The introduction of the Corporate Sector Purchase Programme by the ECB in March 2016 had a significant impact on the financing conditions and the external financing mix of the Spanish non-financial corporations, including not only the issuers of CSPP-eligible bonds, which are typically large companies, but also other smaller firms, which in general face tighter financial conditions. Regarding the former, during the month after the ECB’s announcement of the CSPP, the average yield of eligible bonds decreased significantly, also pushing up the flow of new corporate bond issuances. This expansionary effects of the programme also extended, although to a lesser extent, to others non-eligible bonds issued by non-financial corporations with credit ratings below investment grade. Interestingly, the ensuing contraction in banks’ loans given to firms issuing bonds had a positive side effect on the supply of new credit given to other companies that do not issue bonds, which are typically smaller and with limited access to fixed‒income markets. Thus, in this way, the ECB’s corporate QE unchained an indirect but powerful reallocation of credit in the banks’ loan books towards smaller firms.

On 10 March 2016 the Governing Council of the ECB added the CSPP to the set of sub-programmes comprising the Asset Purchase Programme (APP) in order to strengthen the pass-through of monetary policy to the financing conditions of the real economy.2 The set of bonds that are eligible for purchase under the CSPP comprises those marketable instruments accepted as collateral for Eurosystem liquidity-providing operations.3 These bonds must be denominated in euros with a credit rating of investment grade (BBB‑ or higher). The Eurosystem may purchase bonds on both the secondary and the primary markets.

Since they commenced in June 2016 until the end of 2017, purchases under the CSPP in the euro area as a whole have amounted on average to €7 billion per month (€132 billion in total) and represent around 10% of APP purchases. These purchases were distributed relatively evenly across sectors of economic activity.

Based on a recent working paper by Arce, Gimeno and Mayordomo (2018),4 we provide evidence on the direct effects of the CSPP on the bond market and illustrates a bond-loan substitution by large companies in Spain after the announcement of program, which can be interpreted as evidence of financial disintermediation, in the sense of a reduction in the relative weight of banks loans in the corporate sector’s financing mix. Then, we move onto the question of the indirect effects of the program on Spanish firms without access to the bond market, which benefited from a reallocation of credit. This last effect can be interpreted symmetrically as evidence of bank re-intermediation.

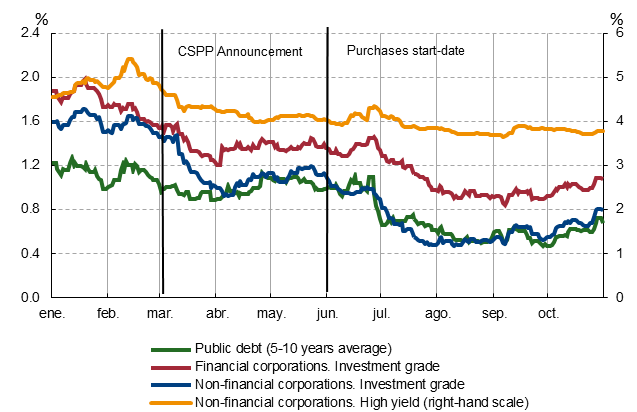

From the announcement of the CSPP in March 2016 until mid-April 2016, the average yield of the bonds eligible under this programme (those with an investment-grade credit rating) issued by Spanish non-financial corporations decreased by 44 basis points (bp) (see Figure 1). This took place against a background in which the interest rates on other long-term debt securities, such as long-term public debt or the Overnight Index Swap (OIS), scarcely changed, suggesting that the fall is largely explained by the CSPP.

The previous effect of the programme was not limited to CSPP-eligible securities, but rather it extended to others such as, in particular, bonds issued by non-financial corporations with credit ratings below investment grade (high-yield bonds), whose yields decreased by almost 50 bp from the announcement date to mid-April. The reason for this positive effect was, arguably, that investors responded to the lower yield on investment-grade bonds by seeking higher yield alternatives among assets with a lower credit rating, through the so-called portfolio channel. There is also evidence that the programme may have contributed to the fall in yields of bonds issued by financial firms, although in this case its effect seems to have been small.

Figure 1: Long term bond yields. Spain (a)

Source: Banco de España

a. Average yield is calculated as the weighted average of the yields of individual bonds issued in euro by each type of corporation from 2010, with a minimum amount of €10 million and maturity of more than five.

