Fiscal rules are important commitment devices to limit fiscal profligacy. They have been an integral part of the euro area architecture and were introduced to insure against weaknesses in the functioning of the market discipline. Nonetheless, they have failed to provide sufficient fiscal discipline and avoid excessive market volatility. However, despite prevalent noncompliance, rules did – on average – influence the behavior of fiscal authorities. The evidence shows that well-designed rules worked better than others. Elevated debt levels and the record of weak compliance and lax enforcement make fundamental reform of the EU fiscal rules more urgent than ever. These reforms should aim at making the rules simpler and more transparent, and better aligning political incentives with rule compliance.

Binding fiscal rules are necessary in a monetary union because market forces alone do not provide a sufficiently strong mechanism to discipline profligate governments. This key insight was prominent in Alexandre Lamfalussy’s contribution to the Delors’ Report (1989). According to the report: “the constraints imposed by market forces might either be too slow and weak or too sudden and disruptive”. Monetary union exacerbates the challenge of maintaining fiscal discipline in individual countries. First, by eliminating exchange rate risk and introducing a more credible monetary policy in members with higher inflation, it increases bond market integration and liquidity, reducing the marginal cost of running profligate fiscal policies (Detken, Gaspar and Winkler, 2004). Second, while markets would require an interest premium from more profligate governments, the size of the premium could be limited by an assumption that solidarity amongst members of the monetary union would prevent the “bankruptcy” of a member country (Lamfalussy, 1989). As such, markets could end up financing the build-up of imbalances in good times. At the same time, markets could pull the plug abruptly in bad times when the perception about a borrower’s creditworthiness shifts.

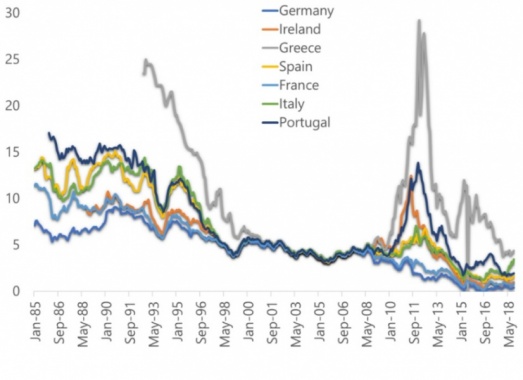

The recognition of these fundamental imperfections in the functioning of market discipline was the main rationale for the inclusion of fiscal rules and the “no bailout” clause in the Maastricht Treaty. Since then, fiscal rules have become a cornerstone of the euro area architecture. Nonetheless, the existence of the rules and the “no bailout” clause did not prevent the realization of developments that they were expected to avert. In fact, following the introduction of a single currency in 1999, sovereign bond yields quickly converged and barely deviated from each other until the onset of the global financial crisis (Figure 1). Markets came crashing down and yield spreads sharply widened as investor perception about public debt sustainability in a few EU countries changed drastically. The risks identified in the Delors’ report in 1989 materialized during the euro area sovereign debt crisis.

Figure 1. 10-year Bond Yields, 1985-2018 (in percent)

Source: Eurostat.

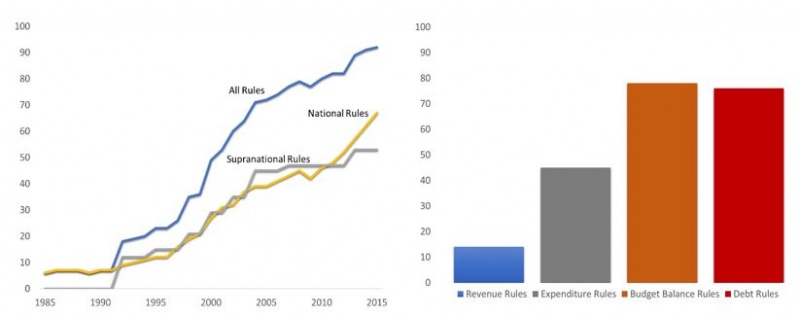

Over the past three decades, a growing number of countries have introduced fiscal rules (Figure 2). In addition to fiscal sustainability, rules have also been introduced to manage business cycle and commodity price volatility, contain the size of the government, and support intergenerational equity. Subsequently, the number of countries with national and/or supranational fiscal rules surged to 92 by 2015. This includes, most recently, responses to the crisis with a view to provide credible commitment to long-term fiscal discipline. National fiscal rules are in effect in 67 countries while supranational fiscal rules were introduced in currency unions and the EU, covering 53 countries. Budget balance and debt rules are the most popular types of rules.

