This Policy Note discusses the changes in the Eurosystem collateral framework since 2018 and how collateral mobilisation with the Eurosystem interacted with the use of collateral on the repo market in the euro area. Over the period 2018-2019 the amount of collateral mobilised with the Eurosystem has decreased despite the expansion of the eligible assets universe. In particular, euro area government bonds were withdrawn from Eurosystem collateral pools at a time when they became increasingly special on the repo market on the back of the higher demand due, among others, to their HQLA status relevant for regulatory purposes. On the other hand, covered bonds, asset-backed securities and credit claims remained the dominant asset classes in terms of mobilised amounts.

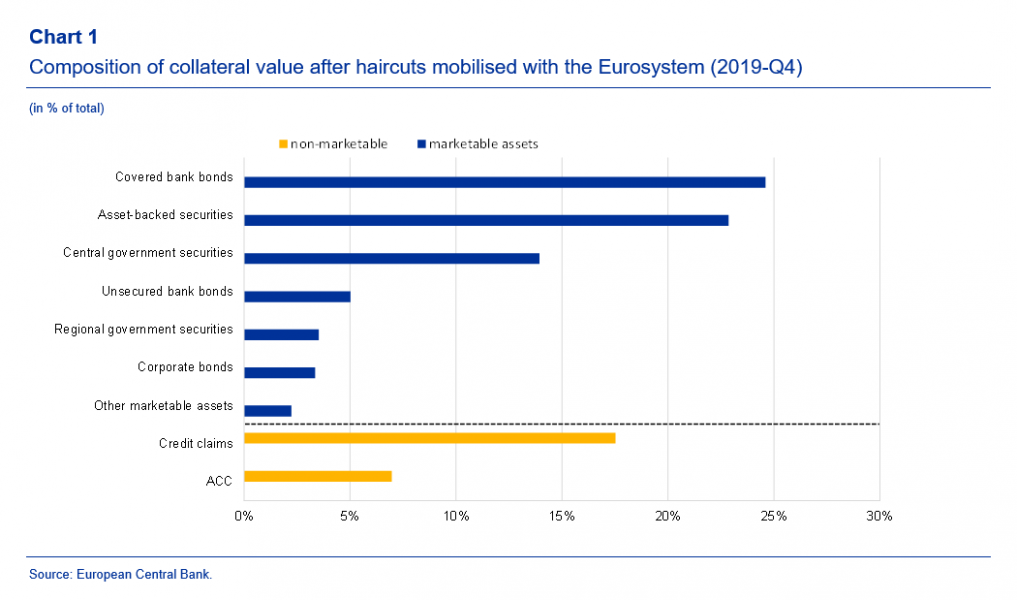

The provision of credit to counterparties against adequate collateral constitutes a main pillar of monetary policy implementation in the euro area. The rules governing the acceptance and valuation of collateral are therefore an essential component of the monetary policy implementation of the Eurosystem.2 They are designed to strike a balance between the smooth conduct of monetary policy throughout the euro area and an adequate protection of the Eurosystem balance sheet against potential losses, taking into account the impact on financial markets (market neutrality), the possible need for flexibility over time and the equal treatment of counterparties. In addition, the collateral framework aims to be operationally efficient, simple and transparent. In view of these principles and constraints, the Eurosystem accepts a broad range of assets, including both marketable and non-marketable assets applying differentiated valuation haircuts that reflect the credit, market and liquidity risk of each asset.3 At the end of 2019, marketable assets accounted for 75.5% of mobilised collateral and consisted of securities issued by EU governments, supranational institutions, agencies, non-financial corporations, banks as well as asset-backed securities (see Chart 1). Non-marketable assets consist primarily of credit claims that are mobilised under the general framework4 and additional credit claims (ACC) that are accepted as collateral in certain jurisdictions under a temporary framework.

While the COVID-19 crisis and the related collateral easing measures implemented in April 2020 changed various aspects of the collateral framework, this article mainly focuses on the period before the COVID-19 crisis, describing the main developments in the Eurosystem collateral framework in 2018 and 2019, both in terms of eligible collateral and collateral mobilised for Eurosystem credit operations.5 This includes changes in the eligibility criteria for marketable and non-marketable assets and changes in the relevant risk control measures which affect the availability and mobilisation of collateral.

