This paper studies the size and source of exchange-traded funds’ (ETFs) price impact in the most ETF-dominated asset classes: volatility (VIX) and commodities. I show that the introduction of ETFs increased futures prices. To identify ETF-induced price distortions, I propose a model-independent approach to replicate the value of a VIX futures contract. This allows me to isolate a non-fundamental component in VIX futures prices, of 18.5% per year, that is strongly related to the rebalancing of ETFs. To understand the source of that component, I decompose trading demand from ETFs into three main parts: leverage rebalancing, calendar rebalancing, and flow rebalancing. Leverage rebalancing has the largest effects. It amplifies price changes and introduces unhedgeable risks for ETF counterparties. Surprisingly, providing liquidity to leveraged ETFs turns out to be a bet on variance, even in a market with a zero-net share of ETFs. Trading against leverage rebalancing delivers large abnormal returns and Sharpe ratios above two across markets.

Recent years have seen a surge in passive investing. Investors are increasingly putting money into funds that track a given benchmark index instead of actively managing a portfolio. The market for one particular type of these funds, ETFs, has grown considerably. As of 2018, ETFs were managing $5 trillion globally compared with only $0.2 trillion in 2004. ETFs are progressively being used by retail and institutional investors to obtain a cost-efficient exposure to portfolios of assets or asset strategies. On the one hand, commoditization of various assets through ETFs makes investing simple and cost-efficient, thereby attracting new capital and possibly increasing liquidity. On the other hand, commoditization could reduce price informativeness and create systemic risks if the presence of large investors with similar objectives leads to synchronized trading, especially during extreme market times. The increasing presence of ETFs in various asset classes has led to a growing number of market participants and academics expressing concerns about the potential distorting impact on underlying assets. The fear is that “too much money is in too few hands”.

Assessing the impact of ETFs on prices is difficult because it is hard to distinguish between noise and fundamentals of the underlying asset. The existing literature has almost exclusively focused on equity markets, where fundamental values are complicated to measure. Most papers have tried to quantify non-fundamental price distortions due to ETFs by looking at price reversals or variance ratios. In the research presented here, I use the beneficial setting of the futures market, where non-fundamental price distortions are easier to measure. I construct a unique data set to identify the size and source of the ETF impact on prices in the most ETF-dominated asset classes: volatility (VIX) and commodities.

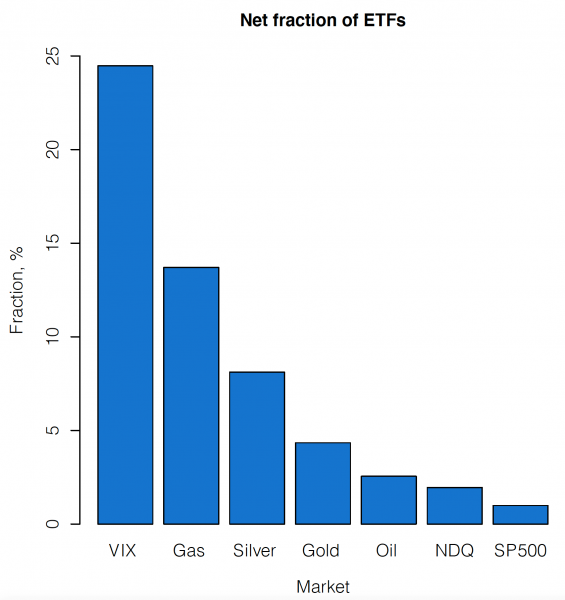

Figure 1. Fraction of ETFs in the total market capitalization for several markets: VIX, gas, silver, gold, oil, NASDAQ, S&P 500.

These ETFs have two beneficial features that make them a useful laboratory to quantify the effects of ETFs on prices. First, ETFs in VIX and commodities hold a much larger share of the market compared to equities. The fraction of ETFs in the market for VIX futures is close to 25%, whereas it is less than 2% in the Standard and Poor’s (S&P) 500 Index. Several VIX episodes in 2018 suggest that large ETF-induced trading exacerbates price movements during turbulent times. Second, using the specifics of futures contracts, I directly test whether the ETF-influenced futures price is informative about the fundamental spot value, or is more influenced by less fundamental premiums. The setting of the futures market also allows me to test specific predictions about the price impact of ETFs on the slope of the futures curve.