Figure 2. Types of Fiscal Rules (number of countries)

Source: IMF Fiscal Rules Database, 2016.

Note: Budget balance rules can be specified as overall balance, structural or cyclically adjusted balance, and balance “over the cycle”. This includes primary balance rules and the “golden rule,” which targets the overall balance net of capital expenditures. Debt rules set an explicit limit or target for public debt in percent of GDP. Expenditure rules usually set permanent limits on total, primary, or current spending in absolute terms, growth rates, or in percent of GDP. Revenue rules set ceilings or floors on revenues and are aimed at boosting revenue collection and/or preventing an excessive tax burden.Fiscal rules pre-date the Maastricht Treaty. Most states in the US had assumed responsibility for keeping current budgets in balance already in the middle of the 19th century (Sargent, 2012) and this experience is very relevant today. The decision to impose constraints on their public finance was the result of debt crises that many US states experienced at that time. It all started in 1789 when the federal government bailed out 13 indebted states as part of a grand bargain that aimed at strengthening the federal government’s finances. While this, on the one hand, helped build a good reputation with creditors, on the other hand it created a dangerous precedent and the perception that the federal government may rescue troubled states in the future. It did not take long and following a financial crisis in the 1830s, many states found their public finances in dire straits again. The request by creditors to the federal government to bail out the states again was not supported by the Congress, and many states defaulted on their debts. It was against this background that many US states opted to tie their hands and mandated balanced budgets.

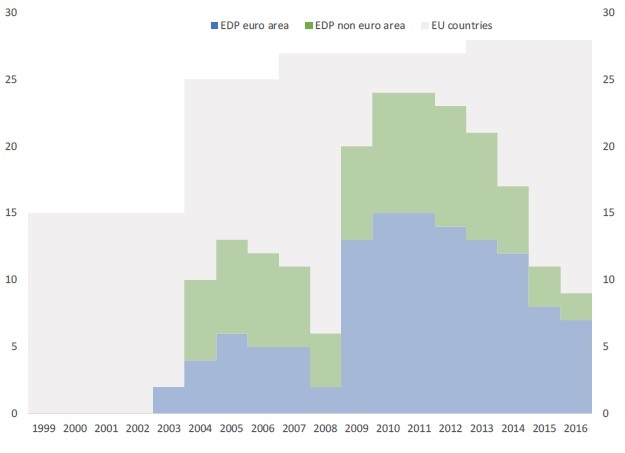

Despite their proliferation, the compliance track record with fiscal rules is relatively poor. In particular, in the EU, breaching fiscal rules has been more the norm than the exception (Diaz Kalan, Popescu and Reynaud, 2018).2 Over the period 1999-2016, there were 37 Excessive Deficit Procedure (EDP) country episodes corresponding to 203 event-years or about 48 percent of the sample period (Figure 3). Most countries have breached either one or both of the deficit and debt rules and/or spent significant periods of time in the EDP. There are only three exceptions: Estonia, Luxembourg and Sweden, which have never been in an EDP. Serial noncompliers were common. Out of the 25-member countries that experienced EDPs, 13 experienced one episode, 11 experienced two episodes and 1 country experienced three episodes. Noncompliance rates rose from 21 percent before the global financial crisis to 63 percent after the crisis.

Figure 3. Number of Countries under the EDP

Source: Diaz Kalan, Popescu and Reynaud (2018).

