Given the size and the relative strength of the British financial service industry, the decision to pull out of the Single Market may well have more severe consequences on financial services than on manufacturing. Brexit will create serious non-tariff trade barriers, dampening foreign trade in financial services and the local production of financial services in the United Kingdom. In the short-term, continuity of existing cross-border contracts requires bilateral transitional agreements between the European Commission, individual member countries of the EU27 and the United Kingdom. In the medium to long-term, the international nature of financial markets in the United Kingdom suggests resilience as a global financial centre but business related to the EU27 is likely to migrate due to regulatory demands by the European supervisory authorities and the European Central Bank.

Public perception is that Britain ranks among the countries having already accomplished most of the secular transition towards a service-oriented economy. This image is fostered by the decline of British industry after the second world war, which has been characterized by low investment, comparatively high wage costs, and the struggle between the Thatcher government and trade unions. Mining, industry, electricity production, water supply and construction together constitute a comparatively small part of the UK-economy (19.8%) as compared to 25.8% at the EU27 level. The comparatively low level of industrialisation emerged even though the United Kingdom joined the European Free Trade Agreement (EFTA) as early as 1960, and – after two vetoes by France – finally became a member of the European Community in 1973. Apparently, the benefits from being a member of a large free trade area did not fully accrue to the British manufacturing sector, although the service sector did not have the same sort of access to the EU market. Accessibility of European markets for British service providers improved markedly only after establishing the EU Single Market in 1993, which gave the UK-economy a notable fillip. Between 1995 and 2018 the United Kingdom increased its total value added in real terms by 61% or an average of 2% annually. This is well above to the EU27’s development of +49% or an average of 1.7% per year, and it happened although the EU27 comprises the fast-growing emerging market economies of Eastern Europe.

Given the size and the relative strength of the British service industry, the decision to pull out of the Single Market may well have more severe consequences on services rather than manufacturing. This conjecture can also be inferred from Table 1 which compares the share of the service sector in the value added of all activities for the EU27 (excluding the United Kingdom) and the United Kingdom itself. Services constitute a larger share in the United Kingdom’s economy; the difference to the EU27 amounted to 6 percentage points in 2016 of which more than a third was due to the larger financial services industry (2.2 percentage points). The Single Market project may well have been a cause of this development because in 1995 the difference between the UK’s and the EU27’s respective share of the service industry was just 3.2 percentage points of which 1.1 percentage points were due to financial services. While the financial sector in the EU27 expanded in line with the rest of the economy, finance outgrew the total economy in the United Kingdom. Particularly the thriving banking sector supported this development (+1.2 percentage points from 1995 through 2016) while insurance was left behind somehow (-0.6 percentage points). The relevance of UK-financial services for the EU can also be seen in the lowest panel of Table 1. While the United Kingdom makes up for 16% of the total value added in the EU28, it accounts for 23% of financial services and almost 30% of total value added in the insurance business.

Table 1: The relevance of services and financial services in the EU28 and the United Kingdom, 1995 – 2016