Eligibility of unsecured bank bonds (UBBs)

One of the most prominent changes to the collateral framework over the review period relates to amendments to the eligibility criteria for unsecured bank bonds (UBBs). In October 2016 the Governing Council decided to temporarily maintain eligibility of certain UBBs while progress was being made towards defining a common EU approach to the bank creditor hierarchy. In December 2017 the Governing Council subsequently decided that UBBs subject to statutory, contractual or structural subordination would no longer be eligible.6 At the same time, UBBs issued by agencies eligible for the public sector purchase programme (PSPP), as well as government-guaranteed bank bonds (GGBBs), were partially exempted from these changes. Unless they have been contractually or structurally subordinated, these bonds remain eligible if they were issued before 31 December 2018. Furthermore, UBBs issued by entities established outside the EU also became ineligible. This change in the geographical scope primarily affected entities in European Free Trade Association countries7 which had been accepted as issuers and guarantors of UBBs under the old rules. In order to allow for a smooth transition to the new eligibility rules for UBBs, the old rules were maintained in parallel until the end of 2018.

Interest rate structure and minimum size threshold for credit claims

With regard to non-marketable assets, one of the most noteworthy changes concerned the requirements for the coupon interest rate structures of credit claims. These requirements were amended in the 2018 and 2019 GD updates so they would be better aligned with the respective rules for marketable assets. The new rules clarified how credit claims exhibiting negative cash flows should be treated, and specified which reference rates are eligible for credit claim coupons with a floating rate. These reference rates now comprise a specific set of established money market and maturity swap rates, as well as euro area government bond yields.8 In addition to the clarification on eligible interest rate structures, a Eurosystem-wide minimum size threshold of €25,000 for the domestic mobilisation of credit claims was introduced in the latest GD update. The aim of this was to further align the eligibility treatment of credit claims, thereby promoting a level playing field across jurisdictions.9

Further steps towards harmonising the general framework

In addition to the changed eligibility criteria for credit claims, the last GD10 update contained several other amendments aimed at increasing transparency and further harmonising the monetary policy implementation framework.

First, the definition of agencies as issuers and guarantors of debt instruments was aligned with the list of agencies eligible for the PSPP. This harmonised list of agencies ensures that the definition of agencies as issuers of debt securities does not differ between the APP and the Eurosystem’s credit operations.

Second, the loan-level data reporting requirements for ABSs were adjusted to reflect the new EU Securitisation Regulation’s disclosure requirements which came into effect on 1 January 2019. In that context, the Eurosystem will move from its own designation process for loan-level data repositories to relying on the securitisation repositories registered by the European Securities and Markets Authority. These changes aim to support a single set of reporting standards for ABS loan-level data and promote efficiency and standardisation in the euro area securitisation market.11

Third, the possibility to value non-marketable assets using theoretical prices assigned by the NCBs was rescinded. Finally, third-party rating tools are no longer accepted for credit assessments in the general framework owing to cost-benefit considerations.

As of 1 February 2020 covered bonds must have an issue rating from an external credit assessment institution (ECAI) to be eligible for own use. This change was introduced in the latest GD update on 10 May 2019, although it only entered into force in February 2020.

