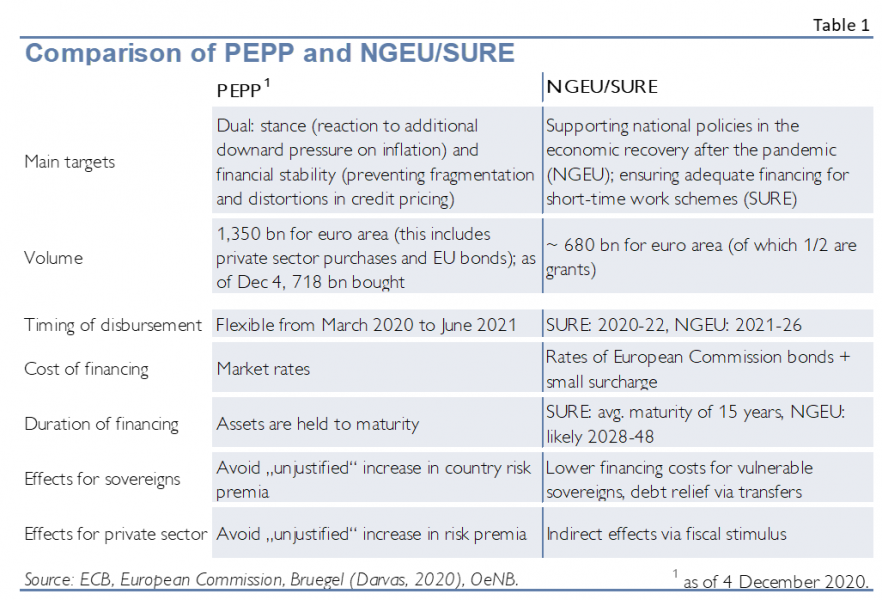

Given the asymmetric nature of the COVID-19 shock (in terms of sectors and countries), fiscal policy is better equipped to implement measures targeted to sectors that are most affected. At the same time, national fiscal responses could be constrained by the national fiscal space in those countries that are most affected. Therefore, NGEU and SURE clearly complement monetary policy to reduce market fragmentation. However, they have a different time horizon than PEPP (especially NGEU) as most of its stimulus will only come into effect after the end of the pandemic. Thus, for the simple reason of timing, APP and PEPP will not become redundant as a result of the creation of NGEU/SURE, but the urgency of using the PEPP’s flexibility to counter market fragmentation has been reduced.

It has often been argued that when an economic crisis happens in the euro area, it ultimately comes down to the Eurosystem (European Central Bank and national central banks of the euro area) to act as “policy maker of last resort”, as EU policy makers are (a) too slow to act, (b) in some cases lack policy space to take decisive action, and (c) given asymmetric shocks, react without a euro area/EU-wide perspective. The main obstacle, it has been argued, is that the euro area (resp. the EU) lacks a central fiscal capacity to take decisive action. This lack of a fiscal and political union gave rise to redenomination risks and a sovereign debt crisis, which motivated the Eurosystem’s SMP (Securities Markets Programme) and OMT (Outright Monetary Transactions) announcements.2

As the shock induced by the COVID-19 crisis is asymmetric in terms of sectors and countries, fiscal policy is better equipped to implement targeted measures to sectors that are more affected. However, the fiscal response may be constrained by national fiscal space in those countries that are most affected.

