Public debt acquired by the Eurosystem has lost its significance. The central bank can keep this part of the public debt on its balance forever. Therefore, it would be wrong to base future fiscal policy on debt ratios without taking this into account. Such a mistake could be prevented by either cancelling this part of the public debt or correcting the public debt ratios of EMU member states. Technically, this is not a problem. The caveat, however, is that such a move could bring moral hazard, which may undermine future fiscal discipline. This moral hazard should be prevented. Only then can be avoided that future fiscal policies in EMU will become too restrictive.

The moment that a central bank starts to buy public debt issued by its own government, this debt loses its significance (De Grauwe, 2021). The reason is simple. A central bank is usually owned by its government. The moment the central bank becomes the owner of its government’s debt, the latter will pay interest payments and redemption to the central bank. This will add to its profits, which usually are distributed to its most important shareholder, viz. the government. As a result, this part of the public debt service becomes an intra-public sector money transfer. Which illustrates the hard fact that public debt purchased by the central bank is no longer a burden for the public budget. Of course, the implicit assumption here is that the central banks does not have the intention to resell the acquired debt to the market and, also important, reinvests the money it receives when the government redeems its debt.

This is not a new insight, it is basic undergraduate textbook stuff (Boonstra & Van Goor, 2021). Central banks have an unlimited power to create money by using the classic printing press or its modern equivalents.1 If this power is used to finance public spending, this is called monetary financing. This power has also a dangerous side, as an unlimited use of the printing press for the financing of public spending may lead to a too high inflation or, in extreme cases, hyperinflation. To be sure, hyperinflations are very rare phenomena, but some of them have resulted in serious economic and social disruptions. And most, if not all of them, began with monetary financing of public spending that ultimately ran out of hand. Which is the reason why monetary financing is explicitly forbidden van Article 123 of the Treaty on the Functioning of the European Union (TFEU).2

