The populist narrative hinges on the feeling of frustration with the current Situation. This SUERF Policy Note focuses on financial inequality, populism and central bank independence, shedding light on the relationships between aggrievement in the electorate and large financial inequality, the advancement of populist parties and the risk that myopic policies are going to be adopted. In such a situation a populist policy that promotes a politically controlled central bank – that is perceived as a technocratic elite – it is more likely to occur.

Is the Populism Wave going to hit the Central Bank Independence Rock?

Several scholars have recently argued that the rise of populism can dent the consensus that underpinned the support for central bank independence (CBI) from the late 1980s until the 2008 Financial Crisis (e.g. Buiter 2016, de Haan and Eijffinger 2017, Goodhart and Lastra 2017, Rajan 2017). The aim of this note is to pin down the possible relationship between financial inequality of the electorate, preferences for populism and CBI. Our argument will use a political economy framework.

In a nutshell, our main point is the following: Populist voters share common feelings of frustration with the current economic situation. It fuels the desire to punish the elite, which is blamed for unequal and unjust outcomes. Populist leaders propose anti-system policies, in which the people gain full control over fiscal and monetary policies. Such policies myopically underestimate the negative consequences of reducing central bank independence for the stability of the financial system. They are more likely to emerge when there is large diversity in voters’ portfolios (financial inequality). The reason is that a larger share of the electorate feels frustrated with the current situation. Consequently, they are more inclined to prefer populist platforms. Moreover, fiscal and monetary policies have stronger redistributive consequences, fuelling the conflict within society.

After a first wave of populism that was mostly concentrated in Latin America (Dornbush and Edwards 1991, Acemoglu et al. 2013) a second wave of populism gained ground in several European countries and in the United States. In Europe, anti-system sentiments are ubiquitous to populist narrative on both sides of the left-right wing spectrum. Such movements have already directly and/or indirectly influenced economic policies in these countries and will continue to do so in the future (Dovis et al. 2016, Aggeborn and Persson 2017, Rodrik 2017).

Populistmovements seem to have in common a demand for short term protection, and a certain degree of myopia as for the future consequences of their current policies (Guiso et al. 2017). Populist leaders present solutions which are welfare enhancing in the short run for a majority of the population, but costly in the long run for the whole population (Sachs 1989, Dornbush and Edwards 1991, Acemoglu et al. 2013, Chersterley and Roberti 2016).

Now “with their PhDs, exclusive jargon, and secretive meetings in far-flung places like Basel and Jackson Hole, central bankers are the quintessential rootless global elite that populist nationalist love to hate” (Rajan 2017). In other words, if the notion of central bankers provides a natural target for populist policies, the research question that naturally arises is the following: what are the conditions under which a populist reform – i.e. a reform that is aimed to guarantee short term protection disregarding longer term consequences – is likely to occur? When is the pillar of the central banks’ power – i.e. its independence – more likely to be undermined?

