We build a dataset of fiscal responses to the Covid-19 crisis for a broad range of countries. Credit guarantees contribute significantly to the policy mix, but a key question is whether these will produce the intended economic effects. Our research on the impact of EU guarantees between 2002 and 2016 supports the view that this policy instrument promotes the growth of Small and Medium-sized Enterprises (SMEs) and reduces bankruptcy rates. We compare the effects of credit guarantee policies within and outside of Europe and find similar positive impacts. However, we also identify dimensions where the instrument failed to bring significant economic impact. Finally, we discuss the use of credit guarantees in mitigating the effects of the crisis and limiting divergence in Europe.

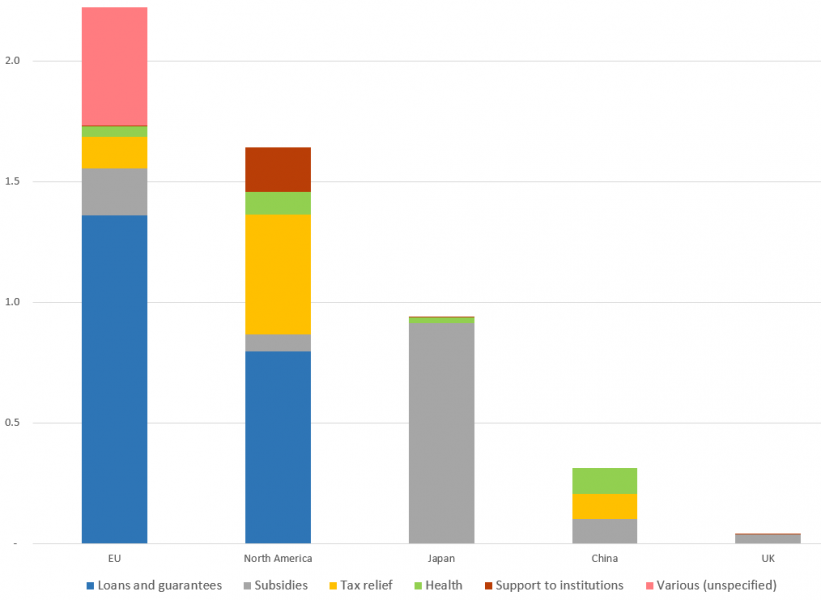

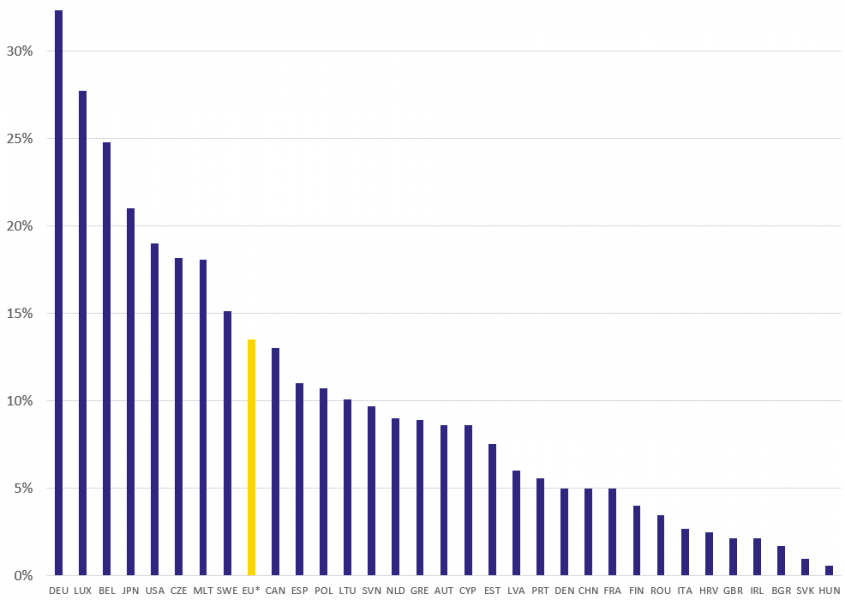

Credit guarantees are one of the main, if not the main, policy action in support of SMEs and mid-caps during the Covid-19 crisis. They were advocated by the IMF to address the near-term liquidity needs of firms (Gopinath, 2020). A mid-April inventory of coronavirus-related fiscal pledges for a broad range of countries reveals an overall prevalence of credit guarantees,2 albeit with large discrepancies between countries (see Figures 1 and 2). The US had at the time pledged €470 billion of guaranteed loans, and European States €1,600 billion. Through the European Investment Bank Group, a €25 billion Covid-19 guarantee fund aims at delivering up to €200 billion for the European economy, with a focus on European SMEs. A significant portion of this support instrument will be implemented via SME credit guarantees.3 The European Investment Fund4 (EIF), the EIB’s subsidiary specialized in SME finance, will manage a significant share of this fund. Indeed, SMEs represent 99.8% of European companies, 60% of value added, 70% of employees, and 31% of total European credit (Kraemer-Eis et al, 2019, and Adalid et al, 2020). They tend to suffer more from structural barriers preventing their access to finance (Stiglitz and Weiss, 1981), and are likely more vulnerable to the current crisis.

Figure 1: Covid-19 fiscal responses by geographical areas and types of policies, in € trillion, as of mid-April 2020, from IMF and EIB, authors’ calculations5

Note: Loans and guarantees: direct loans and credit guarantees. Subsidies: subsidies to employees and companies, welfare expenses, unemployment subsidies, support for resumption of activity. Support to institutions: support to domestic local governments and foreign governments (international aid).

Figure 2: Covid-19 fiscal response by country, in GDP share, as of mid-April 2020, from IMF and EIB, authors’ calculus

*EU: (Measures of EU States + Measures of EU Institutions) / EU GDP

Government-backed credit guarantee schemes exist in most developed countries since the 1980s (OECD, 2013). Their use as a countercyclical policy tool increased especially after 2008. The European Union has, since 1998, guaranteed over €50 billion loans, mostly to individual firms, through several generations of multi-annual financial programmes (“G&E”,6 “MAP”,7 “CIP”,8 and “COSME”9)10 (see Brault and Signore, 2019, for more details). The EIF implements and manages these programmes on behalf of the EU. It guarantees portfolios of loans disbursed by a network of financial intermediaries and national guarantee institutions. By reducing credit risk for partner institutions, the EIF alleviates market failures in SMEs’ access to credit, and supports technology, innovation, growth and employment (ECA, 2011).

