The considerations and references contained in this note constitute the background material for the concluding remarks made by the author at the CESIFIN/EUI Workshop (in Italian) on “The Multiple Role of Central Banks: The New Frontiers of Monetary Policy”, Florence, 30 September 2022. I thank Michele Caivano, Nicola Pellegrini, Massimo Sbracia, Alessandro Secchi and Roberta Zizza for their contributions and suggestions.

The global rise in inflation observed in the last year or so, while reflecting almost everywhere the exceptional rise in energy prices, has seen diverse contributions of demand and supply factors in different countries. Unlike the United States, in the euro area the role of supply shocks has been predominant. Therefore, one should not give for granted that the ECB will follow the Federal Reserve blindly in the coming months. High inflation warrants continuing the normalisation of monetary conditions by the ECB, but at a pace and to a terminal rate that will have to be determined meeting-by-meeting, depending on the flow of new data and updated perspectives. Today, worrying signals come from the sharp deterioration in the growth outlook, both in Europe and globally. This recommends that, as in other tightening cycles, we will have to discover the terminal rate by proceeding gradually.

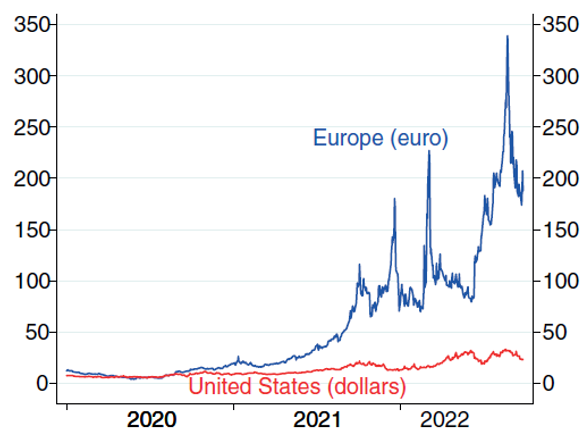

In the last year or so, inflation has been sparked almost everywhere by the exceptional increases in the prices of energy commodities. However, the ways in which these increases have taken place and their relative weight with respect to other factors differ widely across countries, in particular when comparing the United States and the euro area.

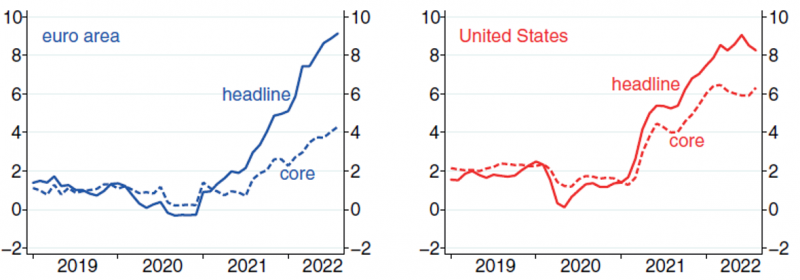

These differences notwithstanding, headline inflation recorded similar dynamics in the two economies and progressively increased to above 8 per cent both in the United States and in the euro area (with similar averages in the two economies during the summer months, at just over 8.5 percent). In the euro area today headline inflation is equal to 10 per cent, while some signs of moderation are starting to emerge in the United States, mirroring both easing pressures on the energy front in that country and the strong monetary tightening. However, the trend of core inflation (which excludes food and energy products) was different. In the United States it went above 6 per cent at the beginning of this year and was still 6.3 per cent in August, while in the euro area it was only slightly above 2 per cent at the start of the year and, in August, its level was still 2 percentage points lower than in the United States (Figure 2).

Figure 1: Gas prices

Source: Refinitiv. Note: Title Transfer Facility (TTF) quotations for European gas and Henry Hub for US gas; latest observations: 29 September 2022.

Figure 2: Headline and core inflation in the euro area and in the United States

Source: Eurostat and U.S. Bureau of Labor Statistics. Note: latest observations refer to August 2022.

The differences in the relative weight of demand factors and in the dynamics of core inflation explain why, in the face of headline inflation reaching similar values, monetary policy normalisation has proceeded with different timing and speed in the two economies. These differences also suggest that assuming that the ECB will follow the Fed blindly in the coming months could be a serious misjudgement.

