Can political polarization have economic effects? Using three decades of survey data from 27 countries over, I show that distortions in subjective economic expectations are a systematic correlate of disagreements between politicians. Such distortions do not reflect only differences in either fundamentals or substantive beliefs about economic policy, but arise from the climate of hostility between partisan camps. These findings suggest a channel through which tensions unrelated to economics could translate into the economic sphere: conflicts over identities or cultural could accentuate the hostility between camps, affect economic perceptions, and potentially interfere with economic choices, policy preferences and policy communication.

Economists have increasingly become aware of political polarization. The rivalry between political camps seems to have contaminated an increasingly large number of discussions, including the response to COVID, climate change, or the causes of inflation. Interestingly, many of these disagreements do not seem to reflect economic policy preferences or beliefs. Instead, their root is in cultural or political identities whose link with economic matters is at best indirect. Could these disagreements interfere with the economic sphere?

In a recent working paper, I show (Guirola 2021) that this is indeed the case: when a society is more polarized, political identities generate hostility between political camps (‘affective polarization’) which extends to economic expectations.

Intuitively, polarization refers to a form of systematic disagreement (Baldassarri & Gelman 2008) where discussions systematically oppose the same two (or more) poles. Are all disagreements an expression of polarization? Not necessarily. Conflicting preferences and beliefs over multiple issues may rationally arise from heterogeneity in self-interest or information. However, when topics are logically unrelated – such as climate change, fiscal policy or gender inequality –, such heterogeneity should create different groups and coalitions. Such disagreements may be worrying, but are not systematic, and could be overcome by providing information or through compromises including side payments.

But imagine that the debate over fiscal stimulus opposes the same groups as the one over LGBTQ rights, which are in turn the same sides as those disagreeing on climate change. In that case, we may suspect that what divides citizens is not their opinion about the size of fiscal multipliers or their reluctance to pay for the debt bill. Instead, we would guess that their root is in deeper priors and values (‘ideology’) or group loyalties (‘identities’) over which compromise may be harder to achieve.

Polarization could have economic consequences through several channels. Firstly, citizens’ preferences and beliefs shape the incentives of their representatives, and thus could affect policies. Politicians will have little reason to compromise or debate rationally if their supporters perceive their opponents as evil. Instead, they will be rewarded for preaching to the choir and for justifying their lack of cooperation appealing (sometimes artificially) to ideology or fundamental value conflicts. This behavior could then produce policy gridlock, volatility or policy uncertainty, and have substantive economic effects (Fernandez-Villaverde et al. 2015).

The same is true for information supply. Politically segmented audiences will translate into increasingly partisan media and potentially biased information. This will not only reinforce the polarization in beliefs, but eventually distort economic choices. Citizens may, for example, tend to attribute the responsibility for economic phenomena, such as inflation (Andre 2021), to political opponents, even when these are out of their control; this may in turn push politicians to criticize central banks or take counterproductive measures.

Through these channels, disagreements in areas unrelated to economics (LGBTQ rights or national identity) could enter the economic arena – a phenomenon known as ‘conflict extension’ (Layman et al. 2002). These conflicts could trigger citizens’ distrust towards opponents, increase the partisanship of their information over the economy, and regard rival economic proposals as a threat.

Conflicts unrelated to economics could thus also undermine economists’ and central bankers’ best efforts to communicate with the public. Their advice could be seen as taking a political which may not only interfere with their communication strategy, but also pose a threat to their independence (Bianchi et al. 2019).

In the field of American politics, political polarization is one of the most studied and best-documented topics (see Barber et al. 2015 for a review). An extensive body of research has shown that American legislators have increasingly voted along partisan lines; that citizens’s vote and attitudes are increasingly predictable by their partisan identity; that its emergence is closely linked to the rise of cable news (Prior, 2013) and inequality; that polarization has resulted in higher economic volatility (Azzimonti & Talbert 2014) and it has also extended to the private sphere affecting consumption (Gerber Huber 2009, Benhabib & Spiegel 2019), investment (Azzimonti 2018) and even friendships and marriage behavior– the so-called ‘affective polarization’ (Iyengar et al. 2019).

The validity of these findings outside the American case remains, however, unclear. Many appeal to phenomena that are specifically American, such as its two-party and electoral systems, the exposure of its institutions to gridlock (Krehbiel 2010), the importance of cable news or racial and economic inequality. Many of the tools are hard to export to other countries’ contexts and are thus an important obstacle to the study of polarization as a global phenomenon with common economic implications. Only recently have several papers started to study polarization in a comparative perspective (Boxell & Gentzkow 2020, Gidron et al. 2020).

