References

International Monetary Fund, Balance of Payments Manual, www.imf.org/external/np/sta/bop/BOPman.pdf

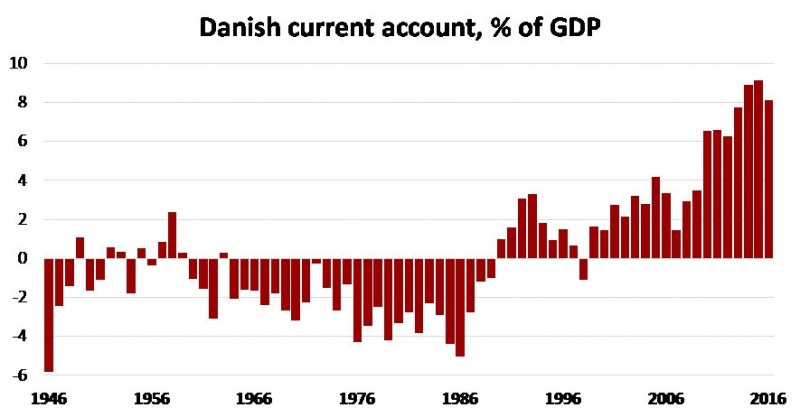

K. Abildgren, A Chart & Data Book on the Monetary and Financial History of Denmark, Working Paper, 2017.

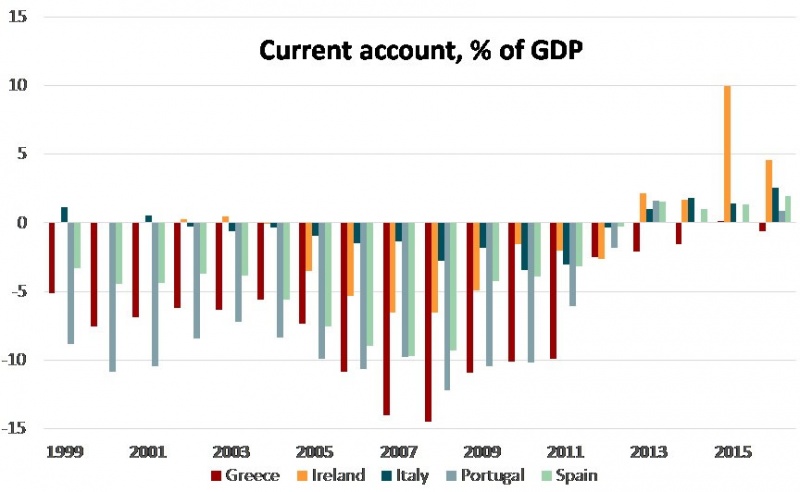

O. Blanchard and F. Giavazzi, Current Account Deficits in the Euro Area: the End of the Feldstein-Horioka Puzzle?, Brookings Paper on Economic Activity, 2002.

O. Blanchard, Adjustment Within the Euro: The Difficult Case of Portugal, Portuguese Economic

Journal, 2006.

M. Bussière, J. Schmidt and N. Valla, (No) worries about the new shape of international capital flows, SUERF Policy Note, 2017.

M. Feldstein and C. Horioka, Domestic Saving and International Capital Flows, The Economic Journal, 1980.

C. Romer and D. Romer, Why some times are different: Macroeconomic Policy and the aftermath of financial crisis, Working Paper, 2017.