This article focuses on the divergence in bank funding costs in US dollar money markets and the developments in FX swap markets during the Covid-19 crisis. We show how dislocations in core US dollar short-term funding markets reverberated globally. Non-US banks lost a substantial part of dollar funding from money market funds and had to resort to borrowing at shorter maturities. The severity of dollar funding strains varied substantially across banks, and eased for banks from jurisdictions with standing swap lines with the Federal Reserve. At the same time, the impact of policy measures to quell the stress was uneven across different funding markets. The divergence between key rates resulted in an unusual divergence of funding cost metrics, with some indicating a “dollar glut” while others a “dollar shortage”.

Dislocations in core US dollar funding markets in March and April 2020 reverberated through the balance sheets of global banks. One important catalyst was the stress in the markets for commercial paper (CP) and certificates of deposits (CDs), debt instruments issued by banks to source funding from non-bank investors such as money market funds (MMFs). Non-US banks lacking access to insured retail dollar deposits are particularly dependent on this type of funding to finance dollar assets. Hence, during the earlier phases of the crisis, non-US banks were especially hit by the decline in both the volumes and maturities of CP/CD funding, when prime MMFs withdrew as marginal buyers of CP/CD after facing large outflows (see Eren, Schrimpf, and Sushko (2020)). Disruptions in these core funding markets spilled over globally, contributing to wide swings in “offshore” US dollar funding costs, as indicated, for instance, by the cross-currency basis.

A number of policy measures helped to stabilise short-term dollar funding markets, but markets for different instruments normalised at different speeds. This opened up a wedge in funding conditions across key market segments. For example, funding stresses quickly eased for banks in jurisdictions with standing swap lines with the Federal Reserve. In such cases, dollar liquidity operations in March allowed the banks to access dollar funding cheaply and easily. This was also reflected in the diverging funding costs paid by these banks in CP/CD markets, which were lower compared with others (without such access or banks that benefited from the expanded dollar liquidity operations only later, in April).

This article focuses on the developments in FX swap markets and the divergence in key US dollar funding rates during the Covid-19 crisis. In a companion article, Eren, Schrimpf, and Sushko (2020) describe the money market fund turmoil that acted as the key transmitter of the funding shock. This article, by contrast, focuses primarily on the pull-back of funding from non-US banks and the associated international spillover effects. It shows that key dollar funding rates – which usually track each other closely – diverged markedly during this episode, and that the funding costs for market participants reliant on MMF funding varied greatly between banks, even for institutions of comparable creditworthiness.