| 1995 | 2000 | 2005 | 2010 | 2015 | 2016 | ||

| In % of EU28 total value added | |||||||

| EU28 | Service sector | 67.9 | 70.1 | 72.1 | 73.4 | 73.7 | 73.6 |

| Financial sector | 5.0 | 4.8 | 5.5 | 5.6 | 5.3 | 5.2 | |

| Banking | 3.4 | 3.3 | 3.6 | 3.9 | 3.5 | 3.4 | |

| Insurance | 1.0 | 0.8 | 1.2 | 0.9 | 0.9 | 0.9 | |

| Auxiliary | 0.6 | 0.7 | 0.7 | 0.8 | 0.9 | 0.8 | |

| In % of UK total value added | |||||||

| United Kingdom | Service sector | 71.1 | 74.1 | 77.6 | 79.4 | 79.3 | 79.6 |

| Financial sector | 6.2 | 5.1 | 7.5 | 8.3 | 7.0 | 7.3 | |

| Banking | 3.2 | 3.1 | 4.5 | 5.6 | 4.3 | 4.3 | |

| Insurance | 2.3 | 1.1 | 2.1 | 1.4 | 1.5 | 1.7 | |

| Auxiliary | 0.8 | 0.8 | 0.9 | 1.4 | 1.3 | 1.3 | |

| Share of UK in total EU28 value added (in %) | |||||||

| United Kingdom | All NACE activities | 13.9 | 18.5 | 17.6 | 14.5 | 17.6 | 16.0 |

| Financial sector | 17.1 | 19.4 | 24.2 | 21.4 | 23.4 | 22.7 | |

| Banking | 12.8 | 17.2 | 22.4 | 20.7 | 21.5 | 20.5 | |

| Insurance | 30.5 | 25.0 | 31.2 | 21.4 | 27.8 | 29.0 | |

| Auxiliary | 19.1 | 23.1 | 21.7 | 24.8 | 26.3 | 24.6 | |

Source: Eurostat. – Gross value added at current prices.

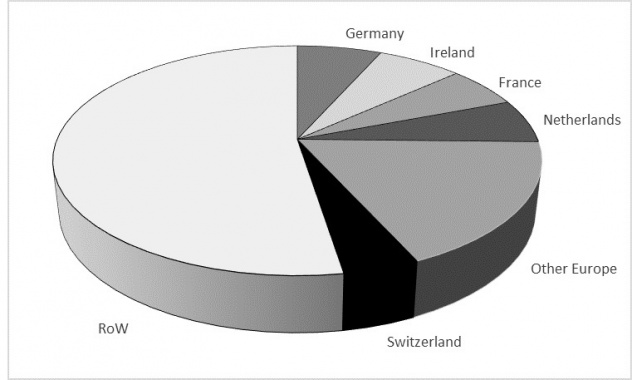

The transition to a more service-oriented UK-economy is even more pronounced in foreign trade statistics (Table 2). Between 1995 and 2017 the share of goods exports declined from 75% of total exports towards 55%. Financial service alone contributed 7 percentage points to this shift and now account for 10% of total exports of goods and services, contributing a surplus of GBP 43 billion to the overall deficit in the total goods and services balance of GBP -24 billion.1 Moreover, the destination countries of UK services exports are mainly within the EU27. Figure 1 shows the most important trading partners of the UK in services as of 2017. In total 42% of exported services goes towards the EU27. The regional structure of trading partners in financial services can only be inferred for the years 1995 through 2012. Exports to members of the Single Market area accounted for 46% of financial services exports (2012), down from 54% in 1995. This shift happened mainly towards countries outside the OECD.

Table 2: The relevance of services and financial services in the United Kingdom

foreign trade, 1995 – 2017

| 1995 | 2000 | 2005 | 2010 | 2015 | 2017 | |

| Share in exports in % | ||||||

| Goods and services | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Goods | 75.2 | 69.7 | 62.0 | 59.7 | 55.2 | 54.8 |

| Services | 24.8 | 30.3 | 38.0 | 40.3 | 44.8 | 45.2 |

| Financial services | 3.1 | 6.3 | 8.9 | 11.0 | 10.0 | 9.6 |

Source: IMF Balance of Payments.

Figure 1: United Kingdom service exports by destination country 2017

Source: Eurostat. Total UK-exports in 2017 EUR 318 billion of which 21% were financial services.

