Both policy makers and the public are only beginning to grasp the full scope of the Covid-19 outbreak. While it is unavoidable that economic activity is reduced to avoid the spread of the virus, there is a strong argument for policy to support the economy during this unprecedented downturn. This note provides a specific policy proposal to support small and medium-sized enterprises (SME). The sudden collapse in demand puts these businesses at the heart of the crisis, with massive liquidity shortfalls that could send millions of businesses into bankruptcy. Our proposal argues for direct cash transfers to businesses, implemented via a negative tax. We point out some existing policies targeted towards SMEs, such as emergency loans, may fall short in terms of timely availability. The note also provides quantitative calculations for a payroll-based cash transfer in the United States.

The Covid-19 outbreak is a health shock rather than a standard slowdown in economic activity. It is materializing as an unavoidable temporary economic paralysis, and its consequences will likely amount to a severe contraction of the global economy and a global financial crisis. The collective attempts to avoid the spread of the virus are needed desperately, but such containment action will also likely lead to an almost full suspension of economic activity in many parts of the economy.

The recourse to standard expansionary fiscal and monetary policies may not be effective right now. Textbook expansionary policies try to stimulate demand, but people who simply stay at home are not currently responsive to such stimulus, which may in fact reduce these policies’ fire-power when it is needed later on. A “war time” economic thinking should dictate that the virus is the external enemy and needs to be defeated at all costs to recover an economy that functions in a regular way. It calls for a host of targeted policies, as suggested by the IMF Chief Economist Gita Gopinath early on.1

Part of this thinking is about figuring out the essence of the shock and its economic transmission in the short run. For macroeconomists, the crisis appears to currently materialize both as a demand shock and a supply disruption. It is also important to pin down whether the shock will lead to a liquidity or a solvency problem for the real sector.

A pure liquidity problem arises when one learns that the return coming today will instead come tomorrow; all that is needed is to manage liquidity accordingly, for example through a loan. A pure solvency problem is associated with a lack of long-term viability. Solvency issues do likely not apply to the majority of the businesses affected by the current paralysis. Önce the epidemic is over and the economy recovers, most businesses should be as profitable as before. SMEs, however, may now go bankrupt. The effects from such default are well known: lay-offs, NPLs, weaker banks, weaker demand, sluggish investment, and a sluggish recovery.

Thus, the losses of the economic paralysis should be shared. Preserving the medium and long term continuity of businesses is important for society.

Several governments have already taken decisive action to address companies’ looming liquidity shortfalls. As a notable example, the German government was quick to legislate a package of economic measures, which includes tax deferrals, as well as unlimited access to loans via Germany’s state owned development bank KfW.2

While these policies are extremely welcome and legislation was rapid, there might still be an issue on the magnitude and timely implementation. First, tax deferrals will allow business to delay payment of outstanding tax liabilities. There is large variation across firms in how the magnitude of these liabilities compares to the dramatic reduction in revenues from the contraction in economic activity.

Second, it is unclear whether the administrative process involved in asking for emergency loans can be executed timely enough. For example, will the owner of a small café or a laundry store be able get access to such an emergency loan to service outstanding payments while demand has already virtually collapsed to zero?

Many firms need liquidity urgently, it is a matter weeks or even days. What if the government provides small businesses with an immediate negative lump sum tax? The magnitude of this government transfer could be determined as a share of the firms’ revenues or costs in 2018 (or a share of an average over past years). How high the share should be (it could in principle be 100% or even above) would depend on how much the government is willing to spend on the program. Further below we provide calculations based on the firms’ payroll.

The negative tax could come with some conditionality, for example could require firms to hold on to their employees. It could be targeted to a subset of firms or industries, ideally to firms below a certain employment threshold, as for these firms the implementability constraint of existing measures, pointed out above, likely binds. Furthermore, it could either come as full-on transfer (pretty much making it “helicopter money”) or it could be partly reversed in later tax years, when the economy has recovered.

Our proposal of a negative tax has the benefit that practical implementation may be swift. For small businesses the problem is a lack of cash and time is already running out. Even if there is the political will to help these businesses, it is logistically tricky to actually send money to firms. A negative lump sum tax would allow a cash transfer of a magnitude that could exceed that of a deferral of existing tax liabilities. Importantly, immediate means that the government literally directly wires the money to the business’ bank account via the existing tax system infrastructure, right now! It could be done without requiring firms to do any paper work whatsoever.

In the case of the US, this may be implemented directly via the Internal Revue Service (IRS). Upon successful legislation, the IRS, which should have the required information and infrastructure, could transfer money within days, the way it would do with a standard tax refund. When the threat of bankruptcy is so immediate, it comes down to practical details such as having a database with the firms’ identities and bank account numbers, which can be further linked to U.S. Census database.

We are aware that this is a rather blunt proposal, however we believe that out-of-the box thinking is urgently needed now. We also acknowledge that there are some parameters to be figured out, such as the magnitude and the universe of firms to be targeted. But the basic idea has the crucial benefit that it would directly and immediately address the disruptive liquidity needs of small businesses, where most employment occurs, and where we therefore think policy intervention currently has most kick.

We want to substantiate our proposal by providing some quantitative analysis for the United States. The idea is to answer the question of how much money would get us how far in supporting US SMEs? To investigate this question, we resort to publicly available data from the US Census Bureau.