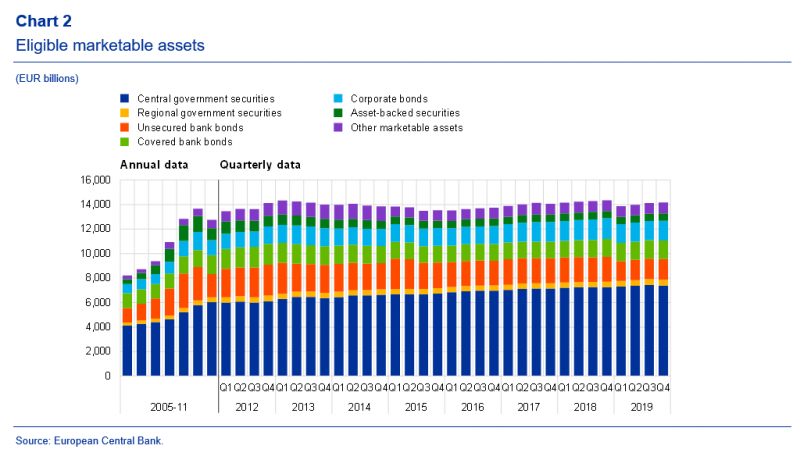

The most noticeable change in the amount of eligible assets since 2017 reflected the changes in eligibility of UBBs. After the period in which the old rules were maintained in parallel ended in December 2018, the amount of eligible UBBs dropped by more than €400 billion to €1.68 trillion (-20%), and, accordingly, the share of UBBs among all eligible marketable collateral declined from 14.5% to 12.1% between the fourth quarter of 2017 and the fourth quarter of 2019 (see Chart 2). At the same time, the amount of eligible covered bonds increased by €171 billion to €1.5 trillion. As a consequence, the share of covered bonds in the universe of eligible marketable assets increased by more than one percentage point to 11.0%. Similarly, central government securities increased both in absolute terms (€247 billion) and as a share of eligible marketable collateral (from 50.8% to 52.8%). Overall, the amount of total eligible marketable collateral increased from €14.1 trillion to €14.2 trillion (0.8%) between the fourth quarter of 2017 and the fourth quarter of 2019. There are no statistics available for the amount of eligible non-marketable assets given that their eligibility is only noted upon mobilisation.

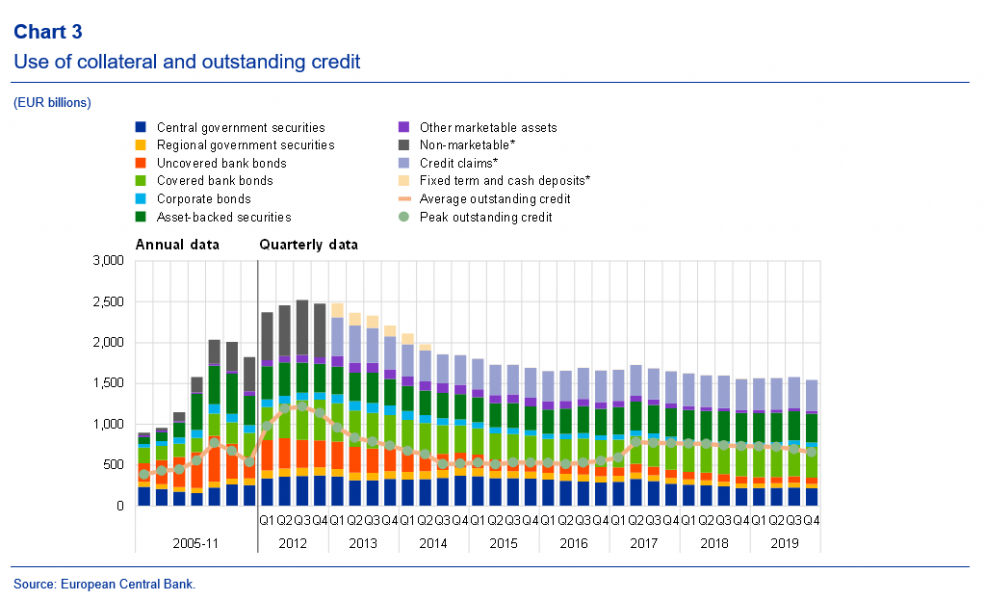

While the universe of eligible marketable assets has increased (see Chart 2), the amount of mobilised collateral has decreased over the past two years by €105 billion, or ‑6.4% (see Chart 3). The decline in mobilised collateral reflects a decrease in outstanding credit of a similar magnitude (-€110 billion), and was slightly more pronounced for marketable assets (-7.2%) than for non-marketable assets (‑3.8%). Among all asset classes, central government securities showed the largest decline in absolute terms, falling by €58 billion to €215 billion (-21%). The new eligibility criteria for UBBs, which reduced the eligible universe of these bonds by 17%, also resulted in a proportional decrease in mobilised UBBs of €21 billion to €77 billion. By contrast, counterparties mobilised €34 billion of additional covered bonds, thereby increasing their share in the pool of mobilised collateral by more than 3 percentage points to 24.2%.

Overall, the most significant mobilised asset classes remain covered bonds (24.2%), asset-backed securities (22.5%) and credit claims (24.1%). Central government securities constitute a relatively small fraction of mobilised collateral (13.7%), considering they account for more than half of all eligible collateral.