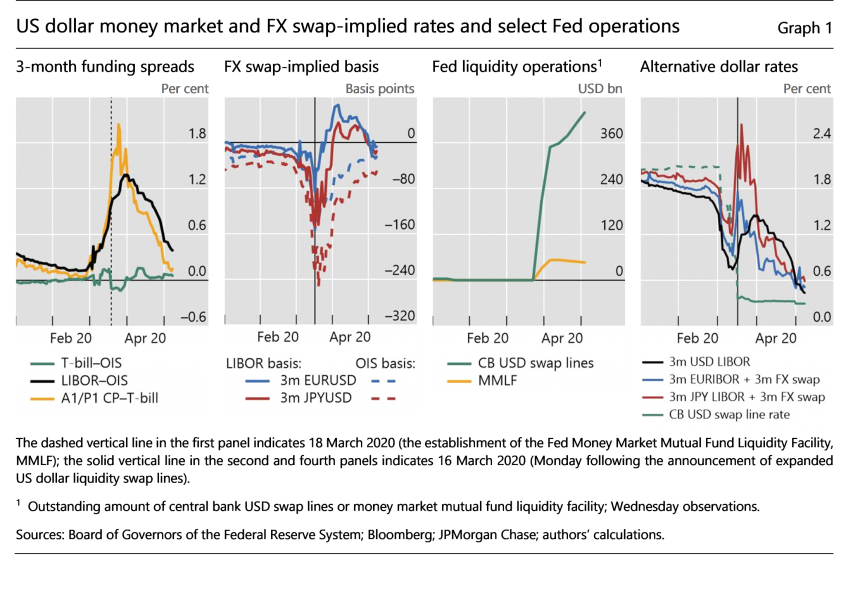

Non-US banks were impacted disproportionately by the large outflows from prime MMFs during the Covid-19 crisis and the associated stress in unsecured funding markets (Graph 1, first panel). These banks are some of the heaviest issuers of unsecured short-term paper (eg three-month CP and CDs) in US money markets due to their lack of a stable dollar retail deposit base. As during the Great Financial Crisis (GFC), MMFs constituted the main dollar lenders to non-US banks (Baba, McCauley and Ramaswamy (2009), Aldasoro, Ehlers and Eren (2019)).

As in past periods of strains in US dollar funding liquidity, the FX swap market, which serves as an important alternative funding source, came under pressure.2 FX swaps link money markets in different currencies, allowing banks to raise dollars in cross-currency funding markets. The so-called cross-currency basis can emerge if the interest differential implicit in FX swaps (as captured by the differential between the spot and forward exchange rate) deviates from the differential in the money market rates in the two currencies. A non-negligible cross-currency basis for dollar currency pairs means that the dollar is at a premium (or a discount) in FX swaps vis-à-vis the other currency. For instance, a negative basis indicates that it is more expensive to borrow dollars via FX swaps than in cash markets.

At the height of the funding squeeze in mid-March, FX swap spreads indicated a scramble for US dollars, reminiscent of the situation during the GFC and the euro area debt crisis. The cost of US dollar funding via three-month FX swaps against euro and Japanese yen collateral exceeded USD LIBOR by a respective 85 bp and 150 bp (Graph 1, second panel). The situation was even more extreme for some other currencies, in particular where the central bank had no swap line with the Fed at the time. A notable example is the Korean won.

As part of an unscheduled announcement on Sunday 15 March, the Fed made important changes to its swap lines with its five main central bank counterparties (Canada, the euro area, Japan, Switzerland and the United Kingdom). These consisted of a cost reduction (from 50 bp to 25 bp over USD overnight indexed swap (OIS) rates) and weekly dollar offerings via longer-term, 84-day (ie three-month), dollar swaps (in addition to the pre-existing seven-day operations, which now take place daily). On 19 March, the Fed further announced the expansion of the swap line network to nine additional central banks, which have since been offering US dollar liquidity in ad hoc operations since the end of March.

US dollar auctions by foreign central banks saw immediate and widespread take-up, especially by Japanese and European banks, which took advantage of the cheap pricing to replenish their dollar funding. This favourable access to dollar funding meant that an important set of participants in the global financial system did not have to shed US dollar assets at fire-sale prices.3 By early May, the Fed’s central bank swap lines, with $448 billion taken up, have been the most utilised of all the Fed’s funding and credit facilities (Graph 1, third panel).4 The Money Market Mutual Fund Liquidity Facility (MMLF) and the Commercial Paper Funding Facility (CPFF), both aimed at repairing CP/CD markets, saw respective take-ups of only $50.66 billion (after peaking at $53.15bn in early April) and $3.37 billion.

A highly unusual price configuration for dollar funding then emerged once the strains in the FX swap market eased, thanks to the above-mentioned US dollar auctions by the central banks. FX swap markets signalled simultaneously a US dollar premium and a discount, depending on which set of money markets instruments were used to source the foreign currency to swap for the dollars, and which set of money market instruments were used to place the US dollars. Specifically, the cross-currency basis based on risk-free (OIS) rates narrowed noticeably, but still indicated a dollar funding premium in FX swaps, as compared with money markets. By contrast, bases calculated based on unsecured rates (LIBOR) turned positive, indicating cheaper access to dollars via FX swaps than in money markets (Graph 1, second panel).