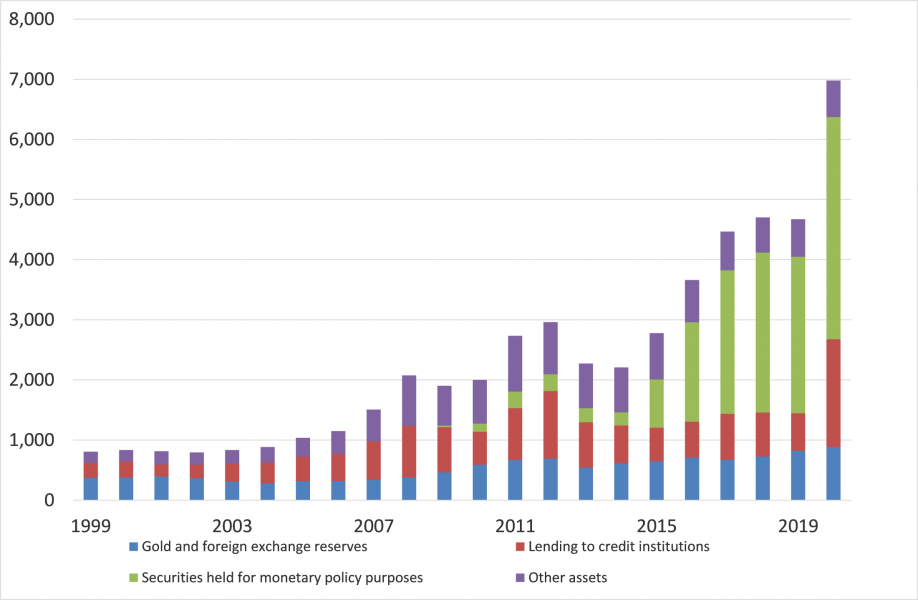

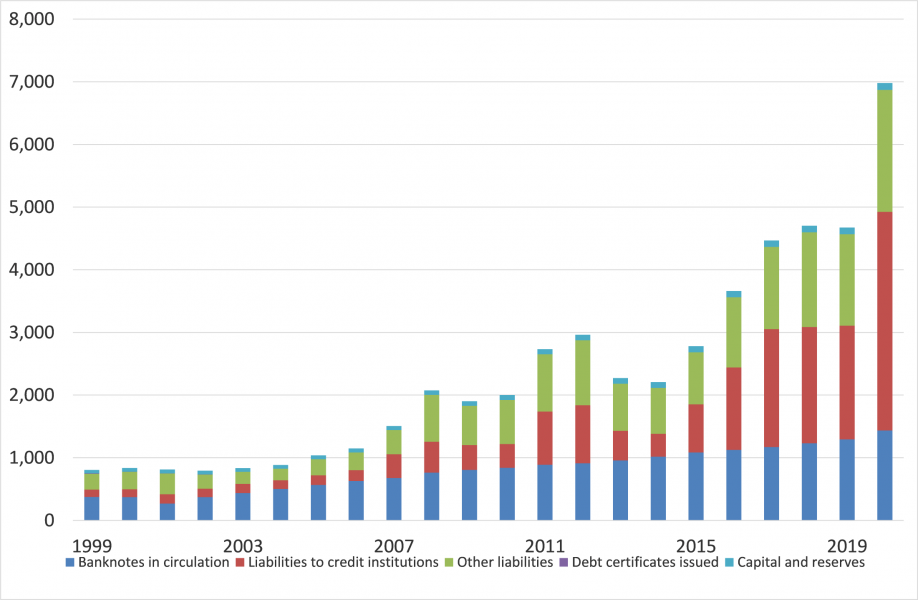

However, during the last years, the Eurosystem, which consists of the European Central Bank and the National central banks of the Eurozone, have bought large amounts of public debt under its programmes of Quantitative Easing (QE). The result is an enormous increase in the size of its balance sheet, which was caused by the strong growth of the entry on the asset side called ‘securities held for monetary purposes’, which is mirrored by an enormous increase in ‘liabilities to credit institutions’ on the liability side (figures 1 and 2).

Figure 1: Assets of the Eurosystem (1999 – 2020, € billion)

Figure 2: Liabilities of the Eurosystem (1999 – 2020; € billion)

Source: ECB

The major difference between QE and straightforward monetary financing of government spending is that under QE the central bank buys existing government debt in the secondary market, while under monetary financing usually new government spending is financed by directly selling public bonds to, or taking loans from, the central bank. So defined, we can understand QE as ex-post monetary financing. An important difference is that during monetary financing, fiscal and monetary policies usually are aligned, meaning that they both are expansive at the same time. It is an extremely effective, albeit potentially dangerous (see above) way of stimulating the economy. Under QE it can happen that, while monetary policy is expansive, at the same time fiscal policy is tight. This is less effective in stimulating total demand, as Europe’s relatively slow recovery after the Great Financial Crisis (GFC) illustrates.

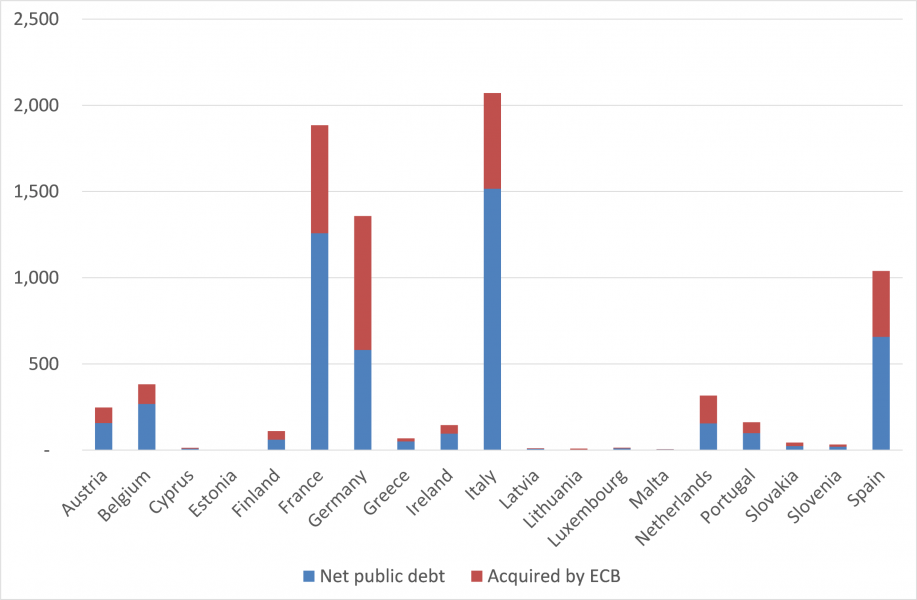

As a result of QE, about 30 per cent of EMU’s public debt (issued state loans) has been acquired by the eurosystem, indeed losing its fiscal relevance. It is not surprising that this led to the call to cancel this debt completely. Technically, this can be done easily by for example replacing the existing debt by a zero-coupon perpetual loan, as explained above in footnote 1. So why not?