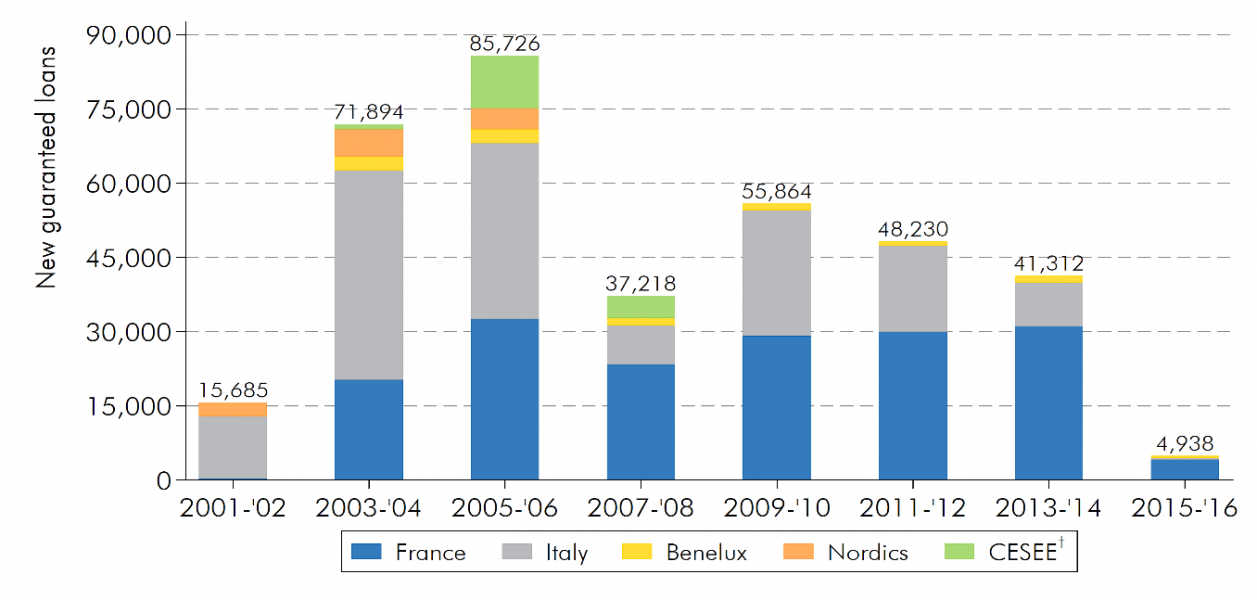

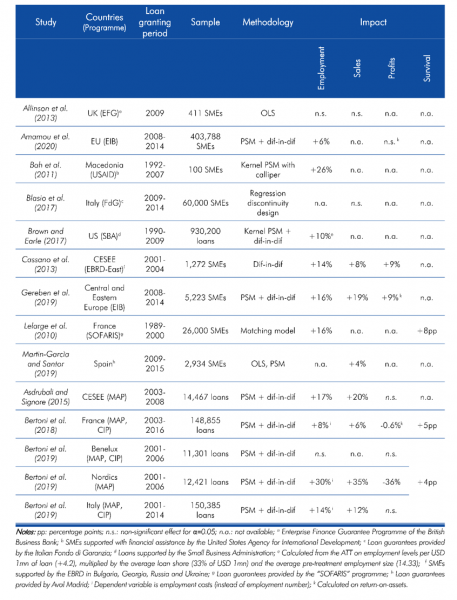

A series of evaluation exercises (Asdrubali and Signore, 2015; Bertoni et al., 2018; Bertoni et al., 2019; Brault and Signore, 2019) looked at the economic effects of 360,000 EIF-guaranteed loans, for a total volume of €22 billion, approximately 60% of total loan volumes under the programmes “MAP” and “CIP” (see Figure 3). To estimate the causal effect of credit guarantees on SME growth and survival, these studies used a combination of propensity score matching (PSM) and difference-in-differences (dif-in-dif) to compare beneficiary firms to similar firms which did not receive guarantees (the counterfactuals). Overall, EIF’s credit guarantees have a positive impact on SME growth and survival, which is in line with other major evaluations of guarantee programmes in Europe and the US (see Figure 4).

Figure 3: Number of guaranteed loans subjected to evaluation, by disbursement period and region.

Source: Authors

Figure 4: Comparison of the impacts of several credit guarantee programmes in the world

EIF-guaranteed loans had several positive impacts. They increased firms’ assets from 7 to 35%, sales from 6 to 35%, and employment from 8 to 30%. Firms were also less likely to go bankrupt: credit guarantees caused a decrease in bankruptcy rates of about a third, and up to a half in some countries.11 The ratio of intangible assets to total assets, a proxy of the weight of innovation in firms’ business models, increased by a third. The effect on productivity was ambivalent, with negative short-run effects (in Central, Eastern, and Southern Europe), but positive impact over the medium-long run (in France). Ceteris paribus, the positive effects were stronger for young and small firms – which typically experience more severe credit rationing – for the service industry over manufacturing, and (expectedly) for larger loans.