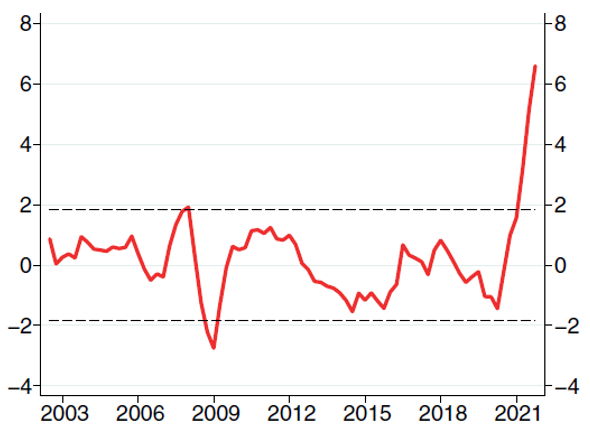

In emphasising the supposed mistake made by the ECB in delaying the change in its monetary policy stance, many commentators have pointed to some errors in inflation projections. While in mid-2021 headline inflation was still below 2 per cent and core inflation was less than 1 per cent, since late last year, inflation has been unexpectedly high in the euro area. In particular, the forecast errors in consumer price growth made by the ECB and Eurosystem staff during the first two quarters of 2022 (Figure 3) have been much larger than those observed in the past (more recently mostly of the opposite sign).2 Some have even argued that these very large errors call into question the credibility of central banks,3 even though other international institutions and private forecasters have made similarly large mistakes.

Figure 3: ECB/Eurosystem projections errors for euro area headline inflation

(percentage points; 4 quarters ahead projection errors)

Note: dashed lines denote an interval around zero of plus/minus two standard deviations of projection errors realized in 2003-2020; latest observation: 2022 Q2.

The observed size of the errors may cast doubt on the reliability of the models used for the projections, resulting in a calling for the use of less formal frameworks and more judgmental assessments (although all forecasting models include judgmental factors). We must not forget that econometric models are nothing more than simplified approximations of reality. They cannot mechanically take into account all specific non-linearities in financial or commodity markets or regime changes in behaviours resulting from health or geopolitical shocks. When defining economic policy measures, they should therefore be used carefully, integrating them with external information and qualitative assessments. However, while they can be subject to continuous checks and improvements as well as better used, we cannot dispose of them, as they are especially useful for a disciplined organisation of the evaluations on which policy measures are based.4 This said, our analyses indicate that the effects of energy prices – the most important exogenous variables, whose changes are inferred from the quotes of futures contracts – explain, directly and indirectly (i.e. via their effects on production costs), 65 per cent of the overall error made in forecasting inflation. This share rises to 80 per cent when the effects of food prices, the other volatile component of the harmonised index of consumer prices, are also taken into account.5

These results suggest that the functioning of the economy has not changed dramatically in the last year or so and that the framework used for projections remains valid overall. They do draw our attention, however, to the quality of the forecasts used as inputs. A key problem has been a generalised underestimation of geopolitical tensions, with the sharp drop in gas supplies from Russia observed since early last year, attributed first (and probably mistakenly) to the effects of a particularly cold winter and then to pressures by the Russian Government in connection with the Nord Stream 2 pipeline. But the most important factor has, of course, been the Russian invasion of Ukraine: while the quotes of futures had continued to factor in descending oil and gas prices up to the end of last year, the conflict has pushed not only current but also expected prices to extremely high levels.

Gas prices provide a significant example. At the end of September 2021, when the spot price of gas had risen to €100 per megawatt hour, the quotes of futures had predicted a decline to well below €50 by June 2022. As it turned out, instead of declining by more than 50 per cent, gas prices increased by almost 100 per cent, averaging, as already pointed out, at about €200 since the second half of June. In general, while the repercussions of rising energy prices on inflation were considered as temporary before the outbreak of war, owing to the expectations of base effects soon turning negative, they instead became persistent. These considerations are emblematic of the difficulties in predicting macroeconomic variables, particularly when driven by non-economic phenomena, like mounting geopolitical tensions. We will have to take this into account if and when, symmetrically, a tendency to make forecast errors of the opposite sign emerges due to the attenuation of these tensions, hopefully in a short time but unfortunately still very uncertain today.

