Disclaimer1

The EMU fiscal response to the COVID-19 outbreak has so far mainly come at the national level, placing significant stress on high-debt countries’ finances. In this note, we take a first look at the state of Euro area member states’ public finances at the end of 2021 from a debt sustainability perspective. We conclude that, assuming an environment of persistently low rates in the medium term, the debt overhang of 2020 can eventually be managed, at the cost of a significant but not necessarily daunting fiscal effort. But, that requires a constructive shift in the region’s fiscal governance system.

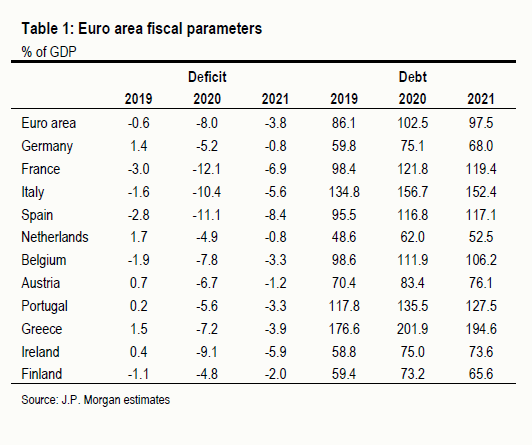

According to our forecasts, fiscal deficits and debt will rise sharply in 2020 everywhere in the region, on the back of an unprecedentedly deep recession (Table 1). Estimates keep changing, on the back of new policy announcements and revisions in the growth outlook, but the fiscal measures announced so far largely aim at cushioning the dramatic impact of lockdowns on incomes and corporate solvency, and as such are temporary (albeit dependent on the duration of the COVID-19 pandemic). Hence, we expect that a significant part of the fiscal easing and of the increase in debt will reverse by the end of 2021, as the economic recovery takes hold.

However, our forecasts allow for significant heterogeneity at the country level, with the increase in fiscal balances and debt proving more persistent in countries that already had elevated debt in 2019 (the periphery and France). By end-2021 debt will be 15%-20%-pts of GDP higher than before the outbreak in the high-debt countries, with 120% of GDP a new normal and the exorbitant exceptions of Italy (above 150%) and Greece (about 190%). These developments will be the norm rather than the exception, in a world where the US and Japan’s government debt are set to reach 130% and 252% of GDP, respectively (IMF forecast for 2020). But, the contrast inside the EMU could hardly be starker, given that low-debt countries are likely to have debt about 50%-pts of GDP below the high-debt countries, and still within shooting range of the 60% debt target embedded in the EU rules.

These heterogeneous fiscal outcomes are partly the result of tighter containment measures in some countries (notably, France, Italy, and Spain), and therefore deeper and more lasting economic damage. But, they also reflect less effective fiscal responses (in a broad sense, extending to contingent liabilities in the form of capital and liquidity provision to distressed businesses) because of reduced domestic fiscal leeway and higher funding costs. For instance, the bulk of the direct fiscal response (as measured by transfers and other forms of support to workers and firms), which has immediate implications for funding needs, has been significantly delayed across the periphery for fear of jeopardizing market access and in the hope of alternative funding under EU-wide initiatives. Eventually, the lack of such funding in the face of an unprecedented collapse in activity is forcing a stronger, albeit reluctant, domestic response almost everywhere. Italy is a clear example, given that the government waited until late May to announce an additional package worth 3% of GDP that had been in the making since late March and whose delay has affected promised disbursements to wide groups of recipients. In our view, this attitude is even more evident in Spain and Portugal, where the governments seem to harbor a paramount concern for preserving market funding conditions.

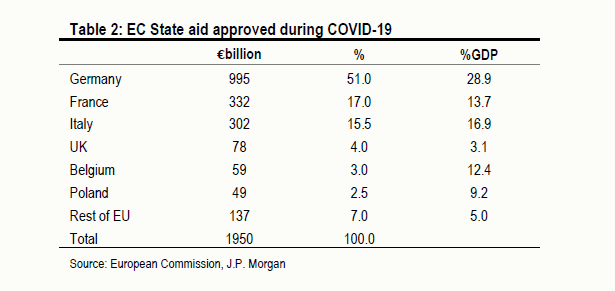

A clear-cut illustration of this uneven ability to counteract the shock is provided by the cross-country distribution of the EU state aid (in the form of both debt and equity) that the EC approved following the suspension of the regulatory framework. Germany alone accounts for more than 50% of the total financial commitments across the whole EU (we include the departing UK) worth about 29% of GDP (Table 2). Whereas France and Italy have also provided significant liquidity and solvency support to the corporate sector, their efforts so far amount to about half of Germany’s (as a share of GDP). With isolated exceptions, the rest of the EU is lagging dramatically on this measure. This cross-country heterogeneity has been noted with alarm by the EC, which expressed deep concern about consequences of the implied disappearance of a common playing field for the integrity of the single market.