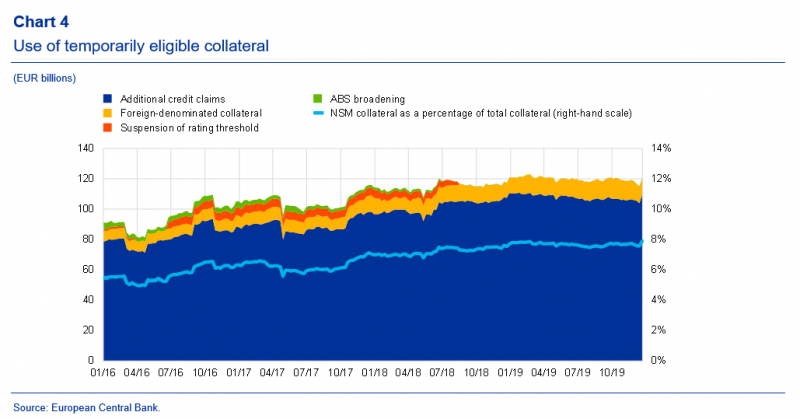

The share of assets mobilised under the temporary framework increased slightly by 0.9 percentage points to reach 9.7% between the fourth quarter of 2017 and the fourth quarter of 2019. More than 70% of these assets are additional credit claims (ACCs) which have increased by €11 billion (11.8%) over the past two years (see Chart 4). At the same time, the cessation of the sovereign waiver for Greece reduced collateral mobilised under the temporary framework by €5 billion.

In April 2020, in response to the coronavirus pandemic, the Governing Council adopted a comprehensive set of collateral easing measures to facilitate banks’ access to Eurosystem liquidity operations and implemented measures to alleviate the effects of potential rating downgrades on collateral availability. The first set of measures announced on 7 April comprised a proportionate reduction of haircuts across all asset classes by 20%, a higher concentration limit for unsecured bank bonds and several adjustments that expanded the acceptance of credit claims as collateral. In particular, the Governing Council decided to remove the non-uniform minimum size threshold for credit claims and to review the haircuts applied to non-marketable assets which led to a further haircut reduction for credit claims and ACCs of around 20%. Furthermore, the ACC frameworks were temporarily expanded by reducing the loan-level reporting requirements, enlarging the scope of acceptable credit assessment systems and by accommodating requirements on guarantees to include loans to corporates, SMEs and self-employed individuals that benefit from the new public sector guarantee schemes linked to the coronavirus pandemic. Finally, it was decided that marketable assets that were eligible as Eurosystem collateral on 7 April 2020 would remain eligible in case of rating downgrades in order to avoid the potentially procyclical effects of Covid-19 related rating downgrades.

These collateral easing measures supported counterparties in obtaining substantial amounts of Eurosystem liquidity at favourable rates since the start of the coronavirus pandemic. Peak outstanding credit increased by almost 150% from EUR 668 billion in the last quarter of 2019 to EUR 1,631 billion after the settlement of TLTRO-III.4 at the end of June 2020. This increase in credit was mirrored by a sizable rise in mobilised collateral from EUR 1543 billion in Q4 2019 to EUR 2,374 in Q2 2020 (+54%)12. Although the impact of the various collateral easing measures cannot be exactly quantified, the increase in the eligible universe and the collateral mobilisation patterns suggest that these measures played an important role in facilitating banks’ access to Eurosystem liquidity: The amount of eligible marketable collateral increased by more than one trillion euro (+7%) between Q4 2019 and Q2 2020 which is partly related to increased issuance but partly also to some of the collateral easing measures such as the waiver on marketable assets issued by the Greek government or the rating freeze for marketable assets. However, this number based on the nominal value outstanding of eligible marketable assets represents a lower bound of the impact of the collateral easing package as it neither includes the effect of the haircut reductions nor of the other changes to mobilisation rules (e.g. higher UBB concentration limit, expansion of ACC frameworks). Taking these aspects into account, the impact of the collateral easing package was particularly pronounced for non-marketable assets as credit claims benefited not only from a higher haircut reduction compared to marketable assets (around 40% rather than 20%)13 but also due to a range of targeted measures that eased the mobilisation of credit claims and ACCs. In particular, several jurisdictions decided to adopt ACC frameworks or to adjust the conditions of their existing ACC frameworks. Accordingly, mobilised credit claims and ACCs increased more than proportionately by almost EUR 300 billion (+78%) between Q4 2019 and Q2 2020, accounting for more than a third of the increase in mobilised collateral. As a consequence, the share of mobilised non-marketable assets increased from 24.5% of mobilised collateral in Q4 2019 to 28.3% in Q2 2020.