Given the information available, the claims that the Governing Council of the ECB has wrongly delayed the re-balancing of its monetary policy appear unjustified. The normalisation of the monetary stance has been under way since last December when, against the background of an improvement in the economic outlook and the rise of medium-term inflation expectations towards the price stability target, the Governing Council announced the start of the reduction of net purchases under its quantitative easing programmes. In the early part of this year, the process gained speed, avoiding, however, potentially dangerous cliff-effects of too sharp a drop, and was completed on the 1st of July. A few weeks later, we started raising the key official rates by a significant size (50 basis points in July and 75 in September), aimed at frontloading the exit from their highly accommodative levels.

This radical change in monetary stance mirrors a corresponding sharp change in the economic and inflationary outlook. First, the pandemic fears that drove the economy into recession – not only in Europe – and reduced inflation temporarily to below zero have been overcome. Thanks to the non-conventional monetary policies adopted by the Governing Council, especially its quantitative easing programmes, the risks of deflation have thus dissipated. Moreover, the euro area has been hit by an energy shock of extraordinary magnitude, far greater than the oil price shocks that hit the world economy in the 1970s. The ensuing marked rise in actual inflation cannot be ignored by the central bank: the risk that it could cause an increase in inflation expectations and in turn lead to a futile and damaging spiral between prices and wages should be countered decisively.

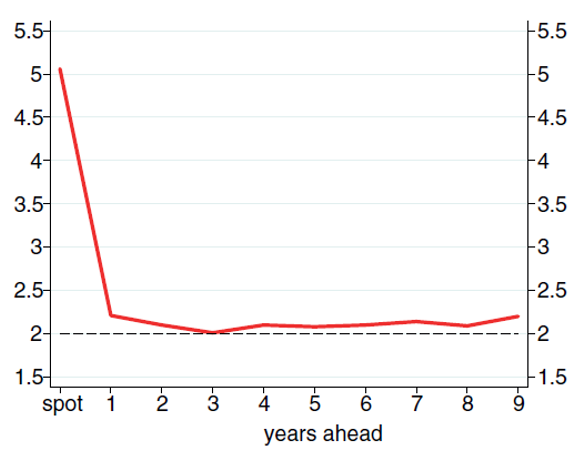

It is therefore crucial, at this stage, to carefully monitor inflation expectations and the dynamics of wages and profits. Indicators of future inflation measured on the basis of inflation-linked swaps continue to suggest that price dynamics will remain elevated in the near future, at around 5 per cent in mid-2023, and then decline rapidly and persistently to levels just above the 2 per cent target (Figure 4).6 As inflation risk premia are currently estimated to be slightly above zero, the actual medium-term inflation expectations implicit in swap rates could, substantially, be in line to our target. Survey-based expectations provide a broadly similar picture. According to the median respondent in the ECB Survey of Monetary Analysts conducted in late August, inflation is expected to stand at 4.4 per cent, on average, in 2023 and at 2.1 per cent in 2024.

Figure 4: Market-based inflation expectations

(per cent; inflation swap rates)

Source: based on Refinitiv. Note: spot and forward one-year rates implicit in inflation swaps, relative to the horizons shown on the x-axis; based on the quotations of 29 September 2022.

At the same time, the median household participating in the ECB Consumers Expectations Surveys foresees inflation at 5 per cent in the next 12 months and at 3 per cent at 3-year horizon. This latter level stands somewhat above those of market participants and economic experts, possibly reflecting a greater relevance of backward-looking elements in the expectation formation mechanism of households. A more granular analysis shows that the upward revision of inflation expectation (over all horizons) has been more intense for less affluent households. The share of the most volatile inflation components, namely energy and food items, in these households’ consumption basket is, however, much higher and may lead them to revise their expectations more frequently and significantly. In other words, the observed rise in expectation from household surveys may simply mirror what is happening in the energy and food sectors, and may therefore be reversed as soon as pressures on the price of these items diminish.