There were however limits to the impact of such guarantees. Notably, they did not seem to have an unequivocal impact on profitability. Moreover, the documented positive impacts were not larger for high-tech and knowledge-intensive sectors, which would be expected to face harsher credit constraints. Over the past years, these sector-specific shortcomings prompted a proliferation of targeted guarantees instruments and/or other hybrid instruments aimed at addressing these target groups. Finally, the magnitude of the impact varied across countries. However, such difference is largely reduced after controlling for the national characteristics of firms, e.g. their sector, age, and size. Hence, the characteristics of national economic and industrial landscapes appear to shape the economic impact of credit guarantees. Heterogeneity in the effectiveness of guarantees also stands out when comparing the results from the literature (Figure 4).

In conclusion, the existing literature supports the view that credit guarantees help maintain and increase growth and employment at the firm-level. These findings are highly relevant for policy design, and suggest that credit guarantees could represent an effective tool to address the current crisis. However, the economic effects of national guarantee programmes might diverge due to at least three factors, which tend to vary across countries. A first factor, already shown in Figures 1 and 2, relates to the magnitude of the deployed credit guarantee volumes. A second factor pertains to the features of national industrial landscapes, shown to increase or decrease the effectiveness of credit guarantees. A third factor has to do with the varying capacity of European States to withstand the fiscal consequences of potential future defaults of guaranteed loans. The volumes of credit guarantees currently pledged across countries are significantly larger than what has been observed in recent history. It is only natural to think that the absolute amount of defaults and/or cancellations on guaranteed loans will rise as the crisis unfolds.