Based on comparison of ex-post data for four key numerical rules, Eyraud, Gaspar and Poghosyan (2017) confirm poor compliance track record in the euro area.3 For example, over 1999–2015, the Medium-term Objectives (MTOs) were violated in 80 percent of observations under consideration, with almost two-thirds of countries exceeding the MTOs in every single year. Compliance particularly worsened during the crisis: in 2009, the MTO rule was violated by 90 percent, the debt ceiling by 50 percent, the deficit ceiling by 85 percent, and the required fiscal effort by 75 percent of the countries. It is also notable that reforms to the EU fiscal framework implemented over 2005–13, such as increased flexibility, greater automaticity in enforcement, and greater ownership supported by revisions in national legislation, have not had an evident impact on rule compliance (without correcting for other factors).

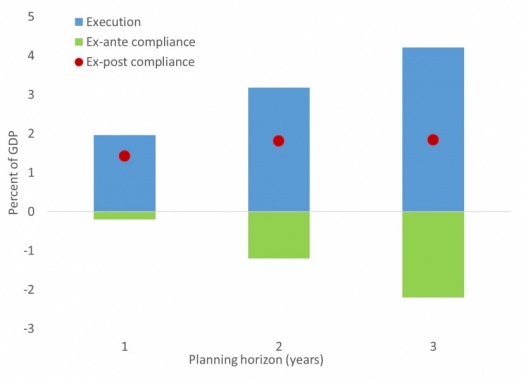

Furthermore, their analysis suggests that the main driver of poor ex post compliance was weak execution of plans. Given that the European Commission has not applied any fines or sanctions, this is also a sign of weak enforcement. Although the noncompliers consistently planned to reduce their deficits below the 3-percent threshold set out by the rules in each of the projected years, execution slippages more than offset these plans, leading to a median upward deviation from the ceiling of up to 2 percent of GDP at the end of the third year (Figure 4).

Figure 4. Decomposition of Deficit Rule Slippages

Source: Eyraud, Gaspar and Poghosyan (2017).

Note: Decomposition formula: ![]()

In general, the use of fiscal rules is correlated with better fiscal performance. Countries with fiscal rules have, on average, lower deficits compared to countries without rules. Also, in several cases of large fiscal adjustments, fiscal rules have played a supportive role (IMF, 2009). An analysis of a comprehensive sample of over 140 countries over the period 1985-2015 reveals that fiscal deficits averaged 2.1 percent of GDP in the absence of fiscal rules against 1.7 percent of GDP in the presence of fiscal rules (Caselli and Reynaud, 2018). Based on a meta-regression-analysis for the budgetary impact of numerical fiscal rules based on 30 studies published in the last decade, Heinemann, Moessinger and Yeter (2018) find that the existing empirical evidence points to a constraining effect of rules on fiscal aggregates. However, they also point out that the positive relationship between rules and performance does not imply causality. In fact, by explicitly addressing the problem of endogeneity, Caselli and Reynaud (2018) find no statistically significant impact of rules on the fiscal balance on average, once endogeneity is adequately controlled for.

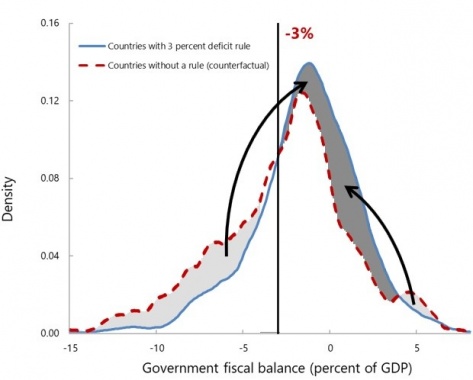

Nonetheless, fiscal rules have been found to have an effect, even when not complied with. Rules could affect low and high-deficit countries differently because of non-linearity of incentives for deviating from the fiscal deficit limit. Rather than looking at the average effect, Caselli and Wingender (2018) examine the effect of the EU’s 3 percent of GDP deficit rules on the entire distribution of general government deficits. They find that rules seem to affect countries with low and high fiscal balances in opposite directions. The rule’s threshold seems to exert a magnet effect from below and from above. From below: the fiscal position of poor performers tends to improve and be attracted towards the rule’s threshold. From above: the most prudent countries tend to reduce their overperformance (Figure 5).

