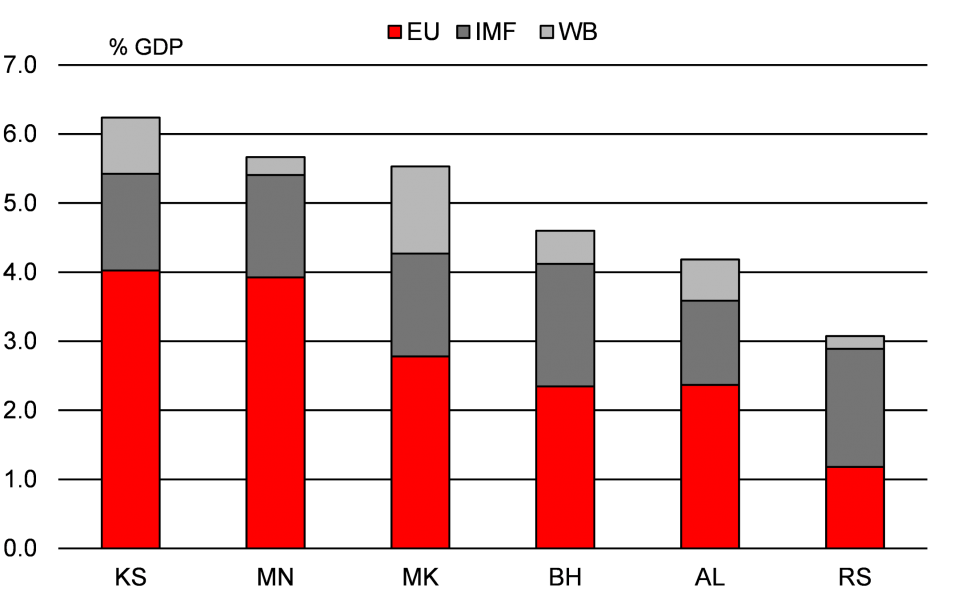

The Western Balkans1 are not EU members yet and thus cannot access significant EU funding available through SURE, ESM, NGEU and MFF2 to deal with the COVID-19 emergency and support a recovery. However, the Western Balkans benefit from access to funding for the public sector from official external sources: the EU, the IMF, the World Bank and foreign governments. Official funding available for the COVID-19 emergency (the immediate needs) is similar in size to that available to most EU-CEE countries, ranging from 3.1% to 6.2% of the recipient nation’s GDP. The EU is the largest contributor in this regard. On average3, close to 60% of these funds are provided by the EU, around 30% by the IMF and around 10% by the World Bank. The Western Balkans have access to less funding for their medium-term recovery compared to most EU-CEE countries. The EU remains the Western Balkans’ main source of financing.

The governments of EU member states have significant EU funding available to deal with the COVID-19 emergency and to support their recovery: SURE, the ESM’s Pandemic Crisis Support, the NGEU (including the Recovery and Resilience Framework [RRF]) and the EU budget, or multiannual financial framework (MFF).

SURE and the ESM’s Pandemic Crisis Support focus on the emergency4 (immediate needs related to the pandemic), and we estimate funding could range between 2.4% and 4.2% of recipient countries’ GDP in EU-CEE5.

NGEU and the MFF are meant to support medium-term recovery6, and available funding is very high for EU-CEE countries. According to our estimates, total resources available from NGEU and the MFF could range from 12.7% of average 2021-27 GDP for Czechia to around 38.9% of average 2021-27 GDP in Croatia.

The Western Balkans7 are not EU members yet and thus do not have access to these funding sources. Albania, Montenegro, North Macedonia and Serbia are EU member-state candidates, which means that they have started, or are about to start, accession negotiations. Bosnia and Herzegovina and Kosovo are currently potential candidates and could start accession negotiations once some requisites are in place.

In this note, we try to measure how much external official funding is available for the Western Balkans to deal with the COVID-19 emergency and to support their recovery.

We focus only on loans and grants to the public sector. While support granted to the private sector is also very important, we want to measure the amount of such cash that has been made available to governments.

We have limited our analysis to official external funding, in particular, EU institutions, the IMF, the World Bank and foreign governments. Official funding is of particular importance for these countries given their limited access to financial markets. In addition, we want to compare such funding with EU resources that have been made available to EU-CEE countries.

We look at two dimensions: 1. funding set aside to deal with the COVID-19 emergency (to address immediate needs). We use a broad definition of emergency, which refers to both funds set aside to cover health-related expenses and those allocated to supporting the initial phase of a recovery; 2. funding set aside to support the medium-term recovery.

