The 2020-2021 review of the ECB strategy will shape monetary policy in the Eurozone in the years to come. Crucially, it will also determine the scope and capabilities of the ECB within the ever-evolving architecture of the euro. As in the aftermath of the Global Financial Crisis and the subsequent Euro Crisis, Member States are discussing new mechanisms to enhance economic recovery and further integration which, one way or another, will involve the support of, or the coordination of fiscal policy makers with the ECB. The impact of the new ECB strategy in the current debate about the future direction of the single currency should not be overlooked. In this note, we offer a proposal for the reform of the ECB strategy incorporating the lessons learned in the recent crises. We discuss several options for the ECB and set up a rule-based strategy suitable to operate in an environment of persistently low inflation and near zero interest rates. Under our proposal, monetary stability becomes the guiding principle for providing macroeconomic stability over the medium and long term, as well as for enhancing the transparency of the ECB communication policies.

The European Central Bank (ECB) launched a comprehensive review of its monetary policy strategy in January 2020, which was meant to be completed initially by the end of 2020 (ECB 2020 a), though now the deadline has been extended until mid-2021 due to the disruption caused by the coronavirus pandemic. The policy strategy of the ECB was first set up by its Governing Council in the Autumn of 1998, prior to the start of the single currency – and with it a single monetary policy – on January 1st, 1999. The original strategy was then ‘clarified’ in the Spring of 2003 and involved two significant changes. Firstly, as regards the quantitative definition of price stability, the ECB made it clear that its aim was to achieve a Harmonised Index of Consumer Prices (HICP) annual rate of inflation ‘below but close to 2%’. This was to reaffirm the commitment of the ECB to avoid deflation2, thus setting an implicit lower bound to disinflation in the Eurozone. And secondly, the ECB stopped publishing the ‘reference value’ for the annual growth of a broad monetary aggregate (M3); that value being compatible with the ECB official definition of price stability (Trichet 2003). As explained in more detail in the next two sections, rather than being a mere clarification of the ECB strategy, these changes have had very relevant implications in the way in which the ECB has been making monetary policy decisions since then, particularly but not only in the 2004-2007 period (see Castañeda and Congdon 2017).

The remit of the current review of the ECB strategy is quite extensive and covers 11 areas, including the impact of climate change, the digitalisation of the economy, how globalisation affects the functioning of the economy and how changes in productivity, innovation and non-bank financial disintermediation affect the Eurozone economy and monetary policy decisions. As regards the core of the review, the ECB will revisit the measurement of price stability and assess ‘alternative approaches to achieving price stability’, the so-called monetary policy ‘toolkit’, the gaps in current economic models to process information in order to understand how the eurozone economy works, its communication policies and the interactions between macroprudential policies and monetary policies (see ECB 2020 b). We cannot assess here in detail the implications and challenges of the ECB strategy review in all these areas; we will rather focus on those monetary policy issues closely related to the core of what central banks currently do3 and how they communicate their decisions to the public.

The discussion of the economic policy responses to the coronavirus crisis in the Eurozone has shown once again the fragility and inconsistency of the euro architecture, as well as the constraints the single currency carries out. Unlike other countries with full monetary sovereignty (i.e., with their own national currency and monetary policy), Member States in the Eurozone cannot resort to their national central banks to coordinate the economic responses to a crisis episode. As the recent ruling of the German constitutional court (5th May, 2020) has highlighted, the ability of the ECB to engage in asset purchase programmes is not as straightforward an issue as in a nation with full monetary and fiscal sovereignty. Since the ECB started to implement the Asset Purchase Programme (APP) back in 2015, it has always maintained that these purchases are in line with its legal mandate and the EU constitution (which prohibits the monetary financing of Member States, see Art. 21, ESCB Statutes), and they constitute an essential means for the proper implementation of monetary policy decisions in the Eurozone. The German constitutional court ruling states that the Asset Purchase Programme (in particular, the Public Sector Purchase Program (PSPP)) does not violate the prohibition of monetary funding of Member States; but it does violate the ‘principle of proportionality’, according to which ‘the content and form of Union action shall not exceed what is necessary to achieve the objectives of the Treaties’ (see Buiter 2020).

In this legal and institutional context, both the discussion and the final outcome of the review of the ECB strategy become key to understand the future of the Eurozone, the availability of suitable tools and mechanisms to respond to a crisis in the future and, ultimately, the preferred model for the euro as a single currency. In particular, the outcome of the review should define much more clearly the sort of model of a central bank the ECB aims to be: whether the one envisaged in its original Constitution and in the Treaty of Maastricht, or that of a ‘modern’ and fully-fledged central bank, able to coordinate with the fiscal policy maker(s) and thus help the national treasuries in times of crisis. The former model is more compatible with a decentralised monetary union, while the latter would signal the intention to create a traditional nation state central bank; one with a single currency, a meaningful federal treasury able to set up countercyclical policies and to assist Member States in crisis (see further details in Castañeda 2018). Both models are feasible but it is vital for the success of whichever is chosen that the EU institutions and their policies (indeed, including the ECB’s) are consistent and in line with the preferred option.

One of the lessons of the euro crisis has been the fundamental role played by the ECB in maintaining confidence in the euro, be it by its commitment to support the euro in public statements4 or by the actual implementation of programmes to purchase Member States’ sovereign debt (2015-2018). The changes made to the EU’s macroeconomic institutions in the aftermath of the crisis5 and the implementation of the APP programme by the ECB signal the trend towards the creation of a central bank more able to support Member States in times of crisis, but not only. The current Covid-19 crisis is another (major) test on the Eurozone architecture and on the roles and policy strategy of the ECB. Whatever the final design of this more ‘modern’ central bank model, it would mean granting more leeway to the ECB to buy the debt of the Member States; thus, to some extent, implying the mutualisation of their debt6. Within this model, a fully functional monetary policy would need a solid new strategy to fulfil its tasks; one that has the necessary tools and objectives compatible with the preferred architecture of the euro in the years to come. We will continue with the discussion of the options as regards the new strategy of the ECB in the next two sections.

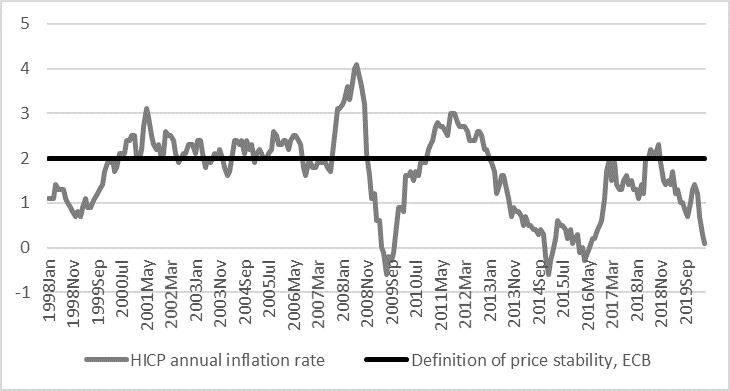

Given that the ECB has a clear mandate in its statutes (see Art. 2, ESCB Statutes)7 to prioritise the preservation of price stability over all other macroeconomic objectives, the review of the definition of what price stability means becomes key to understanding both the scope and the direction of the changes in the current ECB strategy review. As shown in Figure 1 below, the annual rate of inflation in the Eurozone (as measured by the Harmonised Index of Consumer Prices, HICP) remained quite stable and around 2% from 1999 to 2007 and has been lower and much more volatile since then. One of the issues under review should be the measurement of inflation; is the HICP a good measure of inflation? The HICP does not include housing prices directly but rental costs and other repairs8. The trend in consumer inflation as measured by the HICP since the outbreak of the Global Financial Crisis – and during the subsequent Eurozone crisis – has been low, indeed below the ECB’s definition of price stability. Overall, since the start of the single monetary policy in 1999, the monthly year on year average rate has grown by 1.68%, with an average of 2.19% in the pre-crises years (1999 – 2008) and 1.24% from 2009 onwards. In light of these figures, has the ECB run a monetary policy compatible with price stability and therefore effectively fulfilled its mandate? Even more, should the ECB’s definition of price stability be reviewed? These are the questions we address in the remainder of this section.

