References

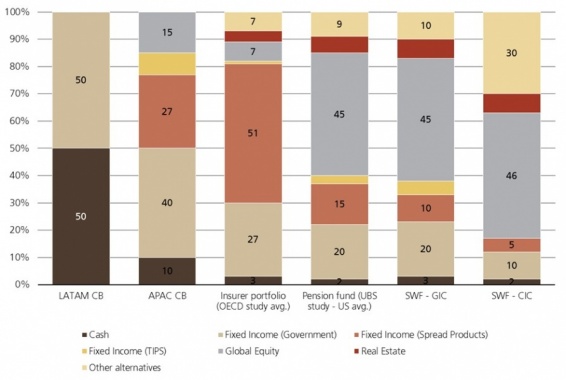

Bank for International Settlements (BIS) (2011), Portfolio and Risk Management for Central Banks and Sovereign Wealth Funds, Proceedings of the Joint Conference organized by the ECB and the World Bank, Basel, 2-3 November 2010, BIS Paper 58.

Berkelaar, Arjan B., Joachin Coche and Ken Nyholm (2010), Central Bank Reserves and Sovereign Wealth Management, edited by Palgrave Macmillan.

Castelli, Massimiliano and Fabio Scacciavillani (2012), The New Economics of Sovereign Wealth Funds, Wiley Finance, United Kingdom.

IMF (2014), Revised Guidelines for Foreign Exchange Management.

Jeanne, Olivier and Romain Rancie re (2006), The Optimal level of International Reserves for emerging market countries: Formulas and Application, IMF Working paper WP/06/229.

Jones, Bradley A (2018), Central Bank Reserve Management and International Financial Stability – Some Post-Crisis Reflections, IMF Working Paper, WP/18/31.

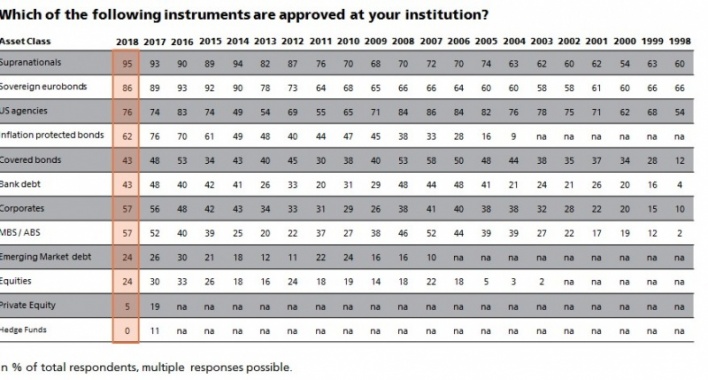

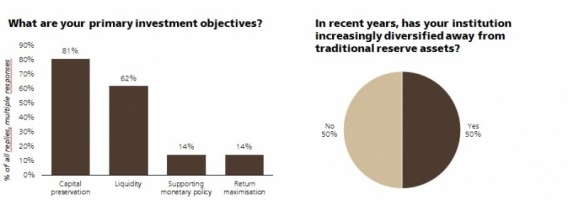

UBS Asset Management (1998-2018), Annual Reserve Manager Survey.