References

Amromin, G. and S. Chakravorti. 2009. Whither Loose Change? The Diminishing Demand for Small-Denomination Currency. In: Journal of Money, Credit and Banking 41(2-3). 315–335.

Assenmacher, K., F. Seitz and J. Tenhofen. 2017. The use of large denomination banknotes in Switzerland. Paper presented at the 3rd International Cash Conference. Deutsche Bundesbank. April.

Bagnall, J., D. Bounie, A. Kosse, K. P. Huynh, T. Schmidt, S. Schuh and H. Stix. 2016. Consumer Cash Usage and Management: A Cross-Country Comparison with Diary Survey Data. In: International Journal of Central Banking 12(4). 1–61.

Baker, S. R., N. Bloom and St. J. Davis. 2016. Measuring Economic Policy Uncertainty. http://www.policyuncertainty.com/media/EPU_BBD_Mar2016.pdf.

Bartzsch, N., G. Rösl and F. Seitz. 2013. Currency movements within and outside a currency union: The case of Germany and the euro area. In: The Quarterly Review of Economics and Finance 53. 393–401.

BBC. 2015. The truth about the death of cash. http://www.bbc.com/future/story/20150724-the-truth-about-the-death-of-cash.

Goodhart, C. A. E. and J. Ashworth. 2014. Trying to Glimpse the “Grey Economy”. VOX – CEPR’s Policy Portal. http://voxeu.org/article/trying-glimpse-grey-economy.

Goodhart, C. A. E. and J. Ashworth. 2015. Measuring Public Panic in the Great Financial Crisis. VOX – CEPR’s Policy Portal. http://voxeu.org/article/measuring-public-panic-great-financial-crisis.

Goodhart, C. A. E. and J. Ashworth. 2017. The Surprising Recovery of Currency Usage. Paper presented at the 3rd International Cash Conference. Deutsche Bundesbank. April.

Google Trends. 2017. http://trends.google.at/trends.

Friedman, M. and A. J. Schwartz. 1963. A Monetary History of the United States, 1867–1960. Princeton: Princeton University Press for NBER.