Figure 1: HICP annual rates of change (%), Eurozone: 1998 – 2020

Source: Data from the ECB website. Accessed in June 2020.

The ECB has an ample range of options available as regards the re-definition of its policy target, which are summarised in Blot et al. (2019). It is clear from the post-crises years that the ECB has struggled to keep HICP inflation close to a 2% annual rate. There are several monetary strategies that will allow the ECB to pursue a more suitable monetary policy, particularly during and after a major crisis.

Price level targeting

One of them is a ‘price level stability rule’, one by which the central bank effectively targets the steady growth of the price level at an x% rate9. The main difference with a standard ‘flexible inflation targeting’ (see Svensson 1998 and Bernanke 201710) rule is the treatment of deviations from the target: in contrast with an inflation targeting rule where ‘bygones are bygones’, a price level targeting rule prescribes the reaction of the central bank to offset any deviation of the price level from the announced level (‘bygones are not bygones’). In case of a deviation of the price level from the desired target level in the past (either if too much inflation or too little), the application of the rule would force the central bank to correct those deviations, by either an inflationary policy in case of a recorded deflation (or too little inflation), or a deflationary policy if a recorded inflation. Provided that the central bank adopts a credible commitment to a price level target, in case of a negative demand shock and falling prices, agents would expect an expansionary monetary policy in the future to bring the price level back on target.

Under the current mainstream New Keynesian models, a credible price level targeting strategy would increase both inflation expectations and current inflation; therefore, the central bank will successfully manage to lower real interest rates (see Hatcher and Minford 2014). This is one of the main advantages of this strategy as an effective policy tool in fighting a recession when nominal interest rates are in the near zero territory. The effectiveness of monetary policy in such an environment of virtually zero nominal rates is even clearer if we use a monetary model – one that assesses the effects of changes in the amount of money on asset prices, which will ultimately affect companies’ balance sheets and agents’ spending decisions (see Congdon 2005). If changes in nominal interest rates have been exhausted as a policy tool, the central bank can tailor the amount and timing of its asset purchases programmes (i.e. QE) to achieve its price level target. Therefore, if following a credible price level targeting rule, in the context of a severe demand-side recession and falling prices, the central bank would always have margin to increase the amount of money in the economy by as much as needed to restore the pre-crisis price level.

As compared to the rather discretionary approach followed in the aftermath of the Global Financial Crisis, this strategy would provide a consistent rule-based monetary policy to react to any severe crisis scenario. This was the strategy proposed by Bernanke (2017) as a temporary solution, when interest rates have reached the lower nominal bound. If credible, a price level targeting rule would indeed enhance true price stability, but it would require frequent changes in monetary policy to offset any price deviations from the target; in particular, a monetary policy-led deflation any time the economy registers a positive rate of inflation. This would mean a degree of price and (nominal) wage flexibility which modern economies and their populations are not used to anymore. In the absence of such flexibility in goods and labour markets, the adjustment of the economy to a deflationary policy by the central bank will likely imply more job and output losses.

Nominal Income targeting

Another monetary strategy option would be the adoption of a ‘nominal income targeting rule’, either in the form of a rate target or a level target. If a rate, now the central bank, rather than adopting a price level target or an inflation target, would choose a rate of growth of nominal income in the economy over the next few years. This strategy virtually allows the central bank to choose any combination of inflation/deflation and real income growth as a target. As constrained by its statutes, the ECB would likely choose as a target the combination of the rate of nominal income in the Eurozone compatible with price stability (0% – 2% inflation rate, as measured by the ECB) and the real rate of growth of the economy sustainable over the long term11. As with the price level targeting strategy, the adoption of a nominal income target would also offer a consistent approach to running a more expansionary monetary policy in the aftermath of a severe demand shock and falling prices (see Sumner 2020). In such a recessive scenario, the central bank could keep its long term commitment to maintaining low inflation (below 2%) while effectively targeting a 4% – 5% rate of inflation in the short term (see Frankel 2012). In addition, in times when the economy is growing over its long term sustainable rate, it would also provide a consistent rule for limiting the growth in the amount of money in the economy, therefore likely to be successful in maintaining a more stable rate of growth of money in the economy along the cycle. As compared with a price level targeting rule, a nominal income rate targeting central bank would not have to offset any deviation of prices from a target; in particular, as regards those coming from supply side shocks to the economy. If the economy is expanding and thus producing more goods and services for the market, we can expect a ‘natural’ disinflationary trend that would not require a response by the central bank if prices remain within the 0% – 2% range. Similarly, a negative supply shock would reduce output in the market but also increase inflationary pressures in the economy. In this scenario, the central bank would not need to offset inflation if it remains within the said range.

One of the major challenges of a nominal income rate targeting strategy is choosing the value for the long term or sustainable real rate of growth of the economy. This rate is not a once and for all estimate as it depends on the expected rate growth of the economy with no inflation; which is a rate that varies with structural and other institutional changes in the economy. As a proxy, this value can be extracted ‘ex post’ from the historical trend of the rate of growth of the GDP over a long period of time. However, arguably the rate must change particularly after a significant shock in the economy (i.e. the Global Financial Crisis).

If a negative shock is deemed to have affected the long-term capabilities of the economy, adopting a nominal GDP target similar to the one in the pre-crisis years would force the central bank (artificially) to over-expand the amount of money in the economy, therefore likely resulting in inflation12. In any case, the adoption of a nominal income target rule requires the input of the expected sustainable rate of growth of nominal spending in the next few years. In choosing this target, what it is important to remember is the commitment of this strategy to maintaining macroeconomic stability over the long term. This is not a strategy suitable for a central bank willing to fine-tune the economy or to intervene frequently to stability output and prices along the cycle.

Another important challenge is the availability of nominal income data in real time. In contrast with HICP data, available every month and very rarely revised, the first estimate of the nominal GDP13 is released with a 3-month delay and it is frequently revised few months later; it is worth noting that the revision of the initial estimate may not be trivial. This makes it more difficult for the members of the monetary policy committee to assess the real estate of the economy in real time. However, as stressed above, a nominal income target rule can (and should) be implemented with a clearer focus on the long term stability in the rate of growth of nominal income; therefore minimising the need to make frequent changes in monetary policy. In this vein, the availability of data in real time is still a challenge but less so as compared with the adoption of a more active, and potentially destabilising, monetary policy rule.