The anomaly emerged because the divergence between unsecured and risk-free dollar interest rates due to market stress did not recede even as FX swap spreads narrowed substantially after the central bank swap line facility was activated. In normal times, unsecured funding rates, say in CP/CD markets, represent marginal funding costs for banks. Hence, in a normal environment, FX swap pricing is more closely aligned with unsecured funding rates (see the narrower currency basis in January and February, Graph 1, second panel), than it is with risk-free rates (see the wider currency basis in January and February, Graph 1, second panel).5 But, in March, as a number of banks turned to central bank swap lines for dollar funding, priced at USD OIS + 25bp (Graph 1, fourth panel), OIS rates began exerting a greater influence on FX swap pricing, reflecting the option of turning to central bank liquidity facilities rather than to interbank borrowing.

At the same time, non-US banks without access to central bank facilities were more likely to face funding costs closer to unsecured funding rates (eg LIBOR), which remained elevated because the impairments in dollar CP and CD markets persisted well into April (Graph 1, first panel). Hence, something like a tug of war emerged between OIS rates and the IBORs as to which type of interest rate would anchor FX swap pricing. Dragged down by the cheap outside funding option for banks via central bank swap lines, the cost of dollar funding via FX swaps thus narrowed substantially relative to what IBOR rate differentials alone would imply.

Given this unusual situation, in which FX bases calculated using LIBOR changed their signs from negative to positive, some banks found it economical to adjust their funding patterns. The pricing of FX swaps implied that raising three-month funding in, say, euro unsecured markets at EURIBOR and then swapping into US dollars (paying the FX swap spread) had become cheaper than funding directly at the elevated US dollar LIBOR.6 Some market participants report taking advantage of the positive LIBOR basis by borrowing euros unsecured, swapping them into US dollars and lending at rates close to USD LIBOR. Such “arbitrage” would lead to upward pressure on EURIBOR and downward pressure on dollar LIBOR, which indeed was the case in the later stages of this episode. International cross-currency arbitrage thus helped to alleviate the stress in core US dollar funding markets and helped to reduce CP/CD rates in April (Graph 1, first panel). This may support the idea of the Fed’s swap lines as an effective tool in keep strains in offshore dollar markets from blocking the transmission of its domestic monetary policy, as argued by McCauley and Schenk (2020).