Fiscal rules are not a “one-size-fits-all” product and the effect of rules depends on their type and design. Well-designed rules have a statistically significant impact on the fiscal balance. An analysis that considers an index of rules’ design, and controls adequately for endogeneity, finds that better designed rules have a significant and positive impact on the fiscal balance (Caselli and Reynaud, 2018).4 Specific country experiences also show usefulness of fiscal rules (Box 1).

Figure 5. Probability Distribution of Deficits

Source: Caselli and Wingender (2018).

Certain design aspects can help strengthen fiscal rules’ effectiveness.

b. Sequencing. A well-designed fiscal rule framework would include an ultimate fiscal policy objective, a policy anchor, and an operational target. It follows that once the objective has been established, the anchor should be calibrated first, followed by the calibration of the operational target. For example, if the objective is fiscal sustainability, the anchor could be set as the debt-to-GDP ratio and the intermediate target, whatever is chosen (e.g., an expenditure ceiling), should be calibrated to advance toward the target for the anchor.

c. Prudency. Given that fiscal performance is affected by business cycle fluctuations, it is important that the calibration allows for building buffers during upturns to minimize the risk of overshooting the target in bad times (including the room to provide fiscal support).

d. Process. There needs to be a properly-defined process for implementing the calibration of the rules. This process should also allow for periodic updates of the calibration.

Box 1. Swedish Experience with Fiscal RulesSweden has had a positive experience with its national fiscal rules since the introduction. Nominal expenditure ceiling for the central government, including the pension system, was put into effect in 1997 (interest expense is excluded from the ceiling). The expenditure ceiling, which cannot be adjusted except for technical issues, is set for a three-year period with the outer year added annually (Lledo and others, 2017). From 2000, the expenditure rule was complemented with a surplus target for the general government over the cycle. For 2000-07 the surplus target was 2 percent of GDP, for 2007-18 it was 1 percent of GDP, and from 2019 it is 1/3 percent of GDP. Overall, the Swedish fiscal rule framework has been successful in its objective to maintain fiscal discipline and macroeconomic stability (Figure 6). The expenditure ceilings have been met regularly. The budget achieved surpluses above 1 percent of GDP in good times, compensating for the lower balances in bad times (for instance in the early 2000s and during the global financial crisis). Thus, the framework has helped avoid procyclicality. The general government debt was also almost halved between 1996 and 2012 to 38 percent of GDP. Although deficits and debt rose in 2013-14, and the fiscal council assessed a breach of the surplus target in 2015, surpluses have been recorded since then, reversing the increase in debt during this period.

Figure 6. Sweden Fiscal Performance after the Adoption of Fiscal Rules(in percent of GDP)

|

The EU fiscal rules need to be reformed to increase their credibility and enforceability. The changes implemented over the last several years have made the EU fiscal rule framework more complex and less transparent. There has been a global trend of increasing the number of fiscal rules per country, which was particularly pronounced in Europe. For example, now there are on average six rules per country in the EU. This multiplicity creates problems of inconsistency between various rules. Moreover, frequent changes to the EU fiscal framework have created a perception that rules can be changed whenever convenient, hence undermining the credibility of the entire framework. Finally, efforts to increase flexibility—both inside and outside the EU—have resulted in countries moving from simpler to much more sophisticated rules with multiple clauses to allow thresholds to be adjusted in special circumstances. Such sophisticated rules have become difficult to implement, monitor, and communicate.

