The euro is twenty years old, a relatively young age for a currency, compared with the several decades and in some cases centuries-old age of some national currencies. As such, it is still in its development phase. An aspect of this development that has recently attracted both analytical and policy interest is its international use. The “weaponization” of the dollar by the US administration has strongly contributed to this renewed interest. This article aims at contributing to the debate about the way to foster a more important international role of the European currency.

To assess the prospects of greater international role for the euro, and suggest appropriate policies to support this objective, one needs to develop a framework of analysis.

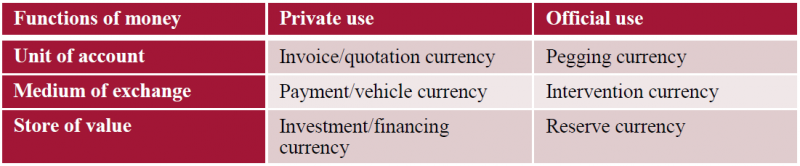

First, one needs to identify the specific international functions of a currency. Based on the three traditional money functions (i.e. unit of account, medium of exchange and store of value) and considering the two types of users of currencies (i.e. private and official agents) we can define six such functions (Krugman, 1984), listed in Table 1.

Table 1.

Source: based on Krugman (2014) and ECB (1999).

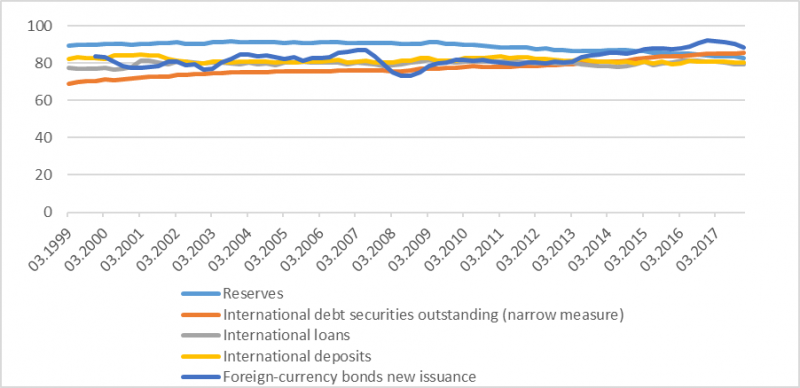

Second, one needs to be aware of the current situation about the international role of the euro. What is, therefore, required is an as accurate as possible picture of the status quo in international currency use. The available statistical evidence for each of the international functions defined above leads to the following conclusions:

Figure 1. Combined shares of the Euro and the US Dollar

Last but not least, one needs to establish which factors determine the extent of international currency use. The rich academic literature (Chinn and Frankel, 2007; Papaioannou and Portes, 2008; Krugman, 1984 and Eichengreen et al, 2018) points to the following list of factors:

Three main conclusions can be drawn about the prospects of the euro as an international currency.

First, it is clear that most of the factors mentioned above change only gradually and, thus, explain better long-term phenomena than short and medium-term changes in the use of international currencies.

In the long-term, however, and as things stand, the euro is potentially better equipped than other currencies to challenge the dominance of the dollar. First, the euro area accounts for the biggest share of international trade (Figure 2). It is also the second largest economy behind the US in terms of GDP (Figure 2), whereas the United Kingdom and Japan, two advanced economies with internationalized currencies, are much smaller. And, while China’s GDP share is projected to overtake that of the euro area by 2019, in all other determinants China clearly lags behind the euro area. Most importantly, in terms of free movement of capital, China’s has severe restrictions (a Chinn-Ito index score close to 0) while the euro area, like the US and other advanced economies (i.e. Japan, the UK), has fully liberalised capital accounts (a score of 1). The fact that the euro is, and has been for years, by far the second most used international currency in almost all functions supports this conclusion.

At the same time, the euro area currently trails the US on almost every dimension that is relevant for the international use of currencies. The US is the world’s largest economy, it is projected to stay ahead of the euro area in all other determinants other than the share of trade, American capital markets are way more developed than those of the euro area and they arguably showed more resilience as the recent crisis affected the euro area’s financial system more than that of the US. Finally, the euro area has no fully-fledged integrated political organisation or military capacity. It is, therefore, unlikely that the dollar would lose its dominant position anytime soon.