In the specific context of the Euro area, a common question that arises is whether the debt overhang generated by the COVID-19 recession is a lethal threat to debt sustainability, with the potential to reignite a new sovereign crisis and new existential concerns. In short, our answer would be that the task of reducing the debt overhang triggered by the COVID-19 recession is extremely challenging, but manageable in a supportive policy environment like the one that seems to be shaping up.

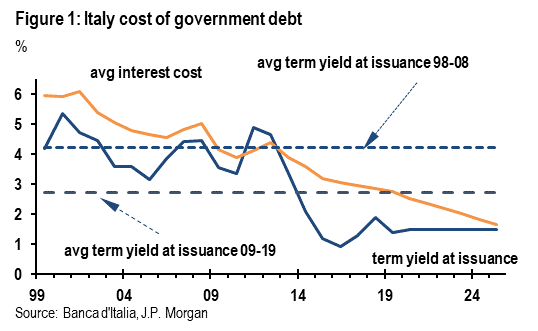

There are two major differences compared to the sovereign crisis of 2011-12 that, in our view, make the current task less daunting than it appears, despite much higher debts. The most decisive difference is the monetary policy stance of the ECB and its different approach to the lender-of-last-resort function. This deserve a separate treatment. Here, we note in passing that the ECB presence in the market (the latest PEPP program stands out) and its long-standing accommodative monetary policy supported by unconventional measures are helping all countries to reduce their average cost of funding. In turn, this helps keep the interest rate-growth differential bounded, preventing the onset of explosive debt dynamics due to skyrocketing refinancing costs. For instance, the average refinancing rate of Italian debt (about 7-year average maturity) has hovered around a historical low of 1.5%, despite significant market concerns and unprecedented issuance. Figure 1 illustrates the relationship between the average cost of sovereign debt and the term yield at issuance (calculations assume that Italian yield will remain at 1.5% until 2025).

In this note we focus on the governance approach to rising fiscal imbalances. At the time of the sovereign crisis of 2011-12, the region’s approach to fiscal policy was dominated by the German austerity mantra, which eventually produced the European fiscal compact, with its two rules of a balanced structural budget in the medium term and the 60% debt convergence rule over a 20-year period. This time, the EC has been much more reactive and has dropped all the fiscal rules indefinitely (the response has gone even further, relaxing also state aid and bank capital rules). The suspension of the framework is important in a very basic sense, as it provides room for maneuver in the current crisis. However, lingering in the background are the implications of a reinstatement of the fiscal framework soon in the aftermath of the COVID-19 outbreak, with a debate that could begin in the Northern low-debt countries (where the crisis is likely to be less intense) as early as the second half of 2021.

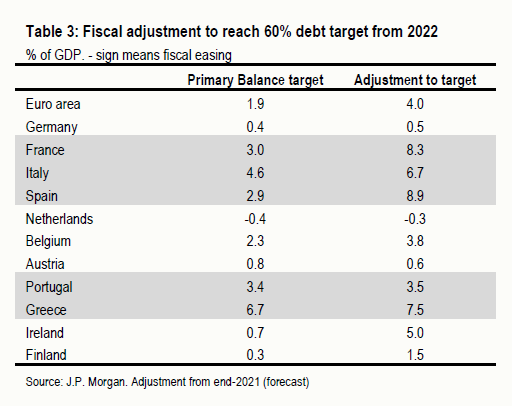

We show these implications by looking at the fiscal adjustment (starting from the 2021 positions in Table 1) that would be required if the fiscal rules in their current form were re-imposed abruptly in 2022. We measure the fiscal adjustment in terms of the change in the primary balance (i.e., the budget balance net of interest expenses) required to achieve a 60% debt-to-GDP target within 20 years. We focus on the debt rule because it is more demanding than the balanced structural budget rule, which only requires a zero cyclically adjusted deficit. By contrast, the debt overhang recorded by several countries by end-2021 would make the debt rule the binding rule as it would prescribe huge primary surpluses for many years. For the sake of simplicity, our calculations assume a 0% average interest rate-growth differential.

Table 3 shows the relevant metrics. Simply put, for the group of high-debt countries, the required fiscal adjustment (starting from 2021 positions) would be prohibitive, as measured, for instance, by the more than 8%-pt of GDP increase in the primary balance required in France or Spain. An adjustment of that size, even if stretched over a few years, would certainly defeat its purpose and trigger a new recession, as the EC itself has come to acknowledge. Furthermore, all countries would be required to maintain extremely elevated (in excess of 3% of GDP) primary surpluses for decades, and as high as 4.6% of GDP in Italy. Historical experience suggests that such an onerous fiscal path is very unlikely to be sustained over long periods of time.

