view, see Bindseil (2016).

To be sure, spurring market development – an important consideration is some cases – can encourage size up to a point. But its main impact is on the composition of the balance sheet. Spurring market development is a common consideration in many EMEs. For a historical example involving the Federal Reserve and the market for letters of credit to encourage the role of the US dollar in trade, see Eichengreen and Flandreau (2010).

See Borio and Disyatat (2021) for a discussion of this point in the broader context of the relationship between monetary and fiscal policies.

For a recent elaboration on this issue, see Bell et al (2023).

On this, see also Plosser (2018) and Selgin (2019).