This note compares the ESM and corona bonds as possible tools to finance liquidity needs of heavily indebted euro countries in the COVID-19 pandemic. It looks into both instruments’ signal effects, the necessary conditionality and their role in a possible comprehensive approach towards dealing with an insolvent euro area country. The comparison concludes that in the current stage of the crisis the ESM is the preferable option of liquidity support and that the purported advantages of corona bonds over the ESM are meagre to non-existent. Corona bonds have the disadvantage of entailing a hasty de facto decision in favour of comprehensive transfers as solution for over-indebtedness. By contrast, the ESM is able to buy time until the acute phase of the crisis has passed before engaging in an open discussion of various options for a sovereign insolvency.

In addition to being a humanitarian disaster, the COVID-19 pandemic is an economic crisis with wide-ranging repercussions. The uncertainty on its full economic and financial consequences is still huge at present given the lack of experience with a similar situation. The damage wrought will ultimately depend on the outcome of the current containment strategy, including the duration and scope of restrictions to public life. All estimates conducted to date indicate that a recession similar in magnitude to that triggered by the 2008 financial crisis is already unavoidable, and that a considerably more severe recession involving even a double-digit drop in economic output in Germany and other industrial countries in 2020 cannot be excluded as a possibility (see e.g. Dorn et al. 2020; IMF 2020).

The economic consequences of the pandemic are particularly grave because it has unleashed a simultaneous supply and demand shock, damaging industrialised and developing countries alike. On the supply side, production is suffering from shutdowns in the service sector; disruptions to global supply chains; and lower labour availability due to quarantine measures, including school closures. On the demand side, the sudden collapse in business and consumer confidence has drastically undermined a willingness to invest or consume. At the same time, the ability of consumers and businesses to engage in spending has been massively restricted.

While the economic shock triggered by the coronavirus pandemic is impacting all European countries, EU Member States diverge considerably in their resilience to economic and financial crisis. The economic policy measures being implemented throughout the industrialised world have a common aim: to prevent bankruptcies and preserve jobs. To this end, governments and central banks have been injecting liquidity into the economy through various means. Whether or not these measures are successful, one inevitable result of the coronavirus pandemic will be a massive expansion in public debt levels and central bank balance sheets. The coming recession will also lead to a collapse in tax revenues and increasing government outlays for social assistance, including unemployment benefits.

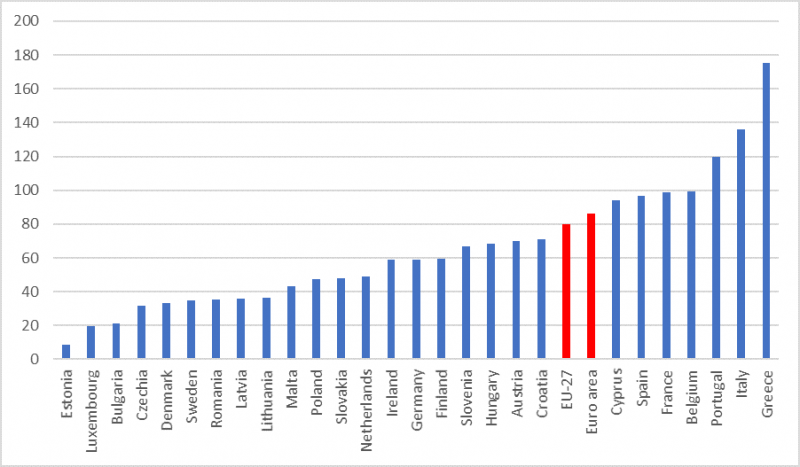

While the crisis is impacting EU Member States at different speeds, a strong rise in public debt levels in all EU countries appears inevitable. However, there is considerable divergence in the room for manoeuvre that each country enjoys engaging in deficit spending. Countries such as Italy, Greece, and Portugal already have debt-to-GDP ratios in excess of 100% (see Figure). During the sovereign debt crisis of 2010–2012, these countries faced rapidly deteriorating conditions for financing their spending, including actual or potential loss of access to international capital markets.

Considering that the economic and financial effects of the coming recession are likely to more severe than that of the crisis a decade ago, a new European sovereign debt crisis is potentially in the cards.

Figure: General Government Debt in % GDP, 2019

Source: AMECO Database

Particularly in countries with high public debt levels in combination with low potential for growth, the coronavirus pandemic poses significant dangers. If public debt levels rise high enough, they may be considered unsustainable by investors. This would lead to higher risk premiums in yields and could ultimately culminate in loss of access to capital markets. Countries might be forced to scale back stimulus measures, which would have negative economic impacts not only domestically, but in other European countries. The eurozone is particularly susceptible to these dangers as a currency union with several highly indebted Member States but without a clearly defined lender of last resort. If the current turmoil emanating from the coronavirus were to be intensified with a full-blown sovereign debt crisis, this would destroy any hope of rapid recovery in Europe as the pandemic subsides.