This paper documents and studies several new ETF-related phenomena. First, I show that ETFs put pressure on prices of underlying assets in VIX and commodity markets. Trading demand from ETFs (called ETF demand hereafter) is strongly related to futures prices at a daily frequency. The effects are robust to a large set of controls and to different sub-periods. I also conduct a difference-in-differences (DD) regression design around the first ETF introduction date to exploit the staggered nature of ETF inception across markets. The DD estimates show that the introduction of ETFs increases futures price and steepens the slope of the futures curve. The inception of ETFs raises the first-month futures basis by 82.5% and the spread between the second and the first-month contracts by 59.1%.

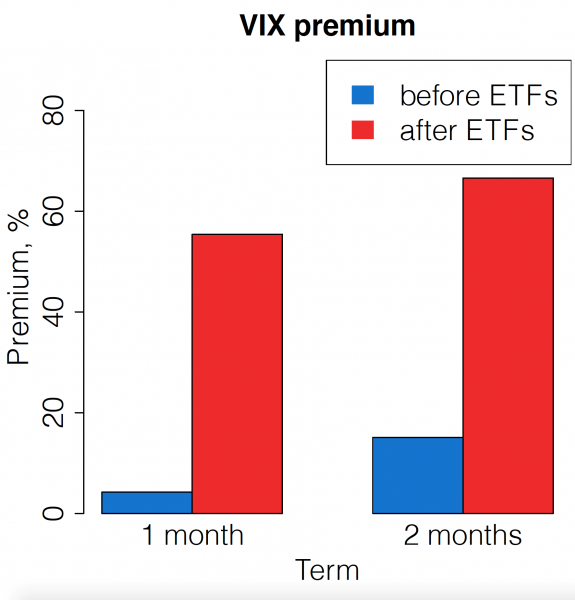

Figure 2. Average size of the VIX futures premium for the most ETF-influenced futures maturities before ETFs were introduced, and after that. The premium is calculated as the annualized net return of a short-seller of a VIX futures contract.

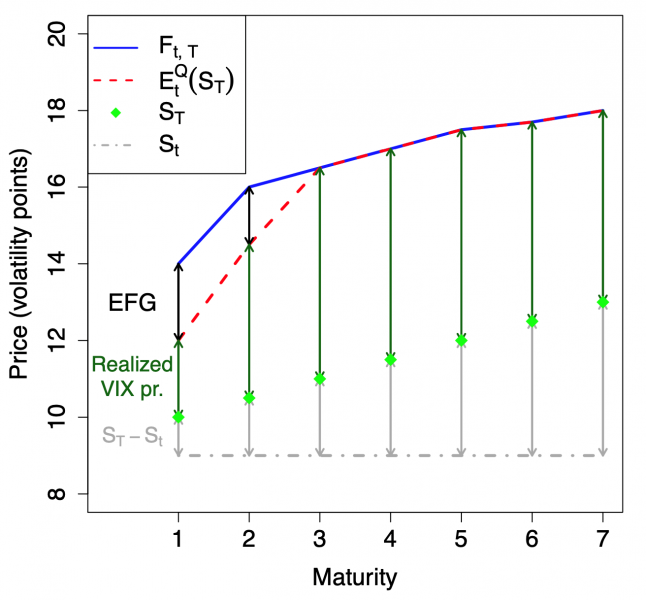

Second, I show that ETF price impact is not related to price discovery but manifests itself through an increase in the non-fundamental part of prices. To identify ETF-induced price distortions, I propose a model-independent approach for replicating the fundamental value of a VIX futures contract. I simply use the definition of variance and construct a synthetic futures contract from option prices on the S&P 500 Index and VIX. One advantage of my framework is that I make no parametric or distributional assumptions: the results are also valid in the presence of jumps. This is an important strength of my approach, given that VIX futures often experience large spikes. The synthetic futures contract is not directly influenced by ETF demand since there are no ETFs in the market for options. The price of the replicated contract was close to that of the traded one before the introduction of ETFs but diverged consistently thereafter. I show that the difference between the prices of the two contracts is strongly related to ETF demand and call this difference the ETF futures gap (EFG). The EFG is also related to measures of funding and market liquidity: bid-ask spreads and the TED spread (spread between 3-month LIBOR in USD and the interest rate of Treasury bills). The size of the gap is 18.5% per year, on average.