To look at the economic effect of polarization, my strategy focuses on its link with partisan bias in economic expectations across a large number of countries and contexts. Partisan bias is the impact of political partisanship on perceptions. It is well documented that supporters of the party in office tend to have substantially more optimistic views of the economy (Alesina et al. 2020, Bullock Lenz 2019). A polarized environment can bias information, accentuate the hostility between groups, and lead to biased perceptions, and it seems natural to see partisan bias as a correlate of polarization (Mian et al 2021).

Why, from all economic variables, focus on expectations to study the impact of polarization? Firstly, survey measures of economic expectations are by themselves interesting (Coibion & Gorodnichenko 2015). Their use in forecasting or in the study of firms and consumers’ behavior is widespread since they provide information about beliefs and economic fundamentals. Several papers have shown that expectations are subject to partisan bias, although a debate is open over whether partisan bias translates into consumer and investment behavior (Gillitzer & Prasad 2018, Benhabib & Spiegel 2019), or whether it is merely a form of measurement error (Mian et al 2021). In my own research, I have found that the translation of bias in expectations onto spending is likely to be imperfect.

Secondly, bias in perceptions provides a lower bound on how polarization affects views on economic policy. Conflicts over a fiscal stimulus reflect two type of disagreements: differences in beliefs over their effects (‘does fiscal stimulus reduce unemployment’?), and in preferences over these effects (‘where do you stand in the inflation-unemployment tradeoff’?). Political motivations would have a larger effect on the latter component, and thus differences in beliefs, as captured by expectations, can be seen as a lower bound on the sum.

Critically, focusing on economic expectations allows to overcome the methodological obstacles in the study of polarization. While partisan bias is an individual trait, polarization refers to the context of a particular society. Assessing the link between both thus requires to have variation in polarization across contexts. Questions on economic perceptions have routinely been asked within the context of multicountry surveys allowing to implement a specific identification strategy.

Once upon a time, social scientists were skeptical about the existence of partisan bias. Even if the correlation between political views and perceptions was present, differences in perceptions could reflect differences in fundamentals – economic circumstances, information, etc – between supporters of different parties. While controlling for observable characteristic – income, education, employment status – could help, unobserved differences in fundamentals could still drive the gap.

Recent research has, however, conclusively established the existence of partisan bias by looking at the change in perceptions happening with changes in the party in office (Gerber Huber 2009, Mian Sufi 2021). With cabinet-shifts, the fundamentals of the economy change. However, if agents change their perception driven by fundamentals, they should do it symmetrically. They may only update their perceptions in different directions if they are partisan. The change in the difference between their perceptions around a shift in cabinet thus can not be explained in terms of fundamentals and provides an estimate of partisan bias in that population.

To identify its magnitude, I rely on 134 events of cabinet shifts in 27 European countries over three decades. These events provides substantial variation in context and questions on economic perceptions and political identity have routinely been asked since the nineties between one and four times a year in the Eurobarometer, a large survey covering all European countries in a comparable way.

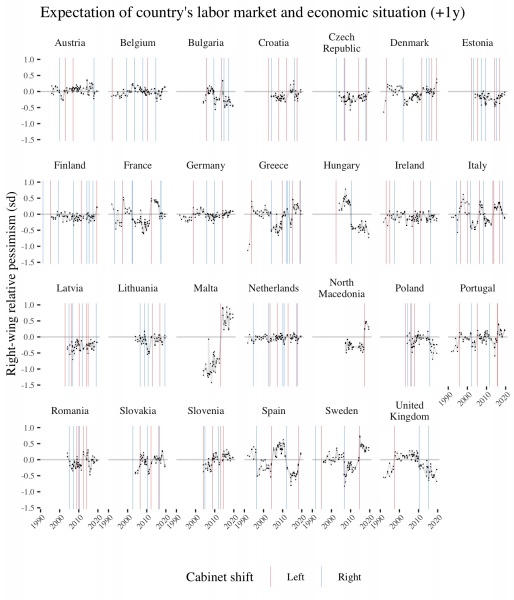

Figure 1.

Figure 1 provides a first idea of the results. The points illustrate the difference between citizens identifying themselves as left and right, conditional on multiple controls for education, age, employment status, etc. Vertical lines indicate moments when cabinet shifts take place, red when the shift is to the left, blue when the cabinet moves to the right. The existence of partisan bias is apparent from the discontinuity around cabinet shifts in most countries.