In our view, early reinstatement is not a likely outcome, at least when considering the electoral calendar over the next few years. The next round of general elections in the region’s largest economies is scheduled for 2021-23 (with Italy coming last, if it avoids an early election). Renewed tensions about fiscal policy might pave the way for further advances by Euro-skeptic movements in the South and in France.

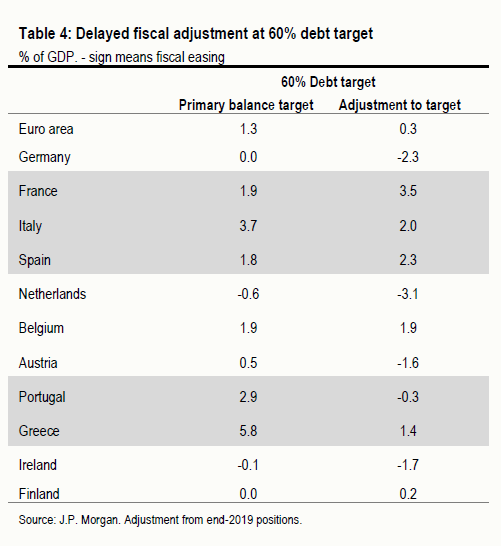

The previous section shows that an early reinstatement of the fiscal framework would be economically and politically undesirable. Hence, a first conclusion we draw is that it would be important that the framework remain suspended for a long period of time. Table 4 shows the fiscal targets and required adjustments if the fiscal rules were reintroduced only at a later date, sufficiently delayed to allow for the high-debt countries to work out a smooth reduction in deficits and debt with tolerable levels of austerity (if any) and with minimal drag on growth and employment. The calculations assume that by the time the rules are reinstated, countries’ fiscal positions have by and large reverted to 2019 levels.

We estimate this requires around 5-6 years suspension of the fiscal framework. In our view, this time frame would be a reasonable interval to eliminate the large output gap created by the 2020 recession and return to the 2019 state, when output gaps on average were close to 0%, with the exception of Greece and Italy. We think member states should use this time window to gradually roll back deficits and reduce debt through above-trend growth, without any significant structural tightening. A fiscal improvement on the basis of largely cyclical forces implies that better/worse growth outcomes would speed up/slow down deleveraging (with a corresponding impact on the convergence horizon).

However, a delay in the reinstatement of the fiscal rules would only make the fiscal adjustment less demanding. The long-term burden of reaching an impractically low debt target would remain, as fiscal policy would still be constrained for decades to maintain elevated and politically implausible primary surpluses. Again, Italy would be in the most difficult position, with a required primary surplus of 3.7% of GDP. In Greece, the adjustment in the tables overstates the true fiscal effort, because much of the Greek debt comes with ultra-long maturity (courtesy of official sector NPV debt relief).

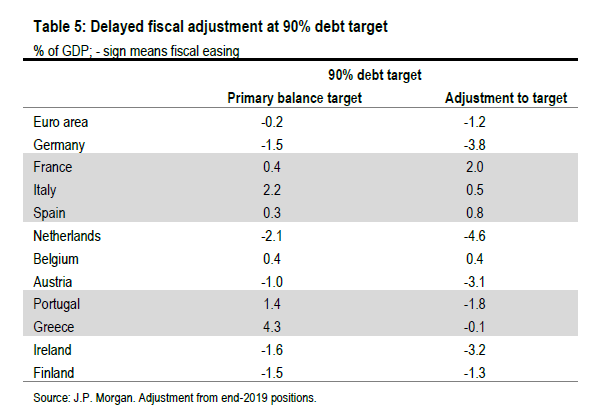

Critiques of the European fiscal rules have been gaining traction in recent years, also in institutional quarters. Recently, ECB president Lagarde was the latest prominent European figure to call for a thorough review of the fiscal framework. In our view, a straightforward innovation – i.e., a review of the debt target – would go a long way to enhance feasibility, compliance with, and acceptance of the rules. If the region were to converge to a higher debt target, the fiscal journey – in terms of both fiscal effort and required long-term discipline – would be much easier, and involve much less economic and political stress. To fix ideas on a specific (although not prescriptive) example, Table 5 shows the implications for the fiscal journey in the high debt countries under two conditions (i) countries are allowed a smooth return to fiscal positions close to 2019, and (ii) the long-term debt target is reset at 90% of GDP.