The EU provides close to 60% of funding…

The EU has provided a significant amount of funding to deal with COVID-19 emergency. First, in May 2020, the EU announced a support package for the Western Balkans worth EUR 3.3bn8. The package is a mix of loans, grants, guarantees and other instruments to support the public and private sectors. It also includes other measures, such as the possibility to join the Joint Procurement Agreement, procedures to address information sharing on COVID-19 and other measures. Second, the Western Balkans also have the possibility to access the EU Solidarity Fund, which we assume could provide around EUR 140mn to the region. Third, the Council of Europe Development Bank (CEB) has provided a total of EUR 275mn in loans to some countries. Altogether, these three components equate to total available COVID-19 support of EUR 3.7bn.

For the purpose of our analysis, we focus only on grants and loans to the public sector. We estimate this amounts to around EUR 2.1bn of the total EUR 3.7bn. This includes funding from the following sources9:

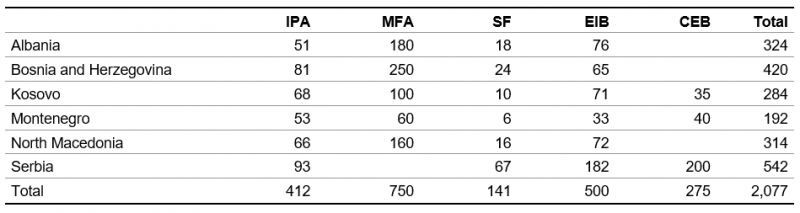

Tables 1 and 2 show the various types of funding and the related amount by country, both in euros and as a percentage of GDP.

Table 1: EU funding available (EUR mn)

Table 2: EU funding available (% GDP)

Source: European Commission, EIB, CEB, UniCredit Research

The lower level for Serbia reflects the fact that Serbia was not part of the group of countries entitled to the EU macro-financial assistance, which accounts for 30-55% of total EU funds for the other countries, as it did not apply for IMF funding. In addition, the lower IPA 2014-20 resources as a percentage of GDP probably reflects the greater size of the economy (46% of total GDP of the Western Balkans).

…the IMF provides 30%…

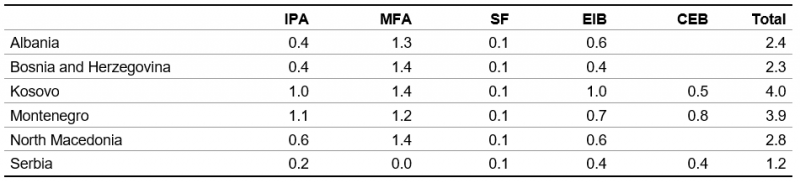

The IMF provided the second largest amount of funding to deal with the COVID-19 emergency, on average10, around 10% of total external official funding for the public sector in the Western Balkans. Under the IMF’s Rapid Financing Instrument (RFI), an amount equal to 100% of the country quota per year can be disbursed for COVID-19 emergency assistance. With the exception of Serbia, Western Balkan countries applied for and obtained this funding (Kosovo obtained 50% of the quota).

The table below shows the amount available in euros and as a percentage of GDP by country, assuming 100% of the quota.

Table 3: IMF funding available through RFI

Source: IMF, UniCredit Research

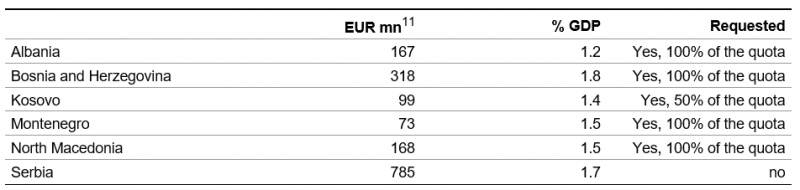

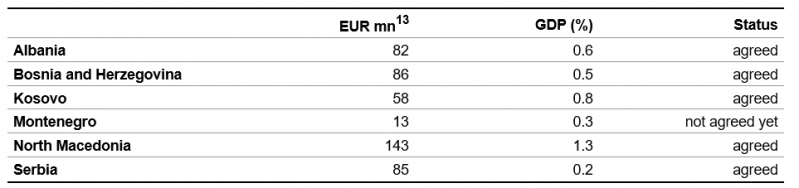

…and the World Bank the other 10%

The World Bank is the third source of financing. On average12, the World Bank provided around 10% of total external official funding for the public sector in the Western Balkans, with North Macedonia receiving a higher share than the other countries (23%). We include the funding committed by the World Bank for the purpose of addressing the needs related to COVID-19, namely those provided under the COVID-19 Response Project. This is an underestimate of the total amount provided as in various countries the World Bank re-oriented some previous projects to the COVID-19 emergency. This reallocation is not included in our figures.