What is perhaps more interesting from figure 1 is that the magnitude of these jumps varies substantially across contexts. In certain countries, like Malta, a cabinet shift results in a gap in expectations of 1.5 standard deviations. In contrast, shifts in the Netherlands have a very symmetric effect on supporters of the left and the right. What could possibly explain these differences? My paper’s main contribution is to show that this variation can be explained by the context of polarization.

To measure the context of polarization, I rely on two indicators of disagreements between politicians. Firstly, I look at the left-right distance between the incoming and outcoming cabinet. This measure is based on expert ranking of where they locate a particular party on the left-right axis. Secondly, I consider how much politicians cooperate, comparing single party, coalition government, and bipartisan (including both left and right parties) coalitions shifts. These two measures provide an idea of the climate of disagreement existing in the country.

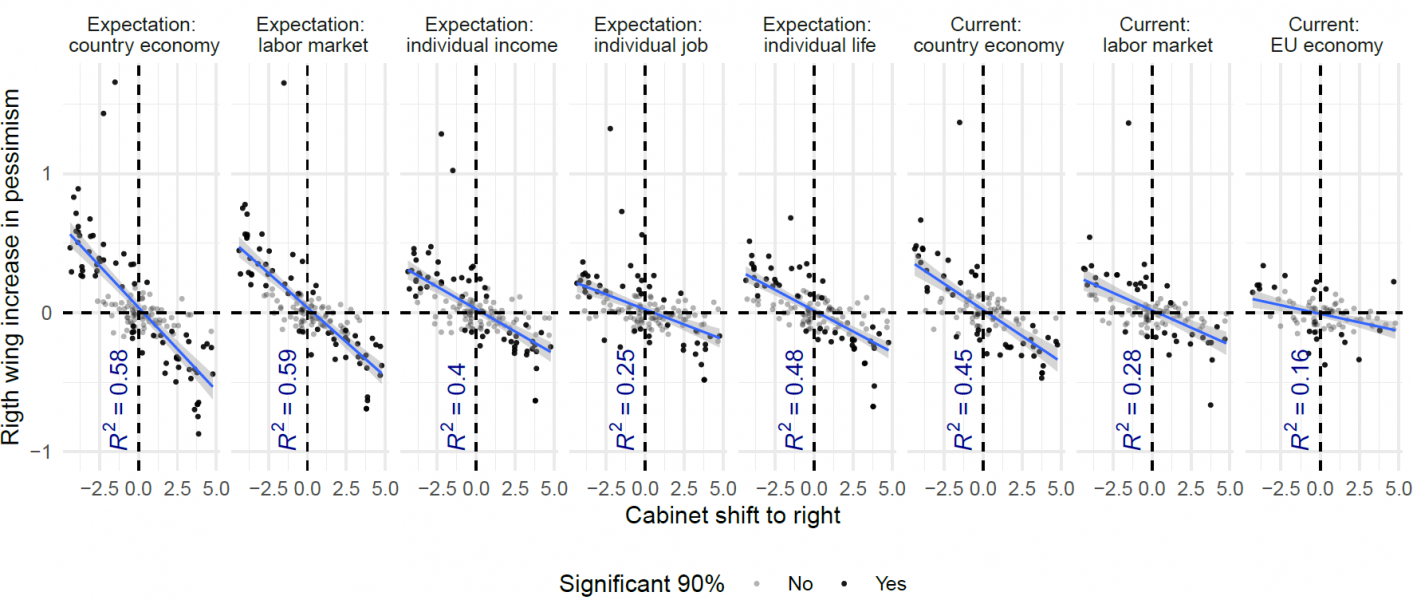

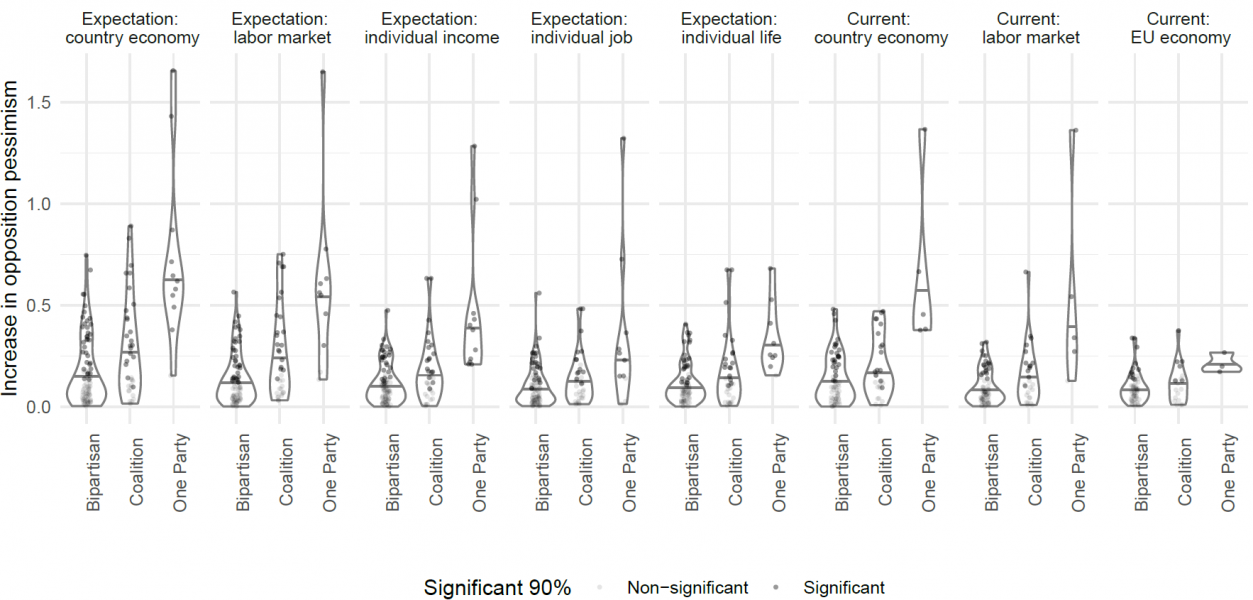

As shown in figure 2, the left-right distance can explain between one and two thirds of the estimated partisan bias in expectations of different items (situation of the country’s economy, of labor market, their own economic and labor market situations). The correlation is strong, and holds both between and within countries. Similar results are observable (figure 3) for measures of cabinet cooperation; countries where parties do not cooperate in coalitions exhibit a smaller size in the cabinet shift.

Figure 2.

Figure 3.

Does partisan bias reflect the interference of the political context into the economic sphere? One reason to worry about polarization is because conflicts whose origin is in the political sphere could contaminate the economy. These conflicts will increase the hostility and distrust towards opponents (affective polarization), increase the size of bias. and thus, interfere with discussions and choices. This is the issue of ‘conflict extension’.

The above findings do not necessarily imply conflict extension. An alternative interpretation is that left and right citizens simply anticipate different future economic policies by the incoming government, and they may have different priors over their effects. These priors may thus reflect their policy ideology rather than only fundamentals, but do not evidence any form of contagion from the political to the economic sphere. This could look more consistent with rationality, since voters would choose their party based on who they think will do a better economic job, and they may legitimately differ in that dimension.

