The unprecedented introduction of negative interest rate policies (NIRP) by several central banks over the last decade was associated with many uncertainties and questions. In this policy brief, we survey the evidence on the effects of NIRP on financial markets, banks, households, firms, and the macroeconomy. Overall, when interest rates are negative, policy rate cuts propagate along the yield curve, with the first policy cut below zero contributing significantly to a fall in longer-term yields. Rates on corporate deposits have dropped more than those on retail deposits because it is costlier for companies to switch into cash. Bank customers have not markedly shifted to cash. Bank lending volumes have risen in response to NIRP, and bank profits have not significantly deteriorated, although there is considerable heterogeneity in the effects. The impact of NIRP on inflation and output appears to be comparable to that of conventional interest rate cuts. Considering these findings, we conclude that central banks should keep NIRP as part of their toolkit.

Starting in 2012 central banks in several countries adopted NIRP, usually alongside other unconventional policy measures. The main goal was to provide monetary stimulus after the room for conventional policy easing had been exhausted (Dell’Ariccia et al., 2018). Negative nominal interest rates appear to be especially peculiar, as they seemingly reverse the usual roles of ‘lender’ and ‘borrower’, often leading to misconceptions. It should then not come as a surprise that the adoption of NIRP by central banks in Denmark, the euro area, Japan, Sweden, and Switzerland was accompanied by skepticism and raised many questions.

Interest rates were historically low even before the Global Financial Crisis, as the global natural real rate of interest – the level of real rates at which demand equals potential output, so that inflationary or deflationary pressures are absent – has been declining for decades in response to slow-moving structural forces (among others, see Del Negro et al., 2019). With inflation targets of about 2 percent, a low natural rate had resulted in very low nominal rates as well, forcing central banks to consider unconventional measures and NIRP as policy options to counteract disinflationary pressures that have materialized since the Global Financial Crisis.

The unprecedented introduction of NIRP was associated with many uncertainties and questions. To what extent would negative policy rates be transmitted to deposit and lending rates? Might the effects be counterproductive, with financial intermediaries reducing lending? Would banks, companies, and households switch massively to cash holdings? What would be the effects on the yield curve as a whole? Would the introduction of NIRP bring about disruptions in the functioning of money markets? Concerns were also raised about financial stability implications stemming from a potentially significant shift to risky assets by financial intermediaries. Beyond these concerns, NIRP was and remains politically controversial, partly since it is novel, counterintuitive, and often misunderstood.

In a recent paper (Brandao-Marques et al., 2021) we review the experience with NIRP accumulated over the last decade. Overall, the available evidence so far suggests that effects of NIRP are comparable to those of conventional interest rate cuts in low, but still positive, territory. In particular, the transmission of cuts in negative territory has been effective and the consequent monetary policy easing has supported growth and inflation. Adverse side effects, such as cash hoarding and risks to financial stability, have not materialized. In the following, we first briefly discuss the conceptual underpinnings of NIRP. Next, we review the fast-growing academic literature that attempts to quantify the effects of NIRP. Finally, we discuss policy considerations.

Real interest rates routinely fall below zero, often because inflation is higher than expected. Consequently, in general, zero has no special status when it comes to real rates of return on assets (Bernanke, 2016). However, the existence of cash and financial constraints of various nature could induce agents in the economy to react differently when facing negative nominal interest rates, potentially involving nonlinear effects on a vast set of financial and macroeconomic variables.

NIRP would make cash attractive for households, firms, and banks. Other safe and liquid assets, such as bank deposits, offer obvious advantages over cash, for instance the convenience of electronic payments. However, for households and firms with smaller liquid asset balances, and less-frequent needs to make larger transactions, cash may be more attractive and deposits may be flightier. Therefore, to avoid a substantial switch to cash, interest rates cannot go below a technical minimum, known as the effective lower bound (ELB), which may lie below zero due to the cost of storing and holding physical cash.

Even above the ELB, central banks may be unwilling to cut rates below a certain level for fear of adverse effects on financial intermediaries and credit dynamics. The interest rate below which these effects could seriously impair, or even reverse, the pass-through of policy rates to lending and deposit rates is the “reversal rate.” The reversal rate may lie above, at, or below the ELB. Unlike the ELB, the reversal rate depends on the composition of financial intermediaries’ balance sheets and income, including their capitalization (Darracq et al., 2020).