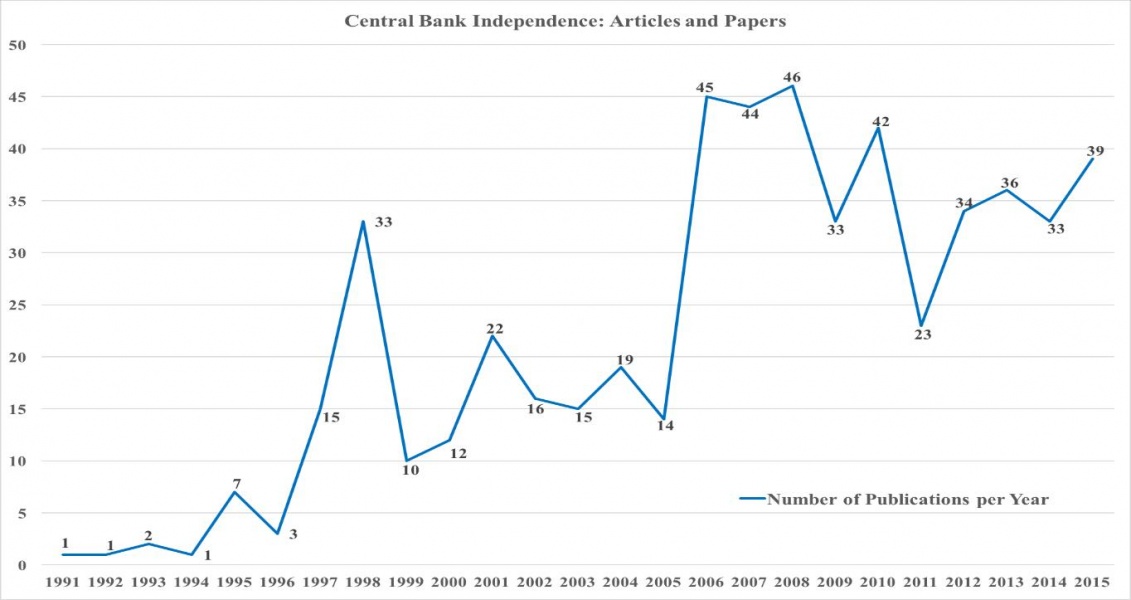

Before the Financial Crisis, the independence of central banks was unquestioned. It had become the benchmark to evaluate the effectiveness of the monetary institutions all around the world, and a broad consensus supported such institutional design (Cecchetti 2013, Bayoumi et al. 2014, Goodhart and Lastra 2017, Issing 2018). After the Financial Crisis, CBI has become again a relevant subject in academia (Figure 1), as well as in politics and in the media. Several scholars (Alesina and Stella 2010, Cecchetti 2013, Bayoumi et al. 2014, Issing 2018) have emphasized that critical voices against CBI seem to dominate (Stiglitz 2013, Ball et. Al 2016, Rodrik 2018).

Figure 1: Research and policy articles with a “Central Bank Independence” title (1991-2015)

Notes: Figure 1 presents the evolution of the number of academic papers whose titles contain the words “Central Bank Independence”, between 1991 and 2015. Data obtained from SSRN and JSTOR. Source: Masciandaro and Romelli 2018.

The reason is mainly that the economic and political importance of central banks in advanced economies has – with good reason – grown since the beginning of the Financial Crisis (Buiter 2014). Supervisory and regulatory functions have piled up at central banks, increasing the links between banking sector, fiscal and monetary policies (Bayoumi et al. 2014, de Haan and Eijffinger 2017). The borders between the central bank’s role as liquidity manager and the government’s solvency support for banking and financial institutions have been blurred, triggering a new debate on central bank competences and design (Nier 2009, Bean 2011, Cecchetti et al. 2011, Ingves 2011, Reis 2013; for an historical perspective, see Bordo and Siklos 2017; on the features of the CBI, see Cukierman 2008 and 2013, Cecchetti 2013, Taylor 2013, Buiter 2014, Sims 2016, Blinder et al. 2017). Against this background an important question is whether the policy blurring effect has made the pendulum swing, triggering a reduction in CBI around the world; so far comparative analyses did not reach homogenous results (Bodea and Hicks 2015, Masciandaro and Romelli 2018).

The Wave and the Rock: Financial Inequality, Populist Policies and the Role of the Central Bank as Veto Player

A recent paper by Masciandaro and Passarelli (2018) argues that a possible channel of the relationship between populism and CBI is financial inequality. The paper considers an economy where a systemic banking shock can occur and the policymakers can design a policy – which involves banking, fiscal and monetary aspects – in order to minimize the spillovers over the real sector. These policies affect the independence of the central bank.

