The notion of risk-sharing in currency unions has recently acquired interest in policy making circles. This note links key findings from the literature to relevant euro area (EA) policies and tools. Risk-sharing in a currency union takes place mainly through the savings and capital markets channels, as well as through fiscal transfers between (member) states. Risk-sharing results in more efficient absorption of (mainly) asymmetric shocks, and can therefore support the smooth and even transmission of monetary policy. Different views emerge on whether the main risk-sharing channels are shock-absorption complements or substitutes. Recent theoretical insights suggest that the full integration of credit and capital markets does not reap the full benefits of private risk-sharing without the support of public institutions. Empirical estimates of risk-sharing suggest that the savings/credit channel accounts for most of the shock absorption capacity of the euro area, with EA loans to currency union members receiving financial assistance during the crisis providing significant consumption smoothing through this channel, and working against the pro-cyclicality imposed by markets on the net borrowing of national governments. Interpreting the literature in the EMU context also suggests that more risk-sharing through the completion of the banking union (BU), capital markets union (CMU) and a fiscal capacity would notably improve the euro area’s shock absorption capacity.

Executive summary

1. Channels of risk-sharing

Current policy debates on institutional reform have unfolded along two dimensions. First, concepts of risk-sharing, on the one hand, are juxtaposed with proposals for risk-reduction, on the other. The former seeks to increase the resilience of the euro area by creating or reinforcing institutions for stabilising or redistributing income and consumption through ex-ante insurance or ex-post compensation (Schelkle, 2017a). Risk-reduction suggests increasing resilience by reducing risks or exposure to risks in the first place. A second distinction is drawn between public and private risk-sharing. While some argue that fostering risk-sharing in the private sector through a fully-fledged banking and capital markets unions can achieve full shock-absorption, new research suggests that the absence of a fiscal union renders private risk-sharing inefficient. As private risk-sharing alone leads to a market failure and is constrained-inefficient, a fiscal union is a necessary complement to (and not a substitute for) the banking and capital markets unions.

This literature review contributes to these debates, but cannot cover it in all of its breadth. It, therefore, primarily focuses on the literature on risk-sharing in a currency union. It reviews three important discussions in the literature: first, the channels of risk-sharing and their respective importance in the euro area; second, the impact of the euro area’s financial assistance institutions on shock absorption via risk-sharing; third, a discussion whether public and private risk-sharing are substitutes or complements. In short, this note analyses to what extent, and how, risk-sharing can contribute to the euro area’s capacity to absorb shocks.

Depending on their institutional design, some forms of risk-sharing can set adverse incentives for national fiscal, financial and economic policies. While it is not contested that risk-sharing increases the capacity to absorb shocks, some authors object to risk-sharing measures for their expected impact on the incentive structure in a currency union (e.g. Bargain et al. 2012). This note, however, separates this issue of incentives analytically, as these incentives do not directly relate to the question to what extent, and how, risk-sharing per se contributes to smoothing shocks.

The academic literature on risk-sharing starts indirectly in the context of Optimum Currency Area theory with Mundell (1961) and Kenen (1969).2 It was more recently and directly developed pre-EMU in Asdrubali et al. (1996), and lately enhanced with a theoretical paper by Farhi and Werning (2017), and empirical investigations such as those of Milano and Reichlin (2017), and Alcidi et al. (2017).

