We analyze results from a self-conducted survey of members of the French and German national parliaments on economic policies and reform options for the Eurozone. Our econometric analysis addresses the key question of the extent to which potential heterogeneity between politicians is driven by national differences or different party ideologies similar to within-country cleavages. We find that a Rhine-divide exists, but that ideological differences between members of national parliaments are quantitatively more important and more robust than national differences between the French and the Germans. However, for EMU-related policies like Eurobonds, the Fiscal Compact and the strong ECB involvement we find a strong and robust difference between parliamentarians of both countries even if they belong to the same party family.

1. Introduction

The dramatic years of the euro area debt crisis have yielded substantial learning effects. The verdict that the EMU in its initial set-up resembles a “half-built house” (Bergsten, 2012) has become a far-reaching consensus. After extensive reforms of euro area fiscal rules, the establishment of the European Banking Union and the creation of the permanent European Stability Mechanism (ESM) the political and academic reform debate remains intense and the future of the Eurozone unclear.2

When it comes to the political feasibility of EMU reforms, the existence of a French-German consensus is usually seen as one of the necessary (albeit not sufficient) conditions. Using an original survey of French and German members of national parliaments (henceforth abbreviated MPs) we provide novel insights on the extent to which this consensus exists. The survey sheds light on the acceptance of existing rules, changes to national policies, and the political feasibility of new European-level institutions to preserve and stabilize the Eurozone. Our survey relates to diverse reform topics, which cover the set-up of new fiscal stabilization instruments for the euro area (for example through a European unemployment insurance), possible new financing instruments for euro area governments, majority voting on taxes as well as structural reforms, and the role of the ECB.

German-French divergence in EMU-related preferences has recently received increasing academic attention. In their analysis of the euro crisis and the underlying national policy traditions, Brunnermeier et al. (2016) focus on Germany and France. They diagnose a “Rhine-Divide” according to which policy approaches between Paris and Berlin differ substantially: Compared to France, German economic policy stresses the importance of rules over discretion and principles of liability over solidarity. Liquidity constraints tend to be seen as an outcome of fundamental insolvency in Germany, whereas in France they are often viewed as part of self-enforcing bad equilibria. Consistent with these assessments, French policy prescriptions are commonly seen as more Keynesian and demand-oriented whereas German approaches emphasize the need of austerity and structural reforms in order to deal with such crises.

Our paper provides some evidence on this view that different economic policy traditions come as a constraint on EMU reforms. We analyze EMU-related reform preferences with a particular focus on the possible Franco-German divide. Our study is unique insofar as it is based on the first comparative survey of euro reform preferences in national parliaments in the euro area: France (covering both chambers, the Assemblée Nationale and the Sénat) and Germany (Deutscher Bundestag).

2. Institutional set-up and survey description

The national legislative chambers in Germany and France differ in various aspects. The German Bundestag has a mixed-member proportional voting system where 299 members of parliament are directly elected (first vote) and 299 are indirectly elected from party lists (second vote).3 Note that the German MPs in our survey were elected in late 2013 for four years in office.

The legislative branch in France is divided into two chambers: the Assemblée Nationale and the Sénat as the lower and the upper house, respectively. Whereas MPs in the Assemblée Nationale are elected by majority decisions in up to two rounds for 5 years (starting in our sample in 2012 for the legislative term ending in 2017), members of the Sénat are indirectly elected by elected officials of various tiers of government including the Assemblée Nationale. Half of the senators are elected every three years for a six-year term, the last election preceding our survey being September 2014. The questionnaires for the French and German MPs were formulated in French and German, respectively, but had the same content and wording. The survey was not anonymized in order to analyze the determinants of participation as well as the elicited beliefs of the MPs about EMU policy reforms. In total, we received 232 completed questionnaires from the overall population of 1,552 national MPs in Germany and France (response rate of 14.95%). In what follows, we use the respective faction membership in the European Parliament (EP) as the measure of the left-right position. Our baseline estimates consider MPs from the fractions of both Socialists and Democrats (S&D), Greens (Greens/EFA) as well as European United Left–Nordic Green Left (GUE/NGL) as left-leaning MPs, which we compare to the conservatives of the European People’s Party group (EPP), the Europe of Nations and Freedom (ENF) and the Liberals (ALDE).

A non-response analysis for the survey is provided by Blesse et al. (2017b). It shows that, for example, age is positively related to participation, while number of years in parliament has the opposite effect. We take account for these insights in the underlying econometric specifications to reduce the risk that a sample selection bias is infecting the results (see Blesse et al., 2017a for details).