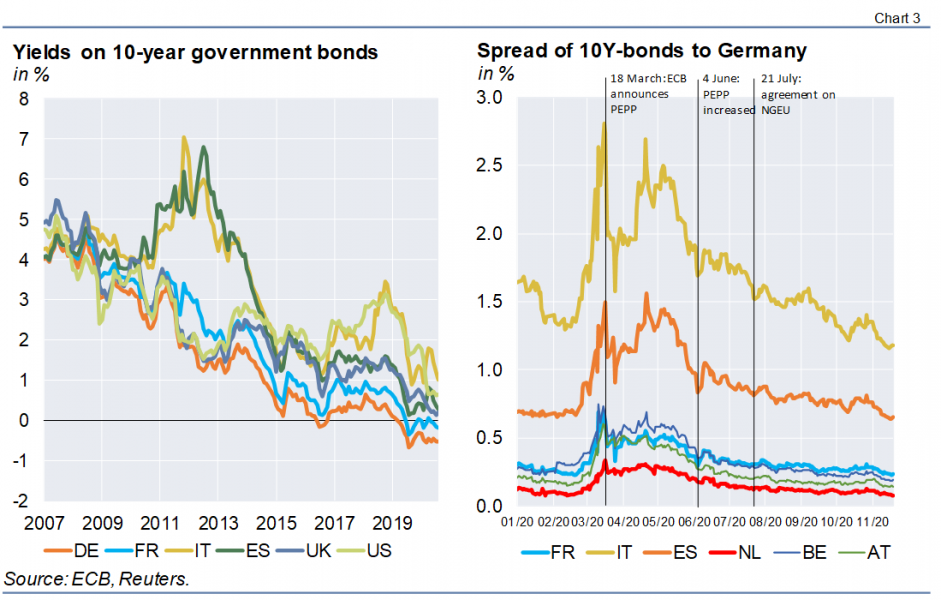

With the announcement of the Pandemic Emergency Purchase Programme (PEPP), the Eurosystem has again provided a strong policy response. In particular, the embedded flexibility in the PEPP introduced the innovation of combining two policy aims: first, to ease further the monetary policy stance in a period of already very low nominal interest rates, and second, in light of the tail risks associated with the crisis, to reduce market fragmentation and guarantee a smooth transmission of the monetary impulse to all jurisdictions by keeping risk premia in these markets consistent with fundamentally justified levels, and by stopping intra-euro area capital outflows from periphery to core (safe-haven) bond markets.

The question arises to what extent the announcement and, ultimately, establishment of SURE (Support to mitigate Unemployment Risks in an Emergency) and NGEU3 (Next Generation EU) are game changers for the above narrative. Are these instruments the long-awaited “central fiscal capacity”, which will help vulnerable euro area countries absorb asymmetric shocks, thus taking off pressure from national sovereign debt sustainability concerns and taking off pressure from the Eurosystem to step in?

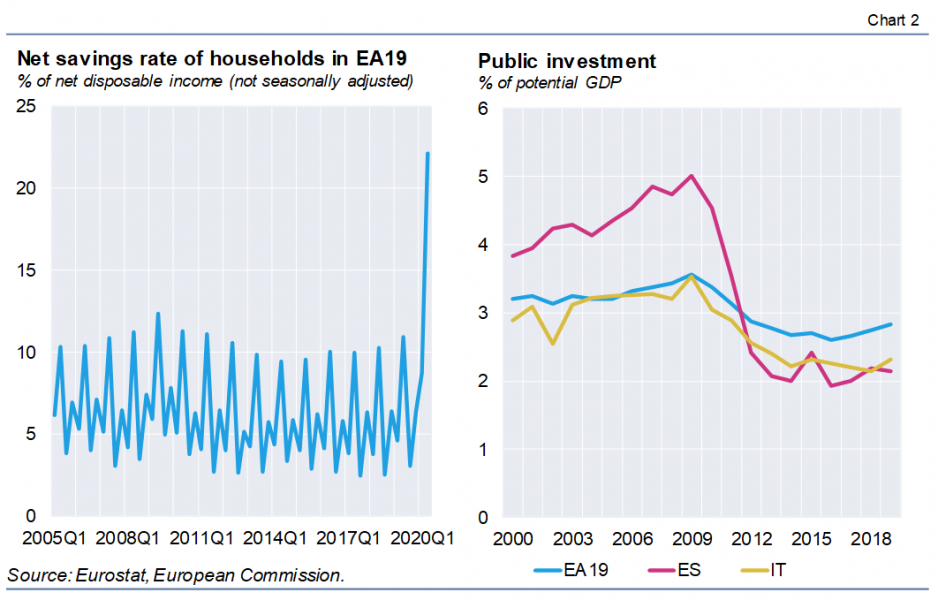

The current crisis does not constitute a standard demand shock, especially for households which would like to consume and would have sufficient resources (at least in the aggregate, see behavior of savings rate in Chart 2). Therefore, typical fiscal and/or monetary stimulus measures to boost demand would be ineffective or even counterproductive as long as contact among persons should be minimized.