Some 8000 financial companies from the EU27 use 23500 passports to offer financial services and products in the UK and vice versa 5500 British companies use 335000 passports to conduct their business within the EU27 (Financial Conduct Authority, 2016). All of this requires passporting rights given under the Fourth Capital Requirements Directive and the Second Capital Requirements Regulation. Alternative EU regulation like MiFID II restricts the EU-wide provision of financial services to very limited business areas. Corresponding to the high UKshare in the value added of the EU28 insurance industry (cf Table 1) half of the UK-companies using a passport (2750) do this under the Insurance Distribution Directive (Kaya et al., 2018). They will have to open and register a fully capitalised branch within the EU27 in order to offer services from there to the remaining member countries. The cross border selling of reinsurance, on the other hand, can be conducted under an equivalence regime (Hohlmeier – Fahrholz, 2018).

It is likely, however, that foreign trade data on services underestimate the amount of financial services provided by UK monetary and financial institutions to foreign customers, because a notable part of the British financial industry is made up of foreign subsidiaries. Together with British owned establishments they process business on behalf of foreign customers without any cross-border transfer: 30% of the FDI stock in the United Kingdom2 is related to the financial services sector. For example, the United Kingdom’s share in EU-wide over-the-counter derivative trading is 65%, the share in foreign exchange trading is almost 80%, and UK hedge funds manage 85% of EU-wide assets (Armour, 2017).

Brexit will have different consequences for international transactions of goods and services depending on the final result of the negotiations. At the moment, a hard Brexit in the sense that international trade will be subject to WTO rules appears likely. WTO rules affect trade in goods and services differently because exports and imports of goods are well covered while international trade in services can be subject to heavy non-tariff barriers. Particularly trade in financial services requires mutual recognition of the regulatory design, national supervisory activities, and it always has to cope with the potential of systemic financial market risks, the associated lender of last resort issues and public bail outs. Therefore, foreign access to local financial markets is more restricted and the exposure of local financial intermediaries to foreign counterparties and markets will remain limited and closely monitored by supervisory authorities.

The following section describes some results of Brexit simulations with computational general equilibrium models, afterwards I will discuss potential consequences of the loss of passporting rights for British and continental financial intermediaries and the potential coverage of equivalence regimes. After a short overview of comparative advantages of producing financial services in the United Kingdom I present conclusion in the final section.

The consequences of Brexit on the UK-economy have recently been estimated using computable general equilibrium models with many countries and sectors. Dhingra et al. (2017) simulate several alternatives and come up with an aggregate reduction in UK-welfare by 1.3% given a soft Brexit and of 2.7% in the case of a hard Brexit. This roughly corresponds to the 3% medium term reduction in UK-gross domestic product estimated by the OECD (Kierzenkowski et al., 2016) and the 2.8% reduction in private consumption presented by Felbermayr et al. (2018). Felbermayr et al. (2018) also provide an estimate for the loss on the side of the EU27 which amounts to -0.8% in case of a hard Brexit. Individual members of the EU27 will be differently affected by Brexit: with Ireland, Luxembourg, and Malta showing a more negative response as compared to Austria, Italy, Spain and several Eastern European countries.

At the sectoral level Felbermayr et al. (2018) expect the highest reduction in value added in basic metal production (-17%) and the lowest in administrative and support services (-0.2%). Within the service sector wholesale trade will experience the most intensive contraction (-7.9%), while financial services (0.4%) and the insurance industry (1.7%) will gain from a hard Brexit; although the latter estimates are not significantly different from zero. Felbermayr et al. (2018) argue that savings in trade cost are small in financial services while the United Kingdom has a strong comparative advantage over its competitors in this sector. Contrary to that, Hantzsche et al. (2018) expect that particularly the trade costs for financial services will increase after Brexit. This expectation rests on the evaluation of the GATS- and CETA-terms for international services trade made by Magntorn – Winters (2018). These terms will offer UK financial intermediaries only 20% of the EU-market-accessibility as compared to the Single Market regime; compared to financial services only transport will face higher trade costs after Brexit.