Figure 3: EMU member states public debt

Note: the graph should be interpreted as a rough indication. It shows the notional value of the state loans issued by the central government. Some countries have a relatively large public debt owed by lower governments levels, such as the German Länder. And of course countries can use other financial instrument for financing their public debt. The ECB intends to acquire a more or less identical percentage of the total outstanding public debt of the member states. As a result of the differences explained before, however, the percentage of debt issued by central governments acquired by the central bank varies between 29% and 51%.

In his recent SUERF Policy Brief Paul de Grauwe makes the point that as the public debt that is acquired by a central bank already has lost its monetary significance, cancelling it altogether makes no material difference. In addition, he argues that a central bank may need its portfolio of government bonds once it wants to tighten its monetary policy in the future once inflation takes off. By reselling its portfolio back to the market, it may drain liquidity (as banking reserves will decline) and push up long-term interest rates as bond prices come under downward pressure once the central bank changes its policy. Although this all is completely correct, it does not fully eliminate an important argument in favour of cancelling the debt already purchased, viz. the impact on future fiscal policy. This is especially relevant for the Eurozone. Moreover, the central bank has other options available for draining banks’ liquidity reserves. Finally, an important argument against debt cancellation is overseen: it may introduce additional moral hazard and undermine future fiscal discipline. In the following paragraphs we will briefly discuss these topics in the European context.

Countries in the Eurozone have to meet the fiscal criteria of the Stability and Growth Pact, viz. a fiscal deficit smaller than 3% of GDP and a public debt less than 60% of GDP – or moving at a sufficient pace towards this 60% of GDP. During the corona-crisis these criteria have temporarily been suspended, at least until 2022, but sooner or later this discussion will flare up. Even apart from the rules, in the Netherlands, for example, there already was quite some discussion about the ‘debt burden that is shifted to future generations’. Very recently, the Dutch central bank warned that debt ratios are too high and future fiscal policy should certainly not be too expansive. The subtle difference between public debt that has to be repaid versus a debt that easily can be rolled-over into eternity because it is already owned by the central bank/government complex is easily lost on politicians, voters and apparently even central bankers. So far, the ECB is reinvesting the amortisation payment of the public debt in its possession by buying public debt in the markets and technically there is no reason why this could not go on forever. The real danger is of course, that Europe falls into the same trap it fell into after the GFC, viz. return to much too restrictive fiscal policies in order to meet the SGP obligations. This would be highly unproductive.

Therefore, it would be wise to either cancel this debt, or redefine the SGP-criteria. Changing the SGP could be the obvious solution, but this will be a highly political end therefore very cumbersome process. The good news, however, is that this may be solved by correcting the public debt figures for (a part of) the public debt amounts in the portfolio of the Eurosystem. Because this part of the debt, at least from a monetary point of view, has indeed become insignificant, it doesn’t make sense to base future fiscal policy on it. One could think about introducing a clause in the Treaty, which states that fiscal policy ‘temporarily’ will be based on the public debt after correction for the debt that has been acquired by the ECB.3 As an indication the Commission could decide to correct the total public debt for all member states with 25 percent.4 This may politically be an easier exercise than rewriting the SGP. Such an exercise would result in the following relevant debt figures of EMU’s member states.

Another argument against cancelling public debt by the central bank put forward by Paul de Grauwe is that the central bank may need its portfolio when it wants to tighten its monetary policies again. This argument is not very convincing, as there are other alternatives available. A central bank can easily take liquidity out of the market by issuing its own bonds. This is standard policy for many central banks, although the ECB currently is not using this instrument.5 But thirty percent of global central banks do use this instrument, including the central banks of Switzerland and Sweden.6 The IMF describes central bank bond issuance as the least disturbing kind of open-market policies available. For the Eurozone this would have an additional benefit, viz. the creating of an EMU-wide common safe asset, which would greatly help to strengthen Europe’s capital market union. A key benefit of issuing ECB debt over selling portfolio holdings back to the market is the potential spread/fragmentation risks that the latter policy could cause, as explained in this publication.