In terms of monetary policy transmission, the introduction of negative rates may have a significant effect on long-term yields. If the removal (or reduction) of what was used to be thought as the ELB is unexpected, it could significantly lower the path of rates over the medium term, with an impact that is likely to be felt further along the term structure (Grisse et al., 2017; de Groot and Haas 2020).

The effects of NIRP on financial intermediaries, and especially banks, deserves particular attention. The reason is that bank profitability may suffer because some assets (e.g., central bank reserves) will have a negative nominal return, and thus banks’ income will decline if they cannot pass on the cost to their own depositors. For the reasons discussed above, retail customers are likely to be strongly resistant to negative rates, causing a fall in banks’ net interest margins (NIM). It is important to stress that the degree of pass-through of negative policy interest rates to bank lending and deposit rates is likely to differ from country to country, since it depends on a host of factors, including the relative importance of retail and wholesale deposits for bank funding.

While NIM may suffer, negative rates may support banks’ profitability by boosting asset values and improving loan quality. Therefore, the net effect of negative rates on bank profits and lending is mostly an empirical question. When the negative net income effect outweighs the positive net worth effect, cuts in rates may hurt lending (Brunnermeier and Koby, 2019). However, other mechanisms may lead banks to lend more (Drechsler et al., 2017; 2018) or make riskier loans (see Dell’Ariccia et al., 2014) in response to shrinking profitability and low policy rates. Negative rates could also potentially affect the profitability and risk-taking of nonbank financial intermediaries.

Against this background, what does the evidence on NIRP show so far? Our survey covers academic studies that try to quantify the effects of NIRP on cash usage, financial variables, the behavior of households, nonfinancial firms, banks, and MMFs, as well as on output and inflation. It also draws on the descriptive analysis of raw data and on technical studies published in policy reports.

There is no evidence of a widespread increase in the use of cash in countries that have implemented NIRPs. In some countries the use of cash has grown over the last two decades, but there is no indication that these increases coincided with the introduction of NIRPs.

The transmission of NIRP to money market rates, long-term yields, and bank rates has been effective. Across jurisdictions, short-term money market rates have tracked policy rates closely as the latter moved into negative territory. Government bond yields tend to exhibit an immediate and persistent response to the introduction of NIRP (Christensen 2019). Once rates are negative, the impact of interest rate cuts on the yield curve appears to be similar to that of interest rate cuts in positive territory. The response of the yield curve in the euro area to changes in the policy rates before and after NIRP was qualitatively similar (Arteta et al., 2016), especially in the short end of the yield curve (Wu and Xia, 2020). The empirical studies regarding the effects of NIRP on exchange rates find mixed evidence.

NIRP seems to have lowered interest rates on new mortgages and corporate loans, but there is substantial heterogeneity across banks. NIRP did lower loan rates among Italian banks and stimulated lending – particularly among banks holding larger shares of liquid assets (Bottero et al., 2019). Similar results have been obtained for Switzerland (Basten and Mariathasan, 2018), although Danthine’s (2018) findings differ. In Denmark, there is no evidence that banks theoretically more exposed to NIRP (that is, with a higher reliance on deposit funding) responded differently than other banks (Adolfsen and Spange 2020). By contrast, Italian banks with a relatively high reliance on retail deposits tend to increase rates on loans to the nonfinancial private sector (Amzallag et al., 2019), while Japanese banks that were more exposed to NIRP did not lower lending rates as much as other banks (Hong and Kandrac, 2018).