A higher inflation target for the ECB? The re-definition of price stability

Another option is to review the current quantitative definition of price stability, within the same monetary strategy which the ECB has followed since 2003. On the one hand, the ECB may opt for increasing the rate of inflation compatible with price stability. As suggested by Blanchard et al. (2010) and Krugman (2012), rather than the long-standing consensus on a rate of CPI inflation of approximately 2%, the adoption of a 3% or a 4% rate would give more margin for the central bank to run expansionary policies within still moderate rates of inflation. One of the major reasons to reject this option is because of how this change in the inflation target would affect agents’ expectations of inflation over the medium to the long term. Once the commitment to low rates of inflation is relaxed, it will become easier for the policymakers to keep on increasing the target rate in the future if needed be (Volcker 2011); and thus, to break its original commitment to low rates of inflation. Even if made in small steps, such an approach may end up quite quickly with the adoption of inflationary policies and the end of expectations of low inflation. This was one the most damaging macroeconomic consequences of the inflationary policies in the 1970s, which required very firm and painful monetary policy decisions to counteract a few years later (see Volcker 2011)14.

On the other hand, the ECB may decide to keep its definition of price stability but to change the way in which price stability is assessed. At the moment, the ECB aims at achieving price stability over an undefined ‘medium term’ period. In addition, as highlighted in Blot et al. (2019, p. 16), the former President of the ECB, Mario Draghi, in his last press conferences made it clear that the ECB would react with the same determination to any deviations of inflation either above or below the current definition of price stability; thus effectively making the ‘below but close to 2%’ rate of inflation not an upper limit but a symmetric target. This would mean a ‘de facto’ 2% average inflation target that the ECB may want to adopt formally in the review of its strategy. If formally announced as an average target, in the scenario of persistently low and below target inflation of the last few years, the ECB would have had ample margin to increase its inflation target temporarily to compensate for the undershooting of the target in the last decade. Unlike the ‘ad hoc’ decision to increase of the target discussed above, the adoption of an average inflation target over a period of ‘n’ number of years to be announced to the public, would be consistent with the anchoring of price expectations in line with the long run target of the central bank.

However, the communication of this new strategy to the public would pose some challenges; as the ECB would need to announce both its commitment to its long-term definition of price stability (say, 2% on average), and the temporary target for ‘n’ number of years. In addition, after an inflationary cycle the central bank would likely need to impose a deflationary policy possibly for several years. In economies with significant price and wage nominal rigidities, the application of this rule may likely result in costly deflationary policies in terms of jobs and output loses. In this scenario, it will become increasingly difficult for the central bank to stick to an average inflation target and agents will rationally anticipate a deviation from the announced commitment at some point in the future. The net result wold be to harm the bank’s credibility and the effectiveness of the policy strategy.

In the debate of the possible alternatives to the current strategy of the ECB we need to consider the long-term implications of major changes in its policy strategy. Perhaps urged by the bleak economic performance of the Eurozone economy in the post-Global Financial Crisis years, in which central banks in major economies have desperately tried to find new policy measures to increase inflation, inflation expectations and nominal spending on a rather ‘ad hoc’ basis, the ECB may be willing to adopt new tools to run a more credible and effective policy in a time of severe crisis. However, the strategy of a central bank is a key framework for making policy decisions over a long period of time. In order to be credible and consistent, this is a core element of the central bank that should not be changed nor adjusted too frequently in response to the pressing circumstances of the day. Once the Eurozone recovers from the current Covid-19 crisis, a return to a period of higher inflation may occur in the next two years and then the ECB would be bound by the constraints of a price level rule, a nominal income target rule or an average inflation target rule; which, depending on the amount of inflation in the future, all of them (though, to a different extent) would prescribe a non-negligible contraction in the rate of growth of money in the economy. This is not necessarily a reason to reject any of these strategies, but a reminder that the new monetary rule, once approved, will be a core element of the long-term monetary strategy of the ECB; and indeed, the key to anchoring market expectations along the central bank definition of price stability.

As stated in the ECB official communications (see ECB 2020 c) and in ample research made by the ECB staff since 1999, changes in the rates of growth of broad money do help to explain and forecast changes in prices over the medium to the long term (see Altimari 2001 and Benati 2009). It is precisely ‘the medium term’ time horizon what the ECB uses (see ECB 1998 and 2003) to fulfil its price stability goal. While in the short term, the so-called ‘economic analysis’ (or second pillar) may well explain fluctuations in inflation, this information is cross-checked against the ‘monetary analysis’ (the ‘first pillar’), so that the ECB can capture the medium to the long-term trends in inflation too. This is the rationale of the ‘mixed’ monetary policy strategy of the ECB since 1999; one that does not commit to inflation targeting fully or formally, nor to the adoption of an ‘intermediate target’ for broad money growth (see Issing 2020). However, this strategy was more transparent before 2003, when the ECB did give a prominent role to M3 annual rates of growth in anticipating changes in inflation over time. This is not the case since 2003 and the role played by changes in monetary aggregates in the ECB monetary policy decisions is more questionable now, if indeed it plays any meaningful role at all. This is a fundamental reason to welcome a review of the policy strategy of the ECB; one that clarifies the main rationale and benchmarks used by the central bank in making its policy decisions.

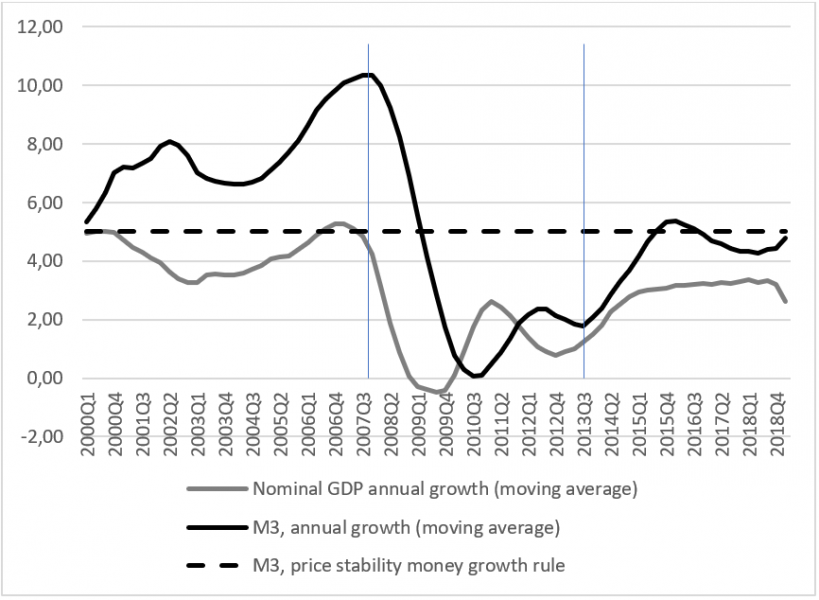

It was a very good move for the ECB to assign a prominent role to changes in broad money in the assessment of inflationary pressures in the economy over the medium to the long term back in 1999. This had been a successful monetary strategy adopted by the most important central bank in the Eurozone, the Bundesbank, for several decades (see Issing 2008). As observed in Figure 2 below, changes in M3 and nominal income in the Eurozone share similar trends15. In addition, when the trend in the growth in the amount of money is compared with the prescriptions of a ‘price stability money rule’16, the results suggest a clear pattern too. When the trend in money growth is systematically above the prescriptions of a price stability rule (i.e. a positive ‘money gap’) we can identify a period of building up of inflationary pressures (see 1999 to 2008 in Figure 2); whereas the years when the trend in money growth is persistently below the rate compatible with price stability (i.e. a negative ‘money gap’) would signal disinflationary or even deflationary pressures (2009 – 2019). It is important to stress that, in order to have a meaningful effect on inflation, the deviations of M3 from the price stability path must occur for a sufficient time period. This is why we use the trends in the rate of growth in both series in our assessment. And, even if the deviations are persistent, the effects of an excess or a deficit in money growth will only be reflected in consumer prices after a two or even three year delay17.