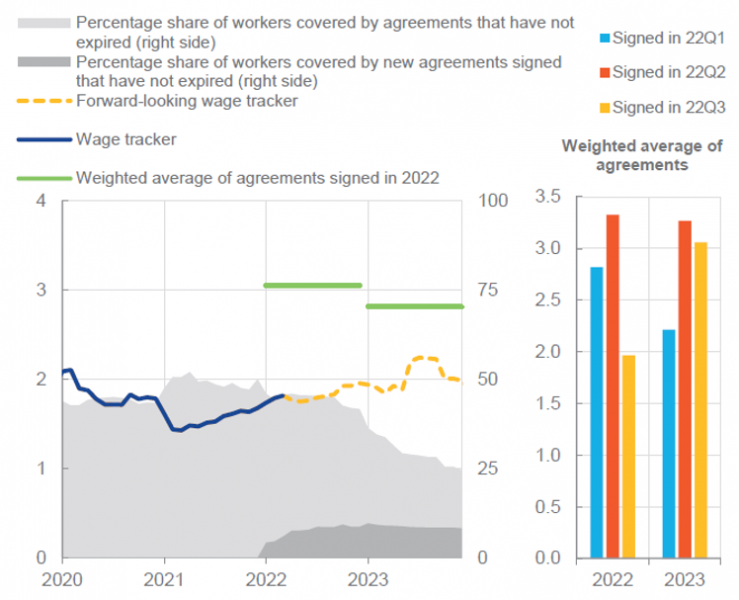

Moving on to wages, even though requests have been made in some countries for increases greater than those recorded in recent years, their growth in the euro area remains, as already mentioned, around 2 per cent (net of one-off components). In addition, the ECB forward-looking wage tracker points to a very gradual acceleration of wages in the last part of 2022 and in 2023 (Figure 5), although some tension may arise in countries where wages (especially minimum wages) react almost mechanically to actual inflation.

Figure 5: Euro area forward-looking wage tracker

(annual percentage change)

Source: P. Lane, Cantillon Lecture, 45th DEW Annual Economic Policy Conference, 17 September 2022. Note: euro area aggregate based on Germany, Italy, the Netherlands and Spain. Calculations based on micro data on wage agreements provided by Bundesbank, Bank of Italy, the Dutch employer association (AWVN) and Bank of Spain.

My reading of these data makes me confident that, at the moment, there is no evidence that medium-term expectations are drifting away from the price stability objective, nor are there signs of pernicious spirals between prices and wages. Indeed, the high level of inflation expectations in the coming quarters, reflecting the standard price growth inertia and the persistence of energy prices at very high levels, rapidly declines in the subsequent years, in line with the Eurosystem/ECB’s projections as well as most others.7 Should energy prices prove to be higher than what is currently projected, their negative demand effects via purchasing-power and wealth losses would probably contribute to curbing actual and expected inflation and, in turn, wage requests.

In any case, we pay close attention not only to the current levels of price and wage expectations, but also to their prospective dynamics. An assessment of the risk of a de-anchoring of expectations from the inflation target based merely on their current level could, in fact, be dangerous.8 Since a de-anchoring could occur abruptly and non-linearly, expectations must be assessed both in terms of their convergence towards the price stability objective as well as their responsiveness to shocks and their dispersion. From this perspective, the evidence is less clear. On one hand, expectations from market data and surveys continue to show a relatively low sensitivity to inflation surprises. On the other hand, in many surveys the distributions of expected inflation tend to be skewed towards high inflation and show an increase in uncertainty, suggesting a greater, though still moderate today, risk of a sharp upward shift of the entire distribution.9 Although these features of expected inflation could be a mere consequence of the repeated upward surprises in actual inflation related to the unforeseen persistence of the energy shock, these developments need to be monitored carefully. However, the fact that the “expectations curve” is downward sloping is reassuring for anchoring, as medium to long-term inflation expectations remain well below current inflation levels.

While the normalisation of monetary policy should continue with the aim of gradually reabsorbing the ample accommodation created since 2014, the Governing Council is currently faced with a difficult dilemma. Rising inflation is now being accompanied by a sudden deterioration in the economic growth outlook, reflecting the loss of purchasing power of incomes (Figure 6). In this context, excessively rapid and pronounced rate hikes would end up increasing the risk of a recession. Moreover, should the deterioration of the economic outlook turn out to be worse than expected, an excessive front-loading in the normalisation of key rates could ex post result disproportionate, something that could seriously undermine public confidence in our ability to make well-considered decisions and that would paradoxically make it more difficult to maintain price stability over the medium term. This is a risk that deserves to be considered carefully, along with that of letting inflation remain excessively high for too long.