To assess which of these two hypotheses makes more sense, I conduct two tests. Firstly, instead of relying on the distance between cabinets on the left-right axis to measure polarization, I decompose this dimension between economic policy and ‘social’ issues (such as immigration, gender equality, etc.), also based on expert scores. Although these two stances typically correlate across parties, when the economic policy dimension is taken into account, polarization on the second dimension still has a substantial effect.

Secondly, I look at perceptions that, unlike expectations, are not affected by the future policy of the government. I thus look at perceptions of the state of the EU economy, the current economic situation. As shown in figure 2 and 3, while significantly lower, partisan bias is still present in these measures, and exhibits the expected correlation with polarization.

Jointly, these findings suggest that polarization can affect the economy. While most of the research on the topic has concentrated in the United States, my findings suggest that distortions in subjective economic expectations are a systematic correlate of disagreements between politicians. They show, in addition, that conflicts unrelated to the economy can extend into the economic sphere by increasing the hostility between political camps.

An implication of these findings is that what we measure from economic expectations is different in polarized and non-polarized contexts. In less polarized contexts, expectations may reflect fundamentals, such as rising prices. In a polarized context, subjective expectations are much more likely to reflect political identities. This deviation from fundamentals should affect how policy makers interpret change in expectations, which will critically depend on whether it translates into behavior. This is a challenge for future research, and for that, expectations surveys should include variables allowing to measure and control for the influence of political identity.

What is safe to say is that a context of intense polarization can contaminate how the state economy is perceived and discussed. Even when polarization results from disagreements unrelated to economic policy, the hostility between political camps will translate into economic perceptions and policy preferences. Depending on institutions, these may affect policy outcomes.

