A monetary union among diverse economies enhances trade and financial integration but has also redistributive effects. The common currency lead to implicit de- and re-valuations, boosting productive incentives and fiscal capacity of strong members at the cost of others. The euro was thus a transfer union from the start, with implicit flows from the periphery to the core. A careful form of solidarity is not just required, but even legitimate.

Since 2008 the Euro has been plagued by fragility. This has led to sharp contrasts among its members, especially on the legitimacy of cross border support for fiscally struggling periphery countries. The contrast has been widely attributed to the Euro’s design as an institutionally diverse monetary union (DMU) without a common fiscal framework.

A general equilibrium analysis of the implicit exchange rate effect offers perspective. The core’s relative success can be seen as the result of its institutions but also of favorable redistributive effects of a common currency, just as the periphery’s difficulties reflect both weaker spending restraint and a higher real fiscal burden induced by the euro. As Martin Wolf wrote in FT, “The Eurozone protected Germany from becoming another Japan. Germans should be thankful for what the euro has given them” (Wolf, 2019).

North (1991) and Acemoglu et al. (2005) gave the insight that governance and contractual institutions reflect deep societal characteristics that shape private and public choices.

The Euro was seen as an economic and political half-step justified by its trade and diversification gains. This vision saw gradual convergence as an act of will, dramatically underestimating the persistence of institutional differences, the visible challenge in the current debate.

We offer some perspective (Perotti and Soons 2019), analysing the general equilibrium outcome of an union among institutionally diverse members, highlighting its redistributive effects. The key insight comes from recognizing that market prices and flows adjust rapidly, while wages and productivity adjust much more slowly. However, deeper institutions are persistent even in the medium term.

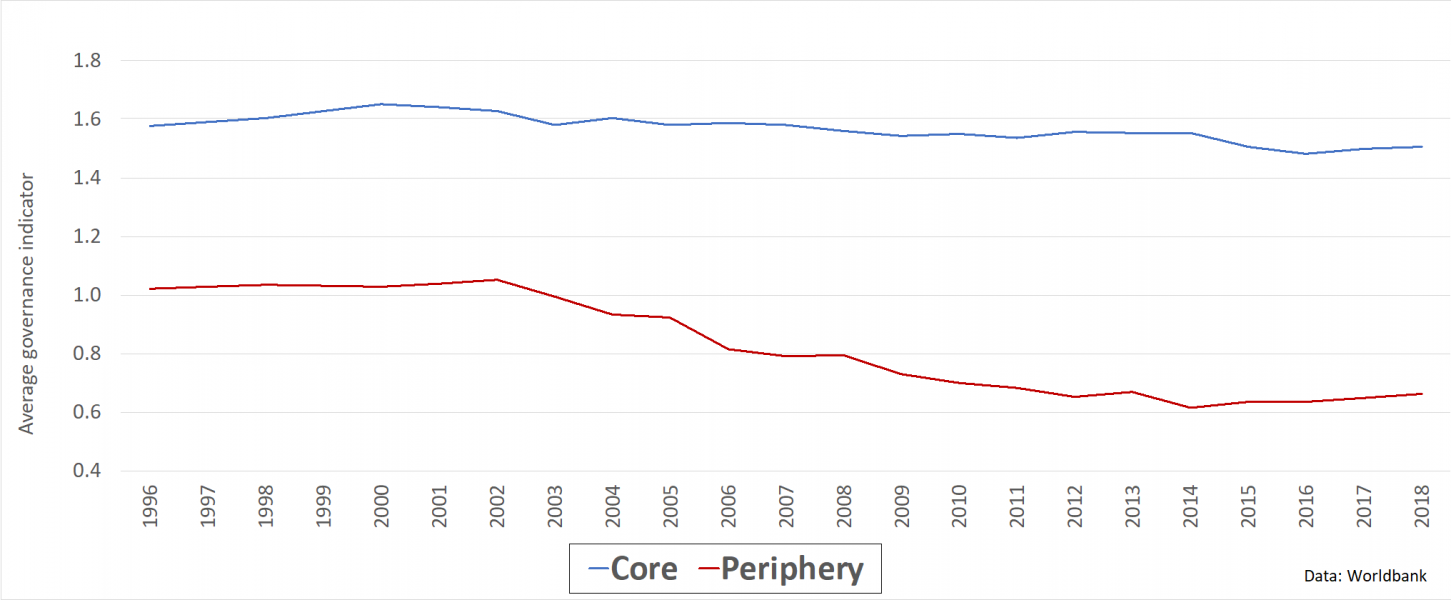

Institutional differences within the Eurozone are large, and indeed did not converge with its creaton (figure 1). Political systems under weak institutions have a tendency for excessive public spending or guarantees.1

