References

Brunnermeier, M., K., S. Langfield, M. Pagano, R. Reis, S. Van Nieuwerburgh, D. Vayanos (2016), ’ESBies: Safety in the tranches’, Working Paper Series No 21, European Systemic Risk Board

Buti, M. and P. Mohl (2014), ‘Lacklustre investment in the Eurozone: Is there a puzzle?’, VoxEU.org, 4 June

Buti, M. (2014) ’Lacklustre investment in the Eurozone: The policy response’, VoxEU.org, 22 December 2014

Buti, M, J. Leandro and P. Nikolov (2016), ‘Smoothing economic shocks in the Eurozone: The untapped potential of the Financial Union’, VoxEU.org, 25 August

Buti, M, S. Deroose, J. Leandro and G. Giudice (2017), ‘Completing EMU’, VoxEU.org, 13 July

EBF-FBE (2014), International Comparison of Banking Sectors

Enderlein, H., E. Letta et al. (2016) ’Repair and Prepare: Growth and the Euro after Brexit’, Gu tersloh, Berlin, Paris: Bartelsmann Stiftung, Jacques Delors Institute – Berlin and Jacques Delors Institute in Paris

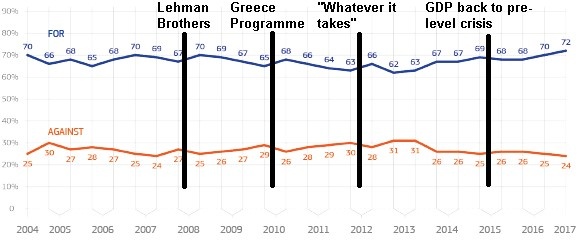

Eurobarometer (2017), Standard Eurobarometer, August 2017

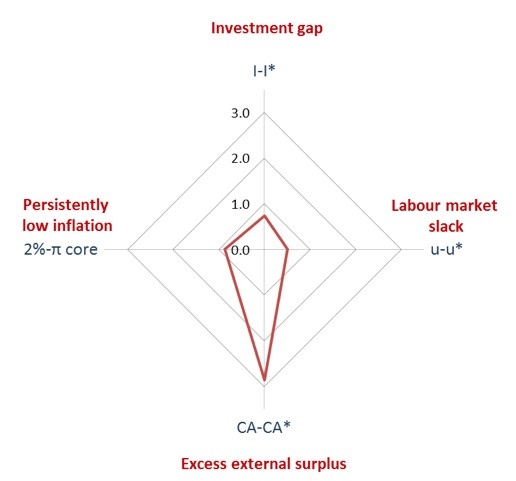

Eurofound (2017), ‘Estimating labour market slack in the European Union’, July 2017

European Central Bank (2017), ‘Assessing labour market slack’, Economic Bulletin 3/2017, May 2017

European Commission (2011), ‘Green paper on the feasibility of introducing stability bonds’, COM(2011) 818, 23/11/2011

European Commission (2017), ‘Reflection paper on the deepening of the economic and monetary union’, May 2017

Juncker, J., Tusk, D., Dijsselbloem, J., Draghi, M., & Schulz, M. (2015). Completing Europe’s Economic and Monetary Union – Five Presidents’ Report.

PIIE (2018), ‘Lessons from the US for the functioning of EMU’ (forthcoming)

Véron, N. (2015), ’Europe’s radical Banking Union’, Bruegel Essay and Lecture Series, Bruegel