Figure 6: Recent evolution of expected GDP growth in 2023

(annual percentage growth)

Source: Consensus Economics. Note: expected GDP growth in the monthly issues of Consensus Forecasts since the beginning of 2022; latest observation: September 2022.

A further concern is related to risks to financial stability. In the current context, these risks are amplified by the rapidly deteriorating economic environment, both in the euro area and beyond. Moreover, the marked rises in official rates being announced by all major central banks may create spillover effects that are difficult to quantify but are likely not to be negligible.10 The risk of financial instability is particularly relevant in the Economic and Monetary Union, whose incomplete architecture – especially its decentralised fiscal policy and the delays in completing the banking and the capital markets unions – exposes it to a possible fragmentation of financial markets along national borders. If this risk were to materialise, we would see severe repercussions in all euro area countries, leading to a tightening of financing conditions well beyond what is deemed appropriate for curbing high inflation. For this reason, the Governing Council is ready to continue to exploit the flexibility in its asset purchase programme related to the pandemic emergency and to resort to its new Transmission Protection Instrument, to prevent financial markets tensions from counteracting any progress made in price stability and hindering economic growth.

The uncertainty surrounding the economic and inflation outlook makes it very difficult to predetermine the possible terminal point of official rates. One shortcut that is often considered is based on the so-called natural rate of interest (usually referred to as r star).11 This is, in the Wicksellian definition, the level of the real interest rate at which investment equals savings, and the economy’s resources are fully employed; if prices were fully flexible, at this rate inflation would be equal to its target.12

This is therefore an equilibrium concept that provides an extremely simplified description of the functioning of the economy and of monetary policy. For example, the credibility of the central bank is irrelevant in this framework, as are the level of uncertainty and inflation expectations, as well as the stance of fiscal policy or the debt-to-GDP ratio.

Furthermore, taking into account the dynamics of the process that leads to the longer-term equilibrium is a crucial challenge. Finally, to further complicate matters, the natural rate is unobservable and a wide variety of methods to estimate it provides a large range of different results.13

In some speeches delivered earlier this year, for example, members of the Governing Council of the ECB estimated r star in a range between below -2 per cent and slightly above 0 per cent.14 An update of those estimates would now place its level in a range between -1.3 and -0.2 per cent.15 By adding to those values the inflation target of 2 per cent, it follows that the “neutral” policy rate (the one at which, in the medium-term equilibrium, monetary policy is supposed to be neither accommodative nor restrictive) would be in a range between 0.7 and 1.8 per cent and could already have been achieved (or be close to being achieved) by the ECB with its latest rate hike (or the ones that will soon be taking place). But it is clear that there is no close relationship between this rate and the level to be achieved to ensure inflation expectations consistent with maintaining the target of an average inflation around 2 percent over the medium term.

How much, then, should we further raise official rates? Two further problems affect this decision.

Even if long-term inflation expectations are still anchored and wage growth remains moderate, the high level of inflation and the need to increase the extremely low values achieved by short-term interest rates in real terms require policy rates to continue to rise. The high uncertainty surrounding the economic prospects, however, suggests prudence in setting the “pace” of the rate hikes and strongly advises against committing to a pre-determined terminal point for official rates.

Our future decisions will therefore continue to follow a meeting-by-meeting approach and will be data-dependent – meaning, however, that they will not simply be dependent on current data, but will instead continue to assume a forward-looking orientation, based on the economic perspectives of the euro area as a whole, over the medium-term. As in other tightening cycles, we will have to discover the terminal rate by proceeding gradually. This does not mean that quantitative assessments cannot be made, based on the experience accumulated to date; on the contrary, they would be certainly useful for estimating the effects of rate increases on aggregate demand and changes in the costs and prices of goods and services.16 However, we will have to take these assessments into account together with the information that will gradually become available on inflation expectations and on the evolution of labour income and profits. In any case, today I do not see any obvious reason to tie our hands with hypotheses of extraordinarily high increases, such as those that can be sometimes read, in some cases extrapolating the more recent decisions or the experience of other countries.