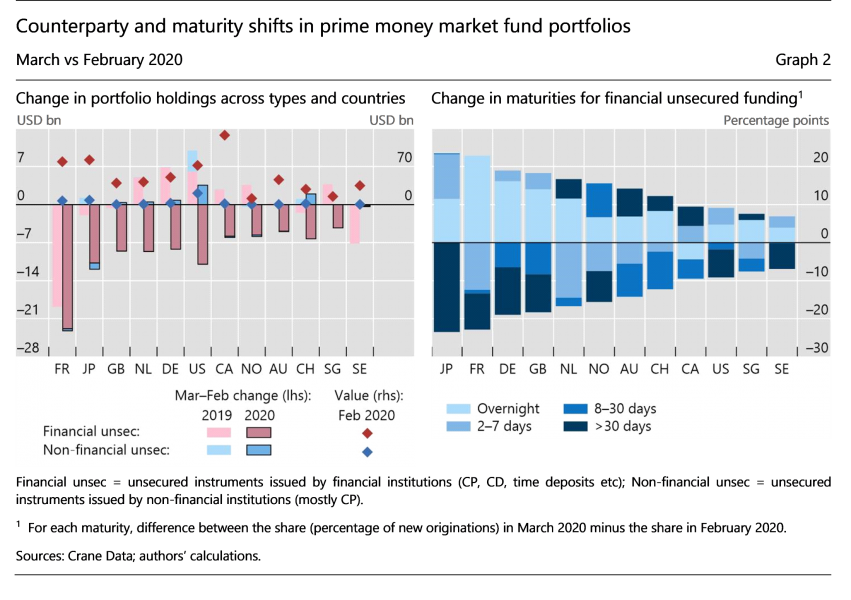

Some of the channels via which the US money market turmoil disrupted the unsecured funding for banks in CP/CD markets can be gleaned from granular MMF holdings data (see also Eren, Schrimpf and Sushko (2020)). Outflows from US prime funds led to a sharp pullback from lending in general, including lending to non-US institutions (Graph 2, left-hand panel). At the same time, even when funding was not lost overall, it became increasingly concentrated at shorter maturities, raising rollover risk. For some banking systems, this meant an increase of more than 20 percentage points in overnight or weekly funding at the expense of longer-term funding between February and March (Graph 2, right-hand panel). The evaporation of term funding liquidity in core US dollar money markets in turn pushed a number of non-US institutions towards raising dollars via three-month FX swaps, thus widening the cross-currency basis, as described above.

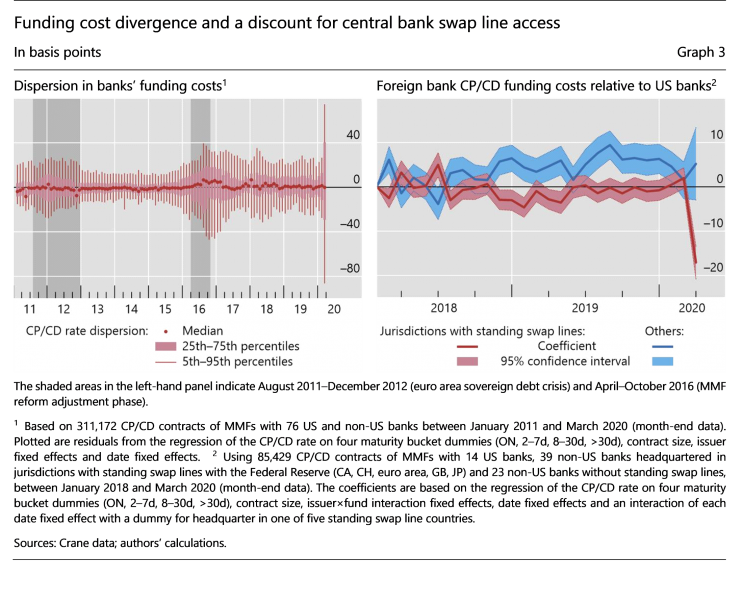

At the same time, borrowing costs did not rise uniformly across institutions – a common feature of episodes of funding strains, especially in US dollar markets (Rime, Schrimpf and Syrstad (2017)). In fact, the dispersion in CP/CD rates across banks jumped to levels exceeding anything observed over the past decade (Graph 3, left-hand panel), as investors became more discriminating about a bank’s dollar funding options and overall balance sheet strength. Notably, banks headquartered in one of the five jurisdictions with Federal Reserve central bank swap lines paid considerably less for funding, even compared with US banks (Graph 3, right-hand panel). A key reason may have been investor awareness of their ability to source dollars via central bank swap lines, the cost of which had been cut on 15 March (see above).

The expansion of the Fed’s swap line network to nine additional central banks, announced on 19 March, also improved the funding situation of banks headquartered in these countries. But not immediately, because the majority of dollar liquidity auctions by these new swap line member central banks only started to take place in early April. Hence, the dispersion in funding costs for non-US banks in core US dollar money markets very much reflected the differences in the options they had in terms of access to dollar funding – direct onshore, versus FX swaps, versus central bank swap lines (as illustrated for the case of EURUSD and JPYUSD in Graph 1, fourth panel).