Credit guarantee programmes at the European level help addressing these types of shortcomings. Thanks to their European-wide deployment, they can at least partially offset the heterogeneous fiscal response across European countries. Thanks to their relatively larger impact on the most credit-constrained firms, they might benefit more those regions hit the hardest by the crisis. By expanding the number and/or the size of loans available to SMEs in supported nations, they may contribute to significant economic impact, even in areas where the impact of guarantees may be lower. Thanks to the European backstop they offer to national public and private guarantee schemes, European guarantees also help harmonize costs at the European level in the case of future defaults. As such, European credit guarantees have a useful role to play along other existing or debated European mutualisation schemes.

As the importance of credit guarantees continues to grow, so does the need for further evaluations of the impact and sustainability of such programmes. Of high interest is the way guarantees are allocated by financial intermediaries. The ambivalent impact on short-run productivity and the lack of unambiguously positive effects on profitability ought to be evaluated more in detail. The fiscal and opportunity costs of choosing such instruments over other policies should be further assessed, especially considering the potentially higher levels of future defaults.

Adalid, R., Falagiarda, M., and Musso, A. (2020). Assessing bank lending to corporates in the euro area since 2014. ECB Economic Bulletin, 1/2020.

Allinson, G. F., Robson P., Stone, I. (2013). Economic evaluation of the Enterprise Finance Guarantee (EFG) Scheme. Department for Business, Innovation and Skills Project Report.

Amamou, R., Gereben, A., and Wolski, M. (2020). Making a difference: assessing the impact of EIB’s funding to SMEs. EIB Working Paper.

Ashenfelter, O. (1978). Estimating the effect of training programs on earnings. The Review of Economics and Statistics, 60, 1. pp. 47-57.

Asdrubali, P. and Signore, S. (2015). The economic impact of EU Guarantees on credit to SMEs. Evidence from CESEE countries. European Commission’s European Economy Discussion Paper 002 and EIF Working Paper 2015/29. July 2015. http://ec.europa.eu/economy_finance/publications/eedp/pdf/dp002_en.pdf and http://www.eif.org/news_centre/publications/eif_wp_29_economic-impactguarantees_july15_fv.pdf

Bah, E., Brada, J.C., Yigit, T. (2011). With a little help from our friends: The effect of USAID assistance on SME growth in a transition economy. Journal of Comparative Economics 39, 205–220.

Beck, T., Klapper, L. F., & Mendoza, J. C. (2010). The typology of partial credit guarantee funds around the world. Journal of Financial Stability, 6(1), 10–25. https://doi.org/10.1016/j.jfs.2008.12.003

Bertoni, F. and Colombo, M. G. and Quas, A. (2018). The effects of EU-funded guarantee instruments on the performance of Small and Medium Enterprises: Evidence from France. EIF Working Paper 2018/52, EIF Research & Market Analysis. November 2018.

http://www.eif.org/news_centre/publications/EIF_Working_Paper_2019_52.htm

Bertoni, F. Brault, J. and Colombo, M. G. and Quas, A. and (2019). Econometric study on the impact of EU loan guarantee financial instruments on growth and jobs of SMEs. EIF Working Paper 2019/54, EIF Research & Market Analysis. February 2019.

http://www.eif.org/news_centre/publications/EIF_Working_Paper_2019_54.htm

Brault, J. (2019). L’impact des programmes européens de garantie de crédit. BSI Economics.

Brault, J., and Signore, S. (2019). The real effects of EU loan guarantee schemes for SMEs: A pan-European assessment. EIF Working Paper 2019/56, EIF Research & Market Analysis. June 2019. http://www.eif.org/news_centre/publications/EIF_Working_Paper_2019_56.htm

Brown, J. D., Earle, J. S. (2017). Finance and growth at the firm level: Evidence from SBA Loans. Journal of Finance, 72(3), 1039–1080.

Cassano, F., Jõeveer, K., Svejnar, J. (2013). Cash flow vs. collateral-based credit. Economics of Transition, Vol. 21, pp. 269–300.