To conclude, since the introduction of the euro, we have always shown our willingness to invest greatly in the analytical capacity of the ECB and the national central banks of the euro area, as well as the readiness to adjust our tools to account for all the factors affecting the pursuit of price stability preservation. Today, the main threat to this objective comes from the energy shock, mostly a consequence of the conflict in Ukraine, which has sparked an exceptional rise in inflation, not only within the euro area.

It has recently been argued that high inflation and repeated errors in our projection exercises have called into question our credibility. However, public confidence in our determination to maintain price stability is not measured by the level of current inflation, which is mainly caused in the euro area by the unprecedented energy shock. Nor is it determined by the forecasting errors, which do not signal a major failure of the quantitative models used in the Eurosystem, but instead are the result of the intrinsic unpredictability of geopolitical tensions lying outside the economic realm. Our credibility is measured, rather, by the anchoring of medium-term inflation expectations,17 a key factor that also helps to prevent the triggering of dangerous price-wage spirals.

High inflation warrants continuing the normalisation of monetary conditions, but at a pace and to a level that will have to be determined meeting-by-meeting, based on the flow of new data and on updated perspectives. Worrying signals, however, come from the sharp deterioration in the economic growth outlook, whose ultimate cause is still the energy shock and its consequences on the purchasing power of incomes and on firm profits.

Ensuring the containment of the effects of this shock will require not only an incisive and appropriate response from monetary policy, but also the shouldering of responsibility on both sides of the labour market and the contribution of budgetary policy. It must be understood that, as it was with the oil shocks of the 1970s, the current energy shock is an unavoidable burden for the euro area as a whole, and especially for the countries most affected, such as Italy undoubtedly is.

Any attempt to completely counteract its impact on the incomes of labour and capital would be in vain and would inevitably end up having negative repercussions on inflation. To prevent this outcome, budgetary policy can redistribute the effects of the shock between consumers, production factors, present and future generations, with targeted and temporary interventions in support of the households and businesses most affected. The redistributive and allocative consequences of what happens on the energy front, in fact, cannot be ignored. If, however, it were to be decided that the redistribution should weigh most heavily on future generations by issuing public debt, we would run the risk of loading them with unfair burdens and of further fuelling both current and expected inflation. For Italy, this would also entail the risk of derailing public debt (as a share of GDP) from its current descending path – a path that is necessary for preserving the possibility of a swift return to strong and durable economic growth.

Blanchard O., Domash A., and Summers L.H. (2022), “Bad News for the Fed from the Beveridge Space”, Peterson Institute for International Economics, Policy Brief, no. 7, July.

Bok B., Petrosky-Nadeau N., Valletta R.G., and Yilma M. (2022), “Finding a Soft Landing along the Beveridge Curve”, Federal Reserve Bank of San Francisco, FRBSF Economic Letter, no. 24, August.

ECB (2022), “What Explains Recent Errors in the Inflation Projections of Eurosystem and ECB staff?”, Economic Bulletin, 3, April.

El-Erian M.A. (2022), “The Fed’s Historic Error”, Project Syndicate, February.

Hernández de Cos P. (2022), Monetary Policy in the Euro Area: Where Do We Stand and Where Are We Going?, Bank of Spain, remarks at the XXI Congreso de Directivos CEDE, Bilbao, September.

Hilscher J., Raviv A., and Reis R. (2022), “How Likely is Inflation Disaster?”, CEPR Discussion Paper, no. 17244.

Kontogeorgos G., and Lambrias K. (2019), “An Analysis of the Eurosystem/ECB Projections”, ECB Working Paper, no. 2291, June.

Lane P. (2022a), The Monetary Policy Strategy of the ECB: The Playbook for Monetary Policy Decisions, European Central Bank, remarks at the Hertie School, Berlin, March.

Lane P. (2022b), Monetary Policy in the Euro Area: The Next Phase, European Central Bank, remarks at the Annual Meeting 2022 of the Central Bank Research Association (CEBRA), Barcelona, August.

