The paper argues that at the euro’s 20 anniversary, it is a good time for the ECB to evaluate its framework, maintain what serves its objective well and adjust parts that may not quite meet the challenges of the future. We discuss three, without being exclusive, of the issues that the ECB should consider: whether it should target financial objectives, whether there is reason to increase the inflation target, and last whether those unconventional tools applied will remain and join the more conventional tool-kit in its hands.

Ten years after the start of the financial crisis, monetary policy makers are drawing a number of lessons. The Bank of Canada has recently decided to review the monetary policy framework it follows, ahead of the 2021 renewal of the inflation control agreement.1 The Federal Reserve Board in the US has recently also come to the same conclusion.2 Coming up to its twentieth anniversary, should the ECB also review its own framework (Clayes et al 2018)? In this paper we discuss three issues that could help guide this discussion in terms of what the new normal should be and how monetary policy should be organised to achieve its objectives.

Should monetary policy target financial imbalances. The crisis has demonstrated the very tight links between monetary policy and financial stability. Both our knowledge as well as the evidence have guided our understanding of how the two are related, how they complement each other and how they may jeopardise each other’s objectives. Based on our understanding of the literature we recommend that monetary policy does not target financial imbalances but instead aims at price stability only. At the same time there is value in coordinating with those that do target financial stability, primarily the macroprudential authorities.

Would a higher inflation target serve price stability better? The arguments that have been forward in support of raising the target is that it will help avoid long periods of low inflation or deflation better. So, proponents are not arguing for a change of the definition of price stability. Critics worry about the transition to this higher level: it is difficult to achieve 2%, how can we achieve an even higher? Also, what would it mean for the credibility of target and the anchoring of expectations. We will argue that while these criticismσ are valid the value of argument should not be judged on transitory issues. We feel that the main criteria with which to judge the merits of increasing the target is whether it achieves it purpose and increases the system’s resilience.

Last, we ask whether unconventional tools will join the tool-kits that Central Banks have in their hands. We will argue that they will, for two reasons. First, the interest rate, the main instrument to implement monetary policy is becoming increasingly ineffective. Second, it will take a long time for the unconventional measures taken to be removed, so Central Banks will have to reckon with their consequences even if they do not use them actively. At the same time, we feel that Central Banks need to analyse of merits of other untested tools, like helicopter money, in order to be prepared in the case they are used.

The global financial crisis reignited an earlier debate (Borio and White, 2004; Rajan, 2006) about whether monetary policy should target financial stability. We understand now better how the variables targeted by central banks and macroprudential authorities are significantly affected by each other’s actions. Monetary policy will affect financial stability, and the pursuit of financial stability will affect the ability of central bankers to fulfil their mandate.

Financial instability can have large negative feedback effects on price stability through a credit crunch, and also on the conduct of monetary policy itself, as the recent global financial and economic crisis demonstrated. When monetary policy is constrained by the zero-lower bound, decision-makers have to resort to unconventional tools with less-clear effects. Also, in the bust phase of the financial cycle, central banks will have to play the role of lender of last resort for solvent banks that face liquidity shortages. The EU Treaty makes price stability the primary mandate of the European System of Central Banks (ESCB, i.e. the ECB and national central banks)3, but it also requires the ESCB to “promote the smooth operation of payment systems”4 and to “contribute to the smooth conduct of policies pursued by the competent authorities relating to the prudential supervision of credit institutions and the stability of the financial system”5.

Therefore, should monetary policy directly target financial stability? Those who favour leaning against the build-up of financial imbalances with monetary policy instruments (Stein, 2014; Adrian and Liang, 2018, among others) find their argument strengthened by a growing body of empirical research, which shows that the policy rate affects bank risk-taking (Gersl et al, 2015; Dell’Ariccia et al, 2017). But their opponents argue that this does not necessarily justify an altered mandate for the monetary authority: why cannot financial market supervisors alone take care of financial stability risks (Svensson, 2014)?

Agur and Demertzis (2018) show that the monetary policy rate affects the bank’s risk decisions through two channels, profit and leverage, with countervailing effects. On the one hand, a higher rate pushes up the bank’s funding costs. This reduces its profitability and the bank then has less to lose from a risky strategy: when a deposit-insured bank has less own “skin-in-the-game” it is more inclined to consider the upside of risk only. This is the profit channel of monetary transmission to bank risk.

On the other hand, a higher policy rate makes leverage more expensive to the bank, which as a result would then opt for less debt funding. This means that the bank internalizes more of its risk taking and reduces the riskiness on its asset side. This is the leverage channel of monetary transmission to bank risk.