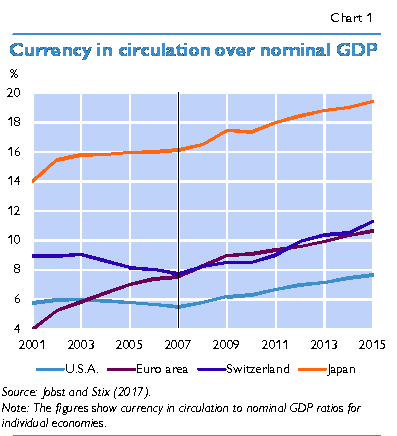

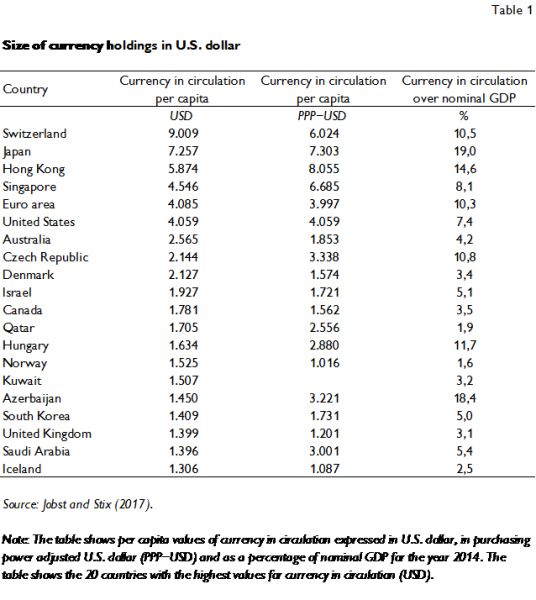

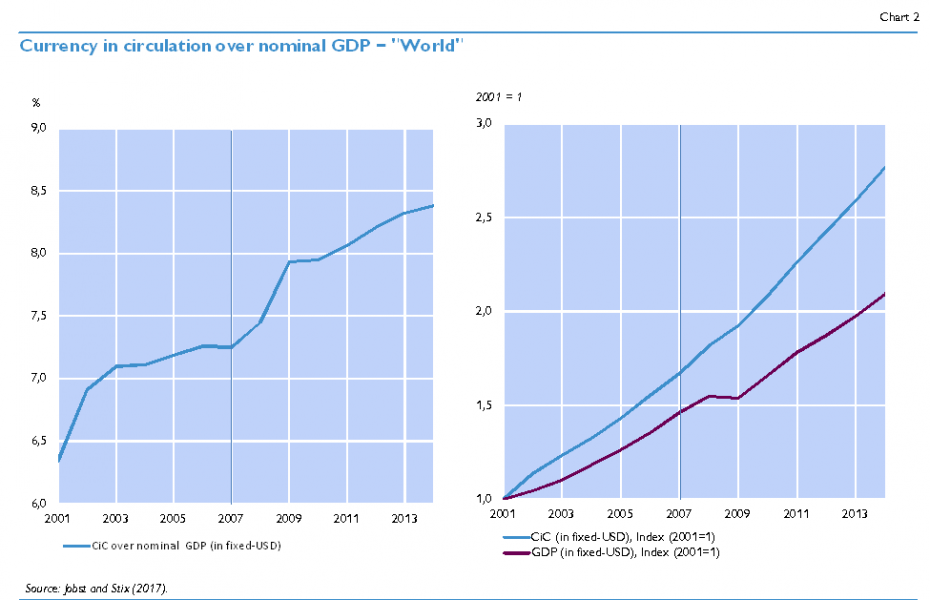

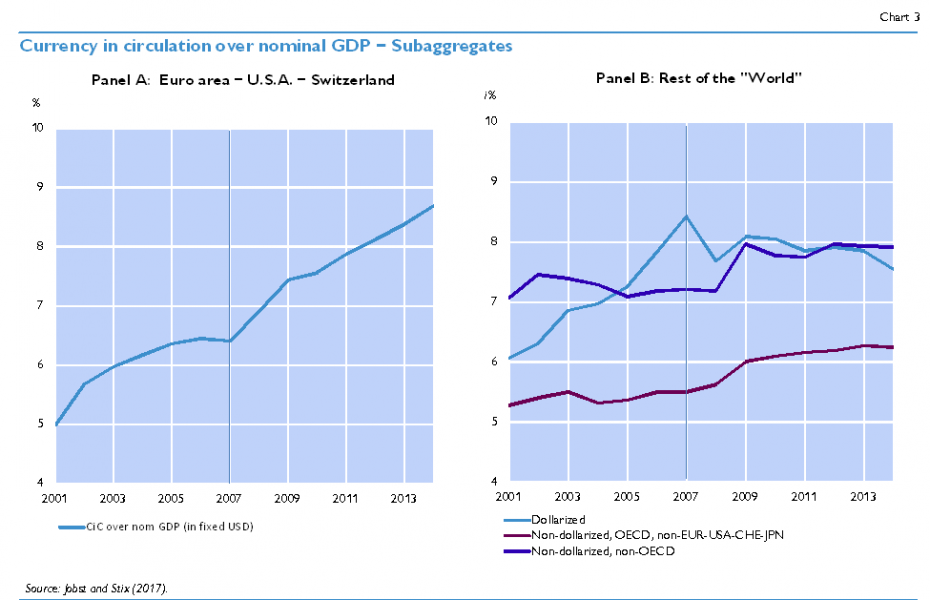

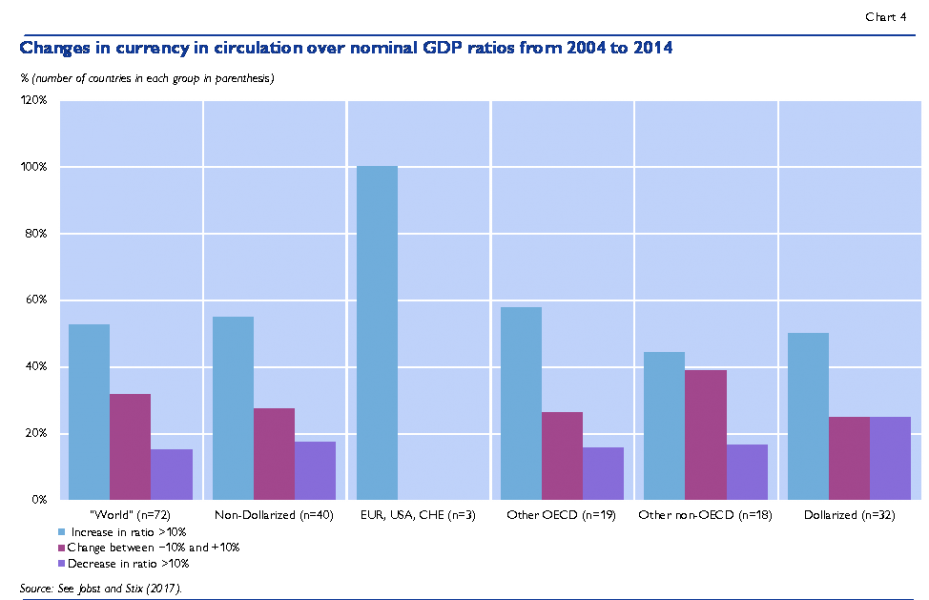

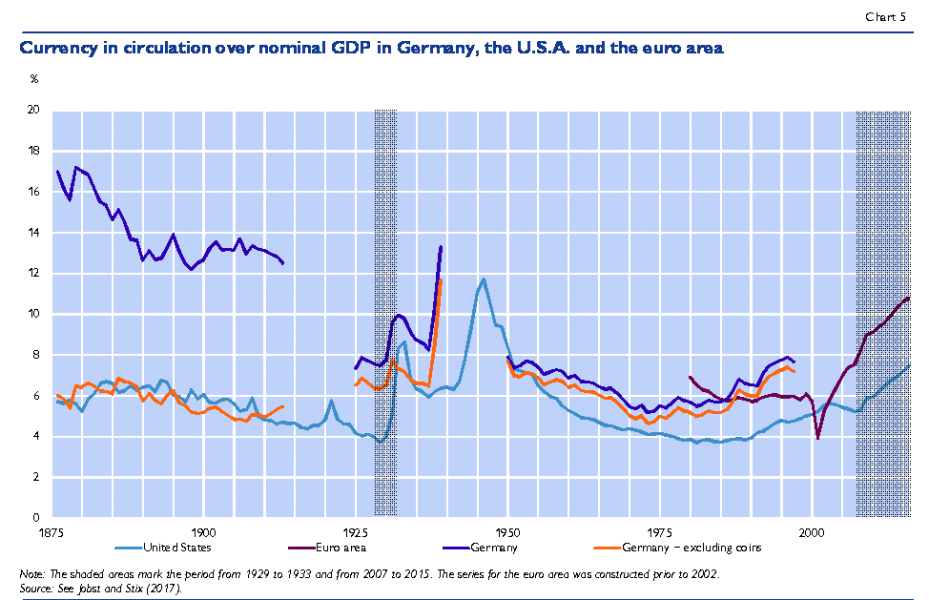

Jobst, C. and H. Stix. 2017. Doomed to Disappear: The Surprising Return of Cash Across Time and Across Countries. Mimeo.

Judson, R. 2017. The Death of Cash? Not So Fast: Demand for U.S. Currency at Home and Abroad, 1990–2016. Paper presented at the 3rd International Cash Conference, Deutsche Bundesbank. April.

Krüger, M. 2016. The Spread of Branch Banking and the Demand for Cash in Post-War Germany. ROME Discussion Paper Series No. 16-09. October.

Laeven, L. and F. Valencia. 2012. Systemic Banking Crises Database: An update. IMF Working Papers No. 12/163.

Malmendier, U. and S. Nagel. 2011. Depression Babies: Do Macroeconomic Experiences Affect Risk Taking? In: The Quarterly Journal of Economics 126. 373–416.

Osili, U.O. and A. Paulson. 2014. Crises and Confidence: Systemic Banking Crises and Depositor Behavior. In: Journal of Financial Economics 111. 646–660.

Porter, R. D. and R. A. Judson. 1996. The Location of U.S. Currency: How Much Is Abroad? Federal Reserve Bulletin 82. October. 883–903.

Rogoff, K. S. 2016. The Curse of Cash. Princeton and Oxford: Princeton University Press.

Schneider, F. 2017. Unpublished data. Source: Professor Dr. Friedrich Schneider, Department of Economics. University of Linz. Austria.

Seitz, F. 1997. How Many Deutschmarks are Held Abroad? In: Intereconomics 32(2). March/April. 67–73.

Stix, H. 2013. Why do People Save in Cash? Distrust, Memories of Banking Crises, Weak Institutions and Dollarization. In: Journal of Banking & Finance 37. 4087–4106.