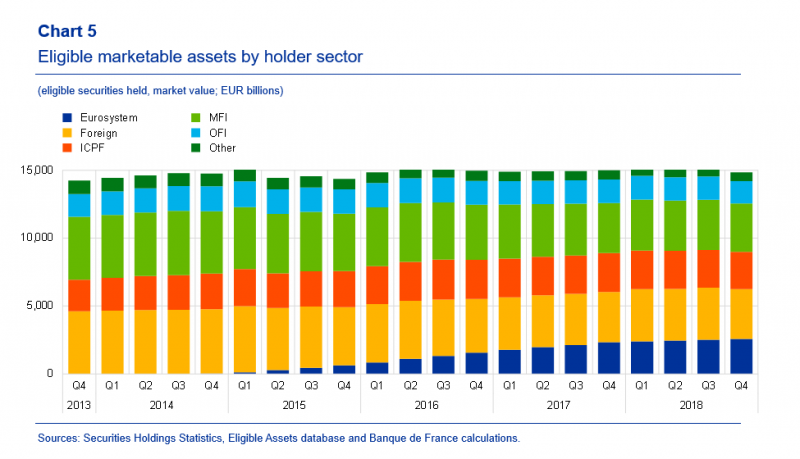

Eligible Eurosystem counterparties can access monetary policy credit operations, provided they have mobilised sufficient adequate collateral with their respective national central bank (NCB). The amount of eligible marketable assets has remained fairly stable, at around €15 trillion, since the end of 2013. Since then, the implementation of the Eurosystem’s asset purchase programme (APP) has had a major impact on the breakdown of holdings of eligible assets by sector. At the end of 2018 the Eurosystem held around 18% of all eligible assets, while the shares of assets held by foreign entities and monetary and financial institutions (MFIs) had each decreased by 7 percentage points since 2013 to around a quarter of all eligible assets. In absolute terms, the availability of eligible assets in banks’ balance sheets decreased by around €1 trillion between 2013 and 2018 (Chart 5).

Despite the absorption of assets by the Eurosystem’s balance sheet, collateral buffers for Eurosystem monetary policy credit operations remained ample over the review period for Eurosystem-eligible counterparties as a whole. Indeed, counterparties typically mobilise more assets than are necessary to collateralise a given amount of liquidity – this ensures that collateral is readily available to obtain liquidity (including intraday credit) and caters for fluctuations in collateral valuations. However, in recent years the opportunity cost of keeping high-quality liquid assets (HQLAs) as collateral in Eurosystem accounts has increased. This box reviews the main drivers behind the changes in collateral mobilised with the Eurosystem over the period from January 2017 to December 2019.