The cumulative effect of monetary policy on bank risk taking will depend on which of the two channels dominates. If it is the leverage channel that dominates, then the transmission confirms the results of the empirical literature: lower policy rates translate into higher risk.

What is interesting about this analysis is that monetary policy will affect financial stability, in this set-up through bank risk taking, differently depending on the side of the financial cycle at which we are. Thus, at the top of the cycle, an interest rate reduction will increase bank risk taking, but at the bottom of the cycle, when banks typically deleverage, it will reduce bank risk taking.

This suggests that the interest rate is not the right instrument to affect financial stability. However, we recognise that it does affect it and therefore optimal policy requires coordination between policy authorities (in this case monetary and macroprudential authorities).

In one of the last speeches that Fed Chair Janet Yellen6 gave before she left her position, she urged to rethink the issue of raising the inflation target to, say, 4%. Ms Yellen, asked for more research to be done to understand what this would achieve and at what cost.

In my view, there are three questions that we need to ask in order to understand what a higher inflation target would offer and also what the risks would be.

Does aiming for higher inflation avoid periods of disinflation more effectively? In my view, it does. This is the main argument put forward by Blanchard et al (2010), and reiterated by Janet Yellen. Having an inflation target at a slightly higher level would provide greater space for the interest rate to move before landing on the zero-lower bound, where it ceases to function. If the costs of falling prices are very high, then we must avoid the problem by overshooting in the other direction.

Is the objective of price stability better served by setting a higher target? Price stability is identified by an inflation rate below but close to 2%. By exploring the merits of increasing the target to 4%, I do not argue that the definition of price stability has changed; I just explore whether a higher target would avoid periods of very low inflation more effectively. What follows naturally in the argument, in my view, is that the inflation objective of 2% cannot be achieved in the policy horizon but has to be considered as an average over a longer period.

But there are important issues to consider here that relate to the possibility of implementing such a target. The success of revealing an inflation target is that it helps anchor expectations and thus build credibility (Demertzis and Viegi 2008). But, importantly, that target should also be consistent with price stability. Can we really talk about credibly committing to an inflation rate other than what is consistent with price stability? Doesn’t that risk de-anchoring expectations, eliminating the benefits of inflation targeting, and effectively jeopardising the central bank’s ability to control inflation?