Under the UK government’s proposed Brexit deal and accounting for long-run negative productivity effects, Hantzsche et al. (2018) expect the UK gross domestic product to be lower by 4% in the long-run. In case of an orderly no-deal, the reduction in GDP magnifies to -5.5%. This is close to the OECD-estimate of the long-term output reduction in the United Kingdom amounting to -5% as measured against a remain scenario (Kierzenkowski et al., 2016). Interestingly, the simulation by Hantzsche et al. (2018) shows that a more orderly Brexit will benefit goods trade while trade in international services will not profit, because free trade agreements usually exclude this area (Tarrant – Tilford, 2018). Hantzsche et al. (2018) report neither sector specific effects for financial services nor the corresponding results of Brexit on the EU27.

Financial markets appear to be very globalised, eg foreign exchange trade moves around the world across time zones permitting continuous activity, but at the same time, they are among the most heavily regulated sectors because countries require compliance with local regulatory standards. WTO-rules allow countries to do so, and usually foreign firms will have to set-up subsidiaries in each jurisdiction. The Single Market has lifted this restriction for all its members and allows financial intermediaries to operate under a single rule-book and home country supervision throughout the Single Market. This freedom is known as financial services passport and will cease to exist after the United Kingdom leaves the Single Market. Monetary and financial institutions interested in supplying their services across the EU27-UK border instead will have to rely on a decentralized model of state-by-state authorization, or registered and fully capitalised subsidiaries, or alternatively on a third country equivalence regime (Armour, 2017; Hohlmeier – Fahrholz, 2018).

After the financial market crisis, the Financial Stability Board started to coordinate the authorization of monetary and financial institutions, which resulted in new standards known as third-country equivalence. Equivalence status is a special form of a third country regime and it can be narrowly restricted to a specific financial service activity. It requires recognition by the European Commission which will base its assessment on the opinion of the relevant European Supervisory Authority. This structure already shows that equivalence regimes with third countries are not harmonised and they are spread throughout a large body of regulatory text (cf Table 1 in Hohlmeier – Fahrholz, 2018). Armour (2017) lists three components which need to be fulfilled for an equivalence regime: (1) substantive equivalence of third country law to relevant EU laws, (2) compliance of third country intermediaries to the rules, and (3) reciprocal market access for EU-intermediaries. Thus, equivalence may offer an opportunity for UK intermediaries to have continued access to the EU market but there is only limited scope for an application in the retail banking and insurance business. Wholesale banking and reinsurance could be based on the equivalence principle. Because many G20 countries and some financial centres outside the G20 already have signed equivalence agreements with the EU, UK firms face additional competition from these regions (Armour, 2017). Particularly US banks may consider relocating their UK-based subsidiaries after Brexit back into the USA. News in the financial press show that between 2016 and spring 2019 international banks moved only 1500 jobs out of the United Kingdom (Financial Times, 2nd April 2019). The hitherto muted response may be a result of the uncertainty with respect to the final terms of Brexit and the savings resulting from a wait and prepare strategy.

Additionally, to concerns about the quality of foreign supervision, the potential fall-out of a financial market crisis makes central banks and fiscal authorities wary about large open cross border positions. Representatives of the European System of Central Banks firmly reject the idea of empty shell companies in the EU27 (Sibley, 2018; Wu rmeling, 2018) and the ECB expressed very early concern for financial market stability emanating from the settlement of euro-denominated transactions by systematically important institutions outside the euro area (ECB, 2011). Brexit will thus also change the attractiveness of the United Kingdom as a potential site for foreign branches, for portfolio investments, and for systemically important clearing counter parties.

Eichengreen (2019), for example, estimates that the inward stock of portfolio investment in the United Kingdom will decrease by 13% after Brexit. Davies – Neill (2018) show that non-bank financial FDI inflows follow much the same pattern as conventional FDI. They are lower in high tax jurisdictions and decrease with geographic distance, and they are higher in big host economies with developed financial markets. The financial regulatory regime in the host country and gravity related controls such as the home and host country sharing a common legal system, language, border and currency are also related to the probability of non-bank financial FDI. This implies a sizeable reduction in non-bank financial FDI inflows into the United Kingdom.