With its Pandemic Emergency Purchase Programme (PEPP), the ECB will be buying 750 billion euros in assets including government bonds in an initial effort to stabilise bond markets. Under its existing Public Sector Purchasing Programme (PSPP), the ECB has committed itself to allocate its purchases among Member States in proportion to the ECB capital key. This rule does not strictly apply to the new PEPP, however. In this way, the ECB is armed with the ability to concentrate its purchase activities on highly indebted countries at risk of losing access to the capital market.

On the potential use of existing or new European fiscal instruments, there is a particular debate on the relative appeal of the following two:

The European Stability Mechanism (ESM): The ESM is equipped with liquidity instruments that could be used to aid countries that have been severely impacted by the coronavirus, among them the Precautionary Conditioned Credit Line (PCCL). A defining feature of ESM support is conditionality which, however, is milder for the PCCL compared to other ESM lending instruments (Bénassy-Quéré et al., 2020). The ESM benefits from partial guarantees of euro countries. Germany, for example, has a maximum liability of 190 billion euros on the current lending cap of 500 billion euros. An increase of this ceiling requires the consent from all euro countries.

Corona bonds: The proposal for the creation of ‘corona bonds’ is based on the euro bond model that was keenly discussed but never adopted in the years of the euro area debt crisis. A key aspect of the proposal relates to liability: all euro states would have to accept joint and several liability for corona bond debts. Accordingly, assuming an identical volume of lending, corona bonds would pose higher risks to individual euro states than financing through the ESM. Based on the proposal formulated by Südekum et al. (2020), corona bonds would also feature a redistributive component. Given the emission of one billion euros in corona bonds, Südekum et al. envision the allocation of repayment liabilities in accordance with the ECB’s capital key. However, a larger share of the capital raised through the corona bonds would flow to euro countries at risk of losing access to capital markets.

In an open letter, nine euro countries called for the establishment of corona bonds (France, Italy, Spain, Portugal, Ireland, Greece, Slovenia, Luxembourg and Belgium) (Financial Times 2020). By contrast, Germany, the Netherlands, Austria, Finland and the Baltic States are more critical on the proposal according to press reports. The figure above vividly demonstrates how the public debt position of a country is correlated with its stance on corona bonds. Among the nine proponents of the idea, six are the most heavily indebted countries in the eurozone. By contrast, countries with lower debt-to-GDP ratios tend to oppose this new European instrument.

There are ultimately two questions at issue in discussions about corona bonds as an alternative to the ESM. First, how should we ensure sufficient liquidity during the pandemic while also averting the acute danger of a sovereign debt crisis? Second, who will bear the losses that will potentially result from possible future insolvencies of euro states?

Corona bonds and the ESM answer these questions in two different ways. Advocates of the model proposed by Südekum et al. (2020) are in favour of collective financing by Member States in tandem with a clear mechanism for redistribution between countries. Corona bonds intentionally overturn the existing principle that there should be a proportional relationship between liability for long-term debt and the share in revenues. In the view of Südekum et al., this would help to keep debt levels sustainable. By contrast, ESM credit lines would only provide immediate and short-term liquidity assistance. ESM assistance is only redistributive to a very limited extent (insofar as interest rates charged by the ESM do not include a spread for the lower credit rating of high debt euro countries). Otherwise, however, the liabilities borne by a country rise in direct proportion to the assistance it receives.

If one compares both options from a present-day perspective – that is, considering that the magnitude of the disruption in each country is still uncertain – it is unclear why corona bonds are viewed as preferable to the ESM, particularly at this phase of the crisis. In this regard, various considerations should be taken into account:

Relative size of Corona recession unclear: European solidarity rests on the principle of mutual assistance in times of need. However, it is currently impossible to predict which eurozone states will be hit hardest by the economic fallout of the pandemic. The standstill in tourism is a particular blow to the tourist destinations in the South of Europe. But also global trade is undergoing rapid contraction, meaning that severe economic dislocation could easily strike export-oriented countries such as Germany or smaller euro states whose prosperity depends vitally on international trade. Germany and Finland, for example, had deeper recessions in 2009 than any of the Southern European countries. If the proceeds from corona bonds were to flow to countries based on the severity of their recessions, then who will ultimately benefit remains quite unclear. By contrast, if assistance is distributed based on public debt levels, as proposed by Südekum et al. (2020), then there could be significant mismatch between where assistance is needed and where it is actually provided, thus contravening the principle of mutual macroeconomic insurance that is frequently invoked in discussions about this issue.

Bailout through transfers is not the sole solution for an insolvent country: Secondly, if the revenues from corona bonds were to flow to particularly indebted eurozone countries, then this would represent a form of bailout, thus obviating further discussion of how unsustainable debt levels should be managed in future. This would also represent an overly hasty decision since a bailout is not necessarily the optimal solution for a sovereign over-indebtedness. Government insolvency can be resolved through various strategies, including a combination of different solutions. One alternative to wealth transfers from taxpayers in other European countries is a partial haircut on the amount owed to creditors. Another option would be to levy a special tax on particularly wealthy groups in the highly indebted country. Such issues are, of course, contentious and involve both difficult economic and political judgments. Accordingly, it is better to take these decisions during moments of relative calm, rather than in the middle of an acute crisis. On account of the uncertainties within a deep recession it is impossible to assess debt sustainability in a reliable way. These considerations argue against the introduction of corona bonds at the present moment as a de facto redistributive solution for overindebtedness.