The table below shows the amount in euros and as a percentage of GDP.

Table 4: World Bank funding

Source: World Bank, UniCredit Research

No new funding officially available from foreign governments

There is no information available regarding new funding provided by foreign governments, either in official data or in press reports, therefore we assume this to be zero. While some countries with geopolitical and economic interests in the region, such as China and Russia, provided some medical aid, they did not provide actual funding.

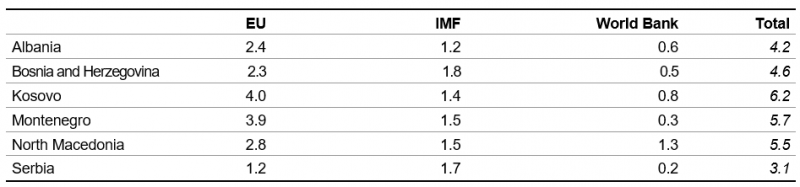

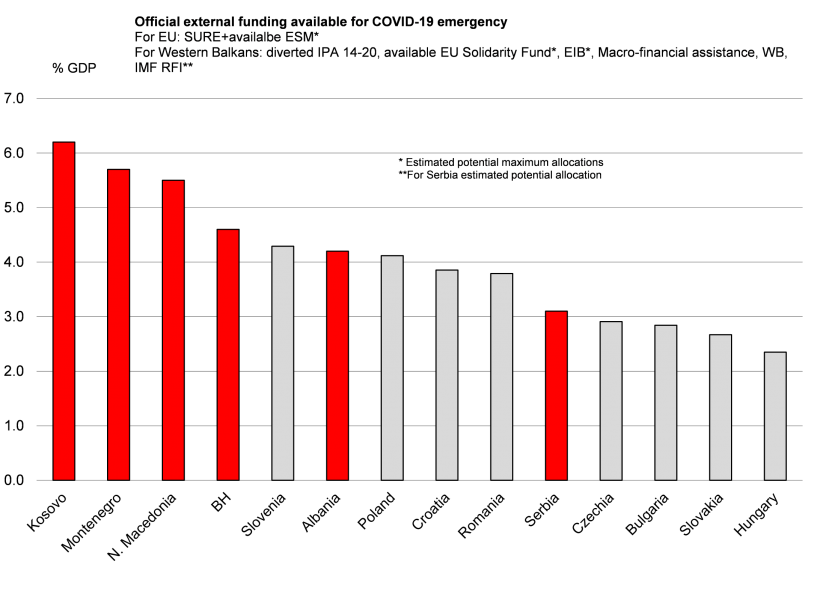

Table 5 shows the breakdown of funding for emergency needs described in the previous section into EU, IMF and World Bank and the combined total. Available funding ranges from 3.1% of GDP in Serbia to 6.2% of GDP in Kosovo.

Table 5: Total funding available for emergency (% GDP)

Source: European Commission, EIB, CE, IMF, World Bank, UniCredit Research

How does the funding received by the Western Balkans compare with the funding available for EU-CEE countries?

For EU-CEE we only consider the amounts approved from SURE and the amounts available from the ESM Pandemic Crisis Support. While some EU-CEE countries have tapped some funding from the World Bank, they are unlikely to draw funds from the IMF.

Chart 1 shows the funding available for Western Balkans (red bars) and EU-CEE (grey bars) as a percentage of GDP. For the Western Balkans it is similar and in some cases higher than for EU-CEE countries.

Chart 1: Official external COVID-19 emergency funding available

Source: EU, IMF, World Bank, UniCredit Research

The EU is providing the strongest support to the Western Balkans, as shown in Chart 2. These amounts could increase for all countries if the adverse economic effects of the pandemic extend further into 2021.