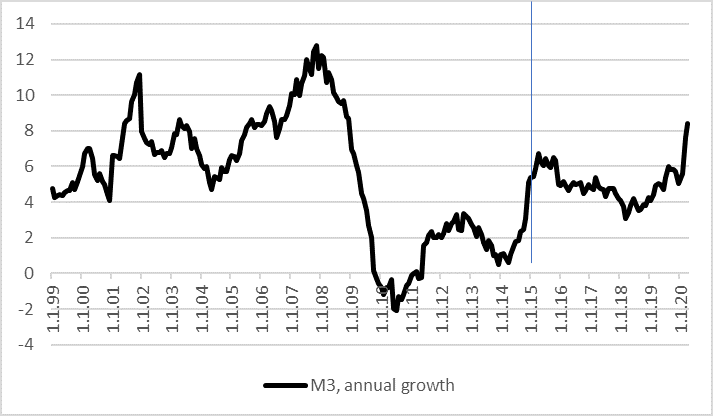

The medium term relation between changes in broad money and nominal income holds for the Eurozone as a whole, as observed in Figure 2. On the one hand, particularly between 2004 and 2008, the amount of money grew far beyond the rate compatible with macroeconomic stability, therefore being inconsistent with sustainable economic growth. It is worth noting that the rate of growth of money in this period of four years was not followed by a proportional increase in the growth of nominal income. As we argue later on in the note, this lack of correspondence between these two variables was only apparent; once the excess in money growth was increasing financial companies’ cash holdings and pushing asset prices up quite dramatically18. On the other hand, from the end of 2008 and until 2019, the rate of growth of broad money has been too little and indeed not enough to maintain a trend rate of growth of output at stable prices. When we look in more detail into the rate of growth of M3 in the post-2008 crisis period, we see that the Eurozone as a whole did not resume monetary stability until when the ECB consistently applied APP (i.e. QE programme). In the 2009 – 2014 period, broad money grew on average by 1.75% year on year while nominal income remained fairly stagnant (0.89% average annual growth, see Table 1 (a) below). By contrast, from 2015 to 2019, the ECB’s QE programme managed to bring the rate of growth of money up to the 4% – 5% range (see Figure 3), which coincided with the recovery of output in the Eurozone and the departure from deflation territory (nominal income annual growth stayed above 3%). It looks as if the ECB had decided the amount of its APP in accordance with a money rule ‘a la Friedman’ (see footnote 15), although surely unintentionally.

These trends are even clearer when we analyse the relation between trends in money growth and in nominal income at a more disaggregated level. Even though the ECB makes policy decisions based on indicators on the whole area, the 19 economies within the Eurozone display a considerable degree of macroeconomic asymmetry among them (see Castañeda and Schwartz 2020). If we split up the Eurozone as a whole into those economies most affected by the 2010s crises (i.e. peripheral economies) and those least affected (i.e. core economies), the relation between changes in the amount of money and in nominal income is even more informative, clear and consistent (see Table 1 (b)). Core countries have experienced more monetary stability both before and after the outbreak of the Global Financial Crisis, while peripheral economies suffered from extraordinary monetary growth before 2007, followed by an average fall of -2.33% in the amount of money and -1.6% recession from 2009 to 2014.

Table 1: Annual average rate of growth of nominal income and broad money (%), 1999 – 2019

1(a) Overall Eurozone

|

GDP nominal |

M3 |

|

|

1999-2003 |

4.16 |

6.72 |

|

2004-2008 (*) |

4.49 |

8.71 |

|

2009-2014 |

0.89 |

1.95 |

|

2015-2019 |

3.21 |

4.88 |

1(b) Periphery vs. Core Eurozone economies

|

GDP nominal Periphery |

Core |

M3 Periphery |

Core |

|

|

1999-2003 |

3.2 |

1.39 |

11.06 |

10.56 |

|

2004-2008 (*) |

2.79 |

2.71 |

14.03 |

11.75 |

|

2009-2014 |

-1.6 |

0.50 |

-2.33 |

1.42 |

|

2015-2020 |

2.2 |

2.02 |

3.28 |

4.70 |

Notes: Eurostat and ECB datasets, accessed online, June 2020. Own calculations of the average in the periods. (*) 2008 Q4 has been taken as the starting point of the Global Financial Crisis. Data on national contributions to M3 start in 2001.

Under peripheral economies we have included Italy, Spain, Greece, Ireland and Portugal; under core economies: Germany, France, Benelux countries, Finland and Austria.

Figure 2: Broad money and nominal GDP annual growth (%), Eurozone: 1998 – 2019

(2-year moving average, monthly data)

Source: Data from the ECB website (accessed in June 2020) and own calculations of moving averages.

Notes: The dotted line depicts the prescribed rate of growth of money compatible with a price stability rule with the following parameters; trend GDP real annual growth of 2%, trend fall in money velocity of 1% per year and annual rate of inflation at 2%. The period between the vertical lines corresponds to falling or stagnant money growth in the Eurozone.

The adoption of the monetary policy framework suggested in this note would provide a clear rationale to interpret price developments at the current juncture, under Covid-19 crisis19. In sharp contrast with the Global Financial Crisis years, since March 2020 both the ECB balance sheet and broad money in the Eurozone (measured by M3) have increased significantly for several months; which would indicate the building up of inflationary pressures in the economy in the medium term20.

Monetary growth and financial stability

The knock-on effects of the observed money gaps in Figure 2 on macroeconomic and financial stability over the long term are very notable. Either an excess or a deficit in the growth in the amount of money pose a threat to the stability of the economy over time. In the years running up to the Global Financial Crisis (2004-2007), too much money was created in the Eurozone and the economy was producing a level of output well beyond its long term equilibrium or sustainable level21. The opposite scenario can be observed in the aftermath of the crisis, when first a falling and then a stagnant and very weak monetary growth (below the rate compatible with macroeconomic stability) led to quite large negative output gaps from 2009 to 2015. The lack of enough attention to monetary (and credit) developments in the years running up to the Global Financial Crisis constituted one of the major flaws in the current models by major inflation targeting central banks (Issing 2020). As shown in Castañeda and Congdon (2017), the instability in the rate of growth of money played an important role in the building up of imbalances in the Eurozone economy right before 200822 and in the deepening of the recession once the crisis struck the Eurozone economies.

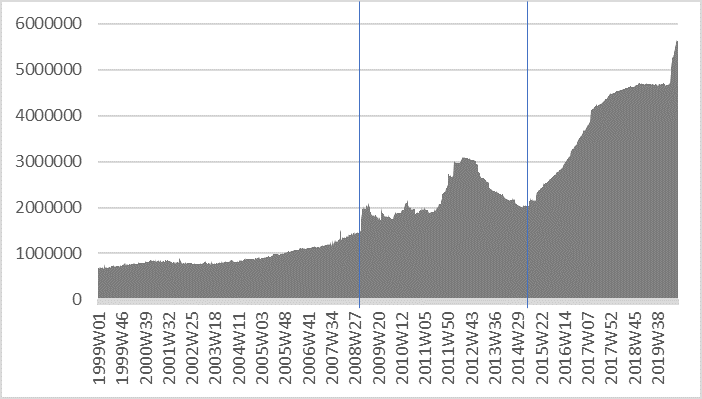

Figure 3: Annual growth (%) of broad money in the Eurozone (1999 – 2020)

Source: ECB data set online (accessed on 30th June, 2020). The vertical line signals the start of the ECB’s QE programme (2015-2018).