Figure 3. The figure shows the decomposition of futures basis into ETF futures gap (observed futures price ![]() minus synthetic one

minus synthetic one ![]() ), Realized VIX premium

), Realized VIX premium ![]() , and spot change from time t to maturity T

, and spot change from time t to maturity T ![]() . Maturity is in months.

. Maturity is in months.

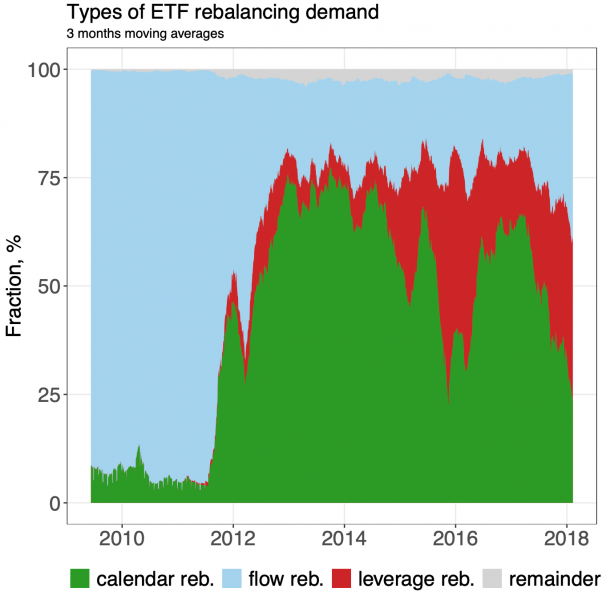

Third, to study the source of the gap in VIX futures prices, I analyze trading by ETFs and propose a novel decomposition of their demand into three major components: calendar rebalancing, flow rebalancing, and leverage rebalancing. Calendar rebalancing arises because futures are finite-maturity instruments as opposed to stocks, and ETFs have to gradually roll expiring contracts into longer-dated ones to maintain their exposure. ETFs sell portions of the first-month futures and buy portions of the second-month futures on a daily basis, thereby rolling their exposure from the first to the second contract. Flow rebalancing is driven by fund flows: ETFs have to scale up their exposure in case of inflows, and scale it down in case of outflows. Leverage rebalancing arises due to the maintenance of a constant daily leverage by leveraged ETFs and is a new type of mechanic institutional demand. The three types of rebalancing are not specific to futures-based ETFs but can be generalized to ETFs in all asset classes, including equity and fixed income. Calendar rebalancing is analogous to the roll due to benchmark exclusion/inclusion for equity ETFs, or due to maturing bonds for fixed income ETFs. Flow and leverage rebalancing for equity and bond ETFs have similar interpretation to that for VIX and commodity ETFs.

Figure 4. The chart illustrates the dynamics of VIX ETFs’ demand decomposition into calendar, flow, leverage rebalancing, and remainder.

I show that leverage rebalancing introduces a source of convexity that is not easy to hedge and exposes ETF counterparties (called arbitrageurs hereafter) to variance. Calendar rebalancing inherits part of the non-linearity of leverage rebalancing. Calendar rebalancing also mechanically exposes arbitrageurs to the risk of widening price discrepancies since arbitrageurs have to close futures positions before expiration. Flow rebalancing has a direct effect on prices and also an indirect effect by changing the size of ETFs, and the amount of their calendar rebalancing in future periods. I find that leverage rebalancing has the strongest impact on the EFG. Calendar rebalancing puts upward pressure on the second-month futures price and downward pressure on the first-month price. Flow rebalancing moves prices in the direction of flows: inflows increase the prices at both maturities, but also increase the difference between them. The short-term price impact of the three types of rebalancing translates into longer-term price deviations (futures risk premium).