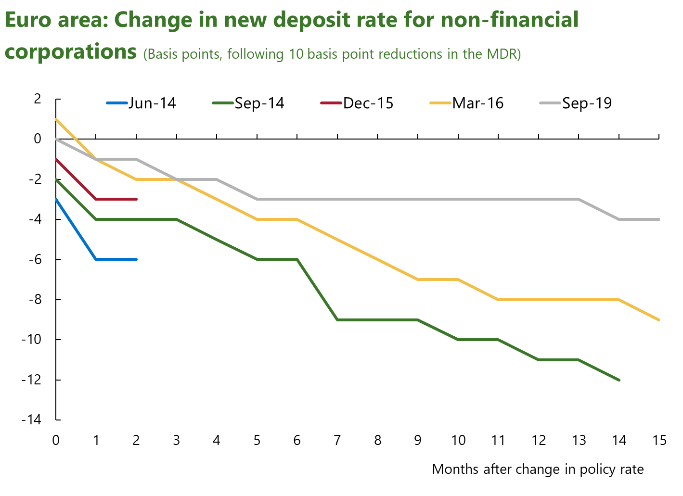

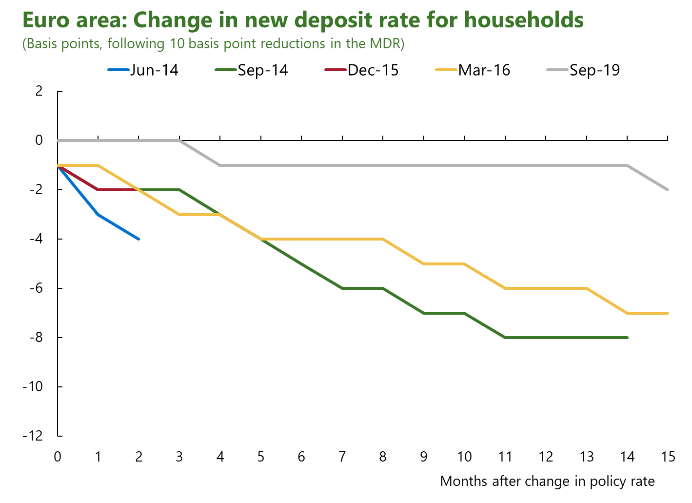

Turning to deposit rates, banks seem be able to pass on negative rates partly to companies, but not to households. Instead, banks increased fees on household deposits (for the euro area , see Arce et al., 2018, Bottero et al., 2019; for Switzerland, see Basten and Mariathasan, 2019). For corporate customers, negative rates are transmitted to rates on firm deposits, in particular if banks are sound (Altavilla et al. 2019). Overall, there is little-to-no evidence that the short-term pass-through from policy to retail deposit rates is statistically different before and after rates turn negative (Madaschi and Pablos-Nuevo, 2017; Brandao-Marques et al., 2021; Klein, 2020).

|

|

On average, NIRP only had a small overall effect on bank profitability. This is because losses in interest income were offset by gains in non‐interest income, such as fees, capital gains, and insurance income (Lopez et al., 2020), or because of lower loan-loss provisions (for evidence on German banks, see Urbschat, 2019). However, the evidence is not conclusive, with some heterogeneity in the impact, and it could be capturing only the short-term effects of NIRP, which may be reversed over time. For instance, Molyneux et al. (2019) report that NIRP squeezed bank profits through a significant contraction in the NIM, which more than offset capital gains on security holdings. Moreover, banks that are small, are not engaged in cross-border lending, face significant competition, are real estate and mortgage specialists, or operate in countries where floating loan rates predominate, see the biggest declines in profits and NIM after the introduction of NIRP. Moreover, Klein (2020) finds that a policy rate cut in negative territory implies a larger drop in NIM for European banks than an equivalent cut above zero.

Bank lending volumes have generally increased in response to NIRP. Existing studies find a stronger rise in lending by banks with a larger share of liquid assets (Bottero et al.,2019), a lower share of deposit funding (Heider et al., 2019; Lopez et al., 2020), or more excess reserves with the central bank (Basten and Mariathasan, 2019). One explanation for this result is that banks may try to compensate for the decline in interest income by hiking lending volumes (Klein, 2020). Importantly, the evidence suggest that this increased lending (or securities purchases) has not been accompanied by excessive risk taking.

The evidence on the macroeconomic effects of NIRP remains sparse, partly because it is challenging to separate the macroeconomic effects of NIRP from those of other concurrent UMP measures. Recent findings show that the effects of policy rate cuts with negative nominal rates are between 60 percent and 90 percent to what is found with positive rates (Ulate, 2021). For the euro area, NIRP seems to have had small but positive effects on inflation and growth (Rostagno et al., 2019) and boosted corporate investment (Altavilla et al., 2019). In addition, in Japan, NIRP may have supported the economy through the exchange rate channel (Honda and Inoue, 2019).