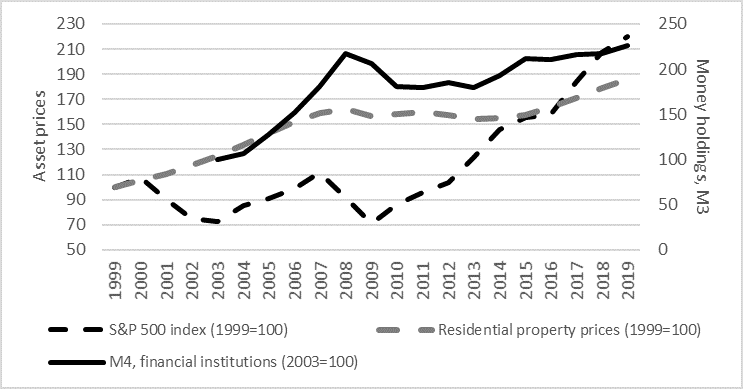

If not in HICP prices, in which other prices did the money gap growth materialise? Between 1999 and 2007, residential property prices increased by 59% and immediately after the burst of the 2001 ‘dotcom bubble’, equity prices increased by 48% from 2002 to 2007 (see Figure 4 below)23. From January 2003 to October 2008, money holdings (as measured by M3) by the financial sector in the Eurozone increased by 123% (see Figure 4 below). These institutions held a substantial excess in cash balances in the years running up to the Global financial Crisis, which may well explain the surge in asset prices in this period.

A corollary of our analysis is that monetary instability has an impact on financial instability over the medium to the long term. Therefore, the analysis of changes in broad monetary growth provides valuable information on trends on asset prices in the short term and, in turn, on households and companies’ spending decisions over the medium to the long term.

Figure 4: Asset prices and money holdings by financial institutions in the Eurozone (1999 – 2019)

Source: ECB dataset, accessed online, June 2020.

Note: Sectoral M3 holdings only available from 2003.

It is also important to note that the size of the ECB balance sheet does not necessarily determine the inflation rate in the Eurozone. An increase in the balance sheet should not therefore automatically be taken as a threat to price stability. This is one of the main lessons learned from the Global Financial Crisis years. As shown in Figure 5 below, the ECB expanded its balance sheet quite significantly from 2008 to 2012, with no noticeable effect on CPI inflation. Only when the ECB started to implement a systematic QE programme in 2015, both its balance sheet and the amount of money (broadly defined) increased24. Therefore, in order to assess the impact of the QE programmes on inflation, we need to make a distinction between those asset purchases that only increase the amount of bank reserves held by the central banks and those that increase the amount of bank deposits (i.e. the amount of money)25.

Figure 5: ECB balance sheet (millions, euros): 1999 – 2020

Source: ECB dataset online (accessed, 30 June 2020).

Notes: The vertical lines signal the start of the Global Financial Crisis (Autumn 2008) and the ECB’s Asset Purchase Programme (January 2015).

If the information cannot be fully obtained from conventional consumer price indices, how can we assess whether the ECB is running a monetary policy compatible with price stability and financial stability? A corollary of our analysis in the previous section points at a more comprehensive definition of price stability over the medium to the long term, one that relies more on keeping a stable and moderate rate of growth of money (i.e. the M3 aggregate in the Eurozone). This means that whenever the amount of money in the economy diverges systematically from its long-term stability path, there will likely be an impact in nominal income and thus eventually in consumer prices, even though with a delay. In practical terms, our proposed strategy for the ECB would consist of the announcement of a medium to long term nominal income target compatible with the sustainable rate of growth of real output with no inflation: assuming an annual long term rate of growth of real output around 1.5% – 2% and price stability as defined by annual changes in the HICP in the range of 0% – 2%, the ECB would announce a 3% – 4% nominal GDP annual growth (range) target for the next two to three years. In order to achieve its target, the rate of growth of broad money (M3) would provide a key reference to make policy decisions: by the application of the quantity equation, assuming a secular decline in money velocity of -1% per year, the central bank would announce a rate of growth of money of 4% – 5% compatible with a 3% – 4% nominal income growth over the medium to the long term. Persistent deviations of M3 growth from the 4% – 5% would be interpreted as a ‘warning indicator’ of macroeconomic and financial instability, as they would not be compatible with a sustainable rate of growth of nominal income in the Eurozone26.

One of the main advantages of this strategy is that it focuses the attention of policymakers on variables much more under their control, such as the impact of monetary growth on changes in nominal income over the medium to the long term; rather than on more loosely defined concepts such as CPI price stability measures. In addition this strategy makes it easier for the central bank to explain and communicate changes in prices as a result of the occurrence of supply-side shocks: in case of a positive supply shock, the central bank can maintain the pre-announced path of monetary growth and nominal income if the increase in real output is accompanied by a fall in prices. Similarly, in case of a negative supply shock, the shortage in production will be followed by an increase in prices, therefore also keeping nominal income relatively steady. As a result, this strategy would mean less activism in the running of monetary policy along the cycle and more stability in the making of monetary policy decisions.

Important caveats apply to the interpretation and potential application of this strategy. On the one hand, the deviations of the growth in the amount of money from the pattern of long-term stability must be persistent and not just a one-off. Also, small deviations from this pattern should not be a cause of concern, as it is the trend and direction of changes in the amount of money which would matter in making monetary policy decisions. This is particularly relevant in times of high uncertainty, when typically, the demand for money increases temporarily27. Therefore, rather than a single target for the rate of growth of money compatible with nominal income stability and financial stability, the central bank should announce a range or average. This would reflect more clearly the degree of uncertainty the policy makers face as regards their ability to control the amount of money in the economy, as well as measurement errors. On the other hand, the assessment of the inflationary or deflationary effects of policies must be made within a sufficiently long time period so the excess or deficit in money growth can be fully passed onto the economy (i.e. on nominal income). As observed in empirical studies on this question for the Eurozone economy (Angeloni et al. 2002), the effects of monetary policies on prices and output can last for as long as two to three years. In addition, as discussed above, the distortionary effects of a monetary policy not committed to monetary stability will likely materialise in the medium to the long term in the form of financial instability. Therefore, in order to design a monetary policy committed to both monetary stability and financial stability, the policy time horizon should be extended, at last up to three years. This would imply a significant change in the focus of central banks, so they do not intend to minimise the fluctuations of output over short periods of time, but rather to establish a strategy compatible with the stability of nominal output over the medium to the long term.

Our proposal is in line with the original monetary strategy of the ECB (1999-2003), but it goes beyond it in light of the lessons learned in the recent crises.

Firstly, the ECB must have the ability to buy private and public assets in order to maintain a level of stability in the amount of money in the Eurozone. This is key for the proposed strategy to succeed. Undeniably the purchase of sovereign debt by the ECB carries political and financial implications within a multi-State monetary area such as the Eurozone. However, especially in an era of historically low interest rates, monetary policy must be able to resort to quantitative easing (and quantitative tightening, QT) whenever needed. It is for the Eurozone Member States to design the tools and mechanisms to facilitate it. As proposed in Castañeda (2018)28, a partial mutualisation programme of the Member States debt may be a reasonable approach to give the ECB the leeway needed to engage in asset purchase operations; while retaining the proper incentives to run a sustainable fiscal policy by the Member States. Anyhow, this is a political decision that should not be made by the ECB but by the EU Member States. If the ECB is to preserve its independence in the future, it must not interfere in Member States’ (national) fiscal policy.