Second, inertia effects are likely to support the dollar’s advantage. Inertia effects are caused by strong network externalities and large switching costs between currencies. The result is a lag between any substantial shift in the international weight of a currency and important changes in its various determinants.

But “a brief review of the history of international currencies in the last century, …, puts inertia effects into perspective.” (Eichengreen et al, 2018).

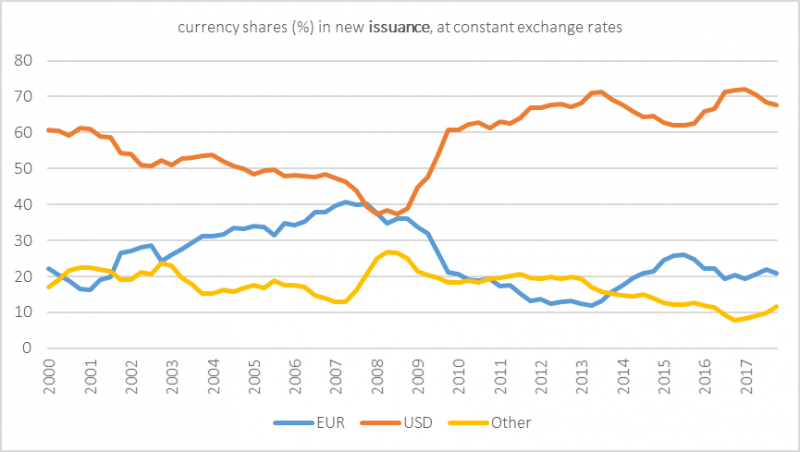

This is confirmed by looking at the changes in the shares of the dollar and the euro since the launch of the euro in the issuance of securities (Figure 2): the share of the dollar decreased between 2000 and 2008, while that of the euro increased, so much that by the later date the two currencies had the same share at around 40 per cent. In subsequent years, however, the euro lost ground and ended the period under review with a share of around 20 per cent, while the dollar reached a share of about 70 per cent. In short, inertia effect should not be exaggerated.

Figure 2. Foreign currency debt securities issuance by currency

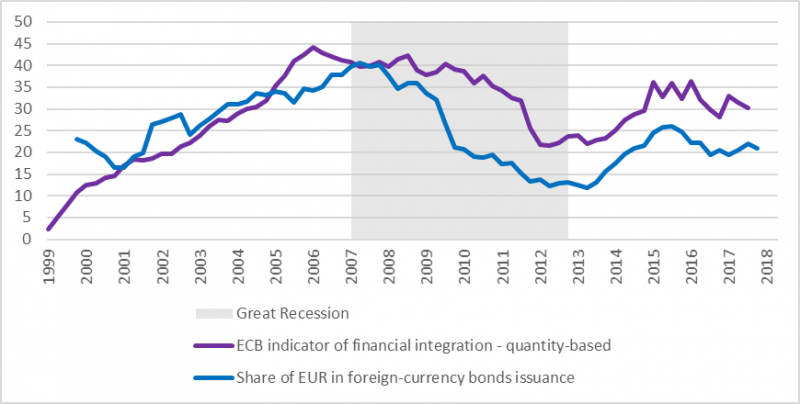

Third, financial stability, or rather financial instability, is the only factor that can change quickly enough to cause relatively fast changes in the shares of different currencies. The crisis-induced financial fragmentation in the euro area has negatively affected the international standing of the euro, specifically in its role as a financing/investment currency. In particular, the euro’s share in the issuance of foreign-currency denominated debt suffered during the financial crisis dropping towards 10 percent around 2012 and has recovered only partially since then. The drop in the euro share of bond issuance is quite closely correlated to the integration of the euro-area financial market (Figure 3). This confirms the importance of the stability of the underlying financial system for the international use of a currency, since the fragmentation of the euro-area financial market closely coincided with a period of acute financial instability.

Figure 3. Euro share of foreign-currency bond issuance and the ECB financial integration index

Overall, the euro’s second position is well established and likely to be retained, but the euro, without really threatening the dominant dollar’s role, could take either a greater or lesser share.