Third country monetary and financial institutions may either move into the EU27 or they may service the EU27-market directly under an equivalence regime. Batsaikhan et al. (2017) consider Amsterdam, Frankfurt, Paris, and Dublin as alternative sites within the EU27 but these cities do not yet have financial sectors of comparable size in terms of staff and market turnover (cf Table 3). The comparatively large number of foreign registered monetary financial institutions in London shows that it serves as a gateway to the continental market especially for large US- and Swiss financial institutions. For the year 2014 Batsaikhan et al. (2017) estimate that between 85% and 97% of foreign investment banking staff and turnover in London was related to activities in the EMEA region (Europe, Middle East and Africa). Sapir et al. (2017) estimate that one third of the assets held by the UK banking system are related to business with EU27 customers. This provides an upper bound for the potential migration of business from London abroad. Together with these assets, Sapir et al. (2017) estimate that 10000 financial services professionals and additionally 20000 professionals offering legal advice, consulting, and auditing may move into the EU27. Sapir et al. (2017) expect that the London business will move into the euro area because the four biggest financial centres of the EU27 are there, the ECB is the most powerful lender of last resort, and the ECB also acts as a banking supervisor within the EU27.

Table 3: Comparison of European financial centres

| London | Paris | Frankfurt | Dublin | Amsterdam | ||

| Banking | Number of MFIs (domestically registered) | 132 | 166 | 60 | 104 | 28 |

| Number of MFIs (foreign registered) | 123 | 39 | 63 | 30 | 34 | |

| Capital and reserves (in billion EUR) | 792 | 524 | 464 | 110 | 121 | |

| Total assets (in billion EUR) | 10.223 | 6.940 | 6.955 | 482 | 2.528 | |

| Wholesale (in billion EUR) | 5.205 | |||||

| Financial Services | Employment (in 1000) | 352 | 270 | 76 | 20 | 54 |

| Forex turnover (in % of global) | 37.0 | 2.8 | 1.8 | – | 1.3 | |

| Interest rate OTC derivatives turnover (in % of global) | 39.0 | 4.7 | 1.0 | – | 0.7 |

Source: Batsaikhan et al. (2017) Table 1.

Baier – Welfens (2019), on the other hand, argue that due to agglomeration effects and economies of scale a relocation towards New York is a sensible alternative for US-based investment banks because the EU already has an equivalence regime with the USA. The introduction of intermediate holding companies in the USA, however, shows that we can observe a general move after the financial crisis towards stricter requirements of providing local equity and liquidity for locally relevant activities. The EU itself introduced the intermediate parent undertaking for this purpose.

London holds a dominant position in foreign exchange trading which is unlikely to move outward because London is located right in the middle between the trading time zones of Asian and US-markets, it is based on a global multi-currency settlement system and it does not depend on access to the European payment system Target2 (Schoenmaker, 2017). London’s dominant position in OTC interest rate derivative trading (Table 3) is closely related to the concentration of clearing services in London. Clearing houses domiciled in London may consider moving to the continent if the ECB requires centralised counterparties to be domiciled within the euro area. Alternatively, a joint supervisory process could be established as it is already applied to EU-based centralised counterparties operating in the USA. Lately a US-based central clearing house moved from London to Amsterdam. By February 2019 BrokerTec – a subsidiary of CME – will transfer the clearing of short-term financial instruments with a daily repo trading volume of USD 240 billion (Bloomberg, 6th November 2018). With a market share of 2% BrokerTec is, however, a small player within the euro-denominated interest rate derivatives market. The London Clearing House processes the lion’s share of 97% of these trades (Brühl, 2018).