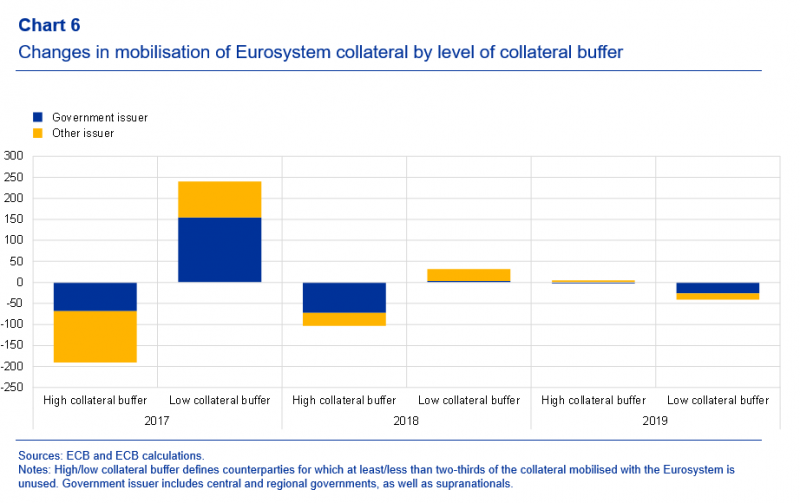

The decrease in collateral mobilised with the Eurosystem is largely driven by the withdrawal of euro area government bonds14 from collateral pools (see Chart 3). In aggregate terms, the collateral buffer has decreased since 2017, albeit with a slight pick-up in the second quarter of 2019, which may be mechanically attributed to the repayment of TLTRO II liquidity.15 In net terms, the bulk of the decrease took place in 2018, when around 70% of the decrease in collateral buffers observed was explained by the withdrawal of government bonds from the accounts of counterparties with high collateral buffers.16 This was not the case for some of the largest banks, however, which are active players in the repo market and still retained a sizeable collateral buffer with the Eurosystem during the review period. Interestingly, these dynamics changed in 2019, when counterparties with low collateral buffers also started to reduce their mobilisation of government bonds (see Chart 6).

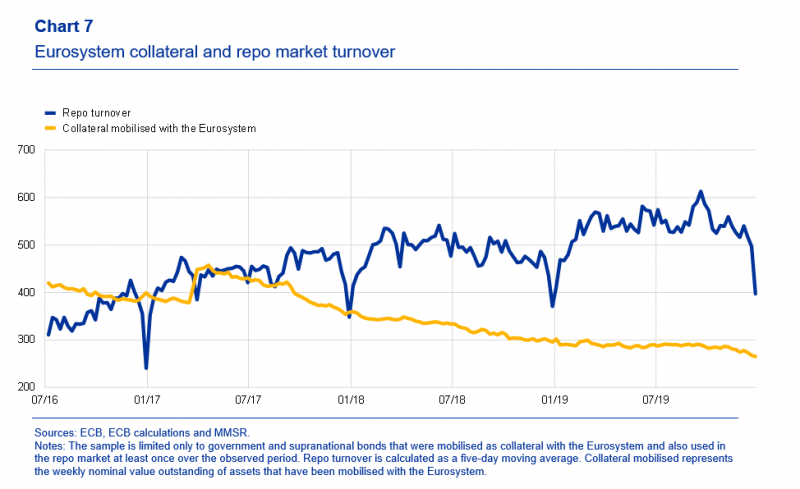

Why did counterparties withdraw government bonds from their Eurosystem collateral accounts? Euro area government bonds became increasingly “special”17 in the repo market owing to higher demand linked to, among other things, their HQLA status, which is relevant for regulatory purposes.18 Repo activity backed by government bonds, especially those used as collateral with the Eurosystem (see Chart 7), started to increase in 2017, suggesting a more productive use of those assets in repo transactions or collateral swaps. At the same time, the Eurosystem continued to absorb government bonds on the central bank balance sheet via purchases in the APP, leading to an increase in the size of the central bank balance sheet. To ensure the availability of collateral in the market, the Eurosystem began lending the securities purchased under the APP through its securities lending facilities in April 201519, thereby increasing the availability of HQLAs in the market.