Issuing bonds by the central bank is basically a simple process of substitution of bank reserves (part of the monetary base, M0) by central banks bonds (Boonstra, 2019). These will be highly liquid, have a much broader investor base than banks alone and, not unimportant, are not part of the monetary base. On the asset side the central bank still has all options available. It may keep the current government bonds on its balance sheet as they are today, it may cancel de facto completely the acquired debt (by replacing it by a perpetual bond) or it may gradually replace retiring debt by perpetuals, keeping a mix of unsellable perpetual bonds or loans and traditional government debt in its portfolio. From a fiscal point this is, as said, not significant.

The above illustrates that from a technical point of view, it is not really difficult to reset Europe’s fiscal situation. By redefining the debt ratios on which policies and the SGP are based, Europe can prevent a too tight fiscal policy and eliminate unnecessary worries about the long-term sustainability of its public finances. Debt that is purchased by the central bank has become insignificant, can be rolled over indefinitely, is therefore not a burden for the budget and is also not a burden for future generations. Moreover, it is not inflationary, as only previous spending is ex-post monetarily financed.

There is a caveat, however. The effective reduction of the public debt burden is not intended to create fiscal space for a further increase in spending. The intent of this action is to reduce the danger that fiscal policy in the Eurozone become too restrictive. Even after correcting public debt ratios for the ‘not relevant debt’, many member states will still have a challenge in meeting the SGP-criteria. This is a subtle, but very important difference. If governments use the extra fiscal space for additional spending, unsustainable public debt levels may return very quickly. Moreover, this may also lead to higher inflation.

Therefore, the real problem is not economic, but political. During the last decades, many EMU member states failed to meet the criteria of the SGP. This is not to say that the SGP did not have a disciplinary effect on public debt. Compared to other major economies, EMU’s public debt ratios on average developed relatively well. Today, the average public debt ratio in the Eurozone is lower than in the US, UK and certainly Japan.

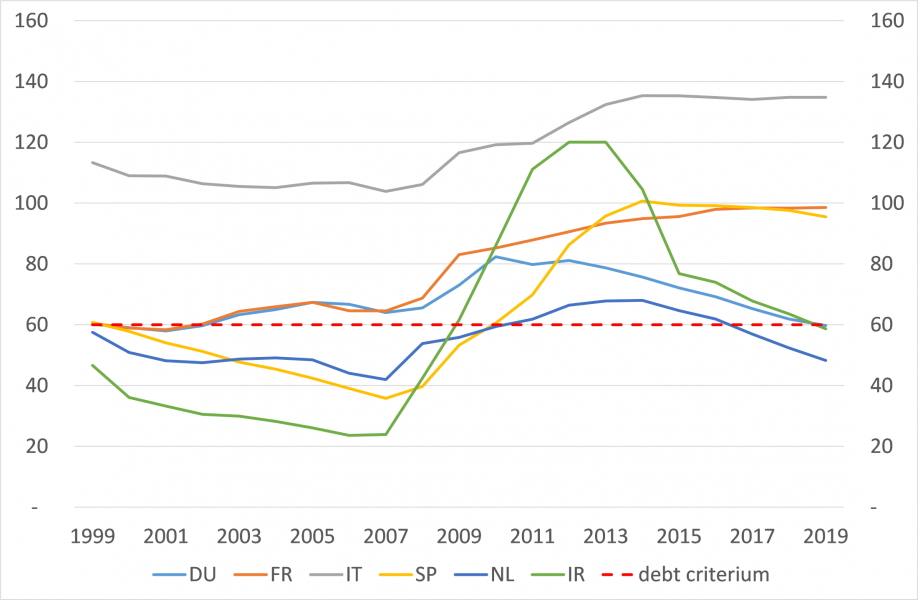

However, individual EMU member states have a wide variety of public debt ratios. Although after the start of EMU most countries sooner or later failed to meet the SGP debt criterion of 60% GDP, it is clear that some of them hardly have tried to reduce their public debt ratios even in good times.