Secondly, our proposal would allow the ECB to conduct QE operations under a rule-based policy strategy, therefore, enhancing its transparency and accountability. The years following the 2008 crisis have witnessed a period of successive ‘innovations’ by major central banks to address the crisis, which have effectively meant a substantial deviation from any sort of policy rule or pre-announced commitment. As justified as this more ad hoc approach to policymaking might have been in the midst of the crisis, it is now time to incorporate the use of the so-called unconventional monetary policy tools (QE being one of them) into the toolkit and policy rule of central banks. The more explicit use of the link between QE operations and their impact in the amount of money would result in a clearer and more binding strategy; and thus, it would enhance the transparency of the ECB and its accountability. The strategy proposed here for the ECB would allow the announcement of a more comprehensive policy with two main policy tools: changes both in policy rates (in the standard open market operations) and in the amount of purchases/sales of assets (i.e. QE or QT) in any given time period. This will make clear the rationale of the central bank in expanding or reducing its QE programmes as they will be set in accordance with the achievement of its nominal income growth target. Therefore, the use of QE (or QT) as policy tools would become embedded in the set of policy tools of the new strategy of the ECB; so that the announced amount of asset purchases would correspond with the expected effects on broad monetary growth and ultimately on prices and output (i.e. nominal income).

Thirdly, as demonstrated in the last decade, the rate of inflation is not an indicator fully under the control of the central bank in the short term; even less so when inflation is measured by the CPI or similar indices, as many other important price indicators in the economy are excluded from the definition of price stability. The evidence available from the years running up to the Global Financial Crisis shows how excessive money growth can have inflationary and destabilising effects on other (asset) prices over the medium term, with significant implications on financial stability29. This is why we would rather suggest focusing on significant and persistent deviations of broad money growth from price stability and nominal income stability long-term patterns. One consequence of this approach would be the lengthening of the time horizon of monetary policy30. Rather than the current unspecified ‘medium term’ horizon of the ECB, we would suggest the announcement of a three year-time period in which to assess price stability and nominal income stability. This is a strategy designed to minimise the need to intervene in the market once the main policy tasks have been set up and announced for such a period.

Central banks should not make policy decisions by following a mechanistic strategy but one that allows them to communicate their goals clearly and to incorporate learning in their decision-making process. These are vital elements in any transparent monetary policy. Furthermore, as the former governor of the Bank of England, Mervyn King, put it few years ago, in the presence of unforeseeable events central banks need some range of manoeuvre to achieve their targets. But, in order to be credible this degree of freedom must be constrained within a credible monetary policy framework (therefore, a form of ‘constrained discretion’ is required, see King 2000). Conventional inflation targeting rules have not allowed central banks to address the challenges of the post-Global Financial Crisis years. Inflation targeting has demonstrated to be too narrow a strategy, particularly when consumer price inflation has been systematically below target and policy interest rates have reached the nominal zero bound. Following the consensus of the New Keynesian models, inflation targeting central banks keep their focus on assessing the impact of so-called unconventional monetary policies on changes in nominal interest rates in the long term and the yield curve, and tend to disregard the use of monetary aggregates for policy purposes. As evidenced in the last decade, they have not managed to find a more consistent and predictable way to communicate their policies to the public. Rather, they have appeared to be reacting to the events rather than applying a coherent set of policy responses within a rule-based strategy. If this pattern is continued in following years, it would dramatically harm the credibility of the central bank and thus the effectiveness of monetary policy.

Following King (2005), central banks may find simple metrics useful as a sort of heuristic to summarise the main determinants of their decisions and thus enhance the communication with the public31. This is in line with the review of the strategy of the ECB proposed in this note. This does not imply that monetary policy decisions are made mechanically or without incorporating further information and the personal judgement of the members of the relevant monetary policy committee. What the heuristics allow is to convey the main information and the rationale used to make a decision, therefore simplifying the communication with the public. In the same vein, the ECB should resume a more rule-based policy strategy compatible with monetary stability and financial stability over the medium and long term. This would imply a significant change in the way the ECB currently makes policy decisions. Our proposed strategy would set a longer-term target for money growth and nominal income, which may allow for prices to move up and down within certain boundaries. In addition, it would hold the ECB more accountable as regards the achievement of targets that are much more under its control.

Altimari, N. (2001): “Does Monetary Policy Lead Inflation in the Euro Area?”. ECB Working Paper Series No. 63. May, 2001. Frankfurt.

Angeloni, I., Kashyap, A., Mojon, B, Terlizzese, D. (2002): “Monetary Transmission in the euro area: where do we stand?”. In ECB Working Paper Series No. 114 (January). Frankfurt.

Benati, L. (2009): “Long run evidence of money growth and inflation”. ECB Working Paper No. 1027. March, 2009. Frankfurt.

Bernanke, B. (2017): “Monetary Policy in a New Era”. Brookings Institution. Conference on Rethinking Macroeconomic Policy, Peterson Institute, Washington DC, October 12-13, 2017. Accessed online in July 2020 at https://www.brookings.edu/wp-content/uploads/2017/10/bernanke_rethinking_macro_final.pdf

Blanchard, O., Dell Ariccia, G. and Mauro, P. (2010): “Rethinking Macroeconomic Policy”. International Monetary Fund, Staff Position Note 10/03. 12th February 2010. Accessed online in July 2020 at https://www.imf.org/external/pubs/ft/spn/2010/spn1003.pdf

Blot, C., Creel, J. and Hubert, P. (2019): “Challenges ahead for EMU monetary policy. Monetary Dialogue September 2019”. ECON Committee. European Parliament. Published and accessed online in June 2020: https://www.europarl.europa.eu/cmsdata/207619/9.%20OFCE_FINAL-original.pdf

Bordo, M. and Filardo, A. (2004): “Deflation and Monetary Policy in a Historical Perspective: Remembering the Past or Being Condemned to Repeat It?” NBER Working Paper No. 10833. October. Cambridge, MA.

Bordo, M. and Landon-Lane, J. (2013): “Does Expansionary Monetary Policy Cause Asset Price Booms; Some Historical and Empirical Evidence”. NBER Working Paper No. 19585, October 2013. Cambridge, MA.

Boskin Commission (1996): “Toward A More Accurate Measure Of The Cost Of Living”. Report to the US Senate Finance Committee from the Advisory Commission to Study. The Consumer Price Index. Accessed online in July 2020 at https://www.ssa.gov/history/reports/boskinrpt.html

Buiter, W. (2020): “German Judges Declare War on the ECB”. In Project Syndicate. Published on 6th May, 2020. Accessed online in July 2020 at https://www.project-syndicate.org/commentary/german-constitution-court-ecb-pspp-ruling-by-willem-h-buiter-2020-05?barrier=accesspaylog

Castañeda, J. (2018): “Rebalancing the Euro Area. A Proposal for Future Reform”. Wilfried Martens Centre for European Studies. Policy Brief. December 2018. Brussels.

Castañeda, J. and Congdon, T. (2017): “Have Central Banks forgotten about money? The case of the European Central Bank, 1999-2014″. In: Tim Congdon (ed.), Money in the Great Recession. Chapter 4, pages 101-130, Edward Elgar Publishing.

Castañeda, J. and Schwartz, P. (2020): “The measurement of the optimality of a currency area: the US dollar versus the Eurozone”. In Castañeda, Roselli and Wood (eds.): The Economics of Monetary Unions. Past Experiences and the Eurozone. Chapter 7. Routledge.