The deterioration in global dollar funding conditions during the height of the Covid-19 crisis was a reminder of global banks’ reliance on short-term unsecured funding in US money markets. Just as during the GFC, MMFs pulled back as holders of short-term paper issued by non-US banks, exposing the roll-over risk posed by this form of funding in episodes of stress. Hence, the events in March showed that the 2016 reforms did not extinguish completely the MMF redemption channel in exacerbating bank funding stresses (see also Eren, Schrimpf and Sushko (2020)).7

At the same time, the speed of the subsequent recovery in funding conditions for banks headquartered in jurisdictions with easy and cheap access to dollars through standing swap lines with the Fed highlights the effectiveness of central bank swap line facilities. These facilities helped to counter some of the forces that hampered the transmission of the Fed’s monetary policy stimulus both domestically and internationally. The rapid take-up of central bank dollar liquidity facilities also reflected the stigma-free access, as banks did not have to worry about any possible negative signalling from tapping central bank liquidity. This is good news as it further suggests that banks have not been a major source of vulnerabilities during the Covid-19 crisis, in contrast to the case during the GFC.

Aldasoro, I, T Ehlers and E Eren (2019): “Global banks, dollar funding, and regulation”, BIS Working Papers, no 708.

Avdjiev, S, E Eren and P McGuire (2020): “Dollar funding costs during the Covid-19 crisis through the lens of the FX swap market”, BIS Bulletin, no 1.

Baba, N, R McCauley and S Ramaswamy (2009): “US dollar money market funds and non-US banks”, BIS Quarterly Review, March, pp 65–81.

Bahaj, S and R Reis (2020): “Central bank swap lines during the Covid-19 pandemic”, in Covid Economics, Vetted and real-time papers, Issue 2, 8 April, CEPR.

Eren, E, A Schrimpf and V Sushko (2020): “US dollar funding markets during the Covid-19 crisis – the money market fund turmoil”, BIS Bulletin, no 14.

McCauley, R and C Schenk (2020): “Central bank swaps then and now: swaps and dollar liquidity in the 1960s”, BIS Working Papers, no 851.

Rime, D, A Schrimpf and O Syrstad (2017): “Segmented money markets and covered interest parity arbitrage”, BIS Working Papers, no 651.

This policy note was previously published as BIS Bulletin No 15, on 12 May 2020.

See Avdjiev, Eren and McGuire (2020) for an analysis of dollar funding costs through the lens of FX swap markets during the Covid-19 crisis.

Also see Bahaj and Reis (2020), who show that central bank swap lines during the Covid-19 crisis were more effective in currencies with a higher take-up in USD operations by the respective central bank.

Via the MMLF, the Fed extends loans to dealers to purchase eligible assets from MMFs, priced at 100 bp over the discount window rate (25 bp) for lending against CP collateral. Via the CPFF, which became operational only from April 14, the Fed directly purchases three-month CP from issuers. The pricing for the CPFF is OIS +110 bp for A1-rated and OIS + 200 bp for A2-rated CP. Thus both facilities are priced at a considerably higher rate than the central bank swap lines. A key difference is that the Fed and the US government are insulated from any credit risk in the dollar liquidity operations with other central banks.

The OIS rate is conceptually an amalgam of expectations of the evolution of an overnight rate (and hence the direction of monetary policy) plus a term premium. For example, a USD OIS rate is the fixed rate paid in exchange for receiving the effective federal funds rate over the term of the contract. Due to collateralisation and because counterparties in an OIS do not exchange principal, there is essentially no credit risk embedded in the rate. As such, there is no dispersion across banks in the rate paid or received in an OIS contract.

In the fourth panel of Graph 1, this is depicted by the blue (EURUSD) and red (JPYUSD) lines compared with the black line; and the difference between each pair is the LIBOR basis shown in the second panel.

The reform addressed some of the lessons learned during the GFC, when the Reserve Primary Fund was forced to reduce its NAV to below $1 due to massive losses, triggering a panic among investors. The reform required prime funds to switch from a stable to a floating NAV calculation and introduced redemption gates and fees at a fund’s discretion should its weekly liquid assets (a combination of government securities and other assets maturing within a week) fall below 30%.