Figure 1: Differences in Institutional quality

Source: Perotti and Soons (2019).

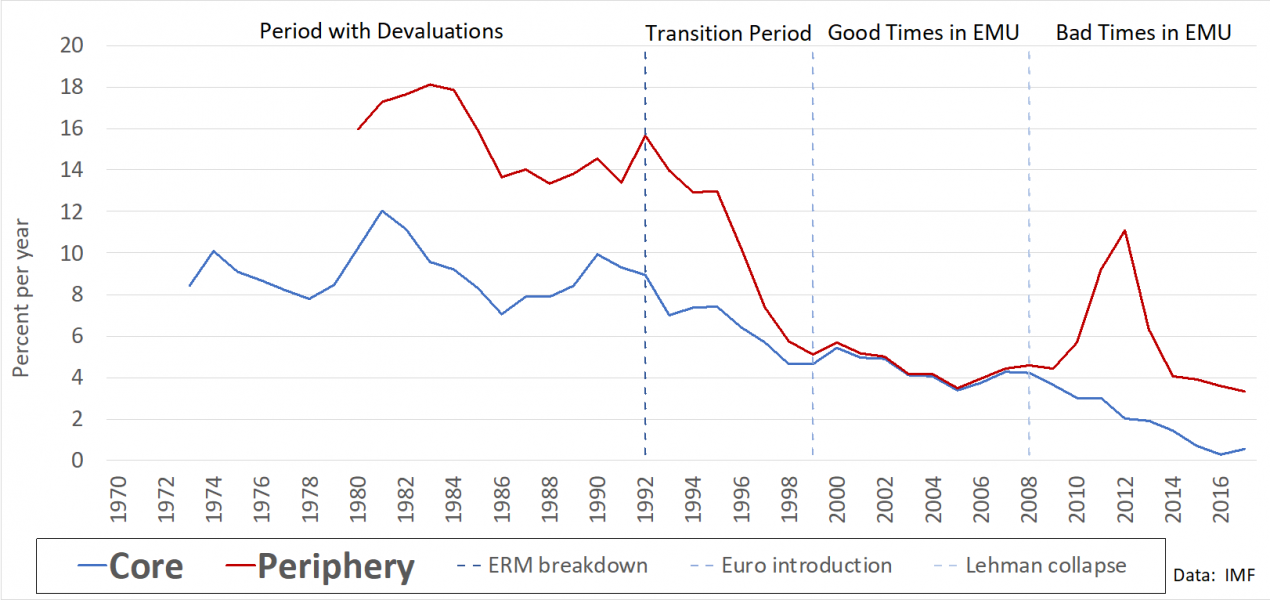

The Euro relaxed financial constraints in periphery countries, but greater borrowing resulted in a sharper downturn. Periphery countries benefit from better financial access, at the cost of relinquishing the valuable option to devalue (Italy devalued thirteen times in 1979-1992). The immediate effect was a major trading and financial integration. Borrowing costs for periphery countries decreased as currency risk evaporated and the devaluation premium fell (figure 2), allowing for a higher dollar value of sovereign debt.

Figure 2: Long-term interest rates core and periphery

Source: Perotti and Soons (2019).