In terms of positive actions to effectively pursue the objective of a wider use of the euro, the critical step would be the full development of the euro-area institutional set-up. The decline in the international use of the euro during the Great Recession clearly showed that the euro’s international role is linked to the general stability of the euro, and sustainable stability depends on a more adequate euro-area institutional set-up. For instance, the completion of banking union, progress on capital markets union, better credit quality of ‘peripheral’ sovereign bonds and even the issuance of a common ‘federal’ bond, with a role similar to that played by Treasuries in the US, would significantly increase the international role of the euro. More broadly, progress in the set-up of euro-area economic policy, in its fiscal and structural components, would favour greater international use of the euro.

A complementary support for the international role of the euro would come if the ECB moved beyond its neutral attitude towards it. An important development in this respect would be for the ECB to enter into a series of swaps with central banks of countries that extensively use the euro, following the Fed example. Papadia (2013) and Andritzky (2018) noted the more guarded attitude of the ECB compared to the Fed in granting currency swaps during the crisis. Papadia (2013) found that the “ECB reticence was likely based on greater concerns about moral hazard and a more conservative approach towards the expansion of its balance sheet”. He added, however, that “the ECB could have been more forthcoming if it could have relied on a strong Treasury partner”, as was the case for the Fed. Agreements on swaps would require, however, utmost care to reduce the risk that drawings unduly impact monetary policy. This risk is less relevant for the ECB than it was for the Bundesbank, but nevertheless needs to be adequately managed. The model of the swaps between advanced economies built into the agreements signed in October 2013 (ECB, 2013) could be a useful starting point, as it assures that the issuing central bank maintains control over the drawing on the swaps.2 An agreement between the ECB and the European Commission and the Council of the EU on the third-country central banks that would have access to the swaps should also be pursued.

Finally, the international use of the euro would be expanded if the EU would pursue a more united, and thus more effective, external and defence policy.

This list of factors shows that promoting the wider international use of the euro is a difficult endeavour since the policies that would lead to this result require quite fundamental progress in the organisation and governance of the euro area and would have consequences well beyond the monetary domain. While they definitely are worth pursuing, the ability of the euro area to implement them in the foreseeable future is uncertain.

Realistically, the strongest factor that could positively influence the international role of the euro is the one which could negatively impact that of the dollar: the reinforced attitude of the US administration to use its first rank among international currencies as a foreign policy tool, forcing foreign countries to align to its policies, possibly in conflict with their underlying interests. More distant is the possibility that the protectionist policy of the current administration would cause instability in the US economy that would reduce the appeal of the dollar as an international currency. Overall, it is difficult to conceive of a configuration of events that would jeopardise the dollar’s primary role as international currency.

Finally, a discussion of the recent European Commission proposal is warranted. Rather than a fully-fledged plan, the Commission in its 5 December 2018 communication (European Commission, 2018a) presented some general considerations, a list of practical options and ideas to further develop its initiative.

The general considerations coincide to a great extent with what is covered above. In particular the Commission stresses that financial stability, progress on capital markets union, the perfection of banking union, the abundant supply of high-rated euro assets and the completion of Economic and Monetary Union are needed to fully develop the euro’s role as an international currency.

The Commission also proposes some more practical steps to facilitate the international use of the euro. Most of these steps, rather than requiring new actions, call for ongoing initiatives to be reinforced: furthering the move of derivatives clearing onto central clearing counterparties, as required by the European Market Infrastructure Regulation (Regulation (EU) No 648/2012), developing the work to provide interest rate benchmarks consistent with the EU Benchmark Regulation (Regulation (EU) 2016/1011), and fully exploiting the ability of the new ECB facility, TARGET Instant Payment Settlement, to provide an instant payment system in the EU also for private individuals. In terms of ideas to further develop its initiative, the Commission has issued a Recommendation to foster the use of the euro to denominate energy contracts (European Commission, 2018b), and is, at the time of writing, considering whether it is possible to further develop the role of the euro in foreign exchange markets and to use it for trade in raw materials and for transport sector manufacturers. In addition, the Commission will encourage European bodies to increase euro-denominated debt, will propose extended use of the euro to further the objectives of European diplomacy and will promote the use of the euro in Africa and in the European Neighbourhood. It has also hinted at the possibility that the ECB could establish broader swap lines.

Overall, these measures will not carry the same weight as the broader measures discussed in this piece. However, the Commission’s proposed measures could help a gradual recovery in the international use of the euro, which has still not returned to the pre-Great Recession level.