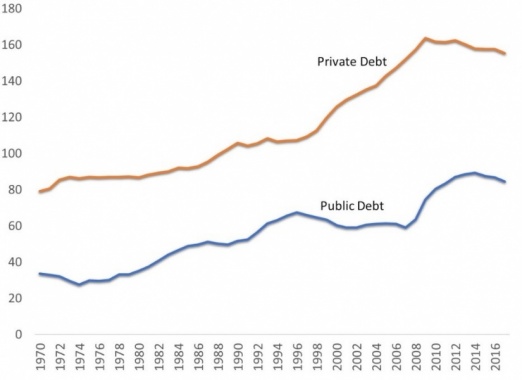

The current period of still solid growth is the right time to adopt important reforms, rather than in the midst of a crisis. Adopting the reforms that strengthen fiscal frameworks would support efforts to increase fiscal buffers and avoid accumulation of costly imbalances. Creating these buffers is important as public debt levels are elevated in many countries of the world. In EU countries in particular, public debt has risen substantially over the last fifty years (Figure 7). Private debt levels have climbed even more. High and rising private debt is an important source of vulnerability, as private liabilities often tend to migrate to the public sector either directly through bailouts or indirectly through fiscal stimulus in response to a private sector growth slowdown. Finally, going forward, population aging will impose additional fiscal burden on public finances. By 2050, aging will add 5 and 4½ percentage points of GDP to public spending in more and less developed countries, respectively (Clements and others, 2015).

Figure 7. Debt Levels in the European Union (in percent of GDP)

Source: IMF Global Debt Database, 2017.

The reforms of fiscal frameworks need to explicitly tackle political economy distortions created by complex fiscal rules. The emphasis should be to ensure that political incentives are well aligned with compliance. Without strong political incentives even the most sophisticated frameworks are doomed to failure. Making fiscal rules politically palatable would require fundamentally revising the incentive structure by establishing more credible sanctions and by creating more tangible benefits for compliers.

In addition to addressing the political economy dimension, reforms should tackle complexity. To paraphrase Albert Einstein, the objective of the reform should be to make rules as simple and as few as possible. In practice, this implies finding the right balance between flexibility and simplicity—i.e. constrain the discretion of policymakers while preserving the ability to respond to unanticipated shocks. This would make fiscal rules more transparent to the public and limit the scope for different interpretations. In the EU, simplifying the framework may require rethinking its overall structure, including consolidating the preventive and corrective arms and eliminating some redundant or ill-designed rules (Eyraud and Wu, 2015).

Striking a better balance between the objectives of flexibility and simplicity could be achieved by introducing a single fiscal anchor with a single operational rule. In the EU, this could include, for example, the public debt-to-GDP ratio as the anchor and an expenditure growth rule linked to the debt anchor, possibly with an explicit debt correction mechanism (Andrle and others, 2015). By placing a ceiling on expenditure but allowing revenue to fluctuate with the business cycle, expenditure ceilings allow most automatic stabilizers embedded in the budget to operate freely. As automatic stabilizers work both ways, expenditure ceilings avoid procyclicality in good times by preventing higher-than-expected revenues from being spent. Since an expenditure rule is simpler, it facilitates monitoring and public communication. However, because it does not cover the revenue side, an expenditure ceiling alone cannot ensure fiscal sustainability. This is why it must be linked to the debt anchor, such as with a debt correction mechanism to revise the expenditure ceiling when debt deviates from its desired path.

Andrle, Michal, John Bluedorn, Luc Eyraud, Tidiane Kinda, Petya Koeva-Brooks, Gerd Schwartz, and Anke Weber, 2015, “Reforming Fiscal Governance in the European Union”, IMF Staff Discussion Note 15/09.

Caselli, Francesca and Julien Reynaud, 2018, “Do Fiscal Rules Improve the Fiscal Balance? A new Instrumental Variable Strategy”, background paper to IMF staff discussion note 18/04.

Caselli, Francesca and Philippe Wingender, 2018, “Bunching at 3 Percent: The Maastricht Fiscal Criterion and Government Deficits”, IMF Working Paper 18/182.

Clements, Benedict, Kamil Dybczak, Vitor Gaspar, Sanjeev Gupta, and Mauricio Soto, 2015, “The Fiscal Consequences of Shrinking Populations”, IMF Staff Discussion Note 15/21.

Cordes, Till, Tidiane Kinda, Priscilla Muthoora, and Anke Weber, 2015, “Expenditure Rules: Effective Tools for Sound Fiscal Policy?”, IMF Working Paper 15/29.