3. Descriptive Analysis

A main objective of our study is to find out to what extent national differences between France and Germany matter in the debate on the future of EMU. Alternatively, differences in policymakers’ views in France and Germany could be rooted in differences in ideology, or simply be the result of certain individual characteristics like age or gender of the respective parliamentarian. We focus in particular on the need to disentangle the influences from nationality and ideology/party membership. The former would constitute a long-run obstacle to a German-French consensus, while the latter can change with elections.

National growth policies

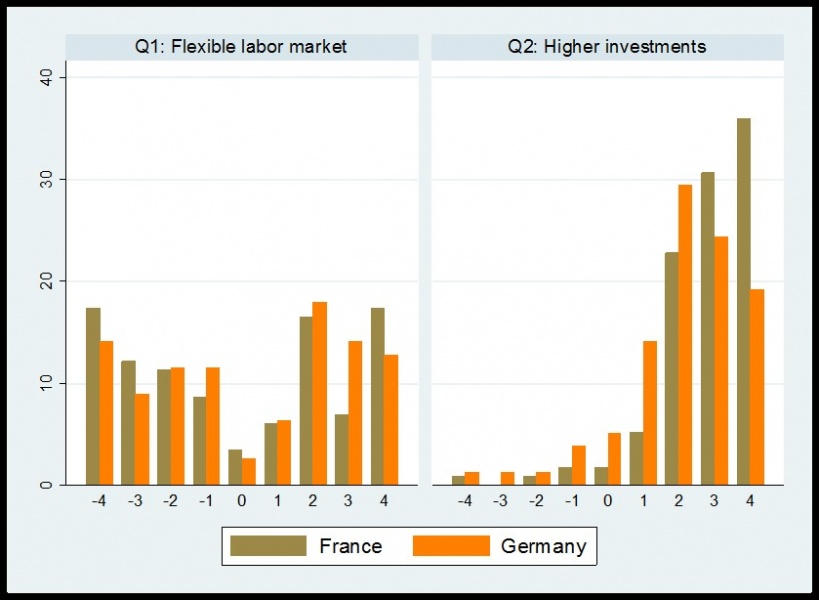

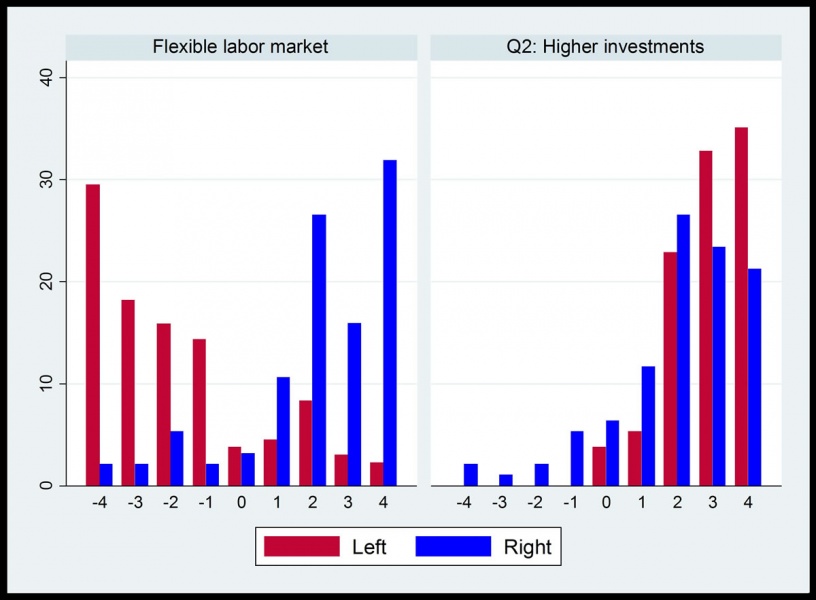

Figures 1 and 2 show the heterogeneity of responses to questions regarding national growth policies by nationality and party ideology, respectively. The issue of labor market flexibility to enhance growth polarizes respondents along party groups but not much along the country dimension.4 Conservative MPs in both countries tend to support higher flexibility of national labor markets, while the opposite is true for social-democratic politicians. Higher investment spending is favored by overwhelming majorities in both countries but German politicians and conservative party members are somewhat less enthusiastic.

Figure 1: National growth policy priorities – national cleavage

Note: Answer categories for all questions range on a 9-point scale from -4 (Disagree) over 0 (Undecided) to Agree (+4). For details on the wording of the questionnaire, see Blesse et al. (2017a).