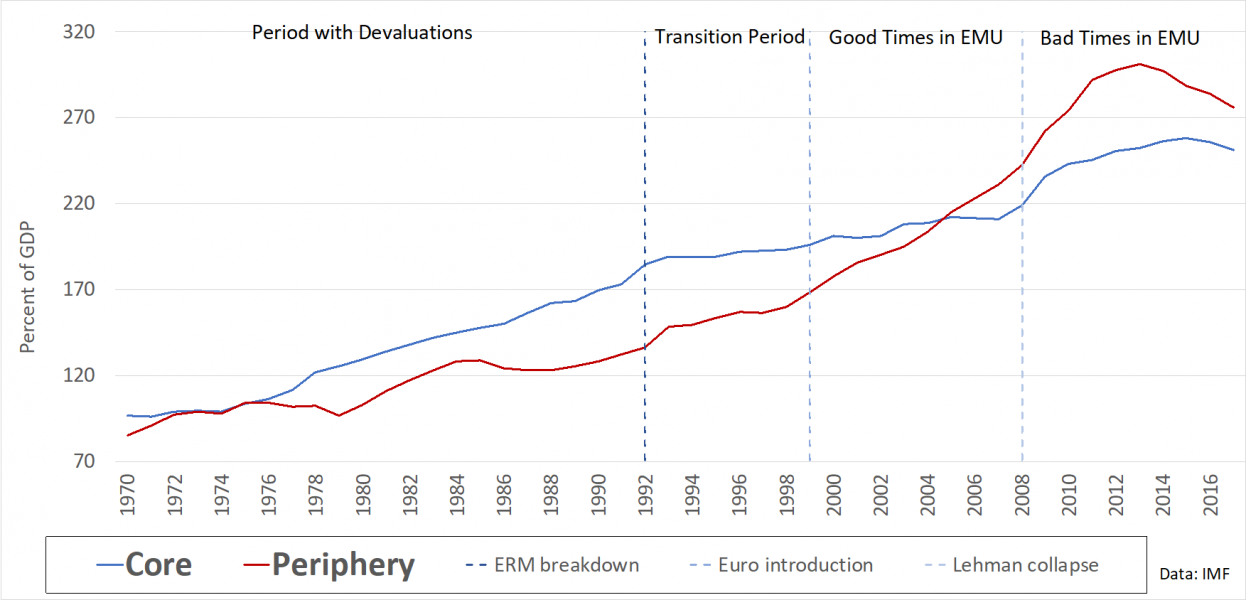

Political reluctance to share (or relinquish) fiscal policy implied that Maastricht fiscal rules were soon breached by both core and periphery countries (see Figure 3 for the trend in private and public debt over GDP). Cheaper borrowing was traded against a higher real cost of public debt, enabling greater borrowing (Greece, Portugal), maintaining excessive debt (Italy, Belgium) or used for massive private borrowing under a public backstop (Portugal, Spain, Ireland). Most capital inflows inefficiently funded non-tradables, further deteriorating competitiveness (Brunnermeier and Reis, 2015; Gopinath et al., 2017). This financial relaxation in good times hid a greater fiscal burden in economic downturns.

Figure 3: Total debt core and periphery

Source: Perotti and Soons (2019).