The ECB wants clearing houses with euro-denominated settlement business to operate within the euro area because systemically important financial institutions impose a thread to financial market stability and they possibly require large amounts of public money including central bank liquidity support. A first attempt by the ECB in 2011 (ECB, 2011) was successfully fended off by the United Kingdom, but the European Market Infrastructure Regulation (EMIR) enacted in 2012, tightened regulation on over-the-counter derivatives and imposed clearing obligations for derivative trades through central counter parties. After Brexit a divergence of regulatory regimes between the EU and the UK is a serious policy alternative on the side of the United Kingdom (Miethe – Pothier, 2016; Baier – Welfens, 2019) which makes future supervision of central counter parties by EU-bodies uncertain. Given the systemic importance of UK clearing institutions for euro-denominated derivatives, Balz (2018) and Wu rmeling (2019) state that the equivalence regime is no viable long-term solution for systemically important central counter parties located in the UK. The proposal for a revised EMIR II directive also points into this direction (EU-COM, 2017). It includes the requirement that systemically relevant third-country central counter parties will be subject to supervision by the European Securities and Markets Authority. Furthermore, in case of an ongoing financial market crisis within the EU, the recognition can be immediately revoked. Finally, the directive suggests that the ECB should be involved in determining the status of a third-country central counter party and it should participate in their supervision. Both requirements are not covered under the equivalence regime.

Given the mixed picture with respect to the expected extent of relocations of monetary and financial institutions from the UK towards the EU27 it is worthwhile to discuss possible comparative advantages of producing financial services in the United Kingdom. Finance as a knowledge-based business needs the proximity to a financial centre, where finance professionals work close to central banks, regulators, financial news providers, exchanges, consultants, universities, and international law firms (Demary – Voigtla nder, 2016). English law will continue to be the basis of many international financial contracts. Armour (2017) additionally points at the high degree of interaction between services offered by financial intermediaries in the United Kingdom and the demand from institutions located in bank-based systems on the continent.

Furthermore, Eichengreen (2019) and Armour (2017) argue that British financial intermediaries benefit from agglomeration externalities creating increasing returns to scale. There are also complementarities between wholesale market activities and the clearing infrastructure in the United Kingdom. The United Kingdom has also access to a deep and liquid pool of human capital which helps to spread innovation and tacit knowledge.

These advantages will hardly change after Brexit but service providers throughout all professions will face higher regulatory trade costs and the associated fragmentation of trading activity may result in higher costs and reduced access to capital for EU27 companies. Kaya et al. (2018) expect higher costs in the range between +6% and +24% if clearing services are to be transferred to the EU. This would be a consequence of the reduced number of netting counterparties in smaller derivatives markets.

History provides a few examples for the rise and fall of financial centres. Venice was the financial centre in the 14th century because of its location at the international East-West trade route and innovations like a bankruptcy law, double book accounting, and deposit banking. Finally, the provision of a reliable currency supported the top position of Venice. The discovery of alternative sea trade routes changed the picture dramatically and Amsterdam took the lead in financial services. After the Napoleonic wars Amsterdam lost out against London and financial markets there benefited from the strong demand for war finance by the crown and military dominance on the sea. The spread of overseas trade strengthened this process as well as the need to finance the industrial revolution. After World War II London took the lead in trading spot and futures in US-dollars outside the USA (Kaya et al., 2018). Schenk (1998) traces this development back to the combination of external sterling convertibility with a rising supply of US-dollars. In 1986 the Big Bang deregulation opened the UK financial market to foreign subsidiaries and London’s exchanges were among the first to switch towards electronic trading platforms (Kaya et al., 2018). Thus, with the beginning of the Single Market in 1994 the United Kingdom had already established a solid comparative advantage in the production of financial services.

Given the likely scenario that the United Kingdom leaves the Single Market, Brexit will impose serious non-tariff trade barriers for financial services. This will create short-term problems for existing cross border contracts and it will have medium and long-term dampening effects on the volume of trade in financial services and on the locational choice of financial intermediaries from outside the Single Market.