Chart 2: Total funding for COVID-19 emergency by source

Source: EU, IMF, World Bank, UniCredit Research

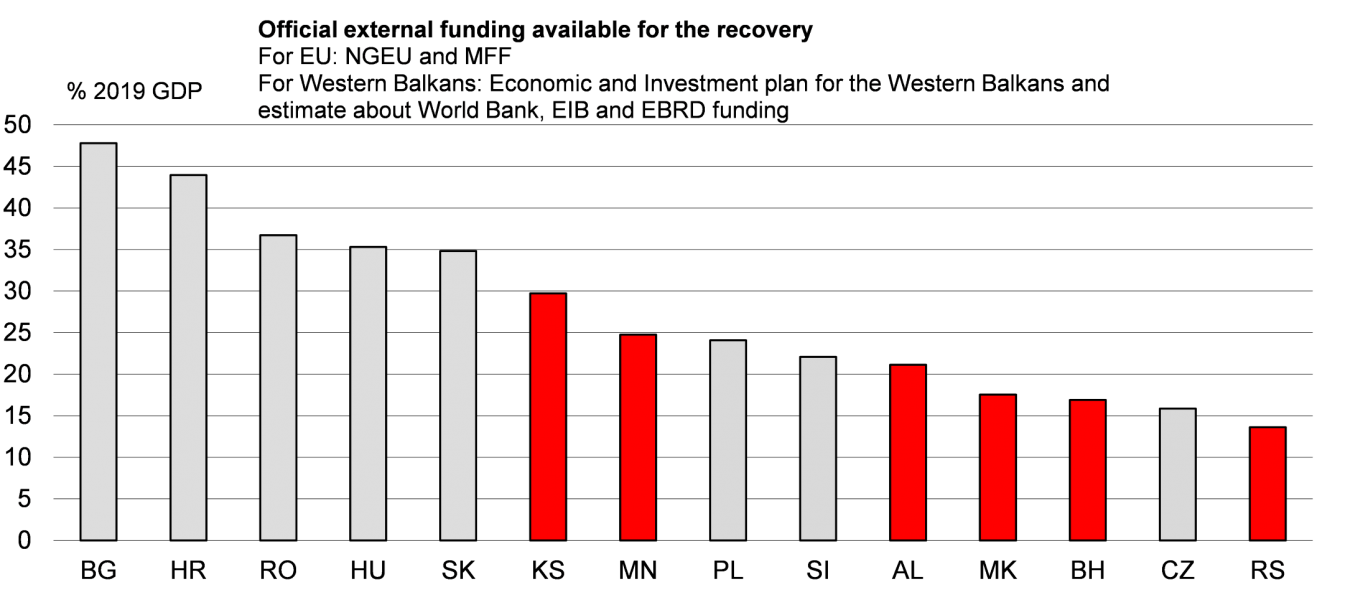

While the Western Balkans can tap similar emergency funding to that of EU-CEE to fight the pandemic, in the medium term, EU-CEE benefits from more significant support under the EU’s financing schemes.

For the Western Balkans, we consider the funding available through the EU Economic and Investment Plan (EIP). The EIP amounts to EUR 9bn of grant funding from the IPA III for the period 2021-27 to finance investment initiatives. There is no country breakdown available for the EIP, therefore, we estimate the country allocations using the proportions allocated in the IPA 2014-20. According to our estimates, funding could range from 7% to 18% of 2019 GDP, therefore a significant amount.

It is important to highlight that this funding has some conditionality. The implementation of the plan goes together with the implementation of reforms that will be jointly agreed under the Economic Reform Programmes and recommended in the annual Enlargement Package. In addition, progress on the rule of law will be central.

While EU financing is likely to remain the most relevant in terms of size, the Western Balkans are expected to benefit from additional funding from other international financial institutions, such as the World Bank, the European Bank for Reconstruction and Development, and the European Investment Bank. In the past five years, on average, this funding has ranged from 1.1% to 2.2% of 2019 GDP per year depending on the country14.

For our analysis we consider six years of this funding to have a timeframe comparable to that of RRF (2021-26), therefore funds could amount to between around 6% and 13% of GDP depending on the country. Clearly this is a rough approximation, but it is simply meant to provide an indicative gauge15.

For EU-CEE, countries we include funding from RRF (2021-26) and the MFF (2021-27). Chart 3 shows total EU funding available for the Western Balkans (red bars) and EU members (grey bars) as a percentage of 2019 GDP. Western Balkans have less available funding for the medium-term recovery compared to most EU-members. As for the COVID-19 emergency, the EU remains the main source of funding, accounting for around 50% of the total.

Chart 3: Funding available for the recovery

Source: EU, UniCredit Research

In summary:

The process of EU accession could bring additional EU funding, contribute to increasing access to debt markets, and strengthen economic resilience.

The new EU accession process envisages the possibility to gradually benefit from additional EU funding in return for progress on the implementation of reforms, which could be an attractive opportunity to obtain additional resources for the medium-term recovery.

Progress on EU accession will also improve credibility and help Western Balkan countries to tap debt markets. Serbia’s experience shows that countries with a EU accession roadmap can benefit from declining yields and longer maturities.