Figure 2: National growth policy priorities – partisan cleavage

EMU institutions and policies

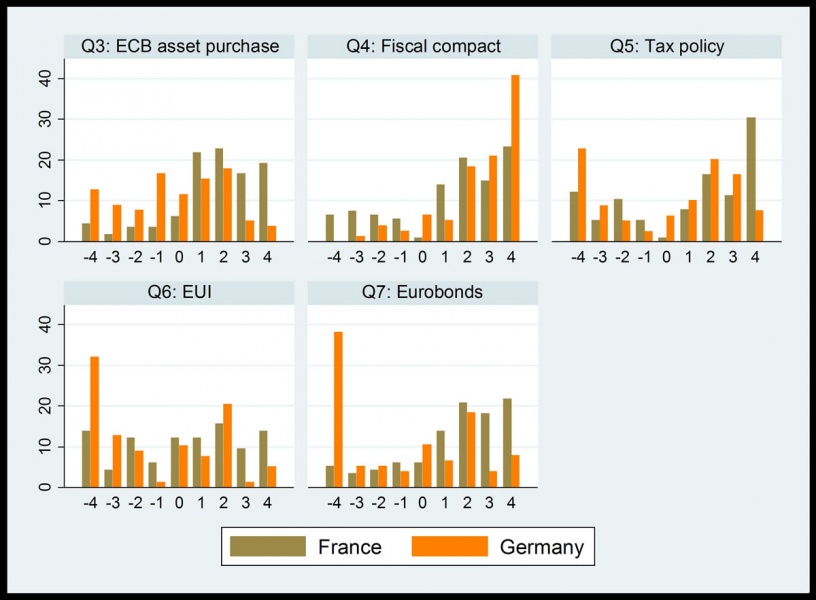

Figures 3 and 4 illustrate the distribution of policy preferences of MPs across the five remaining questions about EMU institutions and reform initiatives along nationality and political ideology of European Parliament party groups.

Figure 3: EMU policy and reform priorities – national cleavage

Figure 4: EMU policy and reform priorities – partisan cleavages

The strong involvement of the ECB during the euro area debt crisis splits MPs into opposite camps along both the country and the party dimension. French and socialist/social-democratic members of parliament are by and large supportive of the central bank’s purchases of sovereign bonds. By contrast, more than half of German and of conservative MPs have a critical view on the role of the ECB.

A reduction of national autonomy in fiscal policy matters receives mixed support with discernable differences at the country and party level for most issues. The views on European decisions rules on tax matters are clearly polarized. A majority of French respondents welcomes a less restrictive decision rule in the EU regarding tax issues, whereas German representatives are split on that issue. The reform is popular among politicians from the left but less so among the right. Conservatives are fervent advocates of fiscal rules, whereas politicians on the left are much less united in their support.

The approval rates for a European fiscal capacity in the form of an unemployment insurance scheme are mixed, both from a country and a party perspective. A strong “no” (-4) to EUI is the most frequent answer given both by German and conservative politicians. A majority of left-leaning politicians support the introduction of a stabilization tool. In France opponents and supporters of EUI roughly balance out.

The issue of Eurobonds, the most far reaching option for mutual debt guarantees in the euro area, is the question associated with the strongest polarization along both country and party group dimensions. There is strong support from French members of parliament, as well as from a majority of left-leaning politicians in both countries. For German and conservative survey participants alike, Eurobonds are highly unpopular: a strong “no” (-4) is by far the most frequent response in our sample.

Overall, the descriptive evidence provides some support for the “Rhine divide”-hypothesis: Compared to their French colleagues, German members of the Bundestag are indeed more skeptical when it comes to a strong role for monetary policy in crisis stabilization, a new stabilization instrument (EUI), and a common public debt management (Eurobonds). Both new policy instruments receive more support in the French parliamentary chambers. However, no strong national cleavage can be detected for an important supply side issue like more labor market flexibility, for which only the partisan cleavage appears to be very strong. Moreover, we find substantial partisan differences across all policy fields surveyed in this study.

4. Summary of econometric analysis

In the econometric testing (fully reported in Blesse et al., 2017a) we enrich the analysis by taking into account individual characteristics of MPs, in addition to the two nationality and party group dimensions. We cover individual characteristics such as gender and age, parliamentary experience (number of years as a member of parliament), education and expertise in economic and financial matters through membership in certain committees (finance or EU affairs).

The results from an ordered probit estimation model and various robustness checks confirm a strong role of party affiliation for preferences on national growth policies. Ceteris paribus, a MP from the left has a 29.8 percentage point lower probability to strongly opt for more flexible labor markets than his or her conservative peer. For the demand side policy “higher national investments” the ideological divide is slightly less pronounced with a 23.4 percentage point higher probability of support from the left. Nationality is much less important as a determinant of preferences. No response category shows statistical significance at conventional levels for nationality of MPs either for the flexible labor markets or higher national investments statements.