In the short-term, continuity of existing cross border contracts requires transitional agreements by individual member countries of the EU27 and the United Kingdom. The European Commission provides contingency measures based on temporary and conditional equivalence regimes for UK central counterparties and UK central depositaries which will last until end 2020. The United Kingdom, on the other hand, has already announced a temporary permission regime for inbound financial services and many EU27 members have enacted similar regimes. Others, among them Austria, have not yet provided a legal basis which gives firms some breathing time to find alternative solutions.3 For example, the Austrian insurance supervisor requires a transfer of retail insurance contracts from the United Kingdom to a fully capitalised and staffed subsidiary registered within the EU27 (FMA press release from 5th July 2018).

In the medium to long-term, comparative advantages and the international nature of financial markets in the United Kingdom suggest resilience as a global financial centre but business related to the EU27 is likely to move outside due to regulatory demands by the European supervisory authorities and the European Central Bank. Particularly the euro-denominated derivative trade and central clearing parties can be expected to move inside the euro area. If an equivalence regime could be negotiated between the EU27 and the United Kingdom, some wholesale banking service related to the EU27 may remain inside the United Kingdom. Financial intermediaries from outside the Single Market may consider a relocation towards the EU27 or alternatively they may move towards their home country if this country has signed an equivalence regime with the EU. The increase in financial costs for continental companies is estimated in a range between 6% and 24%. Cross border trade in retail banking and insurance will presumably end until equivalence regimes are put into place.

Armour, J., (2017), Brexit and Financial Services, Oxford Review of Economic Policy, 33(S1), p. S54 ff, https://doi.org/10.1093/oxrep/grx014.

Baier, F. J., Welfens, P.J. J., (2019), The UK’s Banking FDI flows and Total British FDI: A Dynamic Brexit Analysis, International Economics and Economic Policy, 16(2), p. 193 ff.

Balz, B., How is Brexit Transforming the Global Financial Landscape? Speech at the 2018 Bavarian Banking Day (Bayerischer Bankentag) in Munich, Deutsche Bundesbank, Frankfurt, 9th November 2018.

Batsaikhan, U., Kalcik, R., Schoenmaker, D., (2017), Brexit and the European Financial System: Mapping Markets, Players and Jobs, Bruegel Policy Contribution (2017/4).

Brühl, V., (2018), Clearing von außerbörslichen Euro-Derivaten, Wirtschaftsdienst, 98(4), p. 267ff.

Davies, R. B., Neill, K., (2018), Location decisions of non-bank financial foreign direct investment: Firm-level evidence from Europe, Review of International Economics, Vol. 26(2), p. 378 ff, https://doi.org/10.1111/roie.12336.

Demary, M., Voigtländer, M., (2016), Will Brexit dwarf London”s competitiveness as a financial centre?, IW-Kurzbericht, (50.2016).

Dhingra, S., Huang, H., Ottaviano, G., Pessoa, J.-P., Sampson, T., Reenen, J. van, (2017), The costs and benefits of leaving the EU: trade effects, Economic Policy, Vol. 32(92), p. 651 ff, https://doi.org/10.1093/epolic/eix015.

ECB, (2011), Eurosystem Oversight Policy Framework, European Central Bank, Frankfurt am Main.

Eichengreen, B., (2019), The International Financial Implications of Brexit, International Economics and Economic Policy, Vol. 16(1), p. 37 ff.

EU-COM European Commission (2017), Vorschlag für eine Verordnung des europäischen Parlaments und des Rates 2017, COM(2017/0331).

FCA, Letter to House of Commons Committee Office, Financial Conduct Authority, London, 17th August 2016.

Felbermayr, G., Gröschl, J. K., Steininger, M., (2018), Quantifying Brexit: From Ex Post to Ex Ante Using Structural Gravity, CESifo Working Paper, (7357).

Hantzsche, A., Kara, A., Young, G., (2018), The Economic Effects of the Government’s Proposed Brexit Deal, National Institute of Economic and Social Research Report, London.