In addition, as the process of EU accession continues, deeper economic integration between the Western Balkans and their EU neighbors will contribute to strengthening their economic resilience. In this respect, the agreement in November on an action plan to develop a Common Regional Market in the Western Balkans that builds on EU rules and standards is a very positive development as it could contribute to bringing the economies closer to the EU internal market.

Annex: data sources

EU funding

EU support package for the Western Balkans

https://www.consilium.europa.eu/media/43776/zagreb-declaration-en-06052020.pdf

Funding reallocated from the Instrument for Pre-Accession Assistance 2014-20

Albania:

https://ec.europa.eu/neighbourhood-enlargement/sites/near/files/near_factograph_albania_october_2020.pdf

Bosnia and Herzegovina:

https://ec.europa.eu/neighbourhood-enlargement/sites/near/files/near_factograph_bosnia_and_herzegovina_october_2020.pdf

Montenegro:

https://ec.europa.eu/neighbourhood-enlargement/sites/near/files/near_factograph_montenegro_october_2020.pdf

North Macedonia:

https://ec.europa.eu/neighbourhood-enlargement/sites/near/files/near_factograph_north_macedonia_october_2020.pdf

Macro-financial assistance

https://ec.europa.eu/commission/presscorner/detail/en/ip_20_1457

Solidarity Fund

https://ec.europa.eu/regional_policy/en/funding/solidarity-fund/covid-19

World Bank funding

World Bank COVID-19 response

https://www.worldbank.org/en/about/what-we-do/brief/world-bank-group-operational-response-covid-19-coronavirus-projects-list

Bosnia and Herzegovina:

https://projects.worldbank.org/en/projects-operations/project-detail/P173809

Kosovo:

https://projects.worldbank.org/en/projects-operations/project-detail/P173819

IMF funding

https://www.imf.org/external/np/fin/tad/exfin1.aspx

|

UniCredit Research – Legal Notices Glossary Disclaimer Responsibility for the content of this publication lies with: UniCredit Group and its subsidiaries are subject to regulation by the European Central Bank a) UniCredit Bank AG (UniCredit Bank, Munich or Frankfurt), Arabellastraße 12, 81925 Munich, Germany, (also responsible for the distribution pursuant to §85 WpHG). ANALYST DECLARATION POTENTIAL CONFLICTS OF INTERESTS RECOMMENDATIONS, RATINGS AND EVALUATION METHODOLOGY ADDITIONAL REQUIRED DISCLOSURES UNDER THE LAWS AND REGULATIONS OF JURISDICTIONS INDICATED |

We use the definition of the European Commission, which includes Albania, Bosnia and Herzegovina, Kosovo, Montenegro, North Macedonia and Serbia. As explained by the European Commission, the designation Kosovo is “without prejudice to positions on status, and is in line with UNSCR 1244/1999 and the ICJ Opinion on the Kosovo declaration of independence” (https://ec.europa.eu/info/research-and-innovation/strategy/international-cooperation/western-balkans_en). We report it separately, in line with the European Commission’s official designation.

NGEU= New Generation EU; SURE=The European instrument for temporary Support to mitigate Unemployment Risks in an Emergency; MFF=Multi-Annual Financial Framework; ESM=European Stability Mechanism Pandemic Crisis Support;

Simple average of countries’ shares.

For more details please see: https://www.consilium.europa.eu/en/press/press-releases/2020/09/25/covid-19-council-approves-87-4-billion-in-financial-support-for-member-states-under-sure/ and https://www.esm.europa.eu/content/europe-response-corona-crisis

Bulgaria, Czechia, Croatia, Hungary, Poland, Romania, Slovakia and Slovenia.

For more details please see: https://www.consilium.europa.eu/media/45109/210720-euco-final-conclusions-en.pdf

See footnote 1.

https://www.consilium.europa.eu/media/43776/zagreb-declaration-en-06052020.pdf

See the Annex for details on the data sources

Simple average of countries’ shares.

The EUR amounts are calculated based on the original amount in SDR.

Simple average of countries’ shares.

The EUR amounts are calculated by applying the current EUR-USD exchange rate to the amounts published in USD.

These figures are our estimates based on the financing of projects by the various institutions. It includes all World Bank projects. For the EIB it includes direct financing related to large public infrastructure projects, therefore it does not include the financing to the private sector through banks, which is substantial. For the EBRD it includes all financing for public sector projects, therefore it does not include financing to the private sector, which is substantial. The data report the value of the agreed loan in a particular year but disbursement could take place over several years.

Averages are based on the funding agreed in a particular year, while disbursements typically take several years. As these countries develop further, IFI funding could diminish as a percentage of GDP.