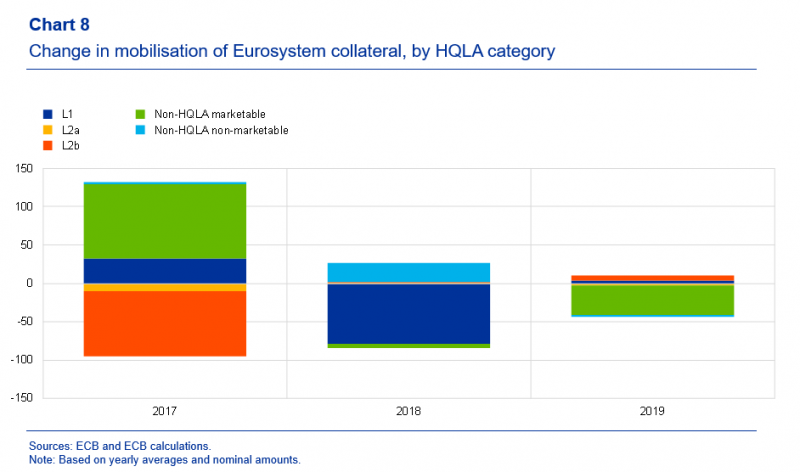

The reduction in government bonds in Eurosystem collateral accounts was partially offset by the mobilisation of eligible assets with lower opportunity costs, in particular non-HQLAs including marketable (such as retained ABS and covered bonds) and non-marketable (most notably credit claims) assets (see Chart 8). This substitution mainly stems from the difference between the set of eligible collateral in the context of Eurosystem MPOs and the definition of HQLAs for the liquidity coverage ratio (LCR). Moreover, the application of haircuts on Eurosystem collateral represents another incentive for counterparties to mobilise fewer government bonds, since the LCR does not require any haircuts on those securities. Theoretically, the increase in the unit cost of collateral at the Eurosystem owing to higher haircuts may lead a counterparty to employ these assets elsewhere, particularly when the assets trade as “special“ collateral on the repo market, i.e. when there is strong, rising demand for a specific asset. However, the counterparty may have limited alternative collateral available, and may therefore opt to use these relatively expensive assets as collateral for the Eurosystem, despite the higher haircut.

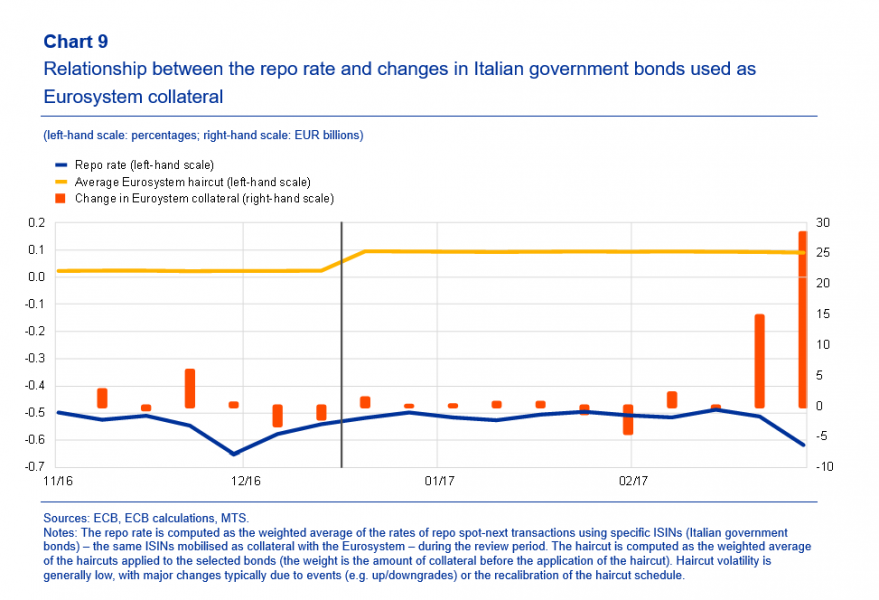

To give a specific example, this box considers the case of the credit rating downgrade of Italian sovereign bonds in January 2017, which implied a shift in the Eurosystem harmonised rating scale from credit quality step 2 to credit quality step 320, corresponding to higher haircuts for this asset type.21 The increased cost of collateral mobilisation with the Eurosystem and some degree of “specialness” of Italian government bonds could have led to the demobilisation of these assets in favour of less liquid assets. However, counterparties did not noticeably adapt their positions with regard to holdings of Italian government bonds, and some even mechanically increased their positions to counteract the lower valuation and the higher haircut applied, at least initially, thereby avoiding undercollateralisation. Some substitution of government bonds with other assets did take place, although this occurred well after the downgrade (see Chart 9).22 This episode confirms that it is difficult to model the relationship between Eurosystem collateral and the repo market, owing to heterogeneity in terms of banks’ balance sheets and collateral mobilisation strategies with the Eurosystem.

The note discusses the changes in the Eurosystem collateral framework since 2018 and how collateral mobilisation with the Eurosystem interacted with the use of collateral on the repo market in the euro area. Over the period 2018-2019 the amount of collateral mobilised with the Eurosystem has decreased despite the expansion of the eligible assets universe. In particular, euro area government bonds were withdrawn from Eurosystem collateral pools at a time when they became increasingly special on the repo market on the back of the higher demand due, among others, to their HQLA status relevant for regulatory purposes. On the other hand, covered bonds, asset-backed securities and credit claims remained the dominant asset classes in terms of mobilised amounts.

In 2020 the collateral easing measures adopted by the Governing Council in response to the economic fallout from the coronavirus pandemic forestall a potential shortage of collateral and supported counterparties’ access to the Eurosystem liquidity operations. The broad set of measures consisted of a proportionate reduction of haircuts across all asset classes by 20%, a higher concentration limit for unsecured bank bonds and several adjustments that eased the eligibility requirements for credit claims. In addition to that, any marketable assets eligible on 7 April 2020 were allowed to remain eligible in case of a rating downgrade to avoid procyclicality of rating requirements.