Castañeda, J. and Congdon, T. (2020): “Inflation, the next threat?”. Institute of Economic Affairs. Covid-19 Briefing Paper, No. 7. June 2020. London.

Castañeda, J. and Wood, G. (2011): “Price stability and monetary policy: A proposal of a non-active policy rule”. In Cuadernos de Economia 34, p. 62-72.

Christensen, L. (2020): All set for a fast recovery after the ‘Great Lockdown’. In The Market Monetarist, Published on 18th April, 2020. Accessed online at https://marketmonetarist.com/

Codogno, L. and Nord, P. (2020): “The rationale for a safe asset and fiscal capacity for the eurozone”. In Castañeda, Roselli and Wood (eds.): The Economics of Monetary Unions. Past Experiences and the Eurozone. Chapter 10. Routledge.

Congdon, T. (2003): “The Business Cycle and Share Prices”. In Lombard Street Research’s Monthly Economic Review. December 2003, p. 3 – 12.

Congdon, T. (2005): Money and Asset Prices in Boom and Bust. IEA Hobart Paper No. 153. London.

Congdon, T. (2010): “Monetary Policy at the Zero Bound. A discussion of the effectiveness of monetary policy, with comments on contributions from Keynes, Krugman and Bernanke”. In World Economic, Vol. 11 No. 1, January-March 2010, p. 11-46.

Congdon, T. (2020): “Will the current money growth acceleration increase inflation?: An analysis of the US situation”. In World Economics (forthcoming, 2020).

Draghi, M. (2012): Speech at the Global Investment Conference in London. 26 July 2012. Accessed online, June 2020 at https://www.ecb.europa.eu/press/key/date/2012/html/sp120726.en.html

De Grauwe, P. and Moesen, W. (2009): “Gains for All: A Proposal for a Common Eurobond”. CEPS Policy Brief (August), accessed online in June 2020 at https://www.ceps.eu/publications/gains-all-proposalcommon-eurobond.

ECB (1998): “A stability-oriented monetary policy strategy for the ESCB”. ECB Press Release, 13th October 1998. Accessed online in July 2020 at https://www.ecb.europa.eu/press/pr/date/1998/html/pr981013_1.en.html

ECB (2003): “The ECB’s monetary policy strategy”. ECB Press Release, 8th May 2003. Accessed online in July 2020 at https://www.ecb.europa.eu/press/pr/date/2003/html/pr030508_2.en.html

ECB (2016): Assessing the impact of housing costs on HICP inflation. In ECB Economic Bulletin. Issue 8. Pp. 47-50.

ECB (2020 a): “ECB launches review of its monetary policy strategy”. ECB Press Release, 23th January 2020. Accessed online in July 2020 at https://www.ecb.europa.eu/press/pr/date/2020/html/ecb.pr200123~3b8d9fc08d.en.html

ECB (2020 b): On the ECB strategy review. ECB webpage. Accessed online in July 2020 at https://www.ecb.europa.eu/home/search/review/html/workstreams.en.html

ECB (2020 c): On the ECB monetary analysis. ECB webpage. Accessed in July 2020 at https://www.ecb.europa.eu/mopo/strategy/monan/html/index.en.html

Frankel, J. (2012): The death of inflation targeting. Vox, CEPR Policy portal. 19th June 2012. Accessed online at https://voxeu.org/article/inflation-targeting-dead-long-live-nominal-gdp-targeting

Friedman, M. (1970): “The Counter-Revolution in Monetary Theory”. IEA Occasional Paper, no. 33. London.

King, M. (2000): “Monetary Policy: Theory in Practice”. Address given on 7 January 2000. Accessed online in July 2020 at https://www.bankofengland.co.uk/speech/2000/monetary-policy-theory-in-practice

King, M. (2005): “Monetary Policy: Practice Ahead of Theory”. Speech given at the Mais Lecture, Cass Business School, London 17 May 2005. Accessed online in July 2020 at https://www.bankofengland.co.uk/-/media/boe/files/speech/2005/monetary-policy-practice-ahead-of-theory

Krugman, P. (2012): “Not Enough Inflation”. Published in the New York Times, 5th June 2012.

Hatcher, M. and Minford, P. (2014): “Inflation targeting vs price-level targeting: A new survey of theory and empirics”. Vox, CEPR Policy portal. 11th May 2014. Accessed online in July 2020 at https://voxeu.org/article/inflation-targeting-vs-price-level-targeting

Issing, O. (2008): The Birth of the Euro. Cambridge University Press. Cambridge.

Issing, O. (2020): “Encompassing monetary policy strategy review”. SAFE White Paper N. 68. June 2020. Leibniz Institute for Financial Research.

Jarocinski, M. and Lenza, M. (2016): “How large is the output gap in the euro area?”. In ECB Research Bulletin No. 24. Accessed online in July 2020 at https://www.ecb.europa.eu/pub/economic-research/resbull/2016/html/rb160701.en.html

Ridley, A. (2017): “The new regulatory wisdom: good or bad?”. IIMR Research Paper, No. 2. Buckingham.

Selgin, G. (1997): The Case for a Falling Price. Level in a Growing Economy. IEA Hobart Paper 132. London.

Selgin, G., Beckworth, D. and Bahadir, Berrak. (2015): “The productivity gap: Monetary policy, the subprime boom, and the post-2001 productivity surge”. In Journal of Policy Modelling. Vol. 37, Issue 2. March – April, p. 189 – 207.

Sumner, S. (2020): “There is No Substitute for Monetary Policy”. In The Bridge. 9th March 2020. Accessed online in July 2020 at https://www.mercatus.org/bridge/commentary/there-no-substitute-monetary-policy

Svensson, L. (1998): “Inflation targeting as a monetary policy rule”. NBER, working paper 6790. Accessed online in June 2020 at https://www.nber.org/papers/w6790.pdf

Trichet, J. C. (2003): “The ECB’s monetary policy strategy after the evaluation and clarification of May 2003”. Speech delivered at the Center for Financial Studies, Frankfurt am Main, 20 November 2003. Accessed online in June 2020 at https://www.ecb.europa.eu/press/key/date/2003/html/sp031120.en.html

Vaubel, R. (2020): “Proposals for reforming the eurozone: a critique”. In Castañeda, Roselli and Wood (eds.): The Economics of Monetary Unions. Past Experiences and the Eurozone. Chapter 12. Routledge.

Volcker, P. (2011): “A Little Inflation Can Be a Dangerous Thing”. Article published in The New Your Times, 18th September 2011.

I would like to acknowledge Alessandro Venieri’s research assistance in the collection of the data; as well as Geoffrey Wood, Charles Goodhart, Scott Sumner, George Selgin, Otmar Issing, Roland Vaubel, Tim Congdon and José Antonio Aguirre, who made very insightful comments on earlier drafts of the note. All remaining errors are entirely my own.

The fear of deflation is a common feature among central banks in our days. Following Bordo and Filardo (2004), what they actually fear is an ‘ugly’ or recessive-type deflation, such as that in the Great Depression years. However, there are other (productivity-driven) ‘good’ deflations which central banks should not fight against but welcome; these are deflations where the fall in prices is the result of an increase in the supply of goods and services in competitive markets (see Selgin 1997). An expansionary monetary policy to avoid this type of benign deflation will create an excess in the amount of money in the economy and eventually destabilise the markets (see Castañeda and Wood 2011). This is an intrinsic flaw in the strategy of most inflation-targeting central banks in our days.