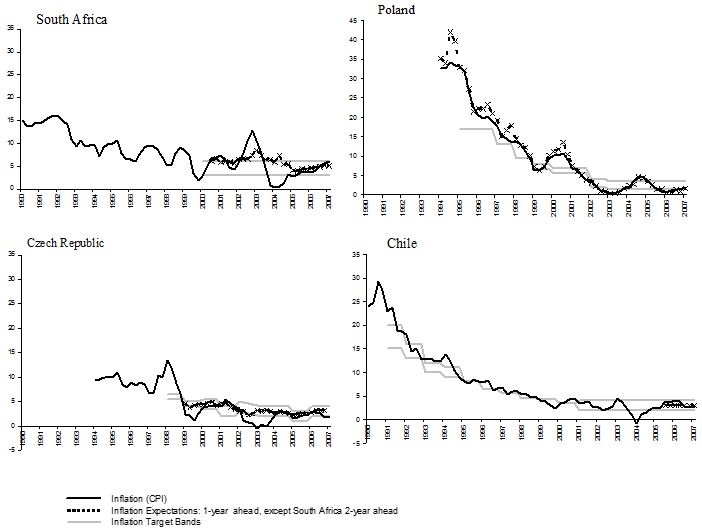

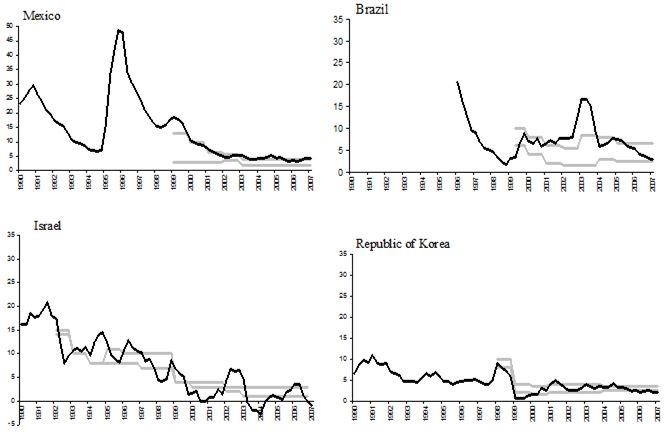

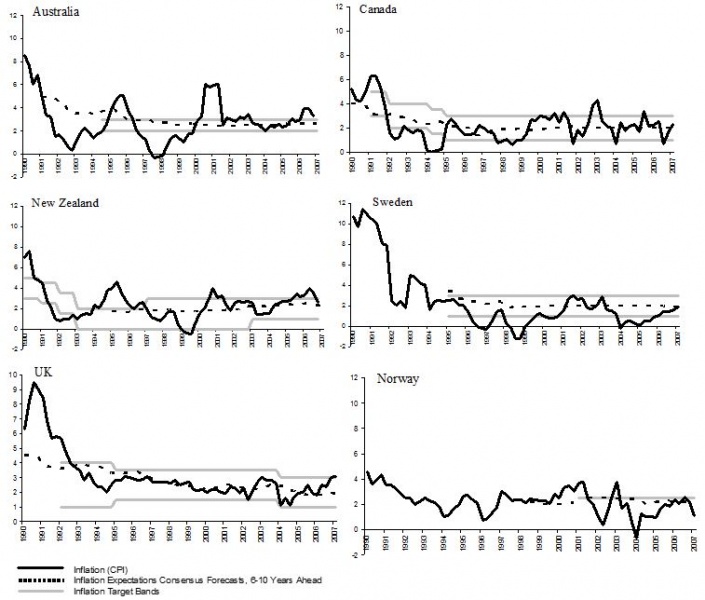

The variety of national experiences in the way they have adopted an inflation targeting regime is quite illustrative in this respect (Figure 1). Some countries that have had to bring inflation down from very high levels (Poland, Chile, Israel, Mexico and to lesser extent Canada and New Zealand) adopted inflation targeting in a step-wise manner. This meant changing the target (and the width of the tolerance band around it) in small consecutive steps. This was a way of making small but very concrete progress by demonstrating that they can indeed control inflation. Each time inflation fell, respective Central Banks reduced the target further, building up credibility along the way (Demertzis and Viegi 2010). Other countries (Australia, Sweden, UK and Norway) instead preferred to reduce inflation to the level consistent with price stability, before adopting (a)n (low) inflation targeting regime.

Figure 1: Inflation, long-term expectations where available and tolerance bands

Sources: Consensus forecasts and Central Banks sites

In my view, both approaches can work. It is a matter of communicating effectively what the new objective would aim to achieve. If this objective in the euro area is communicated as an effort to avoid very distortionary outcomes, then markets can learn to adapt to the new framework. Communication could then take the following form: while the objective of monetary policy is still to achieve 2% inflation, it will be assessed as an average over longer periods of time, not over the 2-year horizon as is currently. Aiming for 4% in the 2-year horizon, the argument goes, would help achieve 2% in the longer run.

So, if putting up with a higher inflation rate in “normal times” is sufficient to ensure avoiding the zero-lower bound, then, yes, the objective of price stability is better served. The target simply becomes an instrument for managing uncertainty in the medium term. And it is a more robust method as it avoids very distortionary outcomes more effectively. The remaining question then is how to decide by how much to increase the target. Is 4% sufficient, and in what sense can we talk about sufficiency? One answer provided in this respect (Ben-Haim and Demertzis 2008) is by moving away from “optimal” outcomes to a “good enough” outcome. Defining “good enough” is then very important. Concretely, policy makers would have to define the highest level of inflation that they would be prepared to tolerate as an objective in good times.

Can we manage the transition? There are important reasons why this might be difficult, the most obvious one being how to get to 4%. With the zero-lower bound difficult to escape from and core prices persistently low, what types of policies could realistically bring the system to this higher level of inflation, when even 2% is proving so difficult to attain? What size would QE have to take and could this harm banks and the financial system?

This difficulty becomes even more pertinent if one believes that the euro area economy is slowly moving into “secular stagnation”. If the new normal does involve lower levels of growth and interest rates, then a higher inflation rate may be difficult to justify. My view on the latter point is that so long as levels of debt (private and fiscal) remain as high as they are in the euro area, we should not attempt to answer this question. We shouldn’t therefore draw conclusions before the financial system becomes capable of generating credit that is convincing for sustainable growth.

Lastly, it is legitimate to ask whether the ECB, coming out of a very difficult 10-year period and still relying on unconventional instruments to perform its tasks, has sufficient standing to afford to change the “terms of the contract” it has signed with its “principal”.