Delors, Jacques, 1989, “Report on economic and monetary union in the European Community”, Presented April 17, 1989 (commonly called the Delors Plan or Report) By Committee for the Study of Economic and Monetary Union.

Diaz Kalan, Frederico, Adina Popescu, and Julien Reynaud, 2018, “Thou Shalt Not Breach, the Impact on Sovereign Spreads of Noncomplying with the EU Fiscal Rules”, IMF Working Paper 18/87.

Eyraud Luc, Xavier Debrun, Andrew Hodge, Victor Duarte Lledo and Catherine Pattillo, 2018, “Second-Generation Fiscal Rules: Balancing Simplicity, Flexibility, and Enforceability”, IMF Staff Discussion Note No. 18/04.

Eyraud, Luc, Vitor Gaspar, and Tigran Poghosyan, 2017, “Fiscal Politics in the Euro Area”, In Fiscal Politics, edited by V. Gaspar, S. Gupta, and C. Mulas-Granados, 439–76, IMF, Washington, DC.

Eyraud, Luc, Anja Baum, Andrew Hodge, Mariusz Jarmuzek, Young Kim, Samba

Mbaye, Samba and Elif Ture, 2018, “How to calibrate fiscal rules: a primer”, IMF How to notes no. 8.

Eyraud, Luc, and Tao Wu, 2015, “Playing by the Rules: Reforming Fiscal Governance in Europe”, IMF Working Paper 15/67.

Heinemann, Friedrich, Marc-Daniel Moessinger and Mustafa Yeter, 2018, “Do fiscal rules constrain fiscal policy? A meta-regression-analysis”, European Journal of Political Economy, Volume 51, January 2018, Pages 69-92.

International Monetary Fund, 2009, “Fiscal Rules—Anchoring Expectations for Sustainable Public Finances”, Policy Paper.

Lamfalussy, Alexandre, 1989, “Macro-Coordination of Fiscal Policies in an Economic and Monetary Union in Europe”, in Alexandre Lamfalussy Selected Essays, edited by Ivo Maes in cooperation with Gyorgy Szapary, Budapest.

Lledo, Victor, Sungwook Yoon, Xiangming Fang, Samba Mbaye, and Young Kim, 2017, “Fiscal Rules at a Glance”, IMF Background paper.

Mbaye, Samba and Elif Ture, 2018, “Do Fiscal Rules Improve the Fiscal Balance? A new Instrumental Variable Strategy”, background paper to IMF staff discussion note 18/04.

Sargent, Thomas, 2012, “United States Then, Europe Now”, Journal of Political Economy, 2012, vol. 120, no. 1.

This Policy Note is based on the presentation delivered by Vitor Gaspar at the Belgian Financial Forum in Brussels on November 27, 2018. The views expressed in this article are those of the authors and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

Key elements of the EU fiscal rules include: (i) deficit ceiling of 3 percent of GDP; (ii) public debt limit at 60 percent of GDP; (iii) country-specific medium-term objectives (MTOs) in cyclically-adjusted terms; (iv) annual adjustments toward MTOs; (v) debt reduction benchmark stipulating that the distance to the 60 percent threshold is to be reduced by 5 percent on average per year; and (vi) and expenditure benchmark.

These four rules include: the 3 percent of GDP nominal deficit ceiling, the 60 percent of GDP debt ceiling, the MTO in structural terms, and a benchmark fiscal effort of at least 0.5 percent per year in structural terms when structural balances are below MTOs or the country is under the EDP.

The fiscal rule strength index produced by the IMF (IMF, 2017) measures the following dimensions: broad institutional coverage, independence of the monitoring and enforcement bodies, legal base, flexibility to respond to shocks, existence of correction mechanisms and sanctions (for a description of the IMF fiscal rule index, see IMF, 2009). The index is equal to zero for countries without rules and ranks from 0.1 (poorly designed) to 1 (well designed) for countries with rules. Figure 2 shows significant skewness of the index, with an average strength index of 0.26 (Table 1), suggesting that there is still room for improvement in most countries.