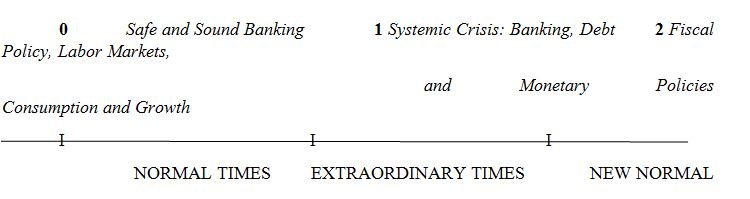

The economy consists of a population of citizens, a government, a central bank and a banking system. The sequence of events is the following (Figure 2 below). At banks implement risky businesses (normal times). The outcome of such activities determines how safe and sound the bank is, i.e. the bank’s capacity to meet its obligations. At a bank failure possibly occurs. It triggers negative externalities that can spread over to the economy. The government has to design a strategy to curb such externalities (extraordinary times). The public policy is three-dimensional: banking policy, fiscal policy, and monetization. The banking policy consists in the amount of fresh capital to inject in the bank to prevent failure. The fiscal policy consists in financing the bailout, at least partially, through taxation, which can be distortionary. The cost is passed to the tax-payer. For the remaining part, the government issues debt. Government bonds can be purchased either by citizens or by the central bank. The degree of central bank independence (CBI) shows the central bank’s capacity to act as a veto player against the political pressures to use the monetary policy tools to fix banking problems.

Figure 2: The Business Cycle: Normal Times, Extraordinary Times and the New Normal

At t = 2 government charges an income tax to repay the debt plus interest. Citizens, given the tax, decide how much to work. This is when taxation may cause distortions. The central bank rebates back to the government the payments for interest received on the share of debt that has been monetized (thus we come back to“new” normal times). Higher monetization yields lower price stability at time 2. This is why having a weak central bank, which monetizes a lot, can be socially costly.

A farsighted government will implement the socially optimal three-dimensional policy. It will take into account the intertemporal trade-off between minimizing tax distortions, curbing banking externalities, and reducing price-instability. However, such policy is likely to have heterogeneous effects on citizens’ portfolios. Different individuals will have different views regarding the policy. The policy outcome is unlikely to be the socially optimal one, while it is likely to be politically distorted.

The theoretical argument hinges on the heterogeneity among citizens in terms of financial inequality, provided the mix between banking and monetary policies can produce the so called 3 Ds effects (Goodhart and Lastra 2017): the Distributional Effect occurs as a result of changes in interest rates; the Directional Effect captures the impact of the public policy on some particular sector and/or constituency of the economy such as the banking industry (Brunnermeir and Sannikov 2013; the Duration Effect measures the monetary policy effect on overall public sector liabilities, including the central bank balance sheet: more fiscal monetization reduces the duration of the state balance sheet and is likely to be associated with monetary instability.

The Duration Effect is associated with the dimension and the risk profile of the central bank balance sheet (CBBS). Recently, several authors have emphasized the relevance of CBBS for monetary policy (Curdia 2011, Bindsell 2016, Reis 2016a and 2016b). An abnormal CBBS can trigger instability in a longer horizon for at least two reasons (Rajan 2017), notwithstanding the gains that the provision of a public safe asset can produce (Greenwood et al 2016). The Directional Effect depends on the banking policy choices, while both the Distributional Effect and the Duration Effect are associated with the corresponding fiscal and monetary policies.

Which type of policy do populist voters prefer? Based on the definition of populist platforms given by Guiso et al. (2017), we assume populist voters are myopic regarding the long-term consequences of the three-dimensional policy described above. They tend to prefer policies that provide short-term protection for bank stakeholders with no fiscal burden on the tax-payers’ shoulders. Banks should be put under the government’s control, in order to prevent elites from extending their power over the banking system. Despite populist platforms being usually silent regarding central banks, such a policy points at two likely long-term consequences: the reduction of central bank independence, and monetization of debt issued to save troubled banks.

The populist narrative emphasizes the idea that the general will should prevail. Thus liberal institutions are less useful (e.g. the separation of powers, checks and balances, the representative democracy, and intermediate state institutions). CBI is one of those institutions. It ensures neutrality and the inter-temporal consistency of monetary policy. Curbing the independence of central banks would be consistent with the populist goal of exerting direct control over conflicts within society (Goodhart and Lastra 2017).