In these circumstances, fiscal policy is much better equipped than monetary policy to implement measures targeted at economic sectors and households hit particularly hard by this crisis, e.g. via subsidies and social transfers. The European fiscal measures (NGEU and SURE) only help to ease the financing constraints of sovereigns; the focus of SURE is on the short run, while the purpose of NGEU is rather to support the stimulus after the end of the health crisis, especially by supporting public investment (in contrast to the counterproductive cuts to public investment observed after 2009).

On the other hand, monetary policy helps by easing the financing constraints for sovereigns as well as for affected enterprises and households. For the demand side effects of expansionary fiscal policy, it does not matter whether debt issued by a country (or the EU) is bought by the central bank or by the private sector. However, for the financial system and investors, central bank bond purchases imply less availability of long-term assets (government bonds)4 and larger availability of short-term assets (deposit facility). Thus, the central bank assumes a maturity transformation function.

As a result, the difference between debt bought by the central bank (monetization) and by the private sector is the effect on interest rates (on both term and risk premia). This is the main contribution of the current monetary policy measures. By keeping interest rates low (not only for sovereigns but also for the private sector) there is a positive effect on the economy through lower financing costs, which should prevent an even stronger downturn and even stimulate the economy. This should help to increase inflation expectations and to eventually help the Eurosystem to fulfil its mandate. As long as the Eurosystem complies with certain criteria (purchases according to the capital key, issues limits, etc.), it is complying with the Treaty and there is no “monetary financing” in the sense of the EU Treaty and its interpretation by the relevant Courts.

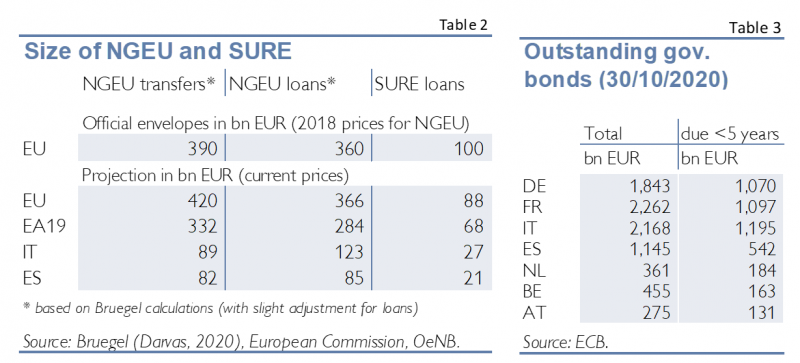

The volumes of NGEU/SURE are quite large compared to what was considered politically feasible only a year ago. Table 1 provides a comparison of PEPP and NGEU/SURE. However, volumes have to be compared with great caution. Transfers have larger effects than cheaper loans, and cheaper loans are difficult to compare with asset purchases. For some jurisdictions, these loans have lower interest than debt issuance with the same maturity. And only these jurisdictions are expected to take up these loans. For example, Austria, Germany, France and the Netherlands have not taken any loans from SURE, while Spain and Italy will borrow significant amounts (Table 2). For NGEU loans it is not clear which countries will take them up at all, Darvas (2020) assumes that all countries which have taken up SURE loans will use this opportunity.6 Overall, as the distribution of NGEU and SURE financing is not constrained by the Eurosystem’s capital key, resources are much more targeted towards vulnerable countries (and are therefore more effective).

However, even if countries like Spain and Italy fully take up their potential share of NGEU loans, they can only cover a fraction of their financing needs over the next years with them. For example, the sum of expected NGEU loans, NGEU transfers and SURE loans for Italy is somewhat above 0.2 tn EUR (Table 2), but the amount of maturing debt securities over the next 5 years is about 1.2 tn EUR (Table 3). So while in these jurisdictions PEPP has a smaller effect on reducing interest rates compared to loans by the European Commission, PEPP affects a larger share of financing needs.

Box: Is NGEU the safe asset for the euro area?NGEU and SURE will lead to debt issuance by the European Commission of close to 0.9 tn EUR (Table 4). This will approximately double the amount of outstanding debt securities by major international institutions of the euro area and the EU (European Investment Bank / EIB, European Stability Mechanism / ESM, European Financial Stability Facility / EFSF, European Commission). The debt securities issued by the Commission are in a way a euro area safe asset as they are issued in EUR and are indirectly backed by the EU budget to which all EU members have to contribute. The European Commission’s debt is rated AAA except for one AA by Standard & Poor’s. Issue yields of SURE bonds so far were generally higher than the market yields of Dutch or Austrian bonds, but for longer maturities they were at least in the range of or even below of the ones for French and Belgian bonds (Chart 1). However, spreads of EU bonds to Germany have decreased after these first issuances and are currently (7 December) about as high as the ones of Austria.