Our conclusion is twofold. First, there would be little need for major fiscal efforts. The largest adjustment would happen in France but would be only about 2% of GDP, whereas all the low-debt countries would (obviously) have large easing space. More importantly, the size of the primary surplus to be sustained over the long term would be within acceptable ranges, and consistent with moderate deficits rather than outright surpluses in the first few years (assuming persistence of low rates).

Because of its outsized legacy debt, Italy would still be in a more delicate position, but a primary surplus around 2.2% of GDP does not seem far-fetched to maintain, if history is of any guide and provided domestic politics remain anchored. Italy maintained a 2.4% of GDP average primary surplus during 1999-2007. Even in 2019, despite a nearly two-year-long flirtation with populist policy-making, the primary balance stood at 1.7% of GDP. We also note that the institutional conflict with the EC on fiscal overshooting was a key focal point behind flare-ups of market stress in the past two years, something that would be less of an issue with a more flexible fiscal framework along the lines we discuss.

It was never clear where the 60% debt target embedded in the EU rules came from, though it seems to be an artifact of the IMF view on the sustainability threshold for emerging countries issuing debt in foreign currency. Interestingly, it turns out that the combination of debt at 60% of GDP and a deficit level at 3% of GDP was in line with the objective of a broadly stable debt ratio around 60% under the prevailing macroeconomic (nominal growth around 4.4%) and financial conditions (average cost of funding around 4.7%) for most of the first decade in the life of the EMU. In the context of creating meaningful space for fiscal policy, we argued in the past that the mix of institutional innovations in the region since the sovereign debt crisis (OMT, QE, ESM, etc.) and the prevalence of a low-for-long rates environment already allowed for a higher equilibrium leverage. In the context of the ongoing response to the COVID-19 crisis, this view seems even more warranted.

Our fiscal estimates only incorporate the fiscal costs related to the current emergency. We do not incorporate any additional fiscal stimulus to support the recovery later on, which in the periphery will be linked to the EU Recovery fund. Nor do we incorporate the use of the other EU facilities (SURE unemployment subsidies, EIB financing to SMEs, ESM credit lines), which have been created to support the emergency response but still await finalization. It is too early, and many important details are lacking, for a detailed debt analysis (for instance, take-up across countries, details about loan maturity, relative share of grants vs. loans, etc.). Nonetheless, it is clear that these resources will be pivotal in reducing the rising cross-country divergences we have documented.

Against this background, the recent Franco-German proposal of a grants endowment amounting to about €500 billion is a milestone as it breaks the joint issuance taboo. We note that a Recovery Fund would serve two key purposes: (i) enhancing growth and job creation by making available resources at low (or zero) cost, and (ii) allowing fiscal transfers and burden sharing. Taken to the extreme (say a pure grant worth about 5% of a member state’s GDP plus additional support in the form of concessionary long-term loans), the scope for reduction of the debt burdens of the high-debt countries is certainly significant, but arguably less important compared to the first purpose. To us, the key role of a Recovery fund is to make available sufficient resources to spur a long-lasting recovery of growth and employment in the high-debt countries, by enabling investment plans that might otherwise not be feasible due to funding constraints. The EC proposal on 27 May supports this view.

An orderly path to reducing the debt overhang requires a hands-on central bank and flexible fiscal governance. But neither would be sufficient without cooperative and efficient policy-making in the high-debt countries. Localized euro-skepticism and more widespread economic populism have been on the rise in Europe. Only time will allow us to evaluate the ultimate impact of the COVID-19 crisis on populism, and eventually on the internal consistency of the EMU. However, we feel that without demonstrable and continued support from the ECB, the EC and the low-debt countries, politics in the high-debt countries might drift away over time and lead to a surge in market risk premia. We have suggested that, if the region wishes to create room for maneuver for high-debt countries to manage their debt burdens, there are straightforward ways to do so. In our view, the insistence on fiscal targets that are neither economically nor politically feasible would create new political frictions, or exacerbate existing ones, down the line.

Courtesy J.P. Morgan Chase & Co, Copyright 2020

Disclaimer: This SUERF policy note includes research content published by J.P. Morgan on 21st May 2020. J.P. Morgan has granted SUERF a limited right to re-publish this research on an information only basis. J.P. Morgan has no liability in any regard for the publication of this SUERF policy note or SUERF’s decision to reproduce any J.P. Morgan research content contained herein. It is not an offer to buy or sell any security/instruments or to participate in a trading strategy or trading activity; nor does it constitute any form of personal financial advice or investment recommendation by J.P. Morgan. This information should not be relied upon for any reason whatsoever by any natural or legal person. For important current standard disclosures that pertain to J.P. Morgan’s research please refer to J.P. Morgan’s disclosure website: https://www.jpmm.com/research/disclosures