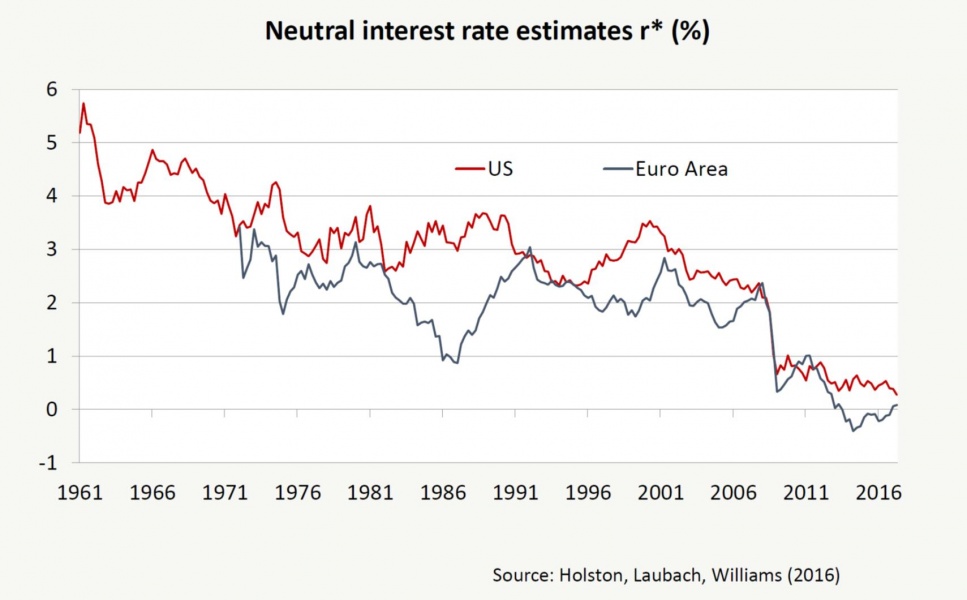

In aiming to understand the tools available to central banks, the first issue to note is that it might not be possible for the ECB to bring back its key interest rate to the average pre-crisis levels in the near future. Estimates of the neutral interest rate for the euro area in Holston, Laubach and Williams (2016) suggest a collapse after 2008 and point towards a negative value in recent years (Figure 2). If the neutral real rate were to stay around that level, even if inflation comes back to around the 2 percent target, the ECB main policy rate should be around 2 percent in steady state (ie when the output gap is 0), which would not give enough leeway to the ECB to cut rates in the next recession (see Clayes, 2016). If we look at the US, the average reduction of the Fed policy rate during the last nine recessions was equal to about 5.5 percentage points. This implies that episodes in which monetary policy is constrained by the zero-lower bound (ZLB) are likely to be more frequent and longer lasting, and that the ECB will need to rely much more on unconventional policies.

Figure 2: Neutral interest rate estimates r* (%)

In this environment, would it feasible to come back to the pre-crisis lean balance sheet? If the ECB does not want to change its inflation target, with low neutral rates, asset purchase will become increasingly one of the main ways to provide monetary policy accommodation. In that case, going back to the previous size of the balance sheet might not even be possible. As shown above, it would take 10 years to allow the balance sheet to shrink passively by half. But the probability of a recession in the euro area in the next decade is very high (on average since the 1950s, a recession has affected countries of the euro area approximately every seven years). In the meantime, it might therefore be better for the ECB to learn to live with large balance sheet and organise the conduct of its monetary policy accordingly.

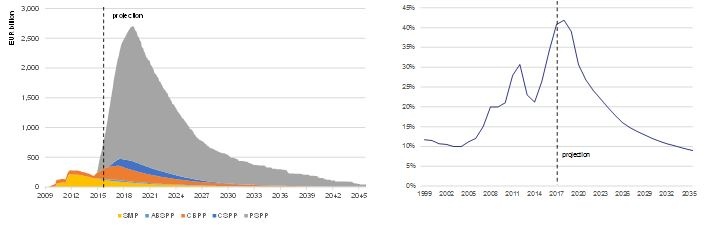

An important question is how long it will take to reduce the balance sheet to its original level. If the ECB ceased its reinvestments of principal repayments and passively let its asset holdings mature, it would take 30 years to clear all the assets from its balance sheet after the purchases end. However, according to our estimates (Figure 3, panel A), it could take approximately five years to reduce asset holdings by one half and 10 years to reduce them by 80 percent. More importantly (given that the size of central banks’ balance sheets has a tendency to grow with nominal GDP), it would take approximately 14 years for the balance sheet to go back to the pre-crisis situation (measured as a share of euro-area GDP).