Taking the existing bonds and the bonds to be issued under NGEU and SURE together, one arrives at about 1.7 tn EUR (~14% of euro area GDP in 2019), with the European Commission’s bonds making up close to 0.9 tn EUR (~7% of euro area GDP in 2019). For comparison, currently outstanding general government bonds of France and Italy are well above 2 tn EUR each, of Germany around 1.8 tn EUR and of Spain above 1 tn EUR (Table 3). Thus, the size of bonds issued by EU institutions continues to be comparatively small for establishing a safe asset. Furthermore, according to current agreements, NGEU and SURE are only temporary and it is therefore uncertain if the supply will increase over time, or whether it will shrink as maturity arrives. The yield is still significantly above that of German bunds, though the increased liquidity might decrease the yield spread. |

NGEU and SURE do not provide any direct support to the private sector, they only help sovereigns to ensure that their short-run and medium-run fiscal response is adequate. They do so by easing the fiscal situation for sovereigns via direct transfers and through a reduction in financing costs and also indirectly via confidence effects on international financial markets due to increased risk sharing in the EU (or perceived risk-sharing).

NGEU is also different in terms of timing as most of the transfers and loans will probably only be granted as the pandemic is – hopefully – over. It is actually not fully clear how much “standard” untargeted fiscal stimulus is really needed after the pandemic as households’ savings have increased sharply in response to the health crisis (left panel of Chart 2), leaving much room for a strong boost to private consumption after the pandemic. Thus, the focus of the NGEU’s transfer component on supporting investment after the pandemic has to be seen in the light of the aftermath of the Great Recession of 2008/09. While public investment actually increased in 2009, it was cut heavily in the subsequent consolidation, especially in countries most affected by the sovereign debt crisis like Italy or Spain (right panel in Chart 2). The NGEU would ensure that this costly policy mistake will not be repeated.

Following the shock, monetary policy eased financing conditions to support aggregate demand and ensure the fulfilment of the Eurosystem’s mandate. Because at the ELB (effective lower bound for policy rates), monetary policy purchases sovereign bonds to lower the longer-term yields. Thereby, the Eurosystem absorbs the extra duration risk that arises from a higher supply of bonds, which at the same time facilitates the fiscal impulse. On the other hand, monetary policy can be constrained if the eligible universe of bonds is not large enough for a significant monetary impulse. In fact, before the pandemic crisis, due to legal constraints the feasibility of the APP (Asset Purchase Programme) was always questioned, which reduced its credibility and effectiveness. With the large bond issuance by national governments and by European supranational issuers, this feasibility concern has disappeared, enhancing the credibility of the purchase program. Thus, this announcement has in fact increased the monetary policy space.

An important element of the Eurosystem’s PEPP program is the flexibility in terms of the pace and composition of purchases. This implies that sovereign bond purchases under the PEPP may (temporarily) deviate from the Eurosystem capital key. An eventual return of the Eurosystem’s composition of euro area sovereign bond holdings to the capital key is an important element to dispel monetary financing prohibition concerns. By significantly increasing the universe of supranational entities in the asset purchases and the amount of risk sharing in the EU, the deviation of Eurosystem sovereign bond holdings from the capital key can be reduced by having a larger focus on the purchase of supranationals.7 In terms of signaling and confidence effects, NGEU and SURE are perceived to have sent a strong signal of EU solidarity, which has contributed to reducing country risk premia, in turn reducing the need for Eurosystem intervention.

However, there could also be some negative effects. On one hand, the increase in bond issuance could put upward pressure on yields and more importantly increase duration risk, which can be absorbed by APP or PEPP. On the other hand, given the high rating of the EU supranational bonds compared to several national euro area jurisdictions, there may be a flight-to-safety towards these bonds putting upward pressure on yields of lower-rated countries. In this case, the Eurosystem could concentrate purchases in lower-rated bonds, which would increase the effectiveness of monetary policy, but which would again increase deviations from the capital key and rise concerns of monetary financing.