Given that the EFG is most sensitive to leverage rebalancing, I next analyze the risks faced by an arbitrageur who trades against this type of ETF demand. The impact of large leverage-induced trading by institutional investors on systemic risk and prices is an important, yet under-researched question. ETFs provide a useful laboratory to study this question on a daily basis. I show that leverage rebalancing amplifies price changes and introduces unhedgeable risks for ETF counterparties. Leveraged ETFs mechanically have to buy the underlying asset after price increases and sell it after price decreases. This creates a potential feedback channel for prices: ETF demand and price changes reinforce each other, pushing prices away from fundamentals. Trading against leveraged ETFs is, in essence, providing liquidity to investors with short horizons, who follow momentum-like strategy. Due to leverage rebalancing, the potential distorting effect of ETFs on prices can be large even in a market with a zero-net share of ETFs. A prominent real-world example of this effect was the VIX market in February 2018. The net market share of ETFs then was close to zero, but the potential price impact due to leverage rebalancing was 60% of the total market size for the first two futures contracts. The amount of leverage rebalancing has been growing in the last decade not only for VIX and commodities but also for some equity and bond indices.

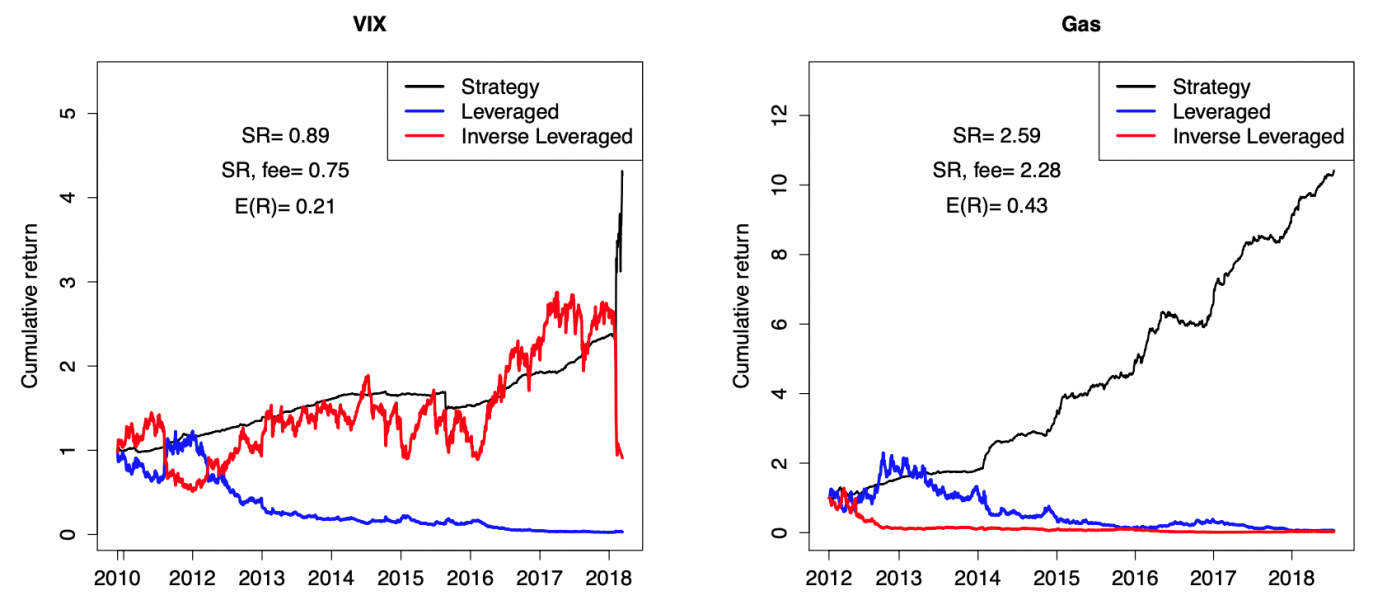

I propose a simple strategy to understand the risks of trading against leverage rebalancing, and document a novel ETF-related anomaly. I form a portfolio that sells short a pair of ETFs with opposite leverages L (e.g., L = 2 and L = −2), to approximate liquidity provision to leveraged ETFs. A natural guess could be that such a strategy should have a zero return since the profit (loss) from selling the long fund is cancelled by the loss (profit) from selling the inverse fund. Surprisingly, I show that the returns on such a strategy are not zero, but are consistently positive across markets. The portfolio delivers annualized returns of 21% in the VIX market, and 43% in the gas market, with Sharpe ratios of 0.89 and 2.59, respectively. Theoretically, trading against opposite-leveraged ETFs should be negatively exposed to large jumps in the underlying asset. However, empirically, the downside risk is almost never realized. A more puzzling observation is that the strategy is exposed to a “right-way risk” since it benefits from ETF tracking errors in crisis times when liquidity dries up and the market breaks down. To the best of my knowledge, my paper is the first to quantify the risks of trading against leveraged ETFs and the first to show that their tracking errors co-move with extreme market times, thereby benefiting liquidity providers.

Figure 5. The figure shows intra-day returns on the strategy that proxies for trading against leveraged ETFs (solid black line). SR is Sharpe ratio. E(R) is the average return.