The extension of conflict beyond the economic sphere can also affect the efforts that societies make to isolate institutions – such as Central Banks – and debates – the causes of inflation – from political conflict. This is, in fact, one of the topics of my ongoing research. Through a similar research design, I show that cabinet-shifts affect citizens trust in state institutions. Partisan shifts are proportional to the degree of polarization and do not only affect those that are controlled by the party in office, but also courts, European institutions and the European Central Bank. This suggests that even when these institutions try to be perceived as neutral, the context of polarization may undermine this effort.

How can societies ovecome the negative effects of polarization? My findings suggest that the size of partisan bias is smaller in institutional contexts favoring the agreement of multiple parties. While the causal direction of this finding is unclear (perhaps such agreements only emerge when the public is less biased), this suggests that political elites could actually reduce the size of polarization.

That the cooperation between politicians could create a climate of mutual political understanding is a tempting conclusion when we look at the last two decades of German politics. As I show in another part of my research, in the aftermath of the 2005 election, the country entered an era of bipartisan coalitions. Due to quasi-random variation around the minimal threshold for parliamentary representation, the conservative party was constrained to shift in 2013 from its previous and arguably preferred coalition partner (the liberals) to its second-best option (the social-democrats). These shifts were paralelled by shifts in the size of partisan differences in economic perceptions, thus suggesting that the action of politicians can indeed affect the size of bias.

Alesina, A., Miano, A., & Stantcheva, S. (2020, May). The polarization of reality. In AEA Papers and Proceedings (Vol. 110, pp. 324-28).

Andre, P., Haaland, I. K., Roth, C., & Wohlfart, J. (2021). Inflation Narratives. CEBI, Department of Economics, University of Copenhagen.

Azzimonti, M., & Talbert, M. (2014). Polarized business cycles. Journal of Monetary Economics, 67, 47-61.

Baldassarri, D., & Gelman, A. (2008). Partisans without constraint: Political polarization and trends in American public opinion. American Journal of Sociology, 114(2), 408-446.

Barber, M., McCarty, N., Mansbridge, J., & Martin, C. J. (2015). Causes and consequences of polarization. Political negotiation: A handbook, 37, 39-43.

Benhabib, J., & Spiegel, M. M. (2019). Sentiments and economic activity: Evidence from US states. The Economic Journal, 129(618), 715-733.

Bianchi, F., Kind, T., & Kung, H. (2019). Threats to central bank independence: High-frequency identification with Twitter (No. w26308). National Bureau of Economic Research.

Boxell, L., Gentzkow, M., & Shapiro, J. M. (2020). Cross-country trends in affective polarization (No. w26669). National Bureau of Economic Research.

Coibion, O., & Gorodnichenko, Y. (2015). Information rigidity and the expectations formation process: A simple framework and new facts. American Economic Review, 105(8), 2644-78.

Fernández-Villaverde, J., Guerrón-Quintana, P., Kuester, K., & Rubio-Ramírez, J. (2015). Fiscal volatility shocks and economic activity. American Economic Review, 105(11), 3352-84.

Gerber, A. S., & Huber, G. A. (2009). Partisanship and economic behavior: Do partisan differences in economic forecasts predict real economic behavior?. American Political Science Review, 103(3), 407-426.

Gidron, N., Adams, J., & Horne, W. (2020). American affective polarization in comparative perspective. Cambridge University Press.

Gillitzer, C., & Prasad, N. (2018). The effect of consumer sentiment on consumption: Cross-sectional evidence from elections. American Economic Journal: Macroeconomics, 10(4), 234-69.

Guirola Abenza, L. M. (2021). Does political polarization affect economic expectations?: Evidence from three decades of cabinet shifts in Europe. Documentos de Trabajo/Banco de España, 2133.

Iyengar, S., Lelkes, Y., Levendusky, M., Malhotra, N., & Westwood, S. J. (2019). The origins and consequences of affective polarization in the United States. Annual Review of Political Science, 22, 129-146.

Layman, G. C., & Carsey, T. M. (2002). Party polarization and” conflict extension” in the American electorate. American Journal of Political Science, 786-802.

Mian, A., Sufi, A., & Khoshkhou, N. (2021). Partisan bias, economic expectations, and household spending. The Review of Economics and Statistics, 1-46.

The views expressed in this policy note were developed as part of Luis Guirola‘s research agenda, and do not reflect those of the Banco de España or the Eurosystem.