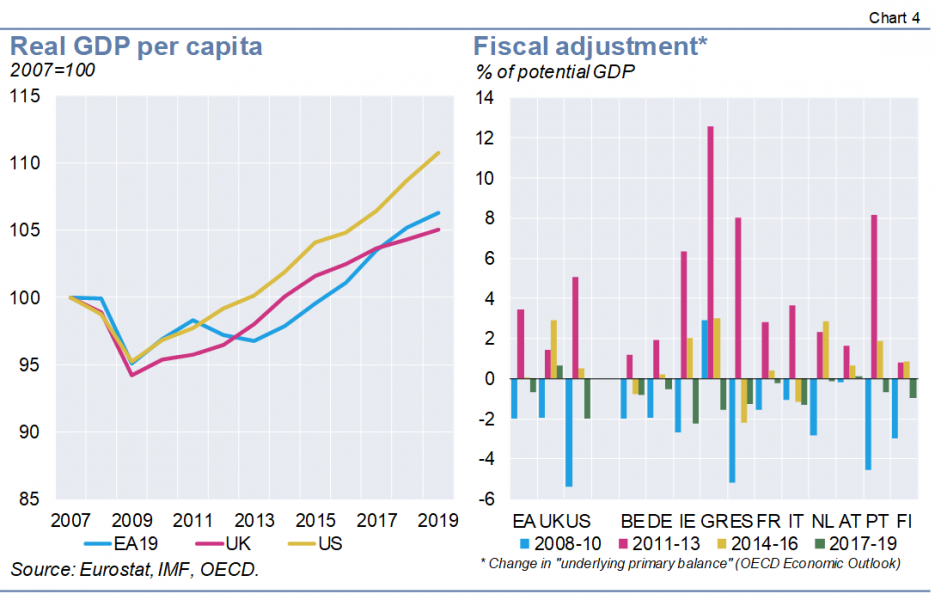

It is also worth considering the experience made in the euro area sovereign debt crisis which was accompanied by a recession in 2012/13 (Chart 4). In fact, overall consolidation in the euro area was smaller (Chart 4) than in the US at that time. But while the US only experienced a small decline in GDP growth, the euro area incurred a painful recession. What was different was the situation in financial markets as interest rates in the US were much lower than in Spain or Italy despite the high budget deficits in the US at that time (Chart 3). Furthermore, consolidation was much larger in some individual vulnerable euro area member states, which should be alleviated this time via the targeted transfers towards them.

Overall, the probability of a sudden spike in sovereign risk premia, driven by redenomination risks, is likely much lower than it was 10 years ago. This is due to the combined effect of monetary policy measures (OMT, APP and PEPP), the strengthening of EU institutions (ESM, SSM) and more recently the announcement of the NGEU and SURE as well as the much better initial fiscal position of most euro area member states.

Bilbiie, F. T. Monacelli and R. Perotti. 2020. Fiscal Policy in Europe: A Helicopter View. CEPR Discussion Paper No. DP15382.

Darvas, Z. 2020. Next Generation EU payments across countries and years. Bruegel Blog, 12 November. Available at: https://www.bruegel.org/2020/11/next-generation-eu-payments-across-countries-and-years/

With significant input from Ernest Gnan, Oesterreichische Nationalbank & SUERF.

For an excellent review of this issue see Bilbiie et al. (2020).

SURE encompasses loans from the European Commission to finance short-time work schemes. NGEU primarily consists of loans and grants from the European Commission to finance measures conducive to the economic recovery after the pandemic (Recovery and Resilience Facility / RRF), but also includes enlargements of existing EU programmes (e.g. European Regional Development Fund and European Social Fund).

Although the PEPP and APP have increasingly expanded purchases to short-term assets, too.

We only look at PEPP and ignore TLTRO-III, changes in collateral, forward guidance, etc.

Note that we take the data on the distribution of NGEU grants and loans from Darvas (2020). The only exception is that we have a slightly different interpretation of the ceiling of NGEU loans of 6.8% of GNI of the respective country: Darvas (2020) uses GNI projections for 2020, while we use the GNI figures from 2019, which leads to somewhat higher loans for all affected countries.

Note that vulnerable countries would especially benefit from lower yields of (EU Commission) supranational bonds as this would reduce their financing costs for NGEU and SURE loans.