The standard rationale for having an independent central bank can be summarized as followed (Fischer 2015): CBI is an institutional device to avoid a distortionary inflation tax. It represents a credible obstacle against political pressure to boost real output through time inconsistent policies (Kydland and Prescott 1977). In standard political economy models, the source of political distortion (and time inconsistency) is income inequality and unemployment. When it comes to banking policy, the source of political distortion is financial inequality. The latter fuels frustration with the elite, and general anti-system sentiments.

Higher financial inequality and stronger feelings of aggrievement in the electorate may lead to the adoption of myopic policies. The fiscal costs of extending public control over the banking system is either partially by-passed to future generations through public debt, or minimized through monetization. This kind of policy requires a low degree of CBI to be implemented.

Acemoglu D., Johnson S., Querubin P. and Robinson J.A., 2008, When Does Policy Reform Work ? The Case of Central Bank Independence, Brooking Papers on Economic Activity 2008 (1), 351-418.

Acemoglu D., Erogov G. and Sonin K. (2013), A Political Theory of Populism, Quarterly Journal of Economics, 128(2), 771-805.

Aggeborn L. and Persson L., 2017, Public Finance and Right-Wing Populism, Research Institute of Industrial Economics, IFN Working Paper Series, n.1182.

Aklin M. and Kern A., 2016, Is Central Bank Independence Always a Good Thing?, University of Pittsburgh and Georgetown University, mimeo.

Alesina A. and Stella A., 2010, The Politics of Monetary Policy. Technical Report, National Bureau of Economic Research

.

Alesina, A. and L.H. Summers, 1993, Central Bank Independence and Macroeconomic Performances: Some Comparative Evidence’, Journal of Money, Credit and Banking, 25, 151-62.

Algan Y., Guriev S., Papaioannou E. and Passari E., 2017, The European Trust Crisis and the Rise of Populism, CEPR Discussion Paper, n. 12444.

Amaral P., 2017, Monetary Policy and Inequality, Economic Commentary, Federal Reserve of Cleveland, January, n.1.

Auclert A., 2017, Monetary Policy and the Redistribution Channel, NBER Working Paper Series, n. 23451.

Backus D. and J. Driffill, 1985, Inflation and Reputation, American Economic Review, 75, 530-538.

Ball E., Howat J. and Stansbury A., 2016, Central Bank Independence Revised, mimeo.

Barro R. and D.B. Gordon, 1983, Rules, Discretion and Reputation in a Model of Monetary Policy, Journal of Monetary Economics, 12, 101-121.

Bayoumi T., Dell’Ariccia G., Habermeier K., Mancini-Griffoli T. and Valencia F., 2014, Monetary Policy in the New Normal, IMF Staff Discussion Note, April, n.3.

Bean C., 2011, Central Banking Then and Now, Sir Leslie Melville Lecture, Australian National University, Canberra, mimeo.

Bindseil, 2016, Evaluating Monetary Policy Operational Frameworks, Economic Policy Symposium Proceedings, Jackson Hole, Federal Reserve Bank of Kansas City.

Bodea C. and Higashijima M., 2017, Central Bank Independence and Fiscal Policy: Can the Central Bank Restrain Deficit Spending? British Journal of Political Science, 47(1), 47-70.

Bordo M.D. and Syklos P., 2017, Central Banks: Evolution and Innovation in Historical Perspective, NBER Working Paper Series, n. 23847.

Blinder A., Ehrmann M., de Haan J. and Jansen D., 2017, Necessity as the Mother of Invention: Monetary Policy After the Crisis, Economic Policy, 90, forthcoming.

Buiter W.H., 2014, Central Banks: Powerful, Political and Unaccountable, CEPR Discussion Paper Series, n. 10223.

Brunnermeier M.K., and Sannikov Y., 2013, Redistributive Monetary Policy, Jackson Hole Symposium, September 1st, 2012, The Changing Policy Landscape, Federal Reserve Bank of Kansas City, pp. 331-384.

Casiraghi M., Gaiotti E., Rodano L. and Secchi A., 2016, A “Reverse Robin Hood”? The Distributional Implications of Non-Standard Monetary Policy for Italian Households, Bank of Italy, Working Paper Series, June, n. 1077.