Hohlmeier, M., Fahrholz, C., (2018), The Impact of Brexit on Financial Markets—Taking Stock, International Journal of Financial Studies, 6(3), 65, https://doi.org/10.3390/ijfs6030065.

Howarth, D., Quaglia, L., (2017), Brexit and the Single European Financial Market, Journal of Common Market Studies, Vol. 55(S1), p. 149 ff.

Howarth, D., Quaglia, L., (2018), Brexit and the battle for financial services’, Journal of European Public Policy, Vol. 25(8), p. 1118 ff.

Kaya, O., Schildbach, J., Lakhani, K., (2018), Die Folgen des Brexit für das Investmentbanking in Europa, EU-Monitor, Deutsche Bank Research, Frankfurt am Main, 28th November 2018.

Kierzenkowski, R., Pain, N., Rusticelli, E., Zwart, S., (2016), The Economic Consequences of Brexit: A Taxing Decision, OECD Economic Policy Paper, (16).

Kindleberger, C. P., (1993), A Financial History of Western Europe, Oxford University Press, 2nd Ed. Oxford.

Lannoo, K., (2016), EU Financial Market Access After Brexit, Intereconomics, Vol. 51(5), p. 255 ff, http://dx.doi.org/10.1007/s10272-016-0614-y.

Lütkenhorst, W., Minte, H., (1979), The petrodollars and the world economy, Intereconomics, Vol. 14(2), p. 84 ff, http://dx.doi.org/10.1007/BF02930203.

Magntorn, J., Winters, L. A., (2018), Can CETA-plus Solve the UK’s Services Problem?, UK Trade Policy Observatory Briefing Paper, (18).

Miethe, J., Pothier, D., (2016), Brexit: What”s at Stake for the Financial Sector?, DIW Economic Bulletin, Vol. 6(31), p. 364 ff.

Moloney, N., (2016), Financial services, the EU, and Brexit: an uncertain future for the city?, German Law Journal, (17), p. 75 ff.

Rhodes, C., (2018), Financial Services: Contribution to the UK economy, House of Commons Library, Briefing Paper, (6193).

Sapir, A., Schoenmaker D., Véron, N., (2017), Making the Best of Brexit for the EU27 Financial System, Policy Brief, (1).

Schenk, C., (1998), The Origins of the Eurodollar Market in London: 1955-1963, Explorations in Economic History, Vol. 35(2), p. 221 ff.

Schoenmaker, D. (2017), The UK Financial Sector and EU Integration after Brexit: The Issue of Passporting’, in Campos, N., Coricelli F. (eds) The Economics of the UK-EU Relations: From the Treaty of Rome to the Vote for Brexit, Palgrave McMillan, London, p. 119 ff.

Sibley, E., (2018), Brexit – where to next? Speech to the DCU Brexit Institute, Central Bank of Ireland, Dublin, 12th April 2018.

Tarrant, A., Tilford, S., (2018), Brexit and the UK’s services trade, Tony Blair Institute for Global Change, London, https://institute.global/insight/renewing-centre/brexit-and-uks-services-trade.

Würmeling, J., (2018), Brexit means Brexit – but what does it mean for Europe as a financial centre? Speech at the annual reception of the Association of Foreign Banks in Germany, Deutsche Bundesbank, Frankfurt am Main, 20th June 2018.

Würmeling, J., (2019), Brexit – Implications for UK branches of German banks, Speech at the Embassy of the Federal Republic of Germany, London, Deutsche Bundesbank, Frankfurt am Main, 14th February 2019.

Office for National Statistics 2019:

https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/datasets/balanceofpaymentsstatisticalbulletintables

Office for National Statistics 2019: https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/datasets/balanceofpaymentsstatisticalbulletintables

Find a list of country specific transitional rules laid out in https://www.regulationtomorrow.com/de/brexit-doing-business-in-the-eu/