The euro already has a significant international role and has the potential to increase it significantly. This development, however, would require the euro-area progressing on the completion of the monetary union, which is proving a difficult and slow process. Barring unexpected progresses in this area, the euro will remain second to the dollar in this function. However, there could be limited progress if the EU Commission initiative proved successful and if the ECB would actively foster the international use of its currency.

Andritzky, J. (2018) ‘Can Eurozone Reform Help Contain Trump?’ Bruegel Blog, 17 October.

Ben-Bassat, A. (1980) ‘The optimal composition of foreign exchange reserves’, Journal of International Economics, 10(2): 285-295.

Chinn, M. and J. Frankel (2007) ‘Will the Euro Eventually Surpass the Dollar As Leading International Reserve Currency?’ in R.H. Clarida (ed) G7 Current Account Imbalances: Sustainability and Adjustment, University of Chicago Press.

Chinn, Menzie D. and Hiro Ito (2008). “A New Measure of Financial Openness“. Journal of Comparative Policy Analysis, Volume 10, Issue 3, p. 309 – 322 (September).

Efstathiou, K. and F. Papadia (2018) ‘The euro as an international currency’, Policy Contribution 2018/25, Bruegel.

Eichengreen, B., A. Mehl and L. Chitu (2018) How Global Currencies Work: Past, Present and Future, Princeton University Press.

European Central Bank (2013) ‘ECB establishes standing swap arrangements with other central banks’, press release, 31 October, available at https://www.ecb.europa.eu/press/pr/date/2013/html/pr131031.en.html.

European Commission (2018a) ‘Commuinication from the Commission to the European Parliament, the European Council (Euro Summit), the Council, the European Central Bank, the European Economic and Social Committee and the Committee of the Regions – Towards a stronger international role of the euro’, COM(2018) 796/4.

European Commission (2018b) ‘Commission Recommendation of 5.12.2018 on the international role of the euro in the field of energy’, C(2018) 8111/2.

Hassan, T. (2013) ‘Country Size, Currency Unions, and International Asset Returns’, Journal of Finance 68(6): 2269-2308.

He, Z., A. Krishnamurthy and K. Milbradt (2016) ‘A Model of Safe Asset Determination’, NBER Working Papers No 22271, National Bureau of Economic Research.

Krugman, P. (1980) ‘Vehicle Currencies and the Structure of International Exchange’, Journal of Money, Credit and Banking 12(3): 513-526.

Krugman, P. (1984) ‘The International Role of the Dollar: Theory and Prospect’, in J.F.O. Bilson and R.C. Marston (eds) Exchange Rate Theory and Practice, University of Chicago Press.

Maggiori, M. (2017) ‘Financial Intermediation, International Risk Sharing, and Reserve Currencies’, American Economic Review 107(10): 3038-3071.

Matsuyama, K., N. Kiyotaki and A. Matsui (1993) ‘Toward a theory of international currency’, Review of Economic Studies 60(2): 283-307.

Papadia, F. (2013) ‘Central bank cooperation during the Great Recession’, Policy Contribution 2013/08, Bruegel.

Papaioannou, E., R. Portes and G. Siourounis. (2006) ‘Optimal currency shares in international reserves: The impact of the euro and the prospects for the dollar’, Journal of the Japanese and International Economies 20(4): 508-547.

Papaioannou, E. and R. Portes (2008) ‘Costs and benefits of running an international currency’, Economic Papers 348, November, European Commission.

Rey, H. (2001) ‘International Trade and Currency Exchange’, Review of Economic Studies 68(2): 443-464.

This article draws material from: Efstathiou and Papadia (2018), The euro as an international currency. Bruegel Policy Contribution. December 18, 2018. https://bruegel.org/2018/12/the-euro-as-an-international-currency/

FAQ from the Federal Reserve website: “The swap line arrangements were authorized by the Federal Open Market Committee (FOMC) of the Federal Reserve System and the policy boards of the other central banks. Activation of the lines remains subject to each central bank’s internal decision-making process, and each central bank maintains the right to approve or deny requests for draws at any time. The FOMC authorized the lines for an indefinite period, but one that could be ended when the FOMC, one of the Federal Reserve’s foreign central bank counterparties, or both decide to terminate the arrangement.”