Chatzouz, M., Gereben, A., Lang, F. and Torfs, W. (2017). Credit Guarantee Schemes for SME lending in Western Europe. EIB Working Paper 2017/02 and EIF Working Paper 2017/42. http://www.eif.org/news_centre/publications/EIF_Working_Paper_2017_42.htm

Gereben, A., Rop, A., Petriceck, M., and Winkler, A. (2019). Do IFIs make a difference ? The impact of EIB lending support for SMEs in Central and Eastern Europe during the global financial crisis. EIB Working Paper 2019/09.

Gereben, A., and Wolski, M. (2020). The impact of public sector lending to SMEs on employment and investment. Vox.eu.

Gobbi, G., Palazzo, F., and Segura, A. (2020). Unintended effects of loan guarantees during the Covid-19 crisis. Vox.eu.

Gopinath, G. (2020). Limiting the economic fallout of the coronavirus with large targeted policies. Vox.eu.

Lelarge, C., Sraer, D., Thesmar, D. (2010). Entrepreneurship and credit constraints: Evidence from a French loanguarantee program. In: Lerner, J., and Schoar, A., International Differences in Entrepreneurship.

Martin-Garcìa, R., Morán Santor, J., (2019). Public guarantees: a countercyclical instrument for SME growth. Evidence from the Spanish Region of Madrid. Small Business Economics. Manuscript submitted for publication.

OECD (2013). SME and Entrepreneurship Financing: The Role of Credit Guarantee Schemes and Mutual Guarantee Societies in supporting finance for small and medium-sized enterprises (Final Report).

OECD (2019). Financing SMEs and Entrepreneurs 2019. An OECD Scoreboard.

Rosenbaum, P. R., Rubin, D. BN. (1983). The central role of propensity score in observational studies for causal effects. Biometrika, 70(1), 41–55.

Riding, A. L., and Haines, G. (2001). Loan guarantees: Costs of default and benefits to small firms. Journal of Business Venturing, 16(6), 595–612

Stiglitz, J., and Weiss, A. (1981). Credit rationing in markets with imperfect information. American Economic Review. 71(3).

The views expressed in this note are those of the authors and do not necessarily reflect the position of the European Investment Fund or European Investment Bank. The authors would like to thank Pierfederico Asdrubali, Fabio Bertoni, Massimo Colombo, Gunnar Mai, David Gonzalez Martin, Helmut Kraemer-Eis, Anita Quas, Andon Penev, Hermine Thelen and Wouter Torfs for their help and contribution.

Numerous caveats apply, as this is a very preliminary inventory in the midst of an ongoing crisis. Notably, most policies thus far are pledges and not realized expenses. Guarantees encompass total supported loans rather than their guaranteed share.

The European Investment Fund (EIF) is Europe’s leading risk finance provider for small and medium-sized enterprises (SMEs) and mid-caps, with a central mission to facilitate their access to finance. As part of the European Investment Bank (EIB) Group, the EIF designs, promotes and implements equity and debt financial instruments which specifically target the needs of these market segments. In this role, the EIF fosters EU objectives in support of innovation, research and development, entrepreneurship, growth, and employment. The EIF manages resources on behalf of the EIB, the European Commission, national and regional authorities and other third parties. EIF support to enterprises is provided through a wide range of selected financial intermediaries across Europe. The EIF is a public-private partnership whose tripartite shareholding structure includes the EIB, the European Union represented by the European Commission and various public and private financial institutions from European Union Member States and Turkey. For further information, please visithttps://www.suerf.org www.eif.org.

Notes: Encompassed are only policies which have been explicitly quantified. North America encompasses the US and Canada. Concerning credit guarantees, if both the guaranteed amount and the total amount of projected supported loans are given, the amount shown is the total amount of projected supported loans. When a policy package corresponds to several policy types but one single monetary amount, we distribute this amount evenly for all the listed policies. When a package is not described in any precise way, we attribute the label “Various”. That is typically the case if the IMF states that a country has pledged a certain amount “to fight the Covid-19 crisis”.

SME Guarantee Facility

Multi-Annual Program for Companies

Competitiveness and Innovation Program

Competitiveness and SME Program

Other more specialized European programmes target innovative firms (“InnovFin” programme), employment and social innovation (“EaSI”) and culture and creation (“CGS”).

Bankruptcy rates decrease by 33% in France and by 50% for the group Benelux-Italy-Nordics. The bankruptcy rate for identified individual firms benefiting from guarantees in this group of countries was 4.74% between 2002 and 2007, but this number may be affected by firms which could not be identified in Orbis.