Neri S., Bulligan G., Cecchetti S., Corsello F., Papetti A., Riggi M., Rondinelli C., and Tagliabracci A. (2022), “On the Anchoring of Inflation Expectations in the Euro Area”, Bank of Italy, Occasional Papers, no. 712.

Neri S., and Gerali A. (2019), “Natural Rates across the Atlantic”, Journal of Macroeconomics, no. 62.

Obstfeld M. (2022), “Uncoordinated Monetary Policies Risk a Historic Global Slowdown”, Peterson Institute for International Economics, Realtime Economic Issues Watch, September.

Panetta F. (2022), Small Steps in a Dark Room: Guiding Policy on the Path out of the Pandemic, European Central Bank, remarks at the at an online seminar organised by the Robert Schuman Centre for Advanced Studies and the European University Institute, Frankfurt, February.

Reis R. (2021), “Losing the Inflation Anchor”, Brookings Papers on Economic Activity, Fall.

Reis R. (2022), “The Burst of High Inflation in 2021-22: How and Why Did We Get Here?”, London School of Economics, unpublished, June.

Schnabel I. (2022), Monetary Policy and the Great Volatility, European Central Bank, speech at the Jackson Hole Economic Policy Symposium, Federal Reserve Bank of Kansas City, August.

Villeroy de Galhau F. (2022), Ethics of Currency: A Possible Guide for Central Bankers?, Michel Camdessus Central Banking Lecture, IMF, Washington D.C., September.

Visco I. (2009), The Financial Crisis and Economists’ Forecasts, Bank of Italy, remarks at the Inauguration of the Academic Year 2008-09, La Sapienza University, Rome, March.

Visco I. (2022), Inflation and Long-Term Interest Rates, Bank of Italy, remarks at Analysis Institutional Forum, Milan, June.

Wheeler G., and Wilkinson B. (2022), “How Central Bank Mistakes after 2019 Led to Inflation”, The New Zealand Initiative, Research Note, July.

Wicksell K. (1898), Interest and Prices, MacMillan, London, 1898.

Woodford M. (2003), Interest and Prices: Foundations of a Theory of Monetary Policy, Princeton University Press, Princeton NJ.

An intense debate about vacancies and unemployment (the so-called Beveridge curve) has been triggered in the United States (where long data series are available for vacancies) following Blanchard et al. (2022); see also Figura and Waller (2022) and Bok et al. (2022).

For an evaluation of the ECB forecasting errors since 2001, see Kontogeorgos and Lambrias (2019). A more recent analysis is in ECB (2022).

See for example El-Erian (2022) and Wheeler and Wilkinson (2022).

For a critical review of quantitative models, forecast errors and their evaluation at the time of the global financial crisis, see Visco (2009).

Between mid-February and mid-May 2022, due to the Russian aggression in Ukraine, the price of wheat (and of other agricultural commodities) increased by over 60 per cent. During the summer, following better-than-expected harvests in the United States and, then, the agreement between Russia and Ukraine to allow exports of grain and other agricultural products to resume from selected Black Sea ports, wheat prices gradually declined, approaching their pre-war levels.

See Neri et al. (2022).

Looking forward, inflation dynamics are therefore not likely to be persistent. On this issue, see however Schnabel (2022).

See Visco (2022).

See Neri et al. (2022), Hilscher et al. (2022), Reis (2021) and (2022).

On this point, see Obstfeld (2022).

See, for example, Lane (2022b) and Reis (2022).

See Wicksell (1898) and Woodford (2003).

These go from pure time-series applications, to semi-structural econometric frameworks in which the natural rate is a latent variable, to fully structural, though extremely simplified, models (such as overlapping-generations or dynamic stochastic general equilibrium models of the New Keynesian tradition). For a recent survey and estimates of r star for both the United States and the euro area, see Neri and Gerali (2019).

See, for example, Lane (2022a) and Panetta (2022).

The variety of methodologies used by the ECB is reported in Panetta (2022) and described in the references mentioned therein. For recent considerations on the relevance and use of the natural rate see Hernández de Cos (2022) and Villeroy de Galhau (2022).

See, for example, Hernández de Cos (2022).

See Reis (2022) and Schnabel (2022).