Figure 3: Projection of ECB’s balance sheet and asset holdings

Source: Bruegel based on Bloomberg, ECB, Ameco. Note: Panel A: Monthly asset purchases are simulated on the basis of data provided by ECB at country/corporate bond level and outstanding bonds in September 2017. Redemption schedule according maturity date of invested bonds. Projections start in October 2017, for simplicity we assume that asset purchases stop in March 2019 after a gradual tapering starting in October 2018. We also assume that supranational bonds mature at the same rate as sovereign bonds; Securities Market Programme (SMP), ABSPP, CBPP3 mature at annual rate of 15 percent. Panel B: we use the Commission’s forecasts for growth and inflation for 2017 and 2018 and after that its long-term potential GDP forecasts and 2 percent inflation. We also assume MRO and LTRO levels to return to pre-crisis level, and other assets are constant at the September 2017 level.

In my view therefore, such instruments are now de facto part and parcel of the suit of tools at Central Banks’ disposal. As we begin to understand how these tools transmit to the rest o the economy and indeed the risk they might bring, Central Banks will have an ability to apply them more effectively. At the same time, it is useful to begin to evaluate the potential of other instruments and how they can add to the flexibility of monetary policy, like helicopter money. This would allow Central Banks to be better prepared in case those instruments were needed.

Monetary policy in the euro area will have to address two main issues in the future: uncertainty arising from things like the digital era and the changing nature (possible unravelling) of globalisation, and a rather complex (and changing) governance structure. Key ingredients will be the ability to adapt in real time to meet the challenges as they arise and indeed as our understanding about their ramifications increases.

The ECB will have to reconsider providing greater clarity where it can and retain greater flexibility where it needs it. Communication at the same, time will have to be less about things that are unknown and more about how policy is prepared for unknown outcomes in particular if those outcomes are very detrimental to welfare.

The change of leadership at the ECB in the near future provides a natural timing to re-examine the framework.

Adrian, Tobias and Nellie Liang, (2018). ‘Monetary Policy, Financial Conditions, and Financial Stability’, International Journal of Central Banking 14(1): 73-131.

Agur, Itai and Maria Demertzis, (2018). “Will Macroprudential policy Counteract the Monetary Policy Effects on Bank Behavior?” Bruegel Working Paper, No. 1.

Ben-Haim, Yakov and Maria Demertzis, (2008). Confidence in Monetary Policy, DNB Working Paper No. 192.

Blanchard, Olivier, Giovanni Dell’Ariccia and Paolo Mauro, (2010). Rethinking Macroeconomic Policy, IMF Staff Position Note, February 12, 03.

Borio, Claudio and William White, (2004). Whither monetary policy and financial stability? The implications of evolving policy regimes, BIS Working Paper No. 147.

Claeys, G., (2016). ‘The decline of long-term rates: bond bubble or secular stagnation symptom?’ Policy Contribution 2016/16, Bruegel

Clayes, Gregory, Maria Demertzis and Jan Mazza, (2018). “A Monetary Policy Framework for the European Central Bank to deal with Uncertainty”, European Parliament, In-Depth Analysis, Requested by the ECON Committee.

Dell’Ariccia, Giovanni, Luc Laeven, and Gustavo Suarez, (2017). “Bank leverage and monetary policy’s risk-taking channel: Evidence from the United States”, Journal of Finance 72(2), 613-654.

Demertzis, Maria and Nicola Viegi, (2008). “Inflation Targets as Focal Points”, International Journal of Central Banking, Vol. 4 No. 1, March, 55-8.

Demertzis, Maria and Nicola Viegi, (2010). “Inflation Targeting: a Framework for Communication”, B.E. Journal of Macroeconomics (Topics), Vol. 9, 1.

Gersl, Adam, Petr Jakubík, Dorota Kowalczyk, Steven Ongena, and José-Luis Peydró, (2015). Monetary conditions and banks´ behaviour in the Czech Republic, Open Economies Review 26(3), 407-445.

Holston, K., T. Laubach and John C. Williams, (2016). ‘Measuring the Natural Rate of Interest: International Trends and Determinants’, Working Paper Series 2016-11, Federal Reserve Bank of San Francisco.

Rajan, Raghuram G., (2006). Has finance made the world riskier? European Financial Management 12(4): 499-533.

Stein, Jeremy C., (2014). Incorporating financial stability considerations into a monetary policy framework, Speech at the Federal Reserve Board, Washington D.C., March 21, 2014.

Svensson, Lars E.O., (2014). “Inflation targeting and leaning against the wind“, International Journal of Central Banking 10(2), 103-114.

https://www.bankofcanada.ca/2018/11/bank-review-monetary-policy-framework-ahead-2021/

Article 127.1 of the Treaty on the Functioning of the European Union (TFEU)

Article 127.2 of the TFEU

Article 127.5 of the TFEU

https://www.marketnews.com/content/yellen-excerpt-still-highly-focused-2-inflation