Significant political hurdles: A third point is that implementing a redistribution solution requires democratic legitimation in potential net creditor nations. The argument that corona bonds would be easier to implement politically as an alternative to raising the cap on ESM assistance is also ill-informed from a legal standpoint. In its ESM judgement, Germany’s Federal Constitutional Court clearly ruled that the Bundestag may not relinquish its budget authority on issues that have far-reaching liability implications. In this way, marshalling the consensus required in national parliaments to enact corona bonds would be a task no less formidable than that of expanding the ESM.

Corona bonds could damage reputation: A fourth consideration is on the reputation effects. A common argument against the ESM is that it stigmatizes a country seeking assistance, while financing via corona bonds would have no impact on investors’ assessment of creditworthiness. This argument is questionable. Clearly, the need for financing through corona bonds would send a strong signal to market participants that high debt euro countries are no longer able to reliably service their debts on their own. This would make the legacy debt that is financed through national securities more susceptible for a bond market run. As a consequence, this could lead to a ‘mission creep’ where corona bond issues must be continuously increased to refinance the maturing national debt. This would constitute a severe change in the instrument’s original purpose, as corona bonds have been proposed as a tool for addressing short-term costs from the pandemic. One trillion euros is often cited as a potential figure for the scope of corona bond issuance (e.g. Südekum et al., 2020). Yet this would do little to resolve Italy’s debt problem. At the end of 2019, Italy’s public debt stood at 2.4 trillion euros, and will soon reach 2.5 trillion euros. If Italy were to receive a net transfer in the amount of 100 billion euros (e.g. corona bond proceeds minus Italy’s share of corona bond debt allocation), Italy would only be able to pay down 4% of its legacy debt. To significantly improve Italy’s creditworthiness, corona bonds worth several trillion euros would have to be issued. This merely emphasises the fact that corona bonds represent a de facto decision in favour of a comprehensive bailout for overly indebted countries.

No significant interest rate advantage: A fifth point against corona bonds is that they are unlikely to have a significant interest rate advantage over ESM credit lines. International rating agencies have given the ESM an AA rating or better. Accordingly, the interest rate advantage that corona bonds would enjoy by virtue of collective eurozone backing would likely range from little to none.

Corona bonds would not ease conditionality: A sixth argument in favour of the ESM is that the conditionality argument seems to be exaggerated. Advocates of corona bonds assert that they would ease the ‘conditionality problem’ associated with the ESM. But if corona bonds were to be implemented as desired by their proponents – that is, with a strong redistributive effect – then creditor nations would have to insist on very significant conditionality. By contrast, creditor nations will be much less insistent on imposing stringent conditions on short-term crisis assistance through the ESM, because this does not create far-reaching facts like Corona bonds are likely to do.

Granting short-term liquidity assistance through the ESM in order to finance costs associated with the pandemic is the solution of first choice at the present moment of the crisis. The purported advantages of corona bonds over the ESM are meagre to non-existent. Furthermore, they have the distinct disadvantage of entailing a hasty de facto decision in favour of comprehensive transfers as solution for ensuring the solvency of highly indebted eurozone nations. The challenge we face at the moment is to contain the spread of COVID-19 while stabilising the economy and ensuring eurozone states have sufficient liquidity. The ESM is suitable tool for pursuing these ends. By contrast, we should wait until the acute phase of the crisis has passed before engaging in discussion of how to handle high debt levels and possible cases of insolvencies among eurozone nations and the difficult question of who finally bears the burden of unsustainable debts.

Bénassy-Quéré, A., Boot, A., Fatás, A., Fratzscher, M., Fuest, C., Giavazzi, F., Marimon, R., Martin, P., Pisani-Ferry, J., Reichlin, L., Schoenmaker, D., Teles, P. und Weder di Mauro, B. (2020): A proposal for a Covid Credit Line, VOX 21.03.2020

Dorn, F., Fuest, C., Göttert, M., Krolage, C., Lautenbacher, S., Link, S., Peichl, A., Reif, M., Sauer, S., Stöckli, M., Wohlrabe, K. und Wollmershäuser, T. (2020). Die volkswirtschaftlichen Kosten des Corona-Shutdown für Deutschland: Eine Szenarienrechnung, ifo-Schnelldienst 4/2020, März.

Financial Times (2020). European Council letter, Nine EU nations call for joint debt deal, 26.03.2020.

IMF (2020). World Economic Outlook, The Great Lockdown, April 2020.

Südekum, J., Felbermayr, G., Hüther, M., Schularick, M., Trebesch, C., Bofinger, P., Dullien, S. (2020): Europa muss jetzt finanziell zusammenstehen, Frankfurter Allgemeine Zeitung, 21.03.2020.

Prof. Dr. Friedrich Heinemann; ZEW – Leibniz-Zentrum für Europäische Wirtschaftsforschung Mannheim GmbH, L 7, 1; 68161 Mannheim; Tel.: +49 (0)621 1235-149 | friedrich.heinemann@zew.de