The main conclusions of this paper are validated in a large set of robustness tests. I verify the major results using several measures of futures basis and spread to address concerns about time to maturity, the absolute level of prices, or other factors driving the relationship between ETF demand and futures prices. I conduct several tests to verify that the ETF futures gap and its relationship to the trading demand from ETFs are robust features of the data. The empirical evidence shows that the gap is unlikely to be driven by the absence of a continuum of option strikes, truncation errors, differences in margin requirements, or hedging pressure in the options market. A potential concern is that price discovery takes place in the ETF-influenced market, and therefore the gap exists because of fundamental information about the realized spot rather than non-fundamental price pressure due to ETF demand. To address this concern, I test which futures contract is a better predictor of the fundamental spot price at maturity. The empirical evidence shows that the ETF-influenced futures contract is a poor predictor, whereas the synthetic futures constructed from options is a better one. The relationship between ETF demand and the EFG is robust to a large set of controls and to different sub-periods.

My main results have several implications. First, they illustrate that price is strongly related to ETF trading demand, when ETFs constitute a large share of the market. In turbulent times, significant leverage-induced rebalancing contributes to extreme market movements and creates a feedback effect on prices. Thus, synchronized trading by ETFs actively moves prices away from fundamentals. This result contributes to the policy debate on the desirability of commoditization. Going forward, the evidence of ETF impact on prices in VIX and commodity markets can be useful for predicting the potential effects of ETFs on stock and bond markets, should these funds develop a larger share of these traditionally studied asset classes.

Second, my results lead to a more nuanced view of the information content of VIX and the VIX futures premium (the average relative difference between the current futures price and the realized spot price at expiration). VIX and its derivatives are often perceived as a barometer of financial stress by large financial institutions and are used as an input in stress-tests and various risk models. The VIX futures premium is frequently interpreted as a measure of investors’ risk aversion and future economic uncertainty. However, my results suggest that the prices of VIX futures contracts are significantly disrupted by non-fundamental mechanical ETF demand. I show that the VIX futures premium has increased since the introduction of ETFs, particularly, for the most ETF-influenced futures contracts: one and two months. Prices for these contracts are less informative about the realized spot price and are influenced more by premiums.

Third, my findings show how to decompose trading demand from ETFs and study different aspects of their price impact. I also demonstrate how to quantify the potential distorting impact of leverage rebalancing and how to capture the risk premium of trading against this rebalancing.

This is a summary of Karamfil Todorov’s paper “Passive Funds Actively Affect Prices: Evidence from the Largest ETF Markets”. The full version is available on: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3504016

The paper was awarded the 7th SUERF/UniCredit Foundation Research Prize.