Overall, most of the theoretical negative side effects associated with NIRP have so far failed to materialize, or have turned out to be less relevant than expected. Economists and policymakers have identified a number of potential drawbacks of NIRP, but none of them have emerged with such an intensity as to tilt the cost-benefit analysis in favor of removing this instrument from central banks’ toolbox. As a consequence, central banks should not rule out NIRP and keep it as part of their toolkit, even if they are unlikely to use it. If markets internalize that rates can be cut below zero, the shift in market expectations is likely to induce declines in longer horizon yields. This suggests a greater loosening effect of NIRP for countries that currently have low but positive rates. Ultimately, given the low level of the neutral real interest rates, many central banks may be forced to consider NIRP sooner or later. There key question is how much further interest rates could go negative before seriously impairing financial intermediation or inducing other negative side effects. Although this question is still open, there may be latitude to push interest rates even more negative.

Adolfsen, Jakob Feveile, and Morten Spange, 2020, “Modest pass-through of monetary policy to retail rates but no reversal.” Danmarks Nationalbank Working Papers 154. (Copenhagen: Danmarks Nationalbank).

Altavilla, Carlo, Lorenzo Burlon, Mariassunta Giannetti, and Sarah Holton, 2019, “Is there a Zero Lower Bound? The Effects of Negative Policy Rates on Banks and Firms.” ECB Working Paper No, 2289. (Frankfurt am Main: European Central Bank).

Amzallag, Adrien, Alessandro Calza, Dimitris Georgarakos, and João Miguel Soucasaux Meneses e Sousa, 2019, “Monetary Policy Transmission to Mortgages in a Negative Interest Rate Environment.” ECB Working Paper No, 2243. (Frankfurt am Main: European Central Bank).

Arce, Oscar, Miguel Garcia-Posada, Sergio Mayordomo, and Steven R. G. Ongena, 2018, “Adapting Lending Policies When Negative Interest Rates Hit Banks’ Profits.” Banco de España Working Paper No. 1832. (Madrid: Banco de España.)

Arteta, Carlos, M. Ayhan Kose, Marc Stocker, and Temel Taskin, 2016, “Negative Interest Rate Policies: Sources and Implications.” CAMA Working Paper 52/2016, Centre for Applied Macroeconomic Analysis.

Basten, Christoph and Mike Mariathasan, 2018, “How banks respond to negative interest rates: Evidence from the Swiss exemption threshold”, CESifo Working Paper 6901. (Munich: Münchener Gesellschaft zur Förderung der Wirtschaftswissenschaft – CESifo GmbH).

______, 2019, “Interest Rate Pass-Through and Bank Risk-Taking under Negative-Rate Policies with Tiered Remuneration of Central Bank Reserves.” Swiss Finance Institute Research Paper No. 20-98.

Bottero, Margherita, Camelia Minoiu, José-Luis Peydró, Andrea Polo, Andrea F. Presbitero, and Enrico Sette, 2019, “Negative monetary policy rates and portfolio rebalancing: Evidence from credit registry data”, IMF Working Paper WP/19/44.

Brandao-Marques, Luis, Marco Casiraghi, Gaston Gelos, Günes Kamber, and Roland Meeks, 2021, “Negative Interest Rates: Taking Stock of the Experience so Far.” IMF Departmental Paper 21/03, Monetary and Capital Markets Department. (Washington: International Monetary Fund).

Brunnermeier, Markus K. and Yann Koby, 2019, “The Reversal Interest Rate”, Manuscript. Princeton University.

Christensen, Jens H. E., 2019, “Yield Curve Responses to Introducing Negative Policy Rates.” FRBSF Economic Letter 2019-27. (San Francisco: Federal Reserve Bank of San Francisco.)

Danthine, Jean‐Pierre, 2018, “Negative interest rates in Switzerland: what have we learned?” Pacific Economic Review 23(1): 43-50.