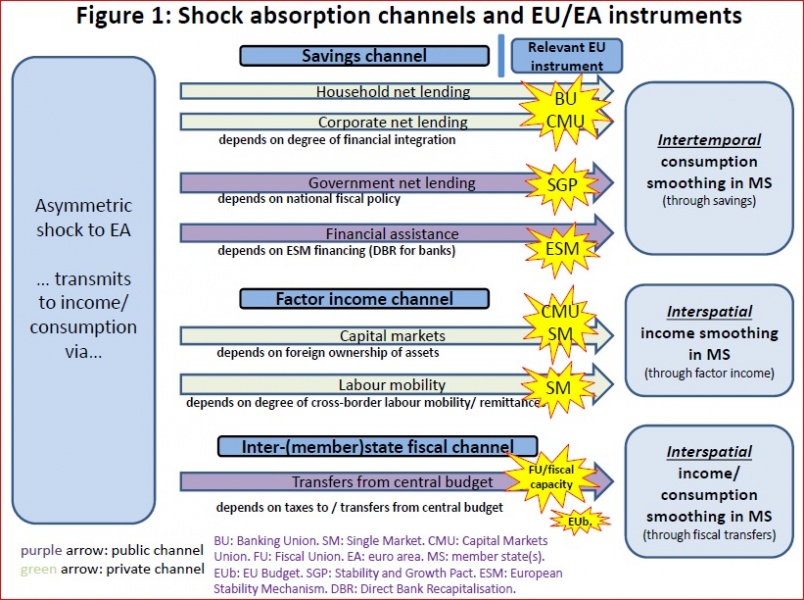

Shock absorption via risk-sharing takes place through three channels:

Savings channel: savings & access to international credit markets

While national credit markets tend to amplify shocks by contracting lending, international credit markets for savings and borrowing smooth the impact of shocks on consumption through the continued supply of credit. Savings are either provided by private (households and firms) or public agents. The latter comprises national governments on the one hand, and financial assistance from EU/EA mechanisms (European Financial Stability Facility (EFSF), European Financial Stabilisation Mechanism (EFSM), European Stability Mechanism (ESM)) on the other. Notably, the EA financial assistance mechanisms are commonly seen in the literature as part of the savings channel as the loan facilities are essentially a centralised form of government lending and borrowing at financial markets. The risk-sharing is intertemporal (as the loans need to be repaid) and ex post (triggered through higher credit demand in countries adversely affected by a shock). They are not direct fiscal transfers across countries, as these are an ex ante and interspatial risk-sharing channel.3

Capital markets channel: international portfolio diversification

With national markets becoming volatile during a crisis, integrated capital markets can smooth the impact of an asymmetric shock on income in a country; capital income continues to co-move with the aggregate output of the union. Capital markets are an interspatial and ex ante shock absorption channel.

Public transfers across countries: public policy (federal/centralised tax/transfers)

In the face of budget constraints on national governments (whether through rules or market discipline), taxes and transfers from a central budget are an interspatial ex ante shock absorption mechanism in that they redistribute income from favourably/less shocked to adversely/more shocked regions, with no direct obligation on the recipients to repay the transfers.

This note focuses on the literature on the above three channels of risk-sharing and does not tackle labour mobility or the price channel. The latter two act as shock absorbers but not necessarily through risk-sharing.4 As for the price channel, it is also not usually addressed in the risk-sharing literature but has been estimated on the basis of the Asdrubali et al. framework in the ECB’s Financial Integration Report (FIR 2016 and 2017). ECB staff has also contributed to the literature on risk-sharing. The ECB’s Financial Integration Reports in 2016 and 2017 provide analysis and empirical evidence on the aforementioned channels, including the price channel (cf. P. Hartmann (2016)). Cimadomo et al. (2017) show that financial integration and financial assistance instruments have increased the euro area’s capacity to absorb shocks. Fratzscher and Imbs (2007) show that international consumption risk-sharing is significantly improved by capital flows, especially portfolio investment. Institutions are crucial in attracting capital for closed economies, but are barely relevant in open ones. Kalemli-Ozcan et al. (2009) find that increased cross-banking integration increases consumption risk-sharing. Corsetti et al. (2004) study the international transmission of productivity shocks and find evidence supporting their prediction of a negative conditional correlation between relative consumptions and international relative prices.