Figure 4 illustrates this for the period 1999 to 2019.7 This has undermined mutual confidence between the member states, which regularly pops up, for example in debates on completing the Banking Union, the Capital Market Union or the issuance of corona bonds. This lack of confidence will certainly result in the fear that debt reduction will bring additional moral hazard in the system. Once policymakers realise that if push comes to shove the central bank will bail them out, this may be killing for fiscal discipline. In the long run, this will further undermine mutual confidence and, just as serious, it may ultimately translate in a structurally much higher inflation, especially in the member states that have the least fiscal discipline. Therefore, rebuilding mutual trust and/or introducing of a credible sanction mechanism for countries that refuse to comply with the agreed policy rules are essential preconditions for debt cancellation. Such a sanction mechanism could be, for example, that the central bank in future purchasing operations will abstain from buying public debt of countries that have ignored the fiscal policy rules.8 If this threat could be made credible, it will certainly improve market discipline, as markets realise that highly indebted countries indeed bring more credit risk and will in the future not be bailed-out by the ECB or the other member states.

Figure 4: Public debt ratios individual member states

Source: Eurostat data via Macrobond

Public debt that has been purchased by the central bank has lost its significance. Therefore, it makes sense to either cancel this debt, or to redefine the public debt ratios under the SGP. Technically, this is not too difficult to do and it may prevent fiscal policies during the coming years from becoming too restrictive. It is important, that the debt cancellation will be given to all member states of the Eurozone, in order to prevent reputational damage. This is of course above all welcome for the countries that already have too high a public debt, but every country should benefit from it. For future monetary policy it important to realize that if central banks want to tighten monetary policy and reduce market liquidity, they have more options available than just selling their securities portfolio back to the market. Finally, the ECB still can decide to keep some public debt on its balance sheet for regular monetary purposes. As said, from a technical point of view, this all can be done. A bigger challenge is, however, to prevent that debt cancellation introduces more moral hazard into the system. It will only work when new, credible sanction mechanisms are introduced in order to discourage countries to ignore the newly defined policy rules in the future. If this is not possible, Europe misses a large opportunity for preventing a too restrictive fiscal policy in the years to come. Again.

TFEU Article 123 states: Overdraft facilities or any other type of credit facility with the European Central Bank or with the central banks of the Member States (hereinafter referred to as “national central banks”) in favour of Union institutions, bodies, offices or agencies, central governments, regional, local or other public authorities, other bodies governed by public law, or public undertakings of Member States shall be prohibited, as shall the purchase directly from them by the European Central Bank or national central banks of debt instruments.

The word temporary will mask the fact that this situation may be with us forever. Just the statement that policies re temporary, without formulating an exact time schedule, may be enough to circumvent a lot of problems.

A percentage of 25 gives the ECB enough leeway to sell some the acquired public debt if it thinks this is necessary. As stated in the main text, it also has the option available to drain liquidity form the markets by issuing central bank bills. See also the footnote below graph 3.

However, the ECB explicitly lists issuance of debt certificates as a possible liquidity draining tool: “Structural operations can be carried out by the Eurosystem through reverse transactions, outright transactions, and the issuance of debt certificates.” (Source: Europa.eu)

Bonds or bills issued by the central bank are of course highly liquid, but are not a part of the monetary base. They can be bought by banks, but also by non-banks. When bought by banks, the monetary base is reduced, but not the money supply. From a bank’s point of view, it is just substituting central bank bonds for liquidity reserves on the asset side of their balance. No-one’s bank deposit is reduced. When bought by non-banks, not only the monetary base is reduced, but so is the money supply. Often, central banks bonds have short maturities, which give the central bank a high degree of flexibility in steering monetary conditions.

In 2020, of course, public debt ratios exploded as a result of Covid-19, as this translated in a huge increase in public spending, while at the same time the recession put an extra upward pressures of debt ratios.

Note, that this kind of conditionality was already an element in the instrument of the OMT, announced by the ECB in 2012. It is important, however, that the ECB remains as independent as possible and can’t be overruled if it decides to stop purchasing debt from certain members states. It could be possible that the majority of Member States (or the Commission) ask the ECB to stop buying public debt issued by certain member states. On the other hand, it is very important that the Commission is not allowed to force the ECB to buy certain public debt. In this scenario its independence and its anti-inflation mandate will not be undermined by political interference.