Cecchetti S.G, 2013, Central Bank Independence – A Path Less Clear, Bank of International Settlement, October 14th, mimeo.

Cecchetti S. G., Lamfalussy A., Caruana J., Carney M. J., Crockett A., Papademos L., and Subbarao D. , 2011, The Future of Central Banking Under Post-Crisis Mandates, BIS Paper, 55.

Chersterley N. and Roberti P., 2016, Populism and Institutional Capture, Department of Economics, University of Bologna, Working Paper Series, October, n. 1086.

Crowe C. and Meade E., 2008, Central Bank Independence and Transparency: Evolution and Effectiveness, European Journal of Political Economy, 24(4), 763-777.

Cukierman A., 2008, Central Bank Independence and Monetary Policymaking Institutions: Past, Present and Future, European Journal of Political Economy, 24, 722-736.

Cukierman A., 2013, Monetary Policy and Institutions before, during and after the Global Financial Crisis, Journal of Financial Stability, 9(3). 373-384.

Cukierman, A., Webb S.B. and Neyapti, B., 1992, Measuring the Independence of Central Banks and its Effects on Policy Outcomes, World Bank Economic Review, 6, 353–98.

Curdia V. and Woodford M., 2011, The Central Bank Balance Sheet as an Instrument of Monetary Policy, Journal of Monetary Economics, 58(1), 54-79.

de Haan J. and Ejiffinger S., 2017, Central Bank Independence under Threat?, CEPR Policy Insight, n.87.

Dornbush R. and Edwards S., 1991, The Macroeconomics of Populism in Latin America, University of Chicago Press, Chicago.

Dovis A., Golosov M. and Shourideh A., 2016, Political Economy of Sovereign Debt: A Theory of Cycles of Populism and Austerity, NBER Working Paper Series, n. 21948.

Eijffinger, S. and Masciandaro D., 2014, Modern Monetary Policy and Central Bank Governance, (ed.), Edward Elgar, Cheltenham, UK.

Fernàndez-Albertos J., 2015, The Politics of Central Bank Independence, Annual Review of Political Science, 18, 217-237.

Fischer S., 2015, Central Bank Independence, Herbert Stein Memorial Lecture, National Economists Club Washington, D.C.

Franzese R., 1999, Partially Independent Central Banks, Politically Responsive Governments, and Inflation, American Journal of Political Science, 43(3), 681-706.

Frisell L., 2006, Populism, Sveriges Riksbank, Research Paper Series, n.9

Furceri D., Loungani P. and Zdzienicka A., 2016, The Effects of Monetary Shocks on Inequality, IMF Working Paper Series, n. 245.

Gertler M., Kiyotaki N. and Prestipino A., 2017, A Macroeconomic Model with Financial Panics, International Finance Discussion Paper Series, Board of Governors of the Federal Reserve System, December, n. 1219.

Goodhart C.A. and Lastra R., 2017, Populism and Central Bank Independence, CEPR Discussion Paper Series, n. 2017.

Greenwood R., Hanson S.G., Stein J.C., 2016, The Federal Reserve’s Balance Sheet as a Financial – Stability Tool, Economic Policy Symposium Proceedings, Jackson Hole, Federal Reserve Bank of Kansas City.

Grilli V., Masciandaro D. and Tabellini, G., 1991, Political and Monetary Institutions and Public Financial Policies in the Industrial Countries, Economic Policy, 6(13), 341–392.

Guiso L., Herrera H., Morelli M. and Sonno T., 2017, Demand and Supply of Populism, mimeo.

Hayo B. and Hefeker C., 2002, Reconsidering Central Bank Independence, European Journal of Political Economy, 18(4), 653-674.

Klomp J. and de Haan J., 2010, Inflation and Central Bank Independence: a Meta Regression Analysis, Journal of Economic Surveys, 24(4), 593-621.

Kydland F.E. and Prescott E.C., 1977, Rules Rather Than Discretion: The Inconsistency of Optimal Plans, Journal of Political Economy, 85(3) , 473-492.

Inglehart R.F. and Norris P., 2016, Trump, Brexit and the Rise of Populism: Economic Have- Nots and Cultural Backlash, Harvard Kennedy School, Research Working Paper Series, n. 26.

Ingves S., 2011, Central Bank Governance and Financial Stability, Bank for International Settlements, May.

Issing O., 2018, Central Bank Independence – Will It Survive?, in S. Eijffinger and D. Masciandaro (eds), Hawks and Doves: Deeds and Words, CEPR E-Book, forthcoming.

Jacome L. and Vasquez F., 2008, Is There Any Link between Legal Central Bank Independence and Inflation? Evidence from Latin America and the Caribbean, European Journal of Political Economy, 24(4), 788-801.

Lohmann, S., 1992, Optimal Commitment in Monetary Policy: Credibility versus Flexibility, American Economic Review, 82, 273-286.

Masciandaro D. and Passarelli F., 2018, Populism and Central Bank Independence: A Political Economics Approach, Bocconi University, Baffi Center Research Paper Series, n.74

Masciandaro D. and Romelli D., 2018, Peaks and Troughs: Economics and Political Economy of Central Bank Independence Cycles, in D. Mayes, P.L. Siklos and J.E, Sturm (eds.), Oxford Handbook of the Economics of Central Banking, Oxford University Press, New York, forthcomings.

McCallum, B.T., 1995, Two Fallacies Concerning Central Bank Independence, American Economic Review, 85(2), pp.207-211.

Nier E.W., 2009, Financial Stability Frameworks and the Role of Central Banks: Lessons from the Crisis, IMF Working Paper Series, n.70.

Persson, T. and Tabellini, G., 1993, Designing Institutions for Monetary Stability, Carnegie – Rochester Series on Public Policy, 39, 53-84.

Posen, A., 1995, Declaration are not Enough: Financial Sectors Sources of Central Bank Independence’, In: B. Bernanke and J. Rotemberg (Eds.), NBER Macroeconomics Annual 1995, The MIT Press, Cambridge MA.

Rajan R., 2017, Central Banks’ Year of Reckoning, Project Syndicate, December 21st, mimeo.

Reis R., 2013, Central Bank Design, Journal of Economic Perspectives, 27(4). 17-44.

Reis R., 2016a, Funding Quantitative Easing to Target Inflation, Economic Policy Symposium Proceedings, Jackson Hole, Federal Reserve Bank of Kansas City.

Reis R., 2016b, Can the Central Bank Alleviate Fiscal Burdens?, NBER Working Paper Series, n. 23014.

Rodrik D., 2017, Populism and the Economics of Globalization, Harvard Kennedy School, Research Working Paper Series, n. 25.

Rodrik D., 2018, In Defence of Economic Populism, Project Syndicate, January, 8th.

Rogoff, K. S., 1985, The Optimal Degree of Commitment to an Intermediate Monetary Target. Quarterly Journal of Economics, 100, 1169-90.

Sachs J.D., 1989, Social Conflict and Populist Policies in Latin America, NBER Working Paper Series, n. 2897.

Sargent T.J. and Wallace N., 1981, Some Unpleasant Monetarist Arithmetic, Federal Reserve Bank of Minneapolis, Quarterly Review, Fall, 1-17.

Smets F., 2013, Financial Stability and Monetary Policy: How Closely Interlinked?, Sveriges Riksbank, Economic Review, Special Issue, 3, 121-159.

Stiglitz J.E., 2013, A Revolution in Monetary Policy: Lessons in the Wake of the Global Financial Crisis, The 15th C.D. Deshmukh Memorial Lecture, Mumbai, January 3rd.

Taylor J.B., 2013, The Effectiveness of Central Bank Independence vs Policy Rules, Business Economics, 48(3), 155-162.

Ueda K. and Valencia F., 2012, Central Bank Independence and Macro-Prudential Regulation, IMF Working Paper Series, n.101.

Full Professor of Economics, Department of Economics, at the Bocconi University, Milan.

Associate Professor of Economics at the University of Turin, and a Contract Professor of Economics at Bocconi University, Milan