Of course, it is undeniable that the other areas which the ECB is looking into under the review are indeed very relevant to the understanding of the Eurozone economy and the transformations that will impact monetary policy in the future.

Such as Mario Draghi’s (former President of the ECB) statement on 26th July 2012 in support of the euro: ‘Within our mandate, the ECB is ready to do whatever it takes to preserve the euro.’ (Draghi 2012).

Such as the increased macroeconomic coordination under the Macroeconomic Imbalances Procedure and the new ‘Fiscal Compact’.

See Codogno and Noord (2020) and Vaubel (2020) for further details about those both in favour and against policies and mechanisms for the mutualisation of the Member States debt in the eurozone.

‘In accordance with Article 105(1) of this Treaty, the primary objective of the ESCB shall be to maintain price stability. Without prejudice to the objective of price stability, it shall support the general economic policies in the Community with a view to contributing to the achievement of the objectives of the Community as laid down in Article 2 of this Treaty. The ESCB shall act in accordance with the principle of an open market economy with free competition, favouring an efficient allocation of resources, and in compliance with the principles set out in Article 4 of this Treaty.’ Statutes of the ESCB and the ECB, accessed online at https://www.ecb.europa.eu/ecb/pdf/orga/escbstatutes_en.pdf

One option to reflect one of the major expenses in an average household’s budget would be to include housing costs directly into the HICP (see ECB 2016 for more details on this issue). Rather than adding asset prices to a consumption good and services’ prices index such as the HICP, we will opt for giving a greater role to changes in the amount of money; so that we can capture the effects of monetary policy on asset prices over the medium to the long term.

One option being the adoption of a zero rate of inflation. Following the seminal estimate of the CPI inflationary bias for the US economy back in the 1990s in the ‘Boskin report’ (see Boskin Commission 1996), estimates of the inflationary bias of the CPI have been made since then for other economies, varying from one to two percentage points. Therefore, targeting a zero rate of inflation, as measured by the CPI, would actually mean the adoption of a one to two per cent rate of deflation.

‘A price-level targeter, by contrast, commits to reversing temporary deviations of inflation from target, by following a temporary surge in inflation with a period of inflation below target; and an episode of low inflation with a period of inflation above target.’ Bernanke (2017).

Of course, this strategy would allow the ECB to revisit and explain to the public what ‘price stability’ means, as mandated in its Statutes. In principle, there is no explicit rule preventing the ECB from adopting a mildly deflationary inflation target (i.e. -1%) in the context of a growing economy.

Even more so if the central bank adopts a nominal income level target, which would force the central bank to restore the level of nominal income prior to the crisis. If the pre-crisis spending levels were not sustainable over the long term (i.e. distortionary), the adoption of the same target would actually mean the running of an aggressive inflationary monetary policy, thus accelerating the recurrence of a series of ‘boom and bust’ cycles.

This is released on a quarterly basis, though in the last few years national statistics offices publish monthly GDP estimates with a two-month delay.

A similar argument has been made by Issing (2020) against the case for rising the ECB’s inflation target above 2%.

In Figure 2 we have used the two-year moving average of nominal GDP growth and M3 growth to extract the medium-term information in the series.

We have calculated in Figure 2 (a) so-called Friedman’s ‘K per cent rule’, compatible with the definition of price stability by the ECB (no more than 2% annually), a 2% trend growth of output in the Eurozone and a secular decline of money velocity of -1% per year. The difference between the prescribed M3 growth and the registered M3 growth can be taken as a proxy of the ‘money gap’ in the economy.

According to the seminal work by Friedman (1970), the excess in money growth will first affect output in the short term (6-9 months) and prices later (12-18 months). As stated in Congdon (2003 and 2005), an excess in cash balances (particularly in financial companies portfolios) will first bring asset prices up in the very short term, and later affect output and consumer prices to an extent that also depends on the stance of the economy; that is, on the value of the output gap.

This is one of the main reasons why we would support the review of the current definition of price stability by the ECB, so it is not only based on the HICP measure but on a broader monetary measure.

See Christensen (2020) for an excellent analysis of Covid-19 as a supply-side crisis and why its effects (and duration) will be very different from a demand-shock to the economy.

Notably, a monetary strategy that does not incorporate the analysis of monetary developments in the making of policy decisions would be unable to identify these inflationary pressures; therefore, increasing the risk of running too expansionary monetary policies with destabilising effects over the medium and long term. See Castañeda and Congdon (2020) for a more detailed analysis of the current surge in money growth in leading economies and its expected impact on prices and the business cycle in the next two/three years.

See Jarocinski and Lenza (2016) for a survey of the estimates of the output gap for the Eurozone both before and after the Global Financial Crisis. Even though there are significant changes in the size of the gaps, they all share the same message as regards the trend of the output gap and most on its direction too: higher in 2007 by roughly 1% to 5%; and lower in 2014 by -2% to -6%.

Taylor (2009) and Selgin et al. (2015) make a similar assessment of monetary policy in the USA but using estimates of (policy) interest rates rather than money growth.

As we know, these prices are not included in a conventional consumer prices index such as the HICP and thus did not directly feature in the ECB’s definition of price stability. In the next section we suggest a reform of the ECB strategy that does consider more explicitly the effects of money growth on CPI prices and also asset prices.

Up to 2015, the ECB’s lending facilities to banks in the Eurozone did increase its balance sheet and bank reserves, but not the amount of money in the economy. In a deflationary period with high uncertainty, there was an increase in the demand for money for precautionary motives. In addition, banks had to increase their regulatory capital by 60% (according to the new Basel III regulations, see Ridley 2017), which constrained their ability to expand their balance sheets and added even more deflationary pressures to the economy (see Congdon 2017). In this context, changes in the balance sheet of the ECB or in the monetary base of the economy (i.e. cash in circulation and bank reserves) do not explain changes in the amount of money in the economy, nor inflation.

This is the distinction made in Congdon (2010) between narrow QE operations (in which the central bank buys assets from the banking sector and only increases the monetary base as a result) and broader QE operations (in which the central bank buys assets from other non-bank financial intermediaries and the Government, and thus increases the amount of deposits in the economy).

In the current Covid-19 crisis, M3 growth in the Eurozone has very much exceeded this range (at the time of writing, July 2020, it is close to 9% annual rate of growth). This would signal the likely return of an inflationary boom in the Eurozone in the next two or three years, unless the ECB takes firm actions in the second half of 2020 to keep monetary growth in check.

In these circumstances, an excess of money growth may be offset by a fall in money velocity, therefore not showing inflationary effects for some time. However, once the level of uncertainty (and thus the demand for money) returns to more normal patterns, we would expect money velocity to revert to its long-term trend and the excess in money balances to affect prices and spending. In the context of the expected effects of the surge in money growth in the USA since March 2020, Congdon (2020) uses US data to confirm the reversion of changes in money velocity to its trend.

In the proposal, it is suggested that up to 30% of the public debt of each Member State is guaranteed by the whole Eurozone. This would be the debt which the ECB would be free to buy in case needed for monetary policy purposes. See De Grauwe and Moesen (2009) for the proposal of Eurobonds in the midst of the Eurozone crisis.

See the historical evidence on this in Bordo and Lane (2013).

This is in line with Issing (2020), who suggests the adoption of a longer time horizon so financial stability concerns can be incorporated into the design of monetary policy decisions.

This does not mean that the policymaker is just following this metric to make decisions. It is merely a useful communication tool to summarise and convey the message to the public.