Darracq Pariès, Matthieu, Christoffer Kok, and Matthias Rottner, 2020, “Reversal Interest Rate and Macroprudential Policy.” ECB Working Paper No. 2487. (Frankfurt am Main: European Central Bank).

de Groot, Oliver and Alexander Haas, 2020, “The Signaling Channel of Negative Interest Rates.” CEPR Discussion Paper No. DP14268.

DellʼAriccia, Giovanni, Luc Laeven, and Robert Marquez, 2014, “Real Interest Rates, Leverage, and Bank Risk-Taking.” Journal of Economic Theory 149: 65-99.

Dell’Ariccia, Giovanni, Pau Rabanal, and Damiano Sandri (2018): “Unconventional monetary policies in the Euro Area, Japan, and the United Kingdom”, Journal of Economic Perspectives 32(4): 147-172.

Del Negro, Marco, Domenico Giannone, Marc P. Giannoni, and Andrea Tambalotti. “Global trends in interest rates.” Journal of International Economics 118 (2019): 248-262.

Drechsler, Itamar, Alexi Savov, and Philipp Schnabl, 2017, “The deposits channel of monetary policy.” The Quarterly Journal of Economics 132(4): 1819-1876.

Drechsler, Itamar, Alexi Savov, and Philipp Schnabl, 2018, “Banking on deposits: Maturity transformation without interest rate risk.” NBER Working Paper No. 24582. (Cambridge, Massachusetts: National Bureau of Economic Research).

Grisse, Christian, Signe Krogstrup, and Silvio Schumacher, 2017, “Lower-Bound Beliefs and Long-Term Interest Rates.” International Journal of Central Banking, Vol. 13, No. 3: 165-202.

Heider, Florian, Farzad Saidi, Glenn Schepens, 2019, “Life below Zero: Bank Lending under Negative Policy Rates,” The Review of Financial Studies, Volume 32, Issue 10: 3728–3761.

Honda, Y., and H. Inoue, 2019, “The Effectiveness of the Negative Interest Rate Policy in Japan: An Early Assessment,” Journal of the Japanese and International Economies, Vol. 52: 142-153.

Hong, Gee Hee and John Kandrac, 2018, “Pushed Past the Limit? How Japanese Banks Reacted to Negative Rates.” IMF Working Paper No. 18/131. (Washington: International Monetary Fund).

Klein, Melanie, 2020, “Implications of Negative Interest Rates for the Net Interest Margin and Lending of Euro Area Banks.” Deutsche Bundesbank Discussion Paper No. 10/2020. (Frankfurt am Main: Deutsche Bundesbank).

Lopez, José A., Andrew K. Rose, and Mark Spiegel,2020, “Why Have Negative Nominal Interest Rates Had Such a Small Effect on Bank Performance? Cross Country Evidence.” European Economic Review, Vol. 124: 103402.

Rostagno, Massimo, Carlo Altavilla, Giacomo Carboni, Wolfgang Lemke, Roberto Motto, Arthur Saint Guilhem, and Jonathan Yiangou, 2019, “A Tale of Two Decades: The ECB’s Monetary Policy at 20.” ECB Working Paper No. 2346. (Frankfurt am Main: European Central Bank).

Ulate, Mauricio, 2021, “Going Negative at the Zero Lower Bound: The Effects of Negative Nominal Interest Rates.” American Economic Review 111(1):1-40.

Urbschat, Florian, 2019, “The Good, the Bad, and the Ugly: Impact of Negative Interest Rates and QE on the Profitability and Risk-Taking of 1600 German Banks.” CESifo Working Paper No. 7358.

Madaschi, Christophe, and Irene Pablos Nuevo, 2017, “The profitability of banks in a context of negative monetary policy rates: The cases of Sweden and Denmark.” ECB Occasional Paper No. 195. (Frankfurt am Main: European Central Bank).

Molyneux, P., Reghezza A., Xie R., 2019, “Bank margins and profits in a world of negative

Rates.” Journal of Banking and Finance, 107, Article 105613, In press.

Wu, Cynthia, and Fan Dora Xia, 2020, “Negative Interest Rate Policy and Yield Curve”, Journal of Applied Econometrics, Volume 35, Issue 6, Pages 653-672.

The views expressed in this note are those of the authors and should not be attributed to the IMF, its Executive Board, or its management.