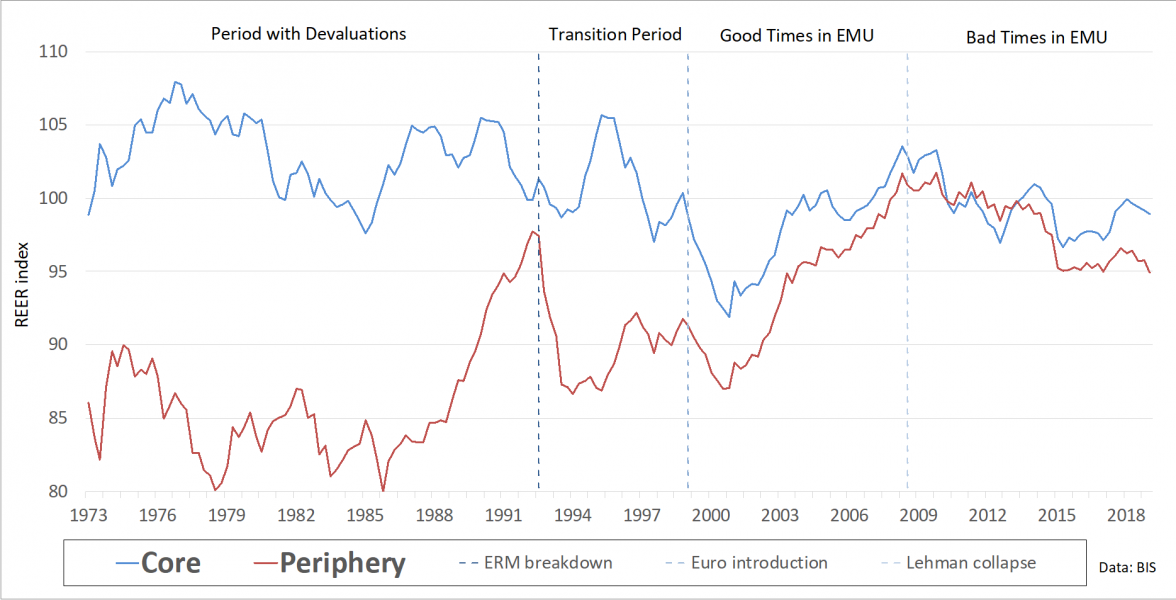

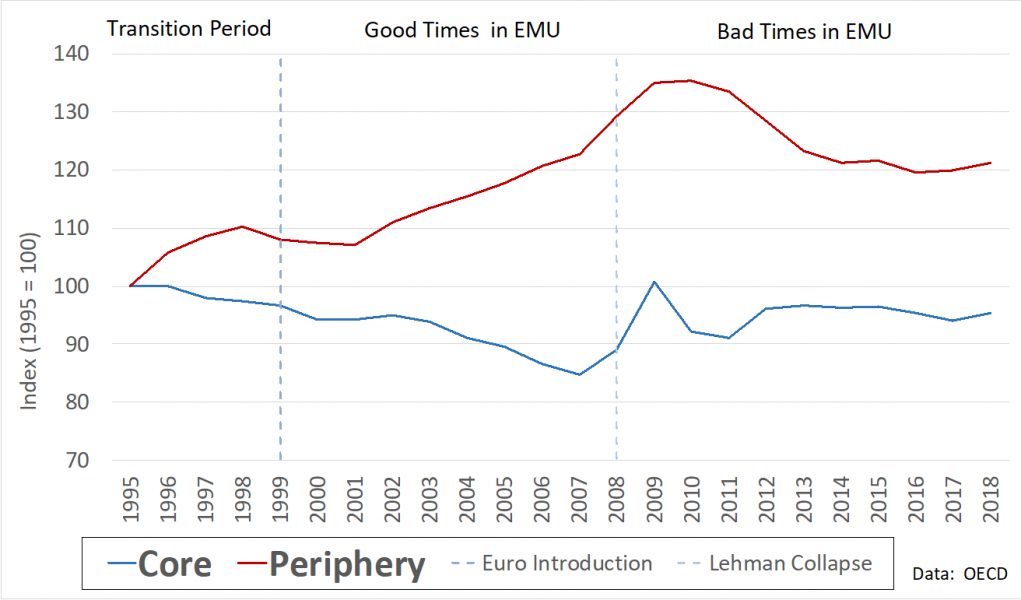

Besides the visible interest and credit volume effects, the hidden effect of a common exchange rate on competitiveness was massive, an effect already described in Frieden (1998). In short, a common currency among diverse countries produced a revaluation for periphery economies and a devaluation for the core. Figure 4 shows exactly this evolution of core and periphery real effective exchange rate (REER), an indicator of a countries exchange rate competitiveness relative to its trade partners.

Figure 4: REER core and periphery

Source: Perotti and Soons (2019).

Our work (Perotti and Soons, 2019) shows how this exchange rate effect of a DMU increases in membership diversity. A weaker periphery boosts the effective devaluation at the core, redistributing productive advantage and incentives on tradable goods.

The euro had also within country redistributive effects. In countries with weaker institutions investment incentives were reduced by a revalued currency, hurting productive forces and tradeable sectors while boosting (temporarily) nontradeable and savers. At the core the opposites happened, younger (productive) generations benefitted while retirees lost some purchasing power.