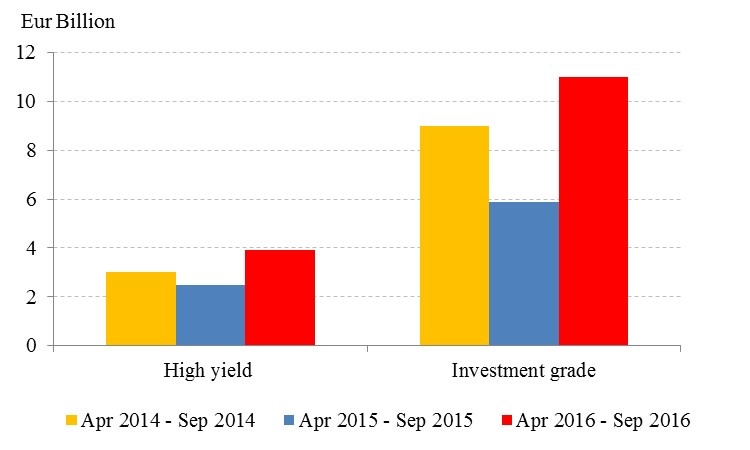

The favourable bond market conditions encouraged companies to issue bonds.5 Figure 2 shows that in the period April-September 2016, the gross amount issued by firms with CSPP-eligible bonds increased by 87% with respect to that in the same months of 2015 and stood above the levels of 2014. Although to a lower extent, firms with non-eligible bonds also raise their volume of issuances relative to the two preceding years. The available estimates indicate that, among the companies that could have issued CSPP-eligible bonds, there was a 31% increase in the probability of new issues during the quarter following the announcement. The propensity to issue bonds also increased in the case of other issuers, with a lower credit rating, by 6% in the same period.

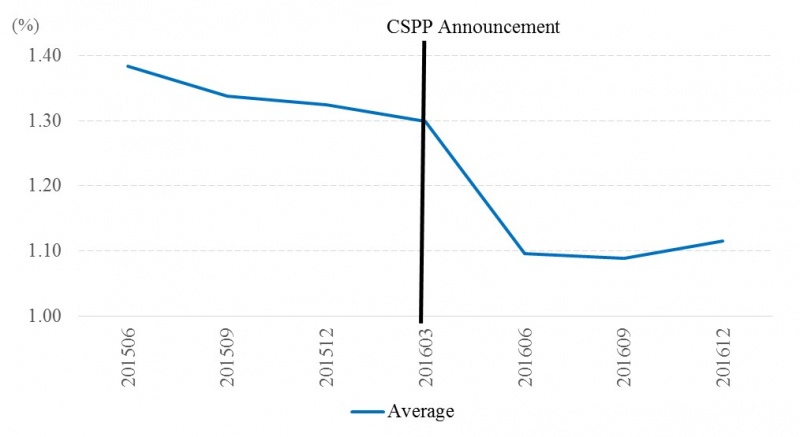

Importantly, the Eurosystem’s corporate bond purchases had effects that extend far beyond the issuers of the bonds purchased by the monetary authority. Arce, Gimeno and Mayordomo (2018) document that those firms increasing their volume of bond issuance as a result of the announcement of the CSPP used the funds raised, at least in part, to reduce their volume of bank credit (see Figure 3). Specifically, for each percentage point (pp) increase in the outstanding amount of bonds that companies issued between February and June 2016, they reduced their bank credit by 0.44 pp. Thus, non-financial corporations with bond-market access mainly took advantage of the announcement of the CSPP to modify the structure of their liabilities, replacing bank credit with bonds, and thereby profiting from the reduction in the cost of funding raised directly on the market.

Figure 2: Total gross bond issuance by Spanish non-financial institutions

Source: Arce, Gimeno and Mayordomo (2018)

Figure 3: Bank credit to debt-issuing firms (a)

Source: Arce, Gimeno and Mayordomo (2018)

a. Credit as % of total assets.

To assess the impact of the CSPP on bank credit at the aggregate level, the substitution of bonds for bank debt among issuing firms needs to be analysed in conjunction with the reaction of the banks most affected by the fall in the demand for credit from these firms. The results of this type of analysis suggest that those financial institutions that suffered the largest fall in the credit previously extended to issuing firms increased their lending to other non-issuing large companies more, but also – albeit to a lesser extent – their lending to SMEs.6 Arce, Gimeno, and Mayordomo (2018) find that this re-intermediation effect towards non-issuing firms amounted to €3.33 billion in the three months following the announcement of the programme. This amount represents 75% of the total decrease in bank credit due to the replacement of loans by bond market debt.