Party affiliation plays also a major role in explaining the heterogeneity in EMU policy and reform preferences. For instance, left MPs are more supportive of ECB interventions than conservatives. On limiting national autonomy, the effects of ideology are strongly asymmetric: relative to the political right, the left favors majority voting on tax issues at the European level and is heavily opposed to fiscal constraints with left-leaning politicians being 49.2 percentage points less likely to be strongly in favor to the Fiscal Compact. Far reaching stabilization (EUI) and mutual guarantees (Eurobonds) within Europe are particularly popular among the left MPs in both countries. Again, ideology effects are widely symmetric across all respective answer categories.

For policies at the European and Eurozone level, the role of differing national views – also within the same European party family – is more pronounced. The results indicate a statistically distinct impact of nationality in all policy areas, which exists independent of the significant ideological cleavage. Compared to German politicians, the French respondents are more supportive of asset purchases by the ECB, debt mutualization through Eurobonds, and stabilization through a European unemployment insurance scheme even if they belong to the same party family as German representatives. Conversely, French politicians are more skeptical about fiscal constraints as implemented in the Fiscal Compact. French MPs are, however, more supportive of the introduction of a system of majority voting on tax issues at the European level. The sizes of the average marginal effects from nationality are on average smaller than those of ideology, but French policymakers have a 18.6 percentage points’ higher probabilities of strongly supporting Eurobonds or rejecting the Fiscal Compact, respectively.

5. Concluding remarks

Overall our results indicate that ideological differences between the members of national parliaments concerning the future of Europe and the Eurozone are quantitatively more important and more robust than national differences between the French and the Germans. However, for EMU-related policies and reform options we find a strong and robust difference between parliamentarians of both countries even if they belong to the same party family. Individual characteristics of members of parliament play only a minor role. Significant differ-ences between German and French politicians are found in key areas concerning the future of the euro zone: the desirability of a strong ECB role, mutual guarantees through Eurobonds and fiscal constraints like those of the Fiscal Compact. Distinct national differences – beyond those explained by ideological differences – are much less pronounced when it comes to national growth increasing policies. When in the same political camp, Germans and French MPs do not hold very different views in this regard. Moreover, among the EMU reform issues country polarization is less pronounced for a reform of decision making at the European level on tax matters and for the introduction of a European unemployment insurance.

Our results suggest that institutional reforms relating to economic policies in the Euro area may be backed by national parliaments when in both France and Germany the majorities in parliament share the same ideological position. However, even accounting for ideological differences, a “Rhine-divide” prevails in fiscal and monetary issues of the EMU.

Bergsten, C. F. (2012). “Why the Euro Will Survive: Completing the Continent’s Half-Built House”, Foreign Affairs, 91(5), 16-22.

Blesse, S.; Boyer, P.C.; Heinemann, F.; Janeba, E. and Raj, A. (2017a). “European Monetary Union Reform Preferences of French and German Parliamentarians”, ZEW Discussion Paper No. 17-059.

Blesse, S.; Boyer, P.C.; Heinemann, F.; Janeba, E. and Raj, A. (2017b). “Intégration européenne et politiques du marché du travail: Quel consensus entre parlementaires Français et Allemands?”, Revue d’Economie Politique, 127(5), 737-59.

Brunnermeier, M. K.; James, H. and Landau, J. (2016). The Euro and the Battle of Ideas, Princeton and Oxford: Princeton University Press.

Dolls, M.; Fuest, C.; Heinemann, F. und Peichl, A. (2016). “Reconciling Insurance with Market Discipline: A Blueprint for a European Fiscal Union”, CESifo Economic Studies, 62(2), 210-231.

European Commission (2017). “Reflection Paper on the Deepening of the Economic and Monetary Union”, COM (2017) 291 of 31 May 2017, Brussels.

This research note summarizes the analysis in: Blesse, Sebastian, Pierre C. Boyer, Friedrich Heinemann, Eckhard Janeba und Anasuya Raj (2017), European Monetary Union Reform Preferences of French and German Parliamentarians, ZEW Discussion Paper No. 17-059, Mannheim.

http://www.zew.de/de/publikationen/european-monetary-union-reform-preferences-of-french-and-german-parliamentarians/?cHash=9fd6334b0e68c3759efb21e6ad5940c8.

† ZEW Mannheim, * CREST, E cole Polytechnique, University Paris-Saclay, ‡ University of Mannheim

The authors gratefully acknowledge the SFB 884 on the Political Economy of Reforms for financial support.

For an academic survey see Dolls et al. (2016) and for a major political initiative see European Commission (2017).

The German electoral system allows for additional parliamentary seats (excess mandates) when number of second vote seats exceeds the number of first vote seats. In the 2013-17 legislative period the total number of seats was 630.

All difference which are stressed in this discussion are also different with a significance of at least 5% (t-test for comparison of means), see Blesse et al. (2017a, Table 2).