In principle, the negative tax could be calculated either based firms’ revenues or based on their costs. Since the payroll is typically the largest cost item for businesses, and job losses started piling up, we focus on the payroll. Note that the UK, for example, has now decided to cover 80% of wages for employees that cannot work because of the outbreak of the virus.3

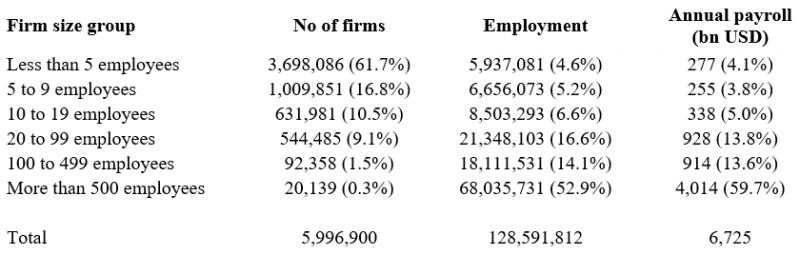

We think that the numbers we provide below are useful even beyond our specific proposal. They could be helpful in putting other policies targeted at US businesses into a quantitative context. Table 1 presents statistics on employment and the size of the payroll across the US firm size distribution for the year 2017.

Table 1

Source: 2017 SUSB Annual Data Tables, United States Census Bureau

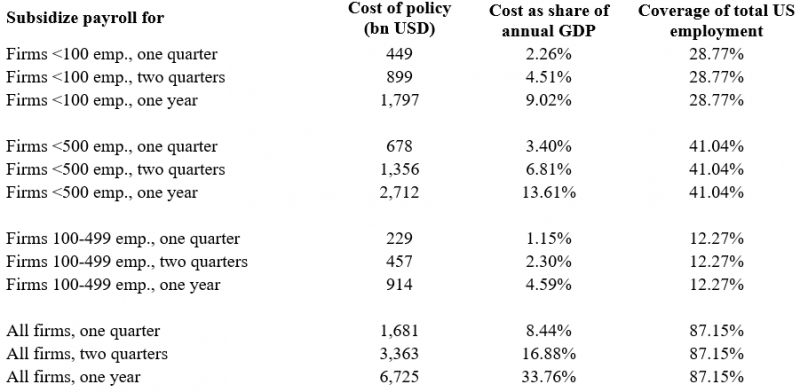

It is visible in Table 1 that a large bulk of US employment is accounted for by relatively small firms. Based on the information in Table 1, we provide calculations for different “policy scenarios”. In each scenario, we postulate that a certain group of firms (as defined by their size in terms of number of employees) receives direct cash payments to cover their payroll for a specific time period: one quarter, two quarters or a year. How costly would these policies be? Table 2 gives the answer by providing the corresponding calculations. To put dollar values into context, we show the cost of potential support policies as a share of US GDP and also include the employment numbers that would fall under a given policy as a share of total US employment.

Table 2

Notes: Annual GDP and total US nonfarm payroll employment, used to compute columns 2 and 3, are taken from FRED for the year 2017. GDP is 19.9 tn USD and total employment is 147.6 Mio. This includes more employees than our numbers in Table 1, which covers only the non-farm, non-government sector.

We believe that Table 2 provides a useful guideline to contextualize the magnitude of potential support payments to US SMEs. Suppose congress is willing to cover the entire payroll of all firms with more than less than 500 employees for 3 months. This policy would cover the wage bill of 61 Million US workers! This would cost around 3% of US annual GDP. Relative to the losses that are looming from businesses shutting down and workers loosing their job, we do not think the numbers in Table 2 are large enough for policy makers to shy away from aggressive policy. The policy can be made conditional on firms keeping the workers on their payroll and if not then the difference can be returned to the government during next year’s filing.

We also want to stress in that the calculations above, we abstract from general equilibrium effects. In particular, any intervention of the sort we suggest will likely have some multiplier effect. A given firm’s costs are in principle likely to include another firm’s revenue. If a given firm can cover their cost instead of delaying payment or defaulting, this will likely help other firms. Furthermore, making sure that firms will be able to cover their wage bill will put money in households’ pockets and alleviate additional negative effects of the contraction through the labor market.

US legislators have been discussing various economic measures, including the direct provision of cash to the economy. Öur proposed policy of a negative lump sum tax, implemented through the IRS, can achieve exactly this in a quick manner. As we write, additional advice by macroeconomists, given with impressive dedication and at an unprecedented speed through social media, points in a similar direction, for instance by calling for a direct “liquidity life line” to European firms via the EIB.4 It is clear that economists hope to see an aggressive response by policy makers which takes their advice seriously.

https://voxeu.org/content/limiting-economic-fallout-coronavirus-large-targeted-policies

See details here: https://www.bundesfinanzministerium.de/Content/DE/Pressemitteilungen/Finanzpolitik/2020/03/2020-03-13-download-en.pdf?__blob=publicationFile&v=2

See details here: https://www.theguardian.com/uk-news/2020/mar/20/government-pay-wages-jobs-coronavirus-rishi-sunak?CMP=share_btn_tw

See this very recent piece circulated by Markus Brunnermeier, Jean-Pierre Landau, Marco Pagano and Ricardo Reis: https://scholar.princeton.edu/sites/default/files/markus/files/covid_liquiditylifeline.pdf