2. Shock absorption in EMU: savings, capital markets, fiscal transfers

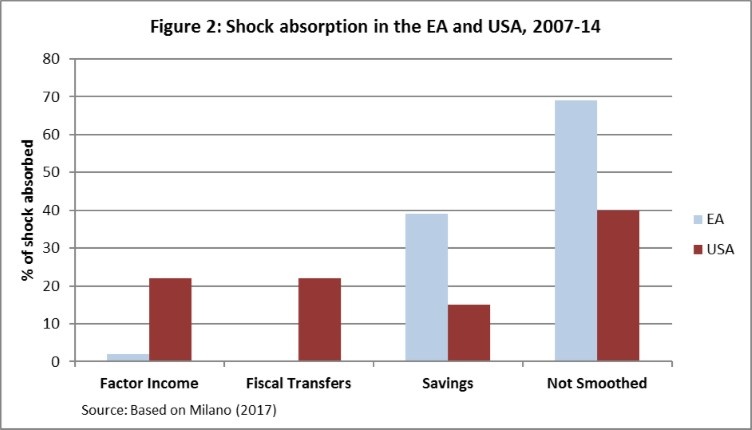

Savings are the most important risk-sharing channel in the euro area (EA). There is broad agreement that around 30-40% of shocks were smoothed through the savings channel during the euro area crisis. For instance, Milano and Reichlin’s (2017) estimate of the shock absorption effect provided by savings is 38% for 2007 to 2014. Van Beers et al. (2015) arrive at the same number, albeit for the years 2008 to 2012.

The shock absorption of EA factor income (capital channel) is very small. According to Milano (2017), factor income from capital smoothed only 2% of shocks between 2007 and 2014 while capital depreciation amplified shocks by 12% (cf. Alcidi & Thirion for similar results). The results from Van Beers et al.’s analysis for the years 2008 to 2012 suggest an even more negative role for capital markets (-29.4%) which is explained by the home bias towards domestic assets (financial fragmentation) and capital depreciation. Impediments to asset trade explain the limited gains through the capital markets channel (Cole and Obstfeld 1991).

Fiscal transfers did not have any significant effect for the period 2007 to 2014 (0%; Milano 2017). Van Beers et al. (2015) suggest that the smoothing by fiscal transfers appears to have increased over the past decades (to about 15% in 2008-12) but this effect is not statistically significant.

Overall, a large portion of shocks remain unsmoothed in the EA and the absorption capacity is significantly weaker than in the USA (see Figure 2). Between 2007 and 2014, 69% of shocks in the EA remained unsmoothed, according to Milano (2017). The estimate of Van Beers et al. (2015) for 2008 to 2012 is even higher at 76%. They notably point out that the extent of unsmoothed shocks has also increased over time, up from 49% for the period 1972 to 2012. By contrast, in the USA capital markets smoothed 22% of shocks between 2007 and 2014 and fiscal transfers 22%. Savings accounted for 15%, which is less than in the euro area but still significant.5

3. The role of EA financial assistance instruments for shock absorption through risk-sharing

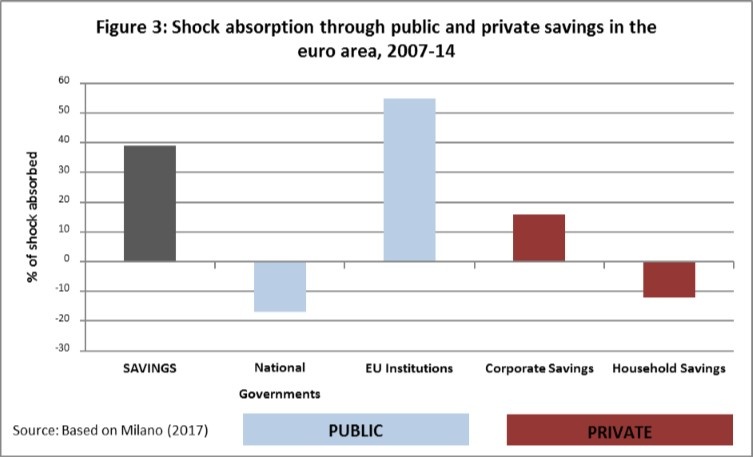

From an institutional perspective, the role of the EA financial assistance instruments for shock absorption is of particular interest. They work through the savings channel, which is composed of both private and public savings. Private savings consist of savings from households and firms which may also become available cross-border through banking sector lending activities and financial integration. Public savings comprise net borrowing of national governments from markets, and in the case of the EA, the EA lending mechanisms. Milano & Reichlin (2017) point out that the combined amount of risk-sharing provided through this channel in the EA was 28% for 1999-2014 and 38% for 2007-14. For the US, it was 19% and 22% respectively.

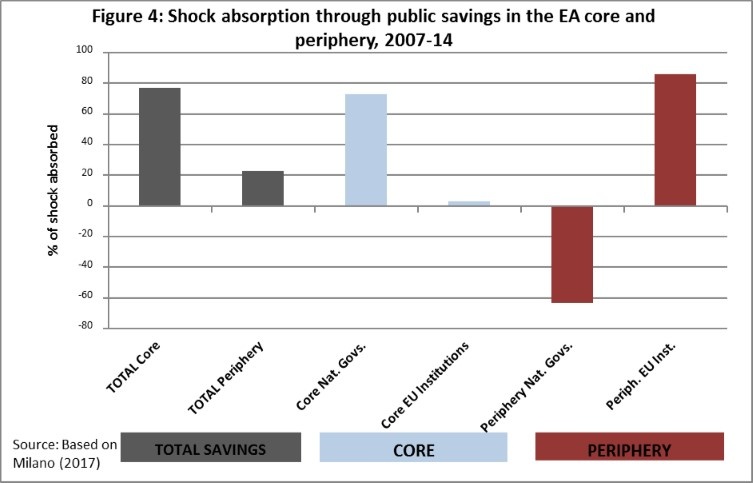

While borrowing in markets by private actors and national governments is an important shock absorber especially in the euro area, Furceri & Zdzienicka (2013) show that the savings channel is weak in absorbing unanticipated, permanent and severe shocks. Credit markets typically collapse in crises. Governments and private actors in the shocked country would need to borrow larger amounts than they can obtain. The bigger the shock, the lower the shock absorption through credit markets (Furceri & Zdzienicka 2013). The introduction of EA financial assistance instruments has stabilised the shock absorption capacity of the savings channel. To be noted, the role of private and public savings significantly differs between “core” (AT, BE, FI, FR, DE, IT, NL) and “periphery” (GR, IE, PT, ES) as a consequence of EA financial assistance. While national governments in the core provided for most of the shock absorption through the savings channel in their own countries (73%), net national government borrowing from the market during the crisis significantly amplified the asymmetric shock in peripheral countries (-63%), taking away most of the shock absorption of EU/EA assistance from the EFSF, EFSM and ESM (86%; treated as part of the savings channel) to leave a total of 77% of shocks unsmoothed in the periphery, compared to only 26% unsmoothed shocks in the core (see Figure 4).

Notably, some authors argue that bail-in is essentially a form of risk-sharing, as it redistributes savings from creditors to debtors. It could, therefore, be functionally equivalent to transfers from surplus to deficit countries through the savings channel (e.g. Sandbu 2017). To our knowledge, this fairly recent proposition has not yet been tested empirically. The magnitude of this effect is likely to be contingent on a high degree of financial integration. The more bail-inable assets are held domestically, the less these losses are spread interspatially, and the lower the risk-sharing effect.

4. The Interaction between public and private risk-sharing

Whether private risk-sharing can substitute for public risk-sharing has led to a controversial debate in the literature. Two separate dimensions of this debate deserve being highlighted. First, some authors test measures of public and private risk-sharing competitively to find out which one is more effective as a shock absorber in a currency union. This debate centres on whether policy-makers should pursue banking and capital markets union, on the one hand, or a fiscal union, on the other. A second and more recent discussion goes beyond treating the public and private risk-sharing as substitutes and analyses instead the complementarity between the two forms of risk-sharing. This literature claims that full risk-sharing is impossible to achieve with private measures only, as the effectiveness of private measures partly depends on the extent of public risk-sharing.

In the absence of significant common fiscal resources in the euro area, private risk-sharing is currently more important than public risk-sharing. For instance, foreign ownership of the Latvian banking sector in 2009-12 resulted in de facto transfers to Latvia from foreign banks (so foreign savers) of roughly 30% of GDP (Gros & Belke 2014). Against this background, some authors argue that ‘a monetary union does not need a fiscal union to work’ (Jones, 2016, p. 30), but instead a fully-fledged banking union. Jones (2016) identifies financial (and not monetary) integration as the cause of the euro area crisis. He considers financial institutions more important for restoring investor confidence than fiscal institutions.

Notably, while different views on the need for a fiscal union are represented in the literature, it is uncontested between both sides of the debate that the shock absorption capacity of the banking union in its current form falls short of realising its full potential. Thus, while Gros and Belke (2014) as well as Jones (2016) strongly deny the need for a fiscal union, they consider a fiscal backstop to the SRM and a deposit insurance scheme essential to reap the full benefits of the banking union in terms of higher shock absorption. This evident crossover between public and private risk-sharing is underlined by Schelkle (2017b) who argues that, in fact, the Federal Deposit Insurance Corporation (FDIC) performs the role of a fiscal backstop for state budgets in a systemic crisis in the US.

These findings are in line with recent research which suggests that concentrating risk-sharing arrangements in one single channel results in constrained-inefficient shock absorption. Farhi and Werning (2017) make a theoretical case for fiscal insurance as a necessary complement to private risk-sharing. A market failure exists in that private agents do not purchase efficient amounts of private insurance, as they do not internalise the positive externalities from the macroeconomic stabilisation effects of their portfolio choices. If public institutions reassure markets of a minimum level of shock absorption, the latter might be more willing to provide more insurance through private risk-sharing. Fiscal insurance through, for instance, a safe asset could provide an effective response to this market failure and lead to a larger extent of private risk-sharing (Farhi & Werning 2017).

The interaction between public and private risk-sharing is difficult to study empirically. Asdrubali and Kim (2004) compare shock absorption in the US, the OECD and the EU over the period 1960/63 to 1990. Their results suggest that capital markets and fiscal risk-sharing are complements, not substitutes. A second effect is a crowding out of the savings channel: while the capital and fiscal channel operate ex ante, consumption smoothing through lending and borrowing is an ex post mechanism. The savings channel varies more strongly with the economic cycle and performs weakly in the event of downturns or permanent shocks. As a result, the crowding out of savings by the fiscal and capital markets channels would result in higher shock absorption overall. The benefits would be higher the more asymmetric and persistent the shocks are. Linking the debate to safe assets, Acharya & Steffen (2017) claim that a capital markets union with fully integrated capital markets “can only work when the status of sovereign bonds as a risk-free asset is restored and the risk-free rate across Euro Area countries is equalized”. This, in turn, would require banking and fiscal union.

As for the nature of fiscal risk-sharing, IMF staff (Allard et al. 2013) argue that ex ante risk-sharing (e.g. rainy-day fund) is more efficient and effective than ex post (e.g. ESM financial assistance). Ex ante risk-sharing ensures that shocks do not turn into funding crises, which reduces the magnitude of shocks. It would benefit credit-constrained governments in particular. Ballabriga & Villegas-Sanchez (2017) underline that financial integration since the introduction of the euro did not contribute to risk-sharing via the capital channel, as it remained incipient and dominated by plain borrowing. For risk-sharing to work through geographical diversification, financial integration would need to be deep and inclusive of specific types of financial flows (esp. debt and equity foreign assets).

Future research should specify further the interplay between private and public risk-sharing. While it is broadly accepted that private risk-sharing remains constrained without at least some form of public risk-sharing in place, the literature is inconclusive with regard to the extent of public risk-sharing that is needed. While some consider a fiscal backstop to the Single Resolution Fund (SRF) sufficient (Gros & Belke 2015), others see the need for a fully-fledged fiscal union (Furceri & Zdzienicka 2013), and many others are located in-between (Jones 2016). Precise estimations of the expected impact for each of the various instruments of risk-sharing (see Figure 1) could significantly advance this debate.

5. Conclusions in view of the EMU deepening agenda

Acharya, Viral V.; Steffen, Sascha (2017): The Importance of a Banking Union and a Fiscal Union for a Capital Markets Union, European Commission Discussion Paper 062.

Afonso, António; Furceri, Davide (2008): EMU enlargement, stabilization costs and insurance mechanisms, in: Journal of International Money and Finance, 27, p. 169-187.

Allard C. et al. (2013), “Toward a Fiscal Union for the Euro Area”, IMF Staff Discussion Note, September.

Alcidi, Cinzia; D’Imperio, Paolo; Thirion, Gilles (2017): Risk-sharing and Consumption-smoothing Patterns in the US and the Euro Area: A comprehensive comparison, Centre for European Policy Studies, Working Document.

Alcidi, Cinzia; Thirion, Gilles (2016): Assessing the Euro Area’s Shock-Absorption Capacity: Risk Sharing, consumption smoothing and fiscal policy, Centre for European Policy Studies, 146.

Asdrubali, Pierfederico; Soyoung, Kim (2004): Dynamic risksharing in the United States and Europe, in: Journal of Monetary Economics, 51, pp. 809-836.

Asdrubali, Pierfederico; Sørensen, Bent E.; Yosha, Oved (1996): Channels of Interstate Risk Sharing: United States 1963-1990, in: The Quarterly Journal of Economics, 111(4), pp. 1081-1110.

Ballabriga, Fernando; Villegas-Sánchez (2017): Specialization, Risk Sharing and the Euro, in: Journal of Common Market Studies, early view article, DOI: 10.1111/jcms.12571.

Bargain, Olivier; Dolls, Mathias; Fuest, Clemens; Neumann, Dirk; Peichl, Andreas (2012): Fiscal Union in Europe? Redistributive and Stabilising Effects of an EU Tax-Benefit System, IZA Discussion Paper Series, IZA DP No. 6585.

Bayoumi, Tamim; Klein, Michael W. (1997): A Provincial View of Economic Integration, IMF Working Paper, WP/97/41.

Cimadomo, Jacopo; Furtuna, Oana; Giuliodori, Massimo (2017): Private and public risk sharing in the euro area, forthcoming manuscript (cited version: July 2017).

Cœuré, Benoît (2012), “Risk-sharing in EMU: before, during and after the crisis” Speech at the inaugural conference “European crisis: historical parallels and economic lessons”, Julis-Rabinowitz Center for Public Policy and Finance, Princeton University, 20 April.

Cole, Harold L.; Obstfeld, Maurice (1991): Commodity trade and international risk sharing, in: Journal of Monetary Economics, 28(1), pp. 3-24.

Constâncio, Vitor (2016), Risk Sharing and Macroprudential Policy in an Ambitious Capital Markets Union, Speech the Joint conference of the European Commission and European Central Bank on European Financial Integration and Stability, Frankfurt am Main, 25 April.

Corsetti, Giancarlo; Dedola, Luca; Leduc, Sylvain (2004): International risk-sharing and the transmission of productivity shocks, ECB Working Paper Series, 308.

Darvas, Zsolt; Schoenmaker, Dirk (2017): Institutional investors and home bias in Europe’s Capital Markets Union, Bruegel working paper.

Demyanyk, Yuliya; Ostergaard, Charlotte; Sørensen, Bent E. (2008): Risk sharing and portfolio allocation in EMU, European Commission Economic Papers, 334.

Draghi, Mario (2014): Stability and Prosperity in a Monetary Union Speech by Mario Draghi, President of the European Central Bank, at the University of Helsinki.

ECB, Financial integration in Europe (2017), May.

ECB, Financial integration in Europe (2016), April.

Farhi, Emmanuel; Werning, Iván (2017): Fiscal Unions, Harvard/MIT (forthcoming in AER).

Ferrari, Alessandro; Rogantini Picco, Anna (2016): International Risk Sharing in the EMU, European Stability Mechanism Working Paper Series, 17.

Fratzscher, Marcel; Imbs, Jean (2007): Risk-sharing, finance and institutions in international portfolios, ECB Working Paper Series, 826.

Furceri, Davide; Zdzienicka, Aleksandra (2013): The Euro area crisis: Need for a supranational fiscal risk sharing mechanism?, International Monetary Fund and University of Palermo.