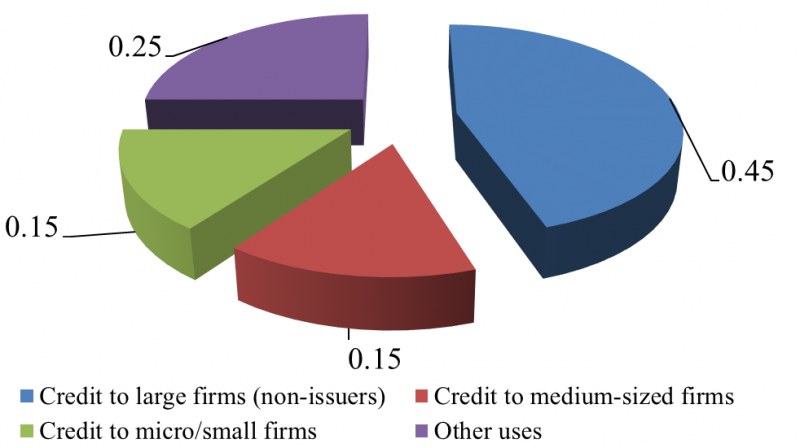

A breakdown of the above figure by borrower size shows that, on average, for each euro of decline in credit to firms that issued bonds following announcement of the CSPP, €0.45 were reallocated to large corporations, €0.15 to medium-sized firms and €0.15 to small and micro firms (see Figure 4). Expressed in terms of the balance of credit to these firms as a whole before announcement of the CSPP, the new credit reallocated to these three groups of firms represents an increase of 3.1%, 1.8% and 0.8%, respectively.

This re-intermediation of credit facilitated a large flow of real investment by those firms that directly benefited from it. In particular, the firms that benefited indirectly from new lending significantly raised their real investment, to the point that 20% of new investment in the quarter following announcement of the CSPP may be attributed to this programme. However, they abstained from significantly raising their liquidity holdings or dividend distributions.

Figure 4: Credit to firms given an outflow of one euro in the loan portfolio of large firms that are bond issuers (in cents)

Finally, the reallocation of credit towards smaller firms could have also been influenced by the extension of the targeted longer-term refinancing operations (TLTRO) that was announced after the same time as the CSPP. Under TLTRO-II, banks were able to borrow a total amount of up to 30% of the eligible part of their outstanding loans as of 31 January 2016, net of any amount previously borrowed under the previous TLTRO-I scheme and still outstanding at the time of the settlement of TLTRO II.7 Importantly, the TLTRO-II scheme specified that the interest rate paid a bank availing itself of this funding mechanism shall be a decreasing function of the volume of new credit granted by it. Thus, the interest rate applied to these loans will decrease from the 0% of main refinancing operations to the -0.4 % of the deposit facility if the requesting bank exceeds the credit target of 2.5% for 31 January 2018.

This way of determining the interest rate under the new TLTRO scheme means that banks which had already taken funds under the previous TLTRO-I programme had a strong incentive to grant new loans so as not to stray from the TLTRO-targets and thus benefit from the lower cost of funds available from the Eurosystem under this facility. This could have been naturally the case of those banks facing important cuts in their portfolio loan as a result of the launch of the CSPP. To explore this last possibility, Arce, Gimeno and Mayordomo (2018) investigate empirically whether banks relying more on TLTRO increased their lending to non-issuing firms to a higher extent than banks less dependent on TLTRO funding, for a given decrease in the flow of loans to issuing firms after the CSPP. Considering two hypothetical banks that have both experienced high credit outflows from bond issuers, one of which has used up 50% of its TLTRO limit, while the other has not taken up TLTRO funds, the results show that the former bank would increase its credit to a given firm on average by 17% after the announcement of the CSPP, whereas in the latter case this increase would be 9%.

Although the TLTRO did not cause by itself the previous reallocation of credit, the above result indicates that the CSPP-induced reallocation of credit was magnified by the simultaneous implementation of that program and the TLTRO-II. This constitutes one of the first pieces of evidence on synergies between unconventional monetary policy measures.

Óscar Arce, Director General of Economics, Statistics and Research; Ricardo Gimeno, Unit Head of Markets and Financial Intermediaries Analysis, at DG Economics, Statistics and Research; Sergio Mayordomo, Economist at the Macro-Financial Analysis and Monetary Policy Department, at DG Economics, Statistics and Research – Banco de España.

See Decision (EU) 2016/948 of the European Central Bank of 1 June 2016 on the implementation of the corporate sector purchase programme (ECBE/2016/16); http://eur-lex.europa.eu/legal-content/ES/TXT/?uri=CELEX:32016D0016.

See Guideline ECB/2014/60; https://www.ecb.europa.eu/ecb/legal/pdf/celex_02014o0060-20160125_en_txt.pdf.

Arce, Ó., Gimeno, R. and Mayordomo, S. (2018) “Making room for the needy: The credit reallocation effects of the ECB’s Corporate QE”, SSRN Working Paper 2996964; https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2996964.

33 companies made new issues during the six-month period following the announcement of the CSPP, of which 11 tapped the market for the first time (generally smaller groups than normal). This was twice the number of new issuers recorded during the six months prior to the announcement of the programme.

This analysis is based on individual data for companies and banks from the Banco de España Central Credit Register (CCR), and from the Central Balance Sheet Data Office, which provide information for more than 300,000 firms and for 500,000 bank-firm relationships.

Banks were given the opportunity to repay funds borrowed under TLTRO-I early, and switch to TLTRO-II funds. In fact, the vast majority of these funds were transferred to the TLTRO-II scheme. This shift of funds between the two TLTRO programmes was attractive because the second programme lengthened the maturity of funding provided by the ECB and lowered its cost.