The article was also published in “The use of the Eurosystem’s monetary policy instruments and its monetary policy implementation framework between the first quarter of 2018 and the fourth quarter of 2019”, ECB Occasional Paper Series, No 245 / June 2020. For information on recent changes to the Eurosystem collateral framework please see European Central Bank (2020), “ECB announces package of temporary collateral easing measures”, press release, 07 April, or Lagarde, C. (2020), “How the ECB is helping firms and households”, blog post, 9 April, or European Central Bank (2020), “ECB takes steps to mitigate impact of possible rating downgrades on collateral availability”, press release, 22 April.

For further details, see Bindseil, U. et al. (2017), “The Eurosystem collateral framework explained”, Occasional Paper Series, No 189, ECB, Frankfurt am Main, May.

For further details, see “The financial risk management of the Eurosystem’s monetary policy operations”, July 2015.

Currently, the Eurosystem’s collateral framework comprises both a general framework, reflected in the General Documentation (GD), and a temporary framework, reflected in the additional Guidelines and national frameworks. The temporary framework comprises an additional set of specific measures that were introduced and amended at different stages since the financial crisis.

According to Article 2(31) of the GD, Eurosystem credit operations mean liquidity-providing reverse transactions (i.e. liquidity-providing Eurosystem MPOs excluding foreign exchange swaps for monetary policy purposes and outright purchases) and intraday credit.

For further details, see European Central Bank (2017), “Changes to collateral eligibility criteria of unsecured bank bonds”, press release, 14 December.

Norway, Iceland and Liechtenstein.

Initially, only euro area government bond yields with a maturity of up to one year were eligible. This maturity requirement was removed as of 5 August 2019.

Or any higher amount that may be laid down by the home NCB. For cross-border use, a minimum size threshold of €500,000 applies.

For further details, see European Central Bank (2019), “ECB amends monetary policy implementation guidelines”, press release, 13 May.

For further details, see European Central Bank (2019), “Transparency requirements of EU Securitisation Regulation to be incorporated into Eurosystem collateral framework”, press release, 22 March.

The data are based on publicly available data on eligible marketable assets, the use of collateral and outstanding credit. The numbers on mobilised collateral refer to averages of end-of-month data for the respective quarter, whereas the data on peak outstanding credit refers to the largest daily amount of outstanding Eurosystem credit within a quarter. Mobilised collateral increased less than credit outstanding as counterparties partially collateralised their participation in the Covid-19 related credit operations by reducing over-collateralisation instead of mobilising additional collateral.

See Chart 2 in the Blog Post by Vice President L. de Guindos and I. Schnabel which shows the impact of the haircut reduction for different asset classes.

In this analysis, we assign to the government category any issuer that can be assimilated to the public sector, notably central and regional governments, public agencies and supranational entities.

In 2017 the net mobilisation of government bonds increased in correspondence with a TLTRO II operation, in particular with counterparties that had lower collateral buffers. Some of the impact on the nominal amounts was due to Italy’s sovereign credit rating downgrade.

Defined as counterparties for which at least two-thirds of the collateral mobilised with the Eurosystem is unused, i.e. it constitutes collateral buffer.

Special bonds trade at a premium relative to general collateral.

See European Central Bank (2017), Financial Stability Review, box entitled “Recent developments in euro area repo markets, regulatory reforms and their impact on repo market functioning”, November.

As of December 2016 the Eurosystem also accepts cash as collateral when lending PSPP holdings.

The shift was due to the downgrade by DBRS of Italy’s sovereign credit rating from A (low) to BBB (high). Until then, DBRS had been the only accepted external credit assessment institution rating Italy in the “A” range – corresponding to credit quality step 2. The downgrade to the “BBB” range implied a shift to credit quality step 3 which, in turn, implied the application of more conservative haircuts.

Shift from a haircut of 0.5%-7% to 6%-16%, depending on the type of coupon and the residual maturity of the asset.

The increased mobilisation of collateral towards the end of March 2017 was due to participation in a TLTRO II operation. The simultaneous decline in the repo rate reflects the usual quarter-end effects.