Gros, Daniel; Belke, Ansgar (2014): Banking Union as a shock absorber – Lessons for the Eurozone from the US, Centre for European Policy Studies.

Hartmann, Philipp (2016): “Crossborder financial risk sharing in the euro area”, presentation at the SUERF-EIB Annual Economics Conference, 17 November 2016, Luxembourg.

Hepp, Ralf; von Hagen, Jürgen (2013): Interstate risk sharing in Germany 1970-2006, Oxford Economic Papers, 65.

Jones, Erik (2016): Financial Markets Matter More than Fiscal Institutions for the Success of the Euro, in: The International Spectator, 51(4), pp. 29-39.

Kalemli-Ozcan, Sebnem; Manganelli, Simone; Papaioannou, Elias; Peydró, José Luis (2008): Financial integration, macroeconomic volatility and risk sharing: the role of the monetary union, in: Mackowiak, Bartosz; Mongelli, Francesco Paulo; Noblet, Gilles; Smets, Frank: The Euro at Ten, 5th ECB Central Banking Conference, p. 116-155.

Kenen, Peter (1969): The Theory of Optimum Currency Areas: An Eclectic View, in: R.A. Mundell and A.K. Swoboda, eds., Monetary Problems of the International Economy, Chicago University Press.

Milano, Valentina (2017): Risk sharing in the euro zone: the role of European institutions, CeLEG Working Paper Series, Working Paper No. 01/17, March.

Milano, Valentina; Reichlin, Pietro (2017): Risk sharing across the US and EMU: The role of public institutions, LUISS School of European Political Economy, Policy Brief.

Mundell, Robert (1961): A theory of optimum currency areas, in: American Economic Review, 51(4), p. 657-665.

Obstfeld, Maurice (1994): Risk-Taking, Global Diversification, and Growth, in: American Economic Review, 84(5), p. 1310-1329.

Sala-i-Martin, Xavier; Sachs, Jeffrey (1992): Fiscal federalism and optimum currency areas: Evidence for Europe from the United States, Centre for Economic Policy Research.

Sandbu, Martin (2017): Banking union will transform Europe’s politics, in: Financial Times, 25 July.

Schelkle, Waltraud (2017a): The Political Economy of Monetary Solidarity: Understanding the Euro Experiment, Oxford University Press.

Schelkle, Waltraud (2017b): Hamilton’s paradox revisited: Alternative lessons from US history, CEPS Working Document, 2017/10.

Sørensen, Bent E.; Yosha, Oved (1998): International risk sharing and European monetary unification, in: Journal of International Economics, 45, p. 211-238.

Van Beers, Nancy; Bijlsma, Michiel; Zwart, Gijsberg (2014): Cross-Country insurance mechanisms in currency unions: an empirical assessment, Bruegel Working Paper.

Demosthenes Ioannou, Principal Economist, DG-International and European Relations, European Central Bank (demosthenes.ioannou@ecb.europa.eu). David Schäfer, Graduate Programme Participant, European Central Bank.

The views expressed in this paper are those of the authors and should not be reported as representing the views of the ECB. The authors are grateful to Gilles Noblet, Johannes Lindner, Alessandro Giovannini, Jean-Pierre Vidal and Sander Tordoir for fruitful exchanges on this topic and useful comments.

As Kenen puts it, “It is a chief function of fiscal policy, using both sides of the budget, to offset or compensate for regional differences, whether in earned income or in unemployment rates. The large-scale transfer payments built into fiscal systems are interregional, not just interpersonal […]”.

By contrast, direct fiscal transfers, which are not repaid directly, are a form of interspatial and ex ante risk-sharing.

Cross-border labour mobility smooths shocks through remittances, for example. The price channel’s shock absorption capacity is measured through changes in the domestic consumer price index relative to the euro area average index.

ECB staff calculations differ somewhat as they use an adapted methodology to include the price channel. Their estimates are 16% shock absorption through the capital channel, 1.3% through the fiscal channel, -10.5% through savings, and 10.2% through the price channel between 2006 and 2016. 83.1% of shocks remain unsmoothed (ECB 2017).