An impossible pace of institutional adjustment required by a rigid monetary framework thus caused the euro to be a transfer union from its very start, even before any explicit fiscal transfers take place. However this general equilibrium effect was not visible, so that core countries attributed their relative success entire to their fiscal restraint rather than the implicit monetary adjustment caused by the Euro.

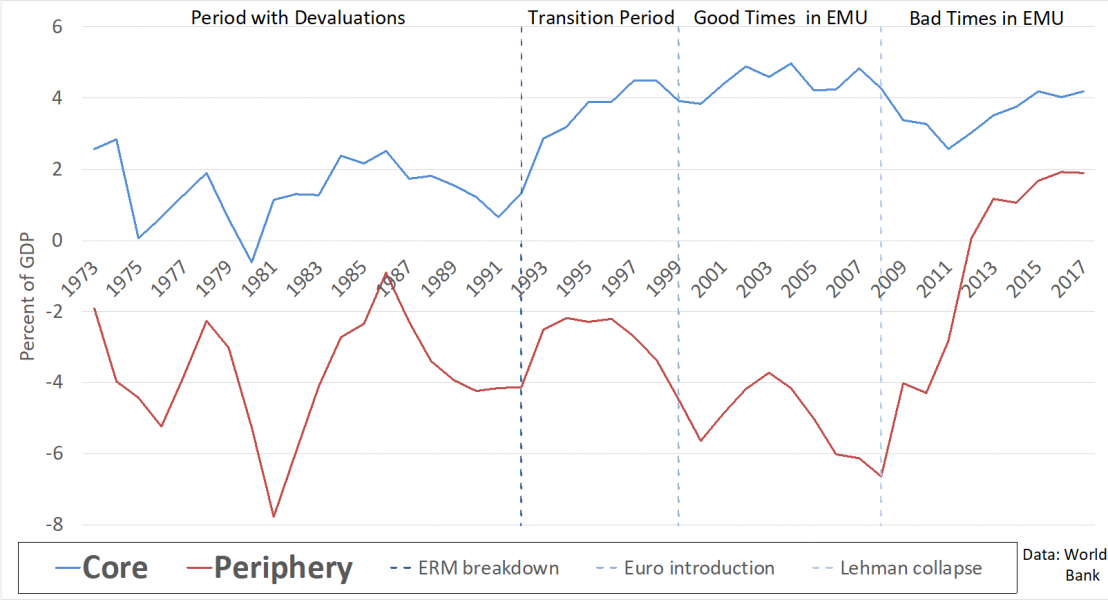

Figure 5 offers suggestive evidence. Core countries had historically a better trade position, but it steadily improved with the Euro, while the performance of the periphery deteriorated markedly. Core countries also outperformed non-Euro OECD countries with comparable institutional quality, while periphery countries underperformed (not shown). The effect was particularly marked on the countries with the most extreme institutional ranking, such as Italy and Greece on one side and Germany and the Netherlands on the other.2

Figure 5: Trade balances core and periphery

Source: Perotti and Soons (2019).

This pattern of exchange rate convergences and trade divergences was already evident during the past currency realignment attempts before 1992. The Euro monetary unification succeeded (for now) to create a rigid “monetary cage”.

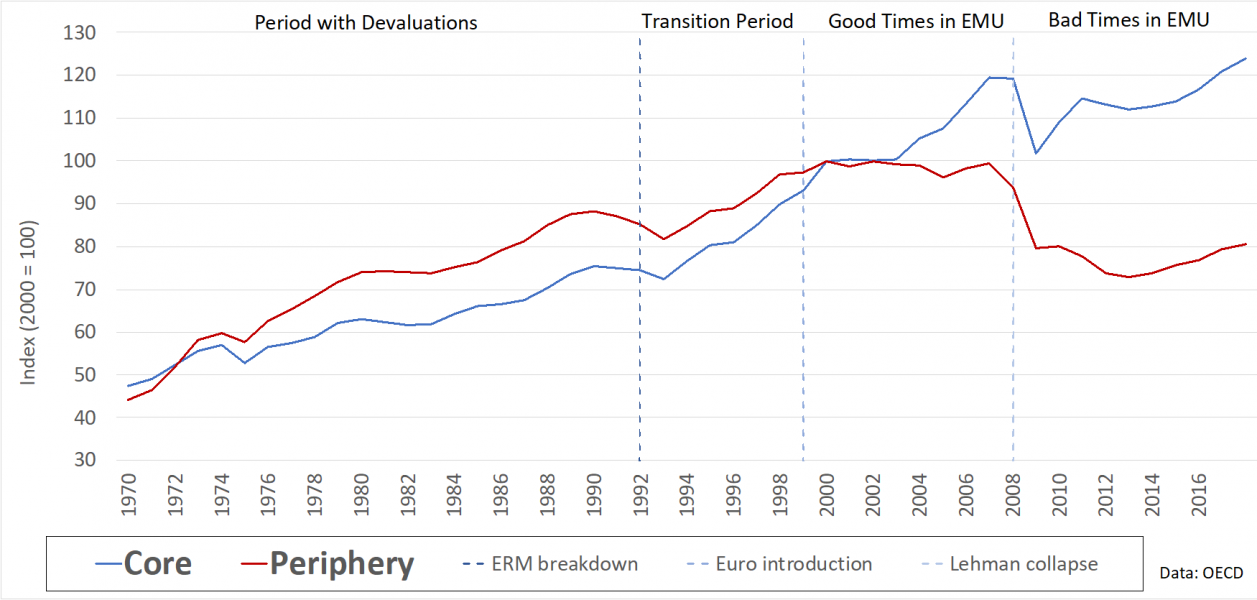

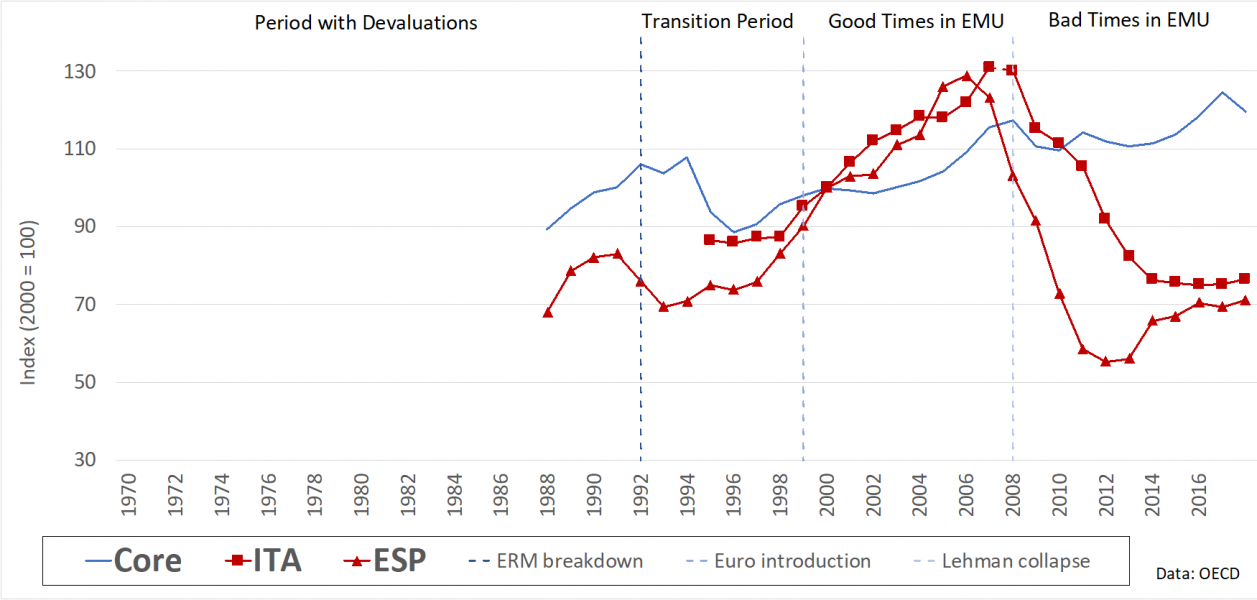

The effect is quite visible in the relative rise in real unit labor costs in periphery countries and drop in output after the Euro (figure 6 and 7). National wages tend to adjust more slowly than prices, and especially nontradeable sector wages were boosted by the initial Euro-induced expansion, compounding the required adjustment. Countries with significant manufacturing and weak institutions suffered worse from the revaluation effect and were less able to adjust when the recession forced even higher taxation. Nontradables were temporarily boosted because of the capital inflows (figure 8).

Figure 6: Manufacturing unit labor cost core and periphery

Source: Perotti and Soons (2019).

Figure 7: Manufacturing output core and periphery

Source: Perotti and Soons (2019).

Figure 8: Evolution of Notradables

Construction output (core and periphery)

Source: Perotti and Soons (2019).

A common currency between strong and weak members has structural consequences, as market prices and flow will adjust while national institutions cannot adjust simply as an act of policy.

The insight that the Euro makes fiscal imbalances heavier to bear at the periphery and lighter at the core suggests a more dynamic narrative than the simplistic view in the current debate that seems to blame cultural traits. It should also partially correct a self attribution of own success popular among politicians and voters at the core, and alert them to its cause.

The creation of the Euro DMU had economic and politicial motives. Core countries benefitted from a devalued currency that underpriced their comparative advantage. Periphery governments gained monetary credibility and funding capacity, but boosted nontradeable sectors at the cost of productive incentives, further weakening fiscal capacity in the recession.

The extreme challenge required to adapt was insufficiently recognized at its creation, though it was recognized that the burden of adjustment was going to fall on weaker members. The Euro survival that benefits its core also requires some fiscal solidarity, legitimized by its implicit gains. Yet even a legitimate transfer is politically unacceptable to a perceived profligate spender, so an institution shift needs to come from outside.

As Farhi and Tirole (2017) state in the context of a banking union, “.. with an externalization of supervision …. all (countries) can be made better off by combining a commitment to solidarity”.

A stable future of the Euro also requires an externalization of fiscal authority. In the US, its state spending discretion is constrained as the federal budget is not responsible for their debt. A centrally funded federal budget can rebalance the gains from trade more credibly than fiscally sovereign states, so a structural shift in specific spending authority or competences must complement fiscal solidarity.

Imposing strict conditions for support as in Scholz (2019) is self-righteuos and doomed to fail. It ignores the structural tension in the euro architecture. On balance, the long-term benefits of the Euro justify, in fact require a wiser path than nationalistic mutual blaming. At a minimum there is legitimate cause for mutually supporting initiatives such as a common euro safe asset.

Acemoglu, D., S. Johnson, and J. A. Robinson (2005): Institutions as a fundamental cause of long-run growth, Handbook of economic growth, 1, 385-472.

Alesina, A., Baqir, R., & Easterly, W. (1999). Public goods and ethnic divisions. The Quarterly journal of economics, 114(4), 1243-1284.

Brunnermeier, M. K., & Reis, R. (2019). A crash course on the euro crisis (No. w26229). National Bureau of Economic Research.

Farhi, E., & Tirole, J. (2017). Deadly embrace: Sovereign and financial balance sheets doom loops. The Review of Economic Studies, 85(3), 1781-1823.

Frieden, J. (1998). The euro: Who wins? Who loses?. Foreign Policy, 25-40.

Gopinath, G., Kalemli-Özcan, Ş., Karabarbounis, L., & Villegas-Sanchez, C. (2017). Capital allocation and productivity in South Europe. The Quarterly Journal of Economics, 132(4), 1915-1967.

North, D. C. (1991). Institutions. Journal of economic perspectives, 5(1), 97-112.

Perotti, E. C., & Soons, O. (2019). The Political Economy of a Diverse Monetary Union, CEPR Discussion paper 13987.

Scholz, O (2019) Germany will consider EU-wide bank deposit reinsurance. Financial Times (November 5th).

Wolf, M (2019) How the euro helped Germany avoid becoming Japan. Financial Times (October 29th).

Excess spending under weak institutions is usually seen as abuse of power (corruption due to poor accountability). A subtler view is political necessity, as internally divided countries need spending to appease conflicting interests and maintain power (Alesina, 1999). In either view, weak institutions result in excess public spending.

While Germany had reformed labor markets after unification, it struggled before the Euro with the loss of competitiveness